Ethereum

Ethereum’s next move remains uncertain amid whale sell-offs – What next?

Credit : ambcrypto.com

- In a serious improvement, one whale moved $19.54 million price of ETH to Kraken.

- Market sentiment remained divided, with conflicting indicators from key indicators.

Regardless of a quick interval of turbulence on November 25, Ethereum [ETH] has proven resilience, with a every day acquire of 1.38%.

This restoration contributes to a formidable weekly acquire of 9.85%, underscoring the market’s present bullish momentum.

However regardless of these positive factors, warning continued. Refined bearish indicators continued to come back into play, with the potential for ETH to fall if broader market circumstances deteriorate.

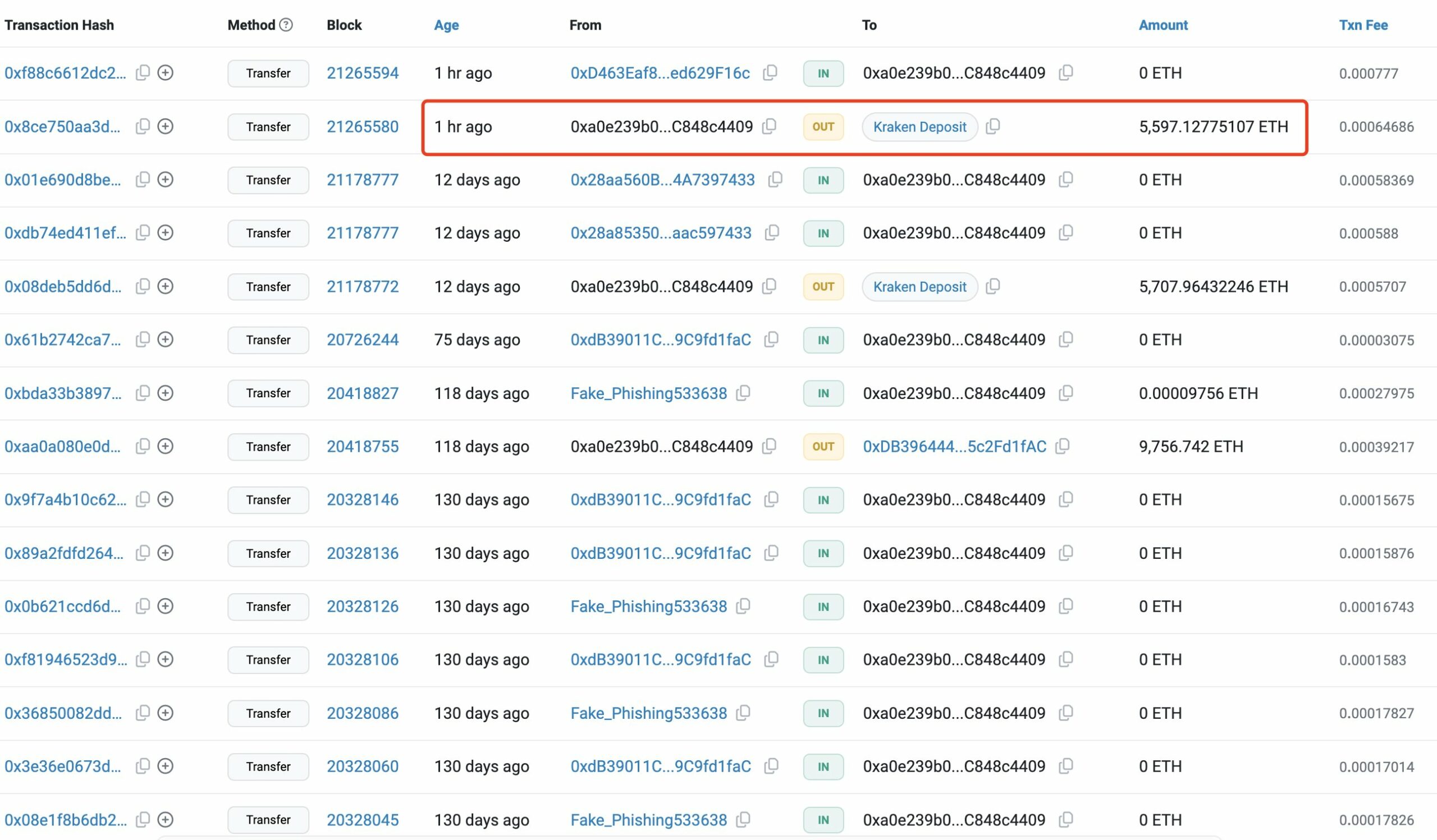

Whale transfers ETH, probably inflicting a worth drop

In line with information from Look at chaina whale pockets related to ETH Devcon not too long ago moved 5,597 ETH – price $19.45 million – to cryptocurrency alternate Kraken.

Supply:

The commerce got here shortly after ETH briefly reclaimed the $3,500 stage. Such strikes are often seen as bearish, as giant inflows into inventory markets usually point out an intention to promote, both for revenue or as a result of declining market confidence.

