Ethereum

Ethereum’s past tells all: Is ETH poised for massive rally?

Credit : ambcrypto.com

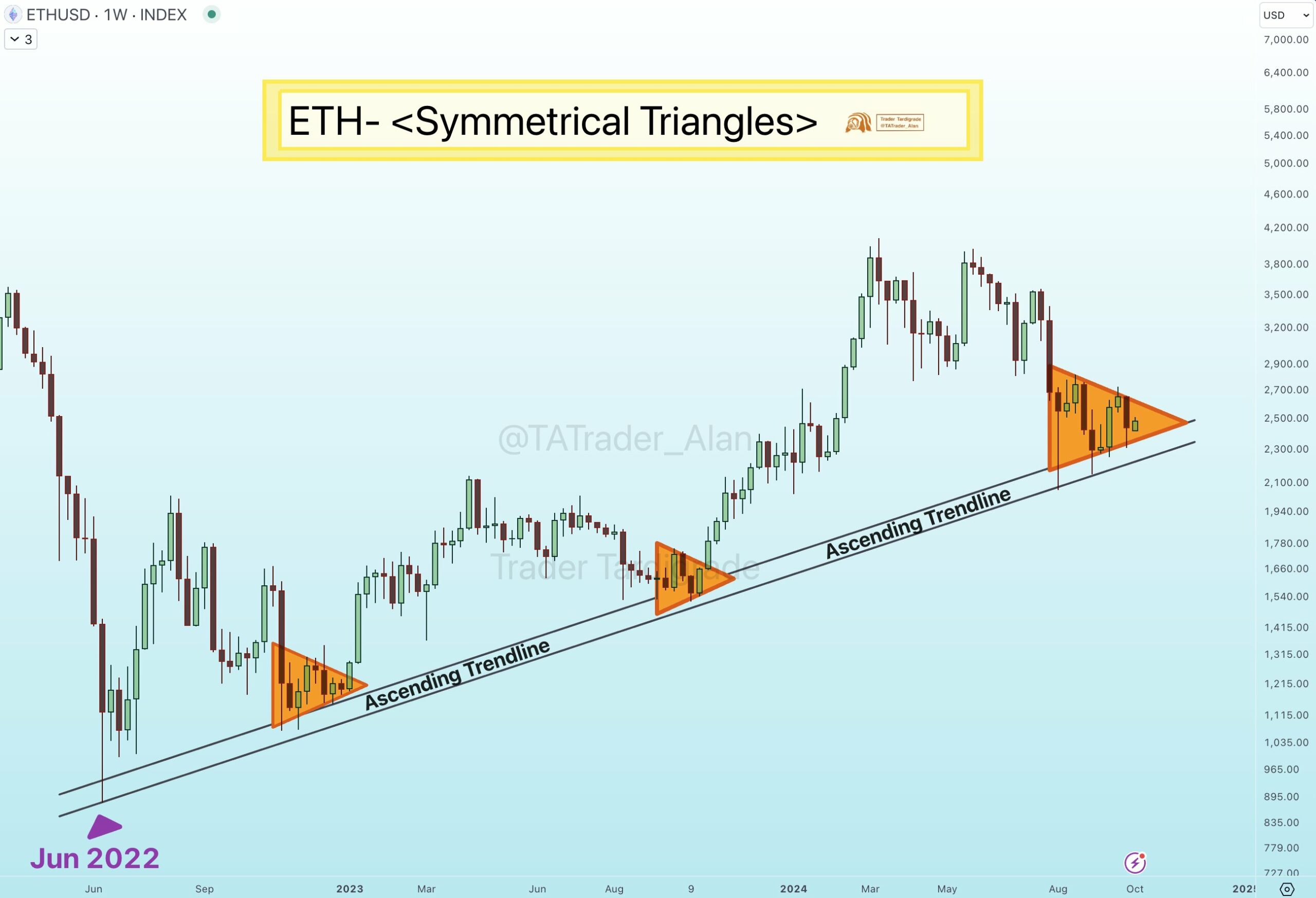

- A symmetrical triangle and an ascending trendline point out an upcoming bullish rebound for Ethereum.

