Ethereum

Ethereum’s NUPL signals rising fear — How $3K can flip sentiment

Credit : ambcrypto.com

- Ethereum’s lengthy -term holder NUPL confirmed concern with buyers however BREiking above $ 3K might restore confidence.

- The approval of an utility on the CBOE to permit 21Shares to make use of the ETH, the brand new catalyst will be for an upward pattern.

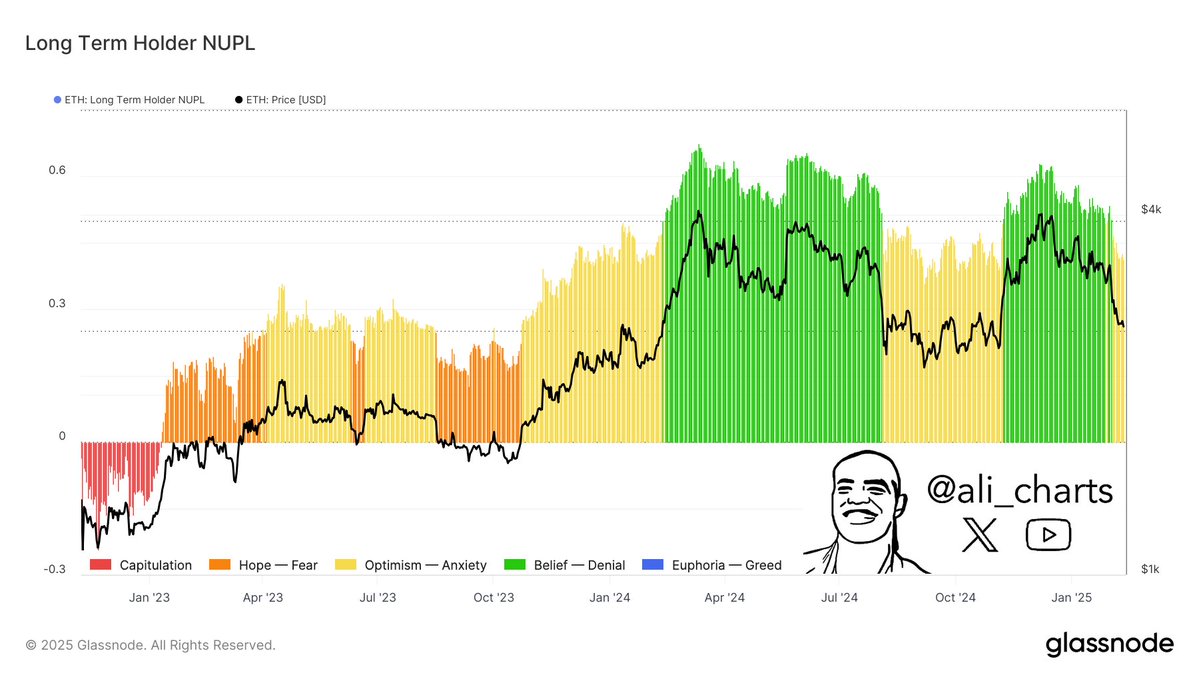

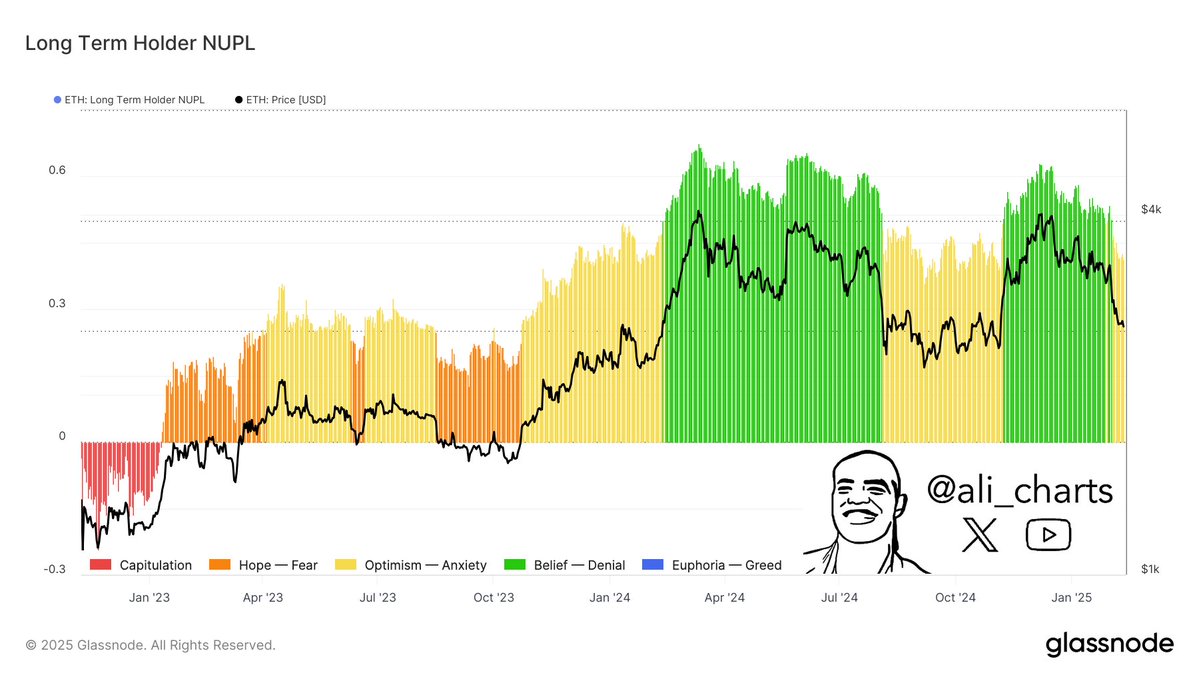

Investor sentiment in keeping with that of Ethereum [ETH] Netto in the long run Holder Internet Non-realized revenue/loss (NUPL) revealed rising concern as the value beneath $ 3,000.

On the time of writing, the NUPL confirmed a pattern to concern. This means that many long-term buyers see that their non-realized revenue is reducing and placing stress on their self-confidence.

A decisive push above $ 3,000 can shift sentiment from concern to religion or optimism. This sample was seen in mid -2023 when Ethereum was approaching these ranges and noticed appreciable conferences.

Supply: Ali/X

A possible motion may cause renewed investor confidence, encouraging retention and attracting new consumers, controlling ETH up. If ETH doesn’t exceed the $ 3K threshold, holders can proceed or improve sale, for concern of additional losses.

This may additional float the value, deepen the market anxiousness and push the NUPL in decrease zones, much like capitulation within the early 2023.

This state of affairs would most likely worsen the downward stress in the marketplace worth of Ethereum.

CBOE information for Ethereum ETF to make it doable

Regardless of the concern, ETH buyers will be hopeful just like the CBOE a proposal submitted to allow 21Shares to introduce enlargement inside his Ethereum Spot ETF

This determination, accepted by the president of the inventory alternate on 12 February 2025, is an important second for ETH. It might function a brand new catalyst for the expansion of the cryptocurrency.

ETH Staken signifies that the cryptocurrency is retained to help blockchain operations, in alternate for rewards.

This approval permits the ETF to broaden, which can improve the worth of ETH through the ETF by providing additional yields by stopping rewards.

This improvement is anticipated to rejuvenate the belief of buyers in Ethereum, particularly after a interval of market volatility.

By integrating pronunciation, ETF gives a double benefit of publicity to the value actions of ETH and the additional revenue from the discharge.