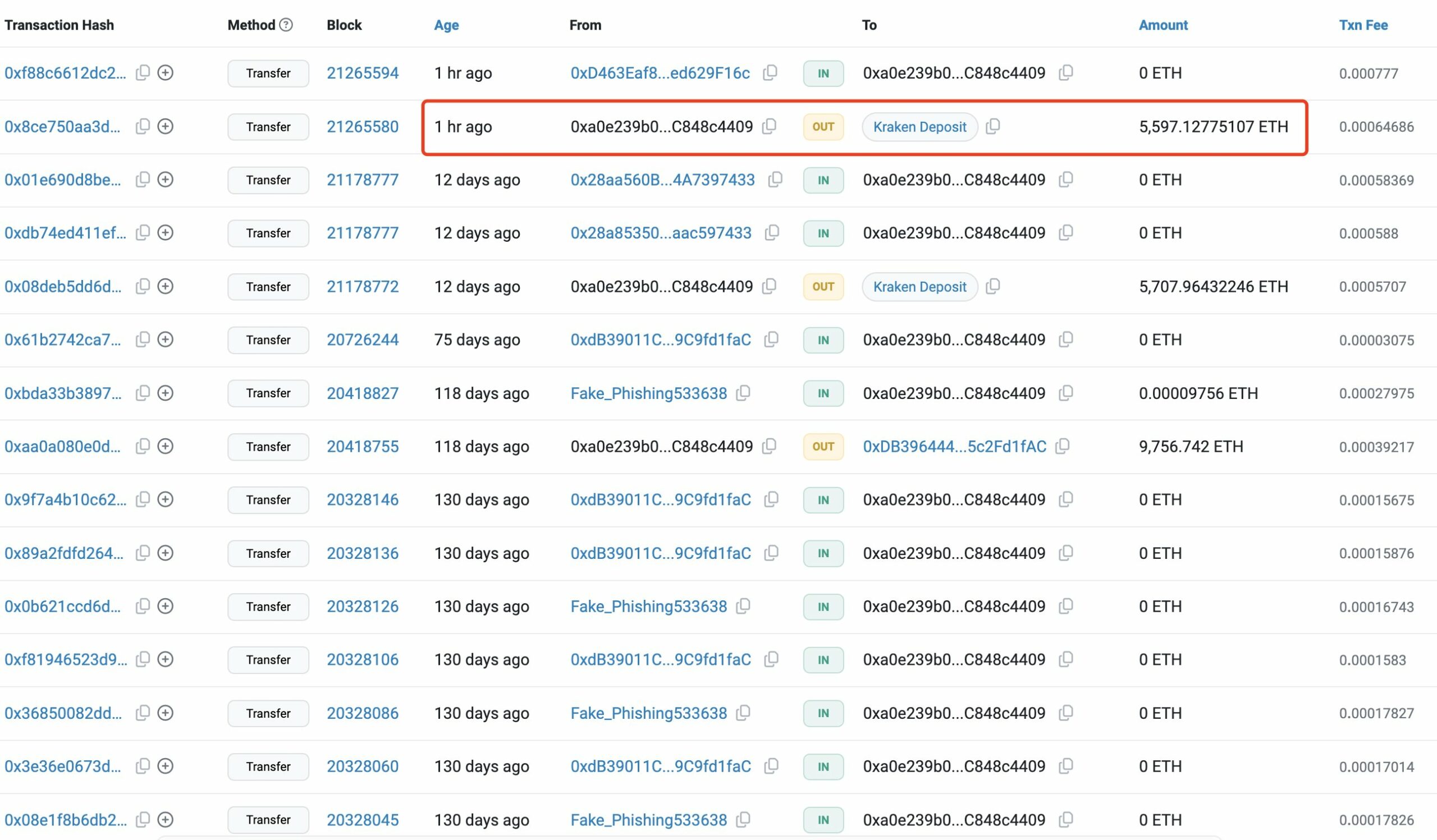

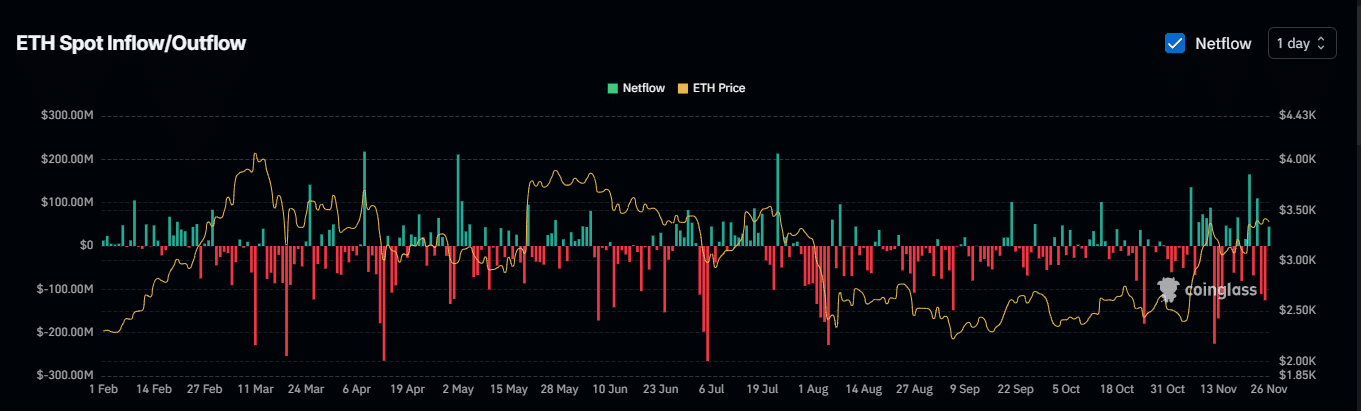

AMBCrypto discovered that the general Change Netflow presents a distinct perspective on ETH’s potential transfer.

Market individuals be a part of whales

Change Netflow, which measures the circulate of property out and in of exchanges, is a key indicator of market sentiment.

Optimistic Netflow usually signifies bearish sentiment as property go public for potential sale, whereas adverse Netflow displays bullish sentiment, indicating drawdowns for holdings.

On November 25, Netflow was adverse, withdrawing $125.17 million from the exchanges – a bullish sign that outpaced whale exercise.

Nonetheless, Netflow has since turned constructive, with $53.96 million returned to the exchanges.

If this development continues, it might improve promoting stress on ETH, indicating that market individuals had been now tending to promote moderately than maintain.

Supply: Coinglass

ETH’s subsequent transfer is unclear

On the time of writing, market sentiment remained divided. On the bearish facet, $52 million in lengthy positions had been liquidated, following important losses because the market moved towards bullish merchants – a transparent signal of promoting stress.

