Ethereum

Ethereum’s path to $4.5K: What the latest analysis reveals

Credit : ambcrypto.com

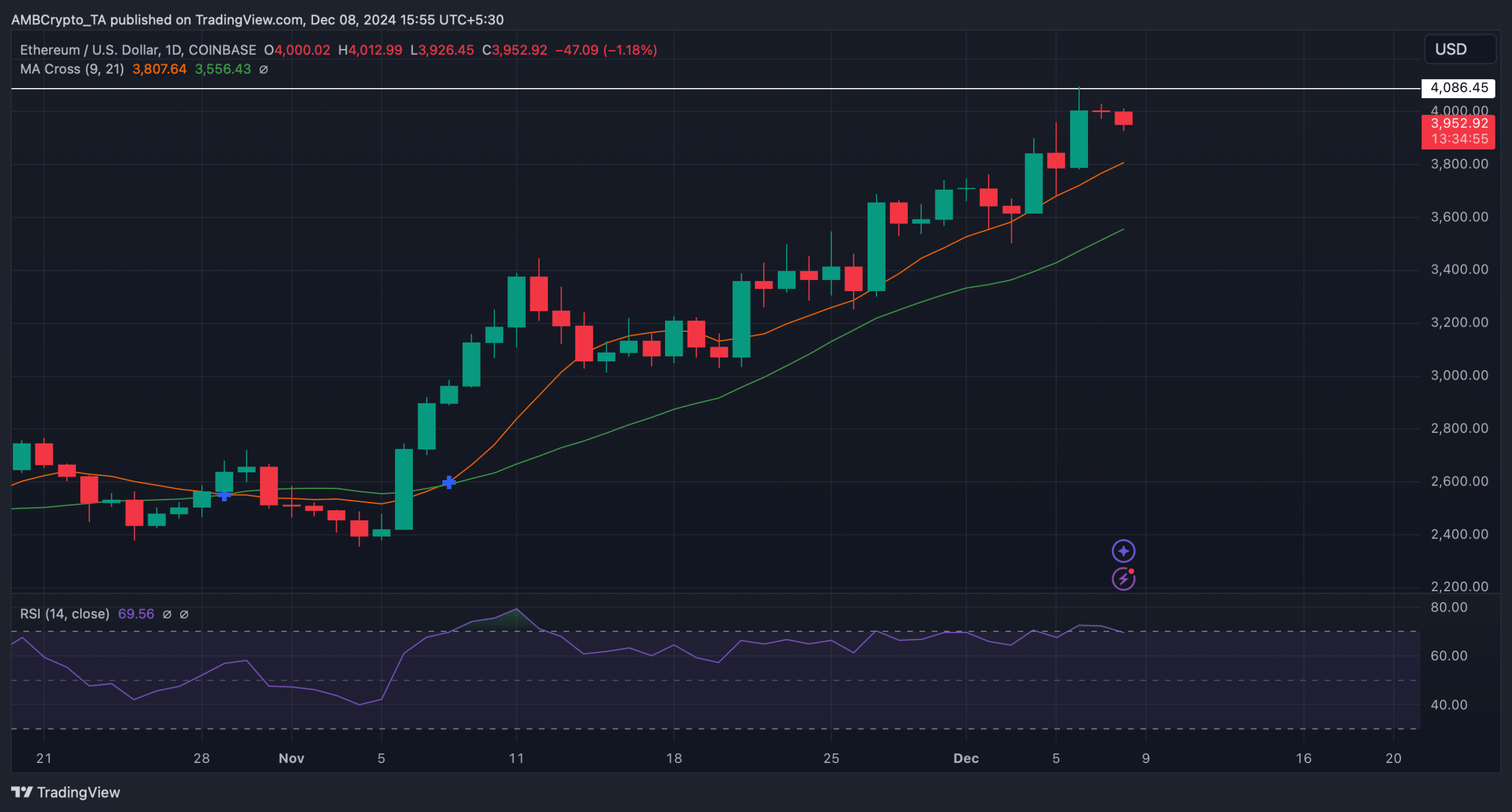

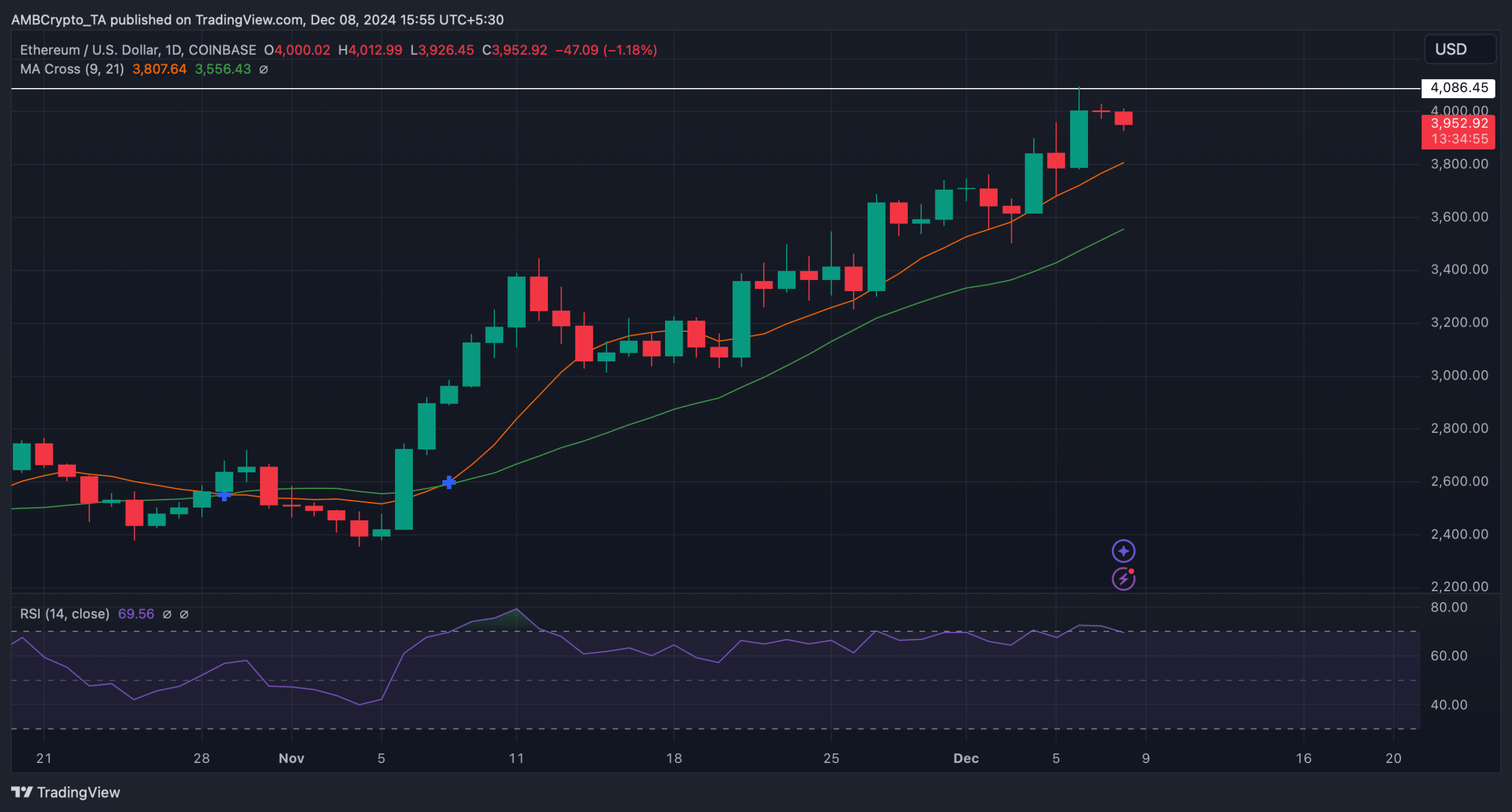

- Ethereum’s forex reserve fell, indicating excessive shopping for stress.

- Nonetheless, the RSI was within the overbought zone.

Ethereum [ETH] has been struggling to interrupt the $4k barrier for fairly a while now as it’s getting rejected close to the resistance.

Nonetheless, the newest evaluation has proven that the trail for ETH heading to a brand new all-time excessive is kind of clear. That’s the reason AMBCrypto has performed additional analysis to search out out whether or not that is really the case.

Ethereum is heading in the right direction

The value of ETH registered a 7% enhance final week, bringing the token’s worth near $4k. On the time of writing, ETH was buying and selling at $3.05k with a market cap of over $476 billion.

Within the meantime, Ali Martinez, a well-liked crypto analyst, posted tweet reveal that nothing stopped ETH from reaching new all-time highs. The one modest resistance zone forward was round $4,540.

However so long as the $3,560 demand zone holds, the percentages are in favor of the bulls.

Will ETH attain $4.5k quickly?

Since Martinez’s tweet revealed the potential of ETH reaching $4.5k, AMBCrypto assessed the token’s on-chain metrics to find out the chance of this occurring within the close to time period.

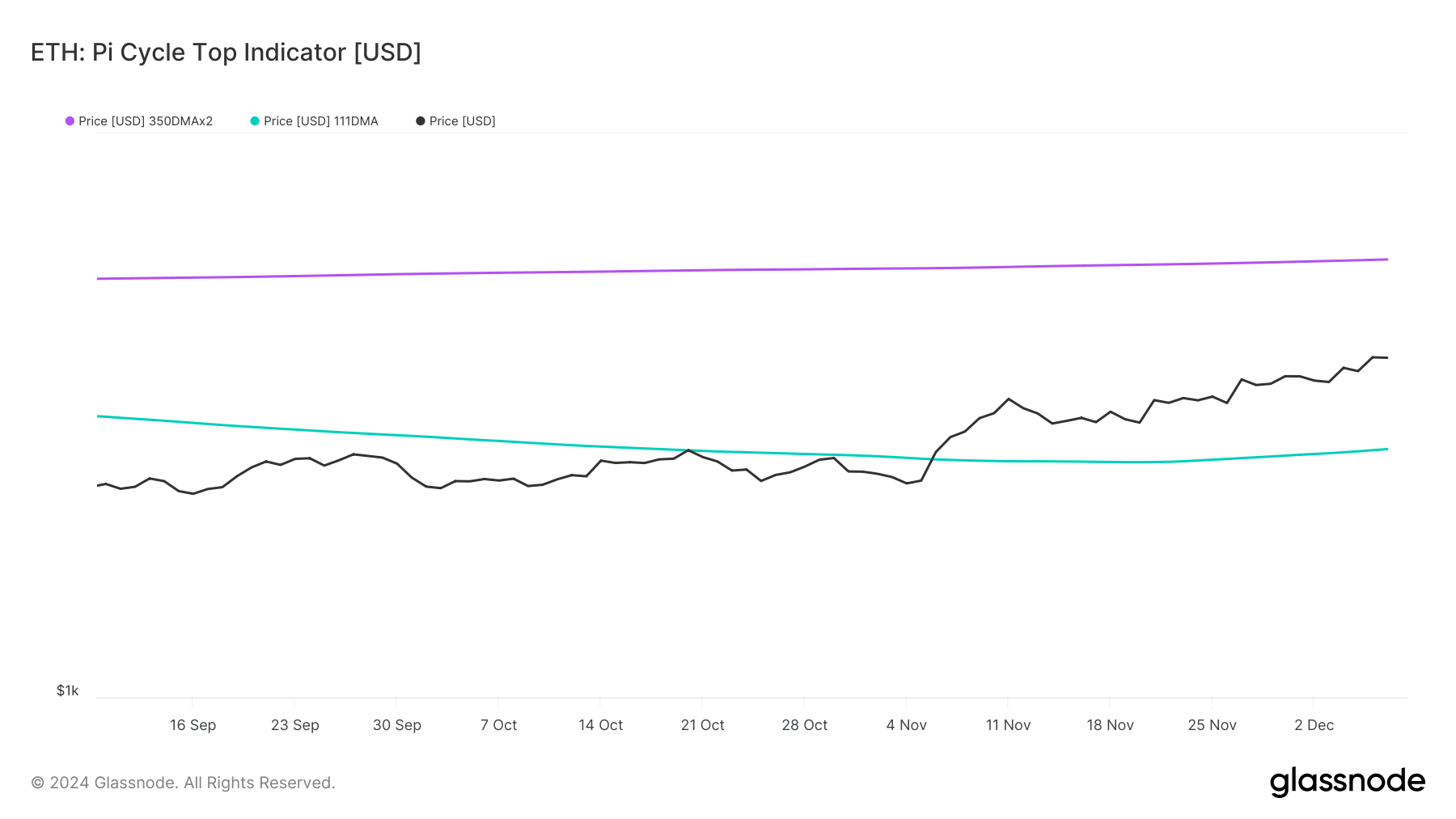

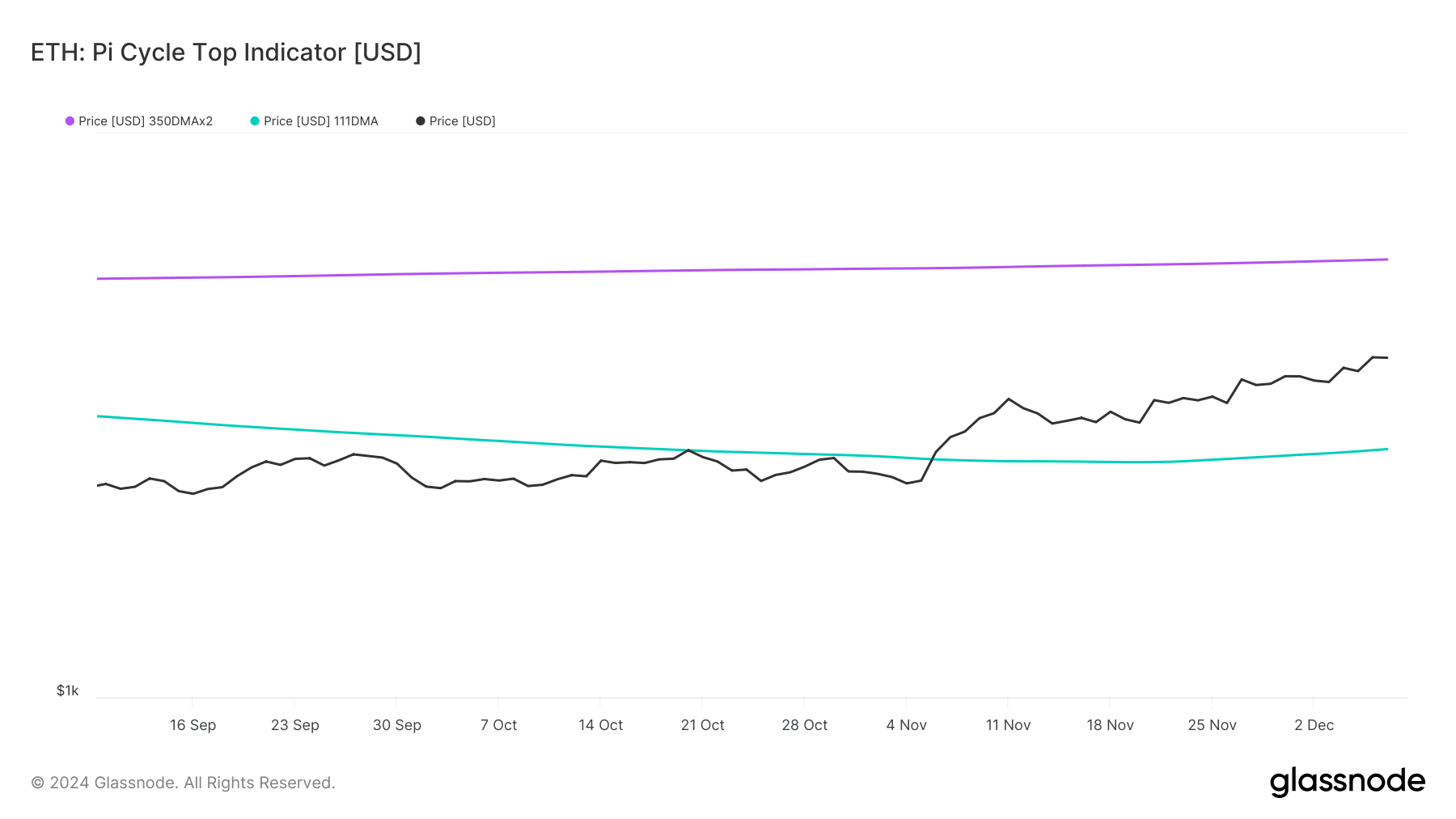

ETH’s Pi Cycle Prime indicator revealed that ETH was buying and selling effectively between the highest and backside of the market. If the benchmark is to be believed, ETH’s attainable market prime was at $5.9k.

Due to this fact, it appeared possible that ETH would quickly attain $4.5k.

Supply: Glassnode

CryptoQuant’s facts revealed that purchasing stress on the token was growing. This was evident from ETH’s declining overseas trade reserve.

Moreover, Ethereum’s Coinbase premium was inexperienced, that means shopping for sentiment amongst US traders was sturdy. Nonetheless, some numbers additionally seemed bearish.

For instance, ETH’s purchase/promote ratio turned crimson. When this occurs, it signifies that promoting sentiment is dominant within the derivatives market. Extra gross sales orders are being crammed by takers.

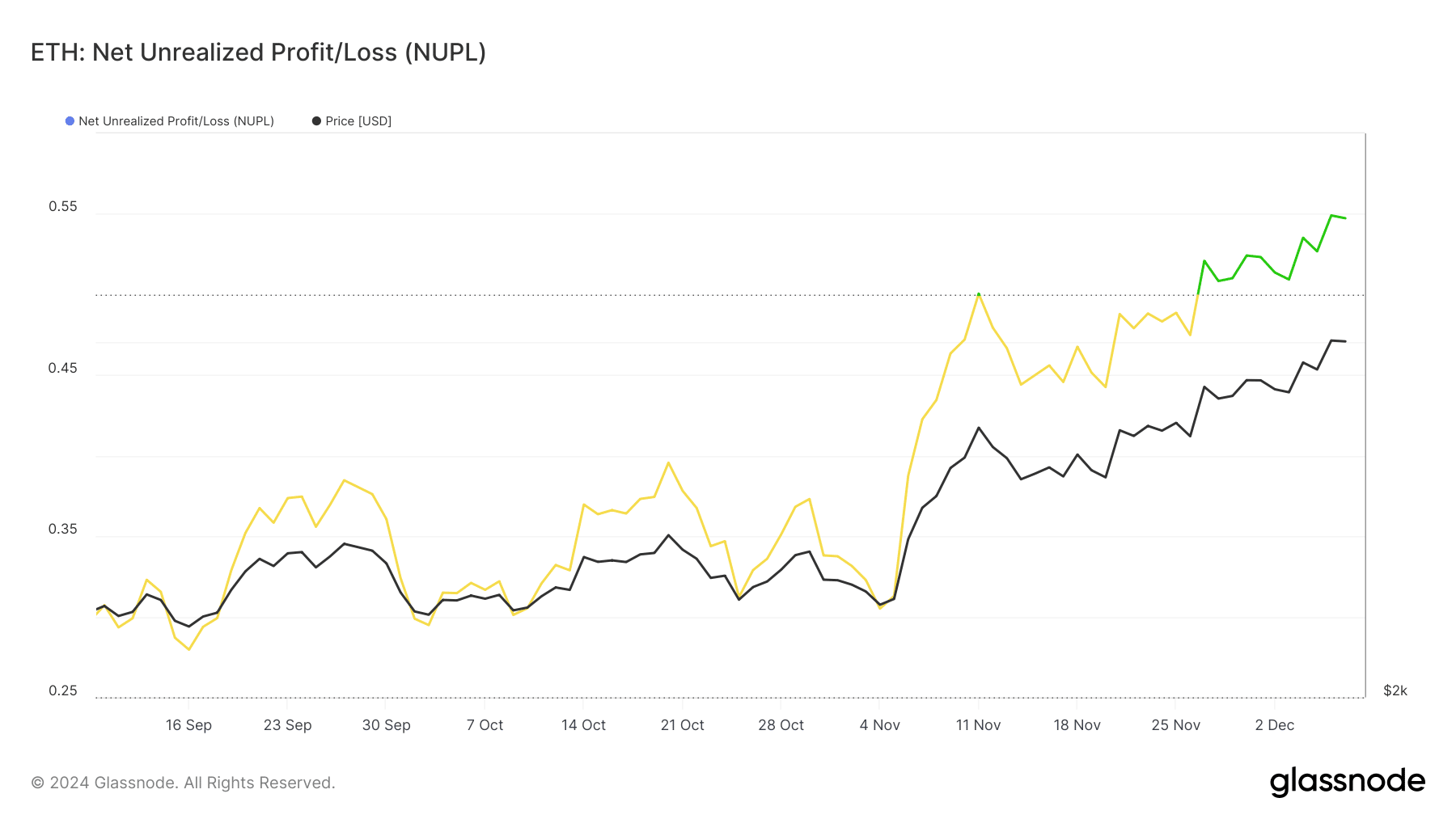