- Ethereum’s leverage ratio and open curiosity are exhibiting vital tendencies that might quickly affect worth actions.

Ethereum [ETH] carefully displays total market dynamics and has lately skilled a notable worth improve.

Following Bitcoin [BTC] strikes, Ethereum is step by step recovering from a week-long dip that noticed its belongings fall 7.2%, pushing its worth under the $2,400 mark.

On the time of writing, ETH has managed to regain some floor, buying and selling at $2,451 with a modest acquire of 1.1% over the previous 24 hours.

Amid this worth restoration, a well known crypto analyst lately talked about the identify Dealer Tardigrade shared insights on the Ethereum worth chart.

The analyst identified that ETH has been following an upward trendline since June 2022 and has been exhibiting a constant sample.

Ethereum recovering quickly?

In keeping with the analyst, each time Ethereum approached this trendline, the worth motion fashioned a so-called symmetrical triangle sample earlier than bouncing increased.

Present market exercise exhibits the formation of a brand new symmetrical triangle simply above this trendline, indicating the potential for an impending restoration for Ethereum.

Tardigrade’s evaluation means that ETH is approaching an important help zone, with this triangle formation doubtlessly offering the momentum wanted for an upside breakout within the coming days.

Supply: Dealer Tardigrade on X

In technical evaluation, an ascending trendline is a straight line drawn to attach at the very least two or extra worth lows.

It signifies an upward motion, with every low being increased than the earlier one, indicating bullish market momentum over time.

A symmetrical triangle, alternatively, is a chart sample characterised by converging pattern strains, which point out a interval of consolidation earlier than a breakout.

This sample often happens when the market is indecisive, however a breakout in both route usually follows as soon as the consolidation section is over.

The repeated look of those symmetrical triangles on Ethereum’s worth chart, coupled with its positioning above the rising trendline, implies {that a} potential bullish breakout is on the horizon.

The elemental view of ETH

Along with the technical indicators, Ethereum’s basic metrics additionally present useful insights into its potential trajectory.

