Ethereum

Ethereum’s next price move – Here are the key levels to watch!

Credit : ambcrypto.com

- Ethereum (ETH) appeared to kind a bullish W sample on the weekly chart

- Altcoin’s market worth to realized worth (MVRV) ratio highlighted its truthful valuation

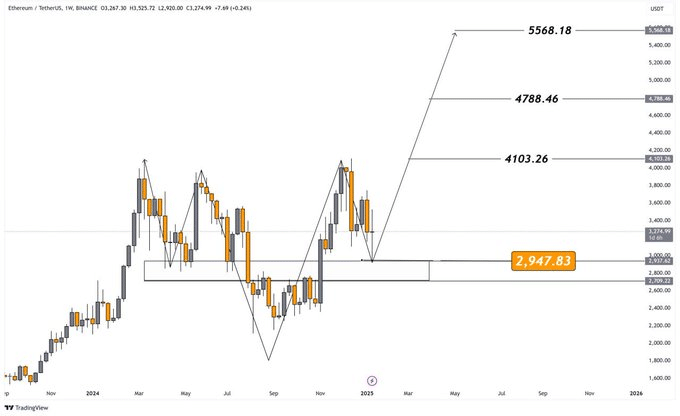

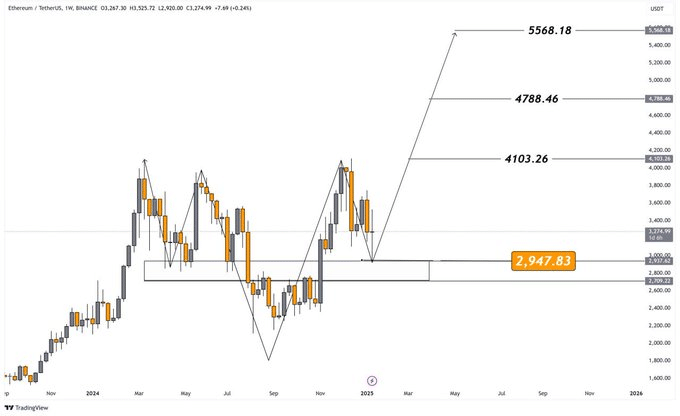

Ethereum (ETH) shaped a bullish W sample on the weekly chart on the time of writing, signaling a possible development reversal and important upside potential. Actually, the altcoin appeared to carry above the vital assist at $2,947 – a degree that now serves because the neckline of this formation.

This assist zone is essential in figuring out Ethereum’s trajectory, with value targets at $4,103, $4,788, and $5,568 as indicated on the chart. A break above the neckline resistance would affirm the bullish development and open the door to important positive factors.

Supply: TradingView

This W sample may be interpreted to underline Ethereum’s resilience and spotlight a shift from bearish to bullish momentum. Actually, the altcoin’s value chart confirmed that sustaining assist above $2,947 can be essential for this sample to happen.

A confirmed break above $3,200 might pave the way in which for a fast upward transfer in the direction of the $4,100 resistance.