Learn Ethereum’s [ETH] Value forecast 2024–2025

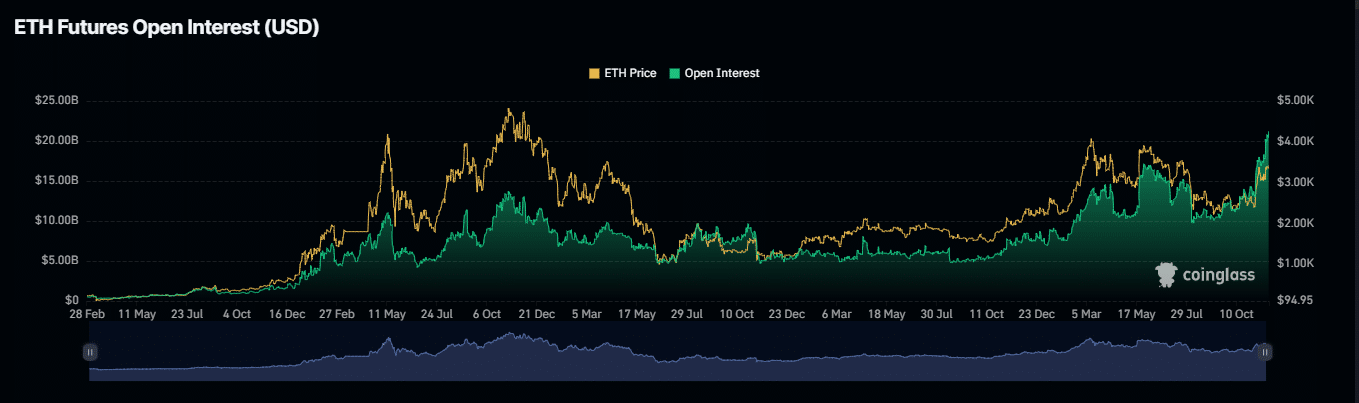

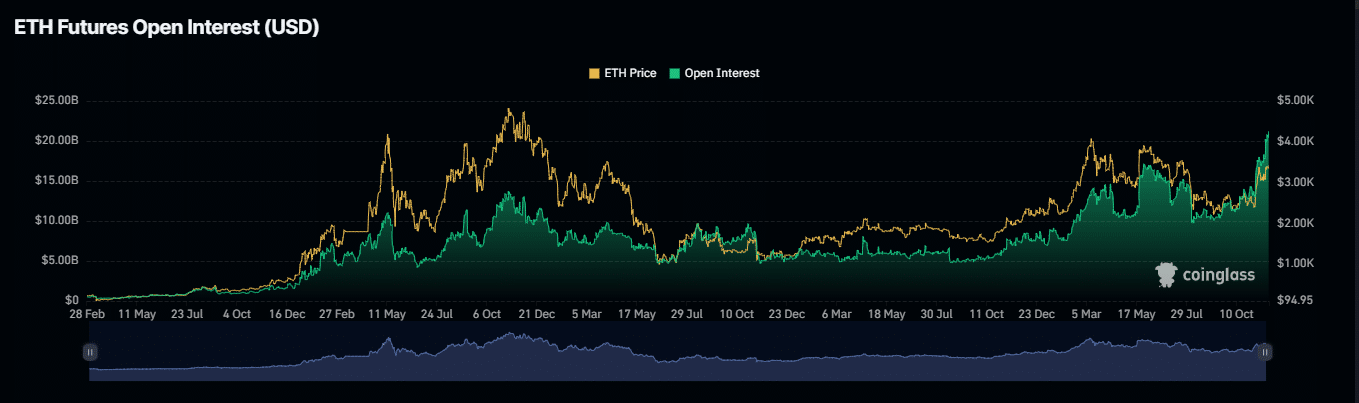

In the meantime, Open Curiosity reached a bullish peak, reaching $21.44 billion – the very best in two years. This improve indicated a rising variety of lengthy derivatives contracts, signaling optimism a few attainable worth improve.

Supply: Coinglass

Till these opposing indicators converge, ETH’s worth path will stay unsure.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024