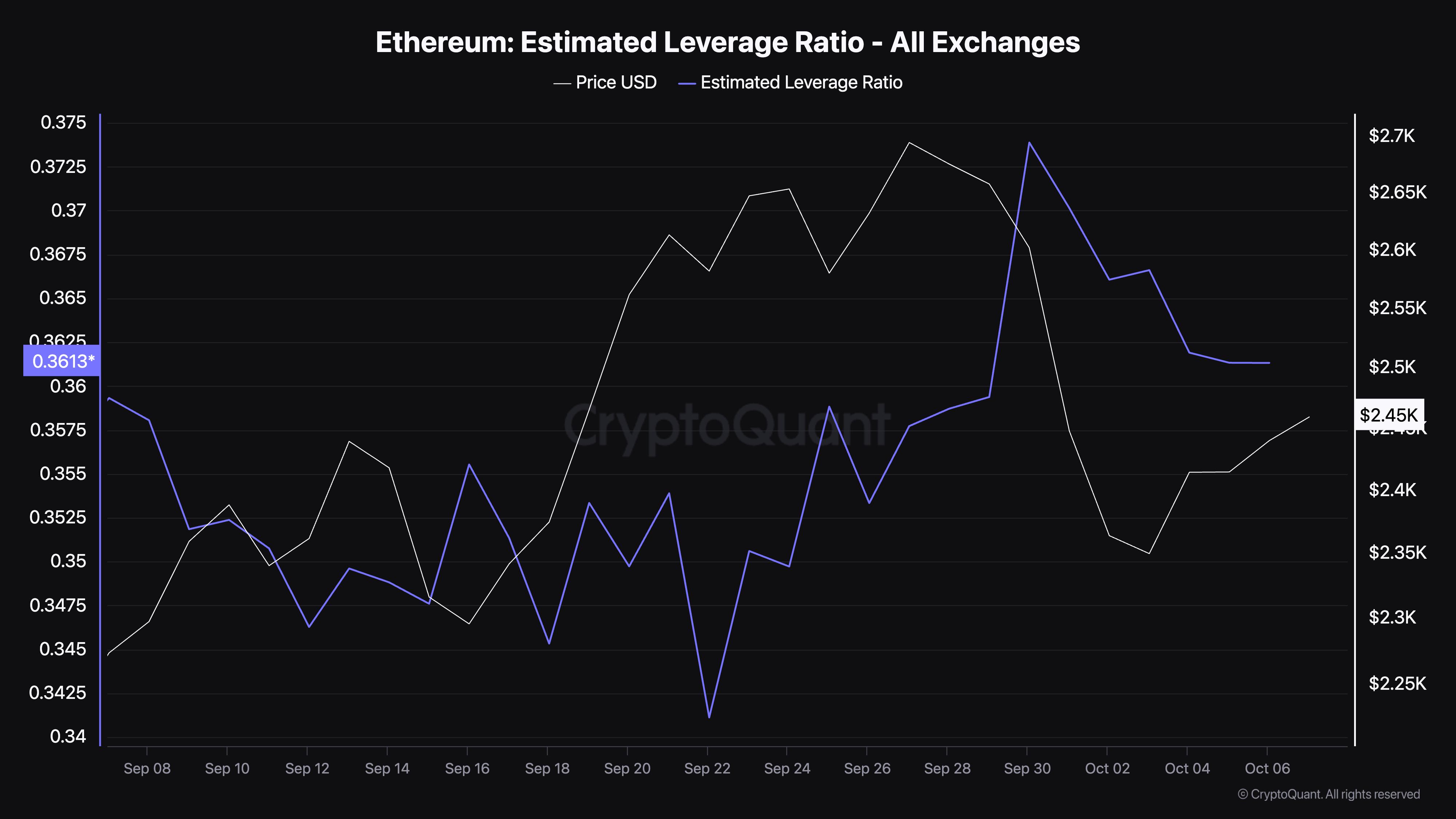

In keeping with facts from CryptoQuant, Ethereum’s estimated leverage ratio has elevated over the previous month, with the determine at present standing at 0.361.

This ratio represents the quantity of leverage merchants use, calculated as Open Curiosity divided by forex reserves.

Supply: CryptoQuant

A rise on this ratio implies that extra leverage is being utilized, which regularly means increased expectations for worth volatility.

Whereas this will result in increased income if the worth strikes within the anticipated route, it additionally will increase the danger of liquidation if the worth shifts unfavorably.