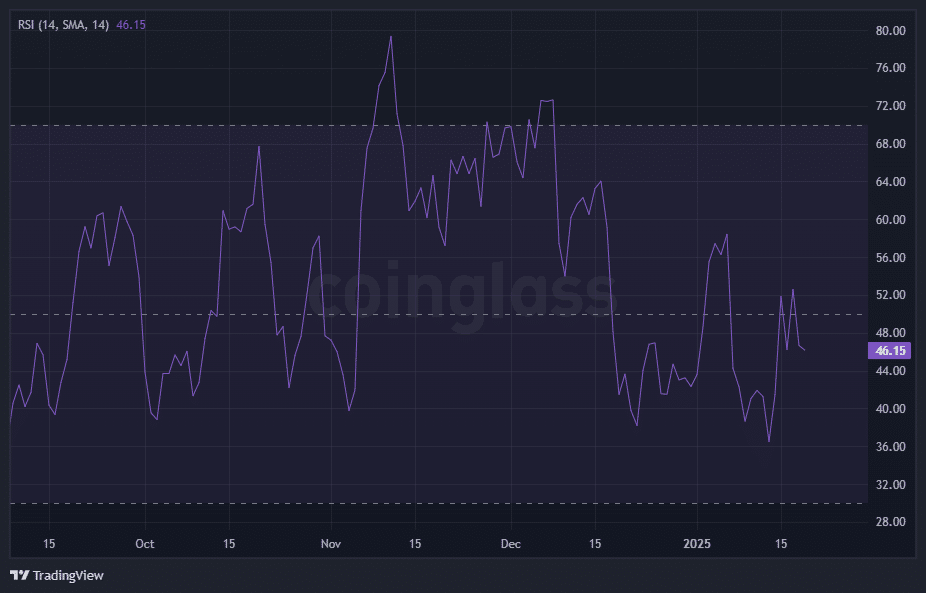

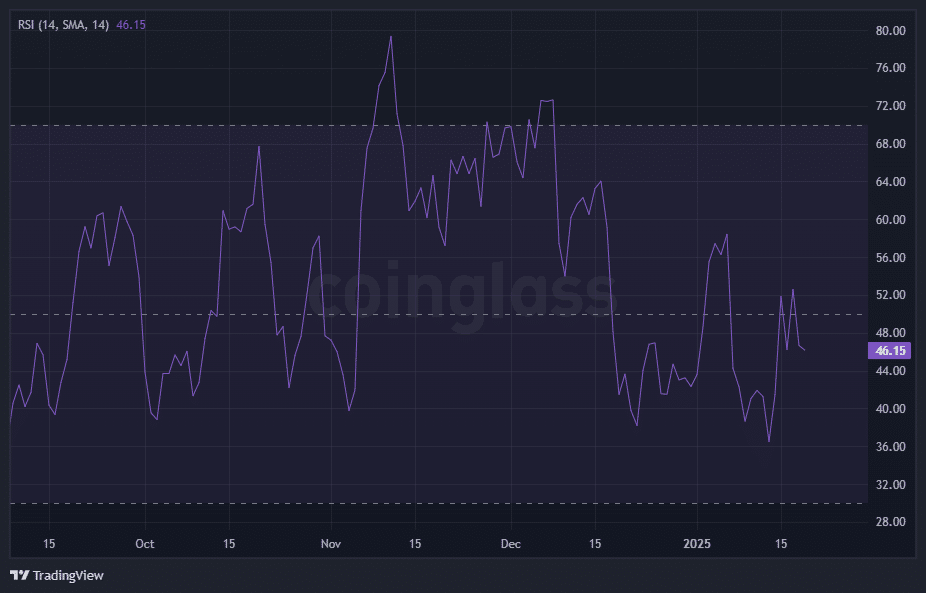

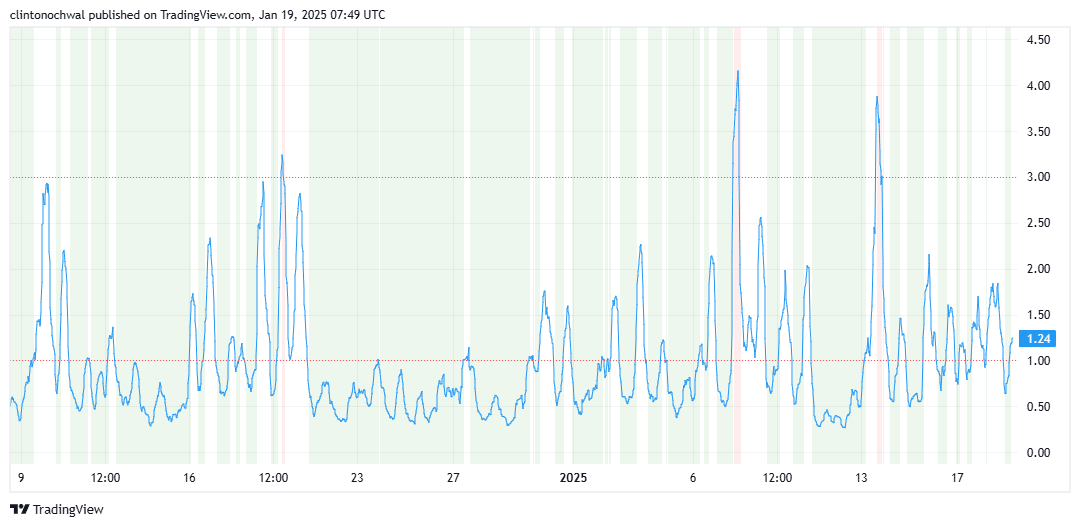

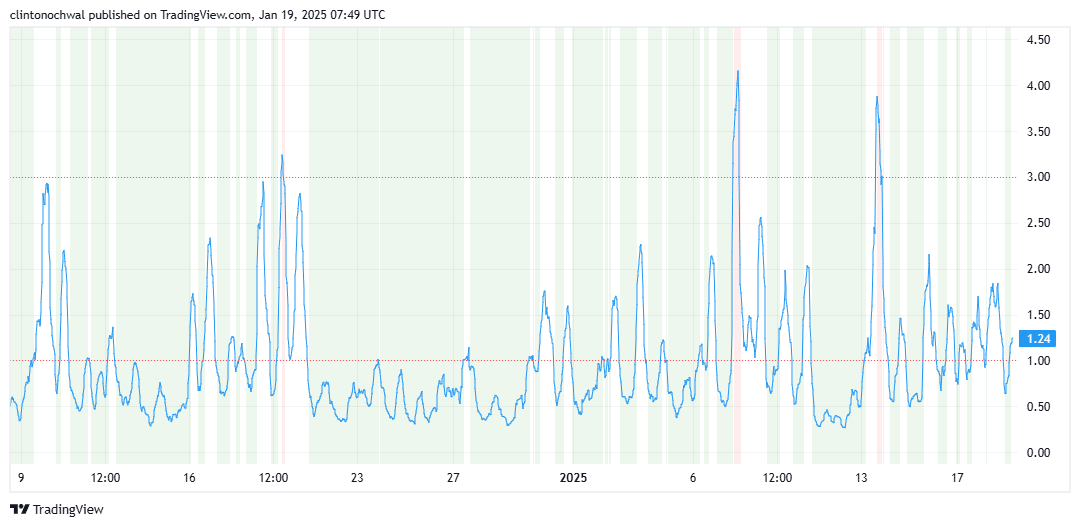

Measuring Ethereum’s momentum

From a momentum perspective, the Relative Energy Index (RSI) was studying 46.15 on the time of writing. This impartial degree indicated a stability between consumers and sellers within the altcoin market.

Supply: Coinglass

Nevertheless, the stabilization of the RSI close to the midline indicated easing bearish stress. A decisive transfer above 50 might sign renewed bullish momentum, according to a possible value breakout.

Conversely, a drop beneath 40 may very well be an indication of an extra decline, placing the $2,947 assist degree in danger.

Ethereum Valuation Evaluation

For extra insights, it’s value additionally taking a look at Ethereum’s market worth to realized worth (MVRV) ratio. On the time of writing this text, the worth displays a good valuation. The ratio hovered close to its impartial ranges – an indication that ETH was neither overvalued nor undervalued.

Supply: TradingView

Traditionally, MVRV values above 1.2 have created some promoting stress, whereas values beneath 0.8 have attracted consumers. As ETH approaches larger targets, the ratio might enter overvaluation territory, which might result in warning amongst long-term buyers.