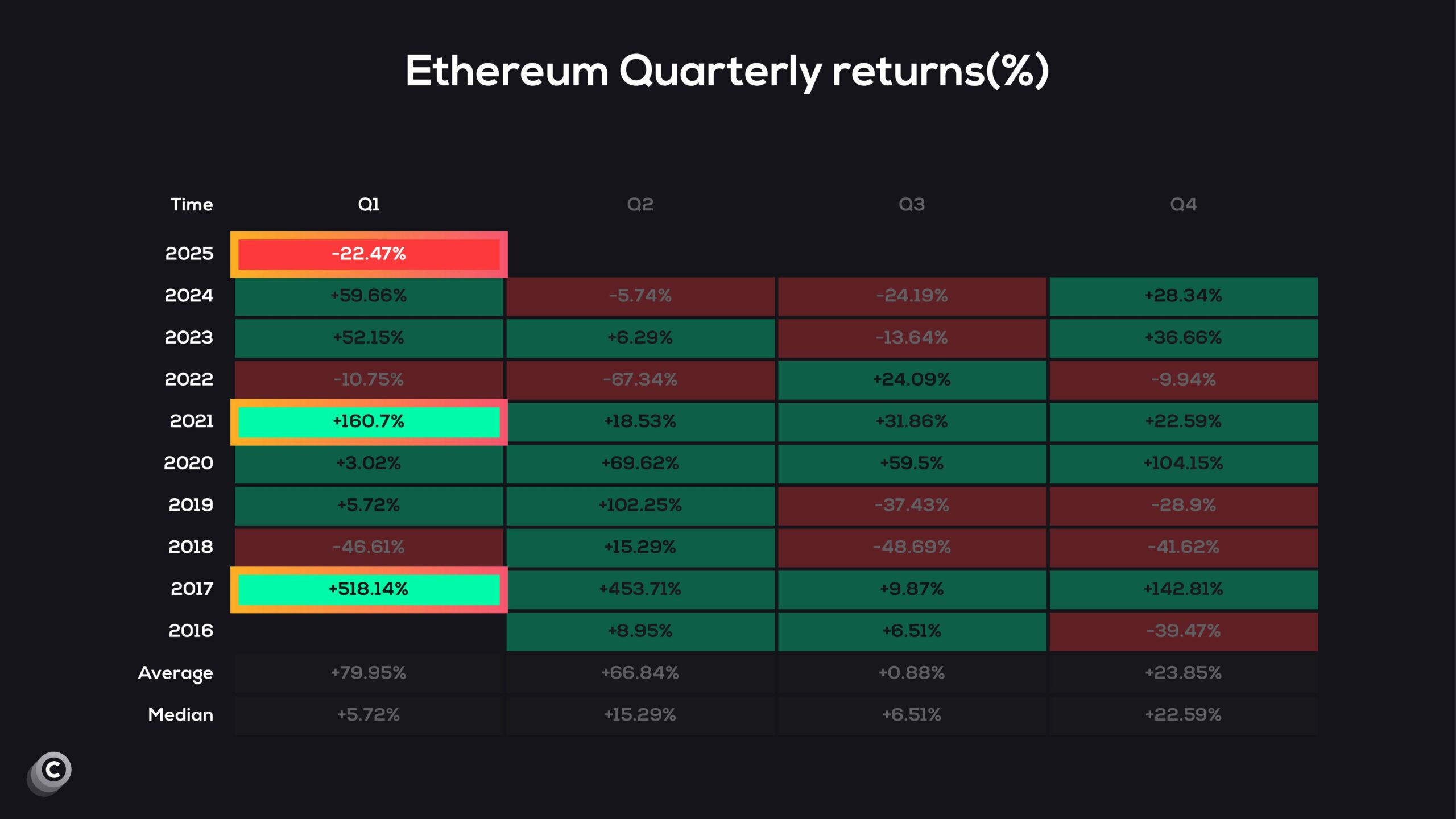

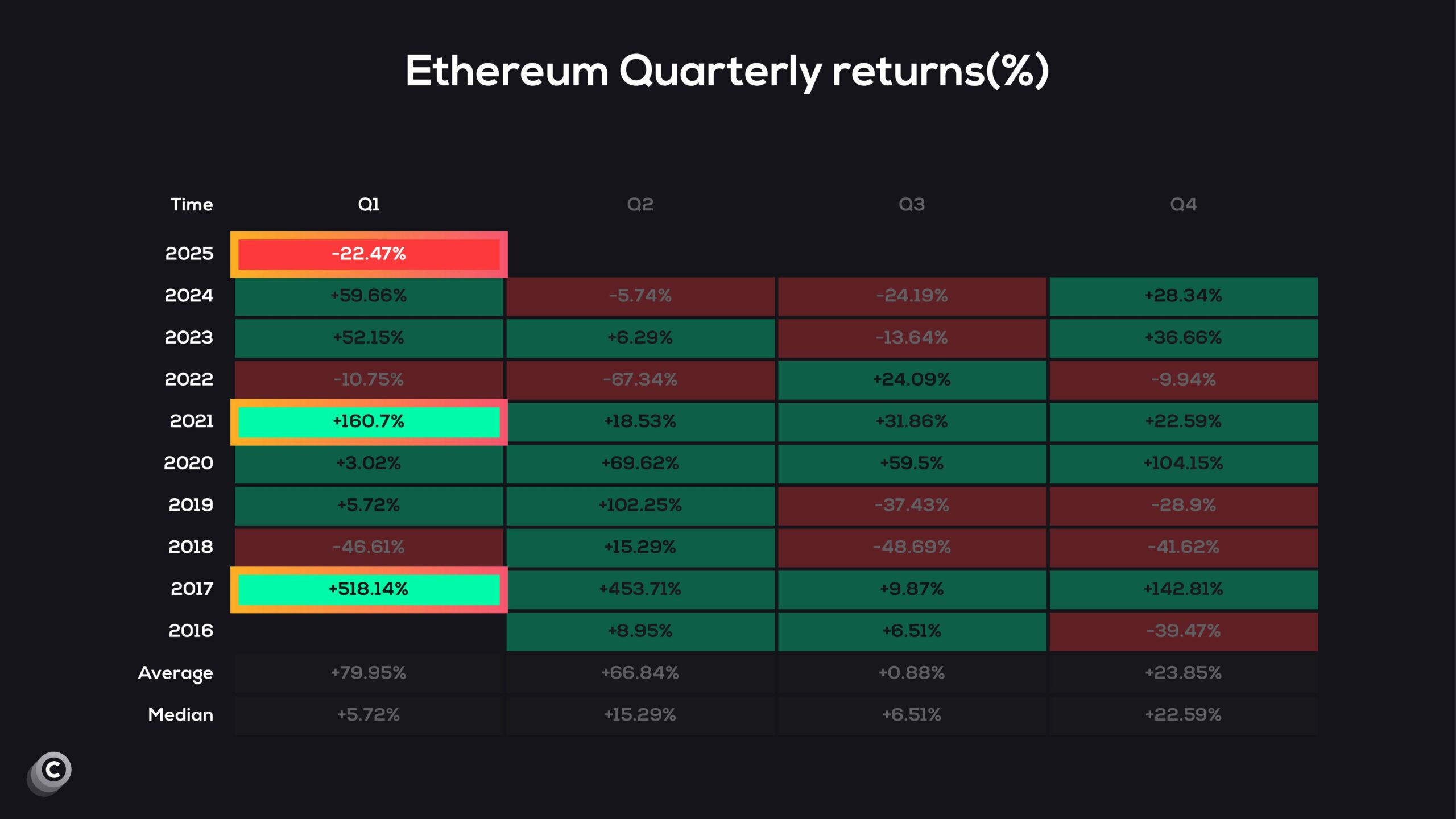

Historic proportion of quarterly returns

You will need to be aware that Ethereum has carried out traditionally nicely in Q1, however it’s at present confronted with a decline and acts with a reduction of twenty-two%.

This lower could be a reflection of the everyday volatility within the early 12 months or broader market tendencies that affect crypto-assets.

Traditionally, Q1 has seen common revenue of round 80% for Ethereum, besides 2018 and 2022. This means a doable rebound or upward correction because the quarter progresses.

Supply: X

If the market sentiment improves or influential crypto occasions happen, ETH can restore the present lows. It might attempt for income which might be similar to the previous first quarters.

Conversely, if the market stays bearish or exterior financial elements, the low cost can live on or turn out to be deeper. This might result in a modest Q1 efficiency for Ethereum.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now