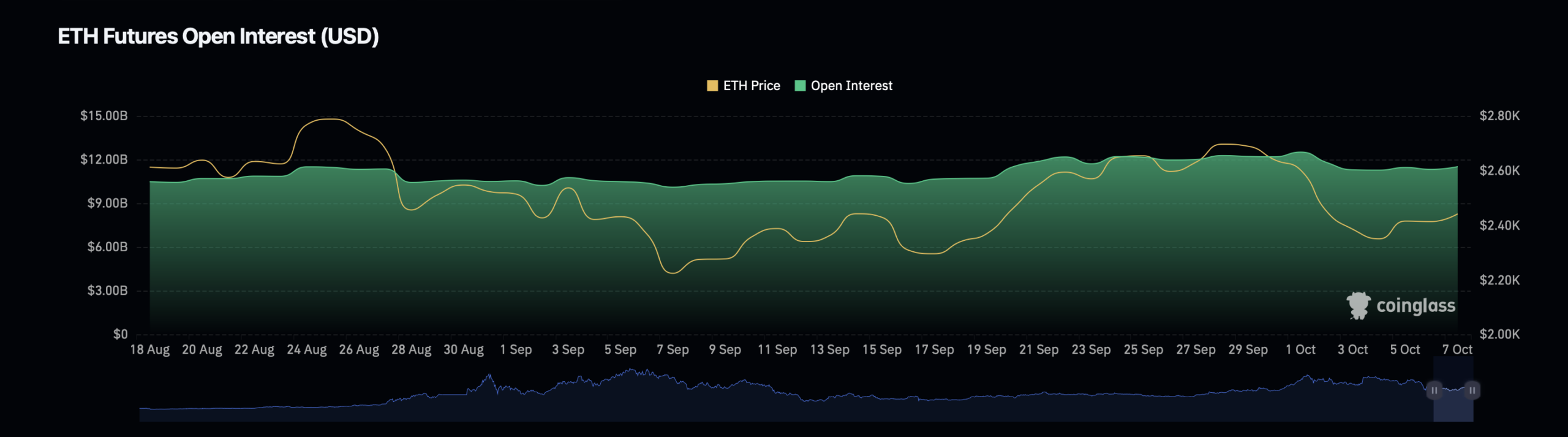

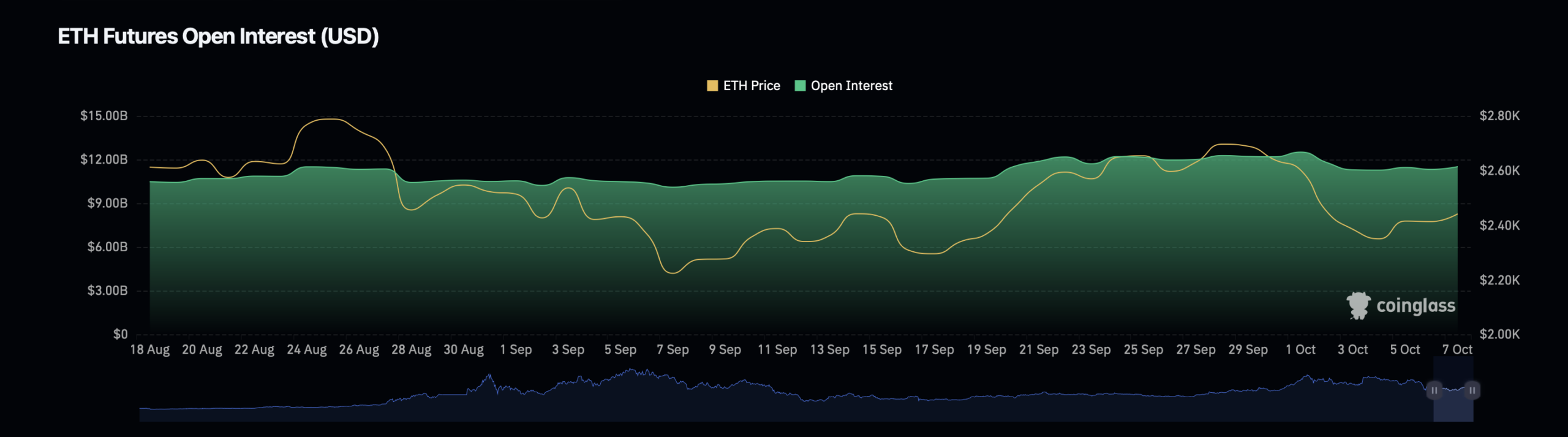

To additional assess Ethereum’s market well being, a take a look at the open curiosity reveals blended indicators.

Open Curiosity, which represents the entire variety of energetic derivatives contracts, has skilled a slight decline of 0.21% and stands at a valuation of $11.38 billion in line with Mint glass.

Nonetheless, Ethereum’s Open Curiosity quantity has elevated by a powerful 120% and is now valued at $18.38 billion.

Supply: Coinglass

This distinction signifies that whereas the variety of open contracts has decreased, the buying and selling quantity and exercise round these contracts has elevated considerably.

The decline in Open Curiosity might point out a section of decreased speculative exercise, which regularly happens when merchants shut their positions to keep away from larger market uncertainty.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Conversely, the rise in quantity might point out that merchants are actively collaborating out there and probably positioning themselves for Ethereum’s subsequent massive worth transfer.

This mixture of decreased speculative positions however elevated quantity exercise implies that market individuals are consolidating their positions, doubtless in anticipation of extra decisive worth motion within the close to future.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now