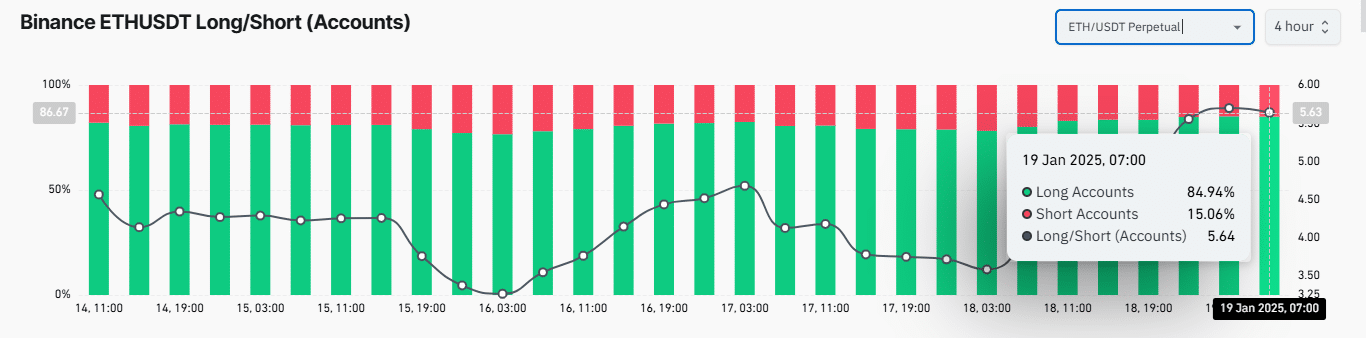

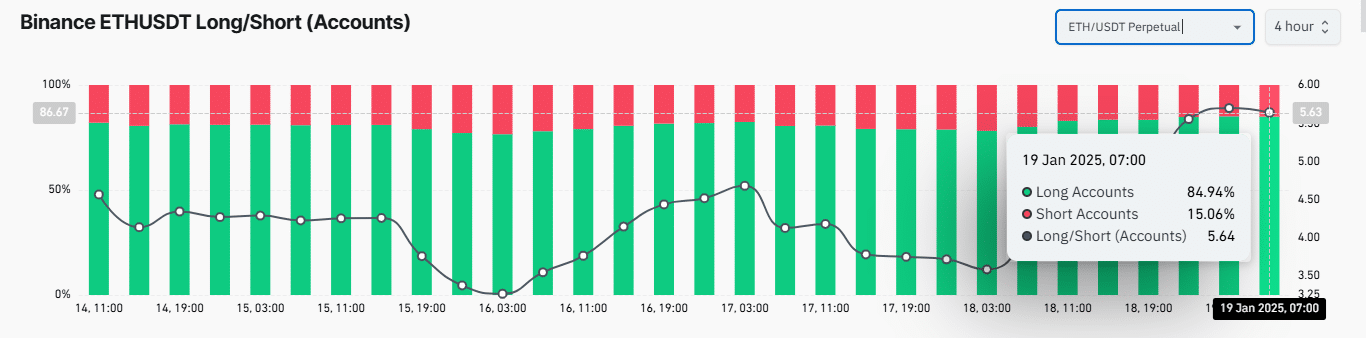

Lastly, the lengthy/quick ratio confirmed that 84.94% of accounts have been lengthy – an indication of sturdy bullish sentiment for Ethereum.

Supply: Coinglass

This huge imbalance hinted at potential upside value momentum as consumers have dominated the market to date. Nevertheless, overwhelming lengthy positions can even carry the danger of sharp value corrections. Particularly if market sentiment modifications or prolonged liquidations happen throughout volatility.

Each Ethereum’s weekly chart and technical indicators pointed to a pivotal second for the cryptocurrency. The W sample, mixed with a impartial RSI and a balanced MVRV ratio, highlighted Ethereum’s potential for a bullish breakout if key ranges maintain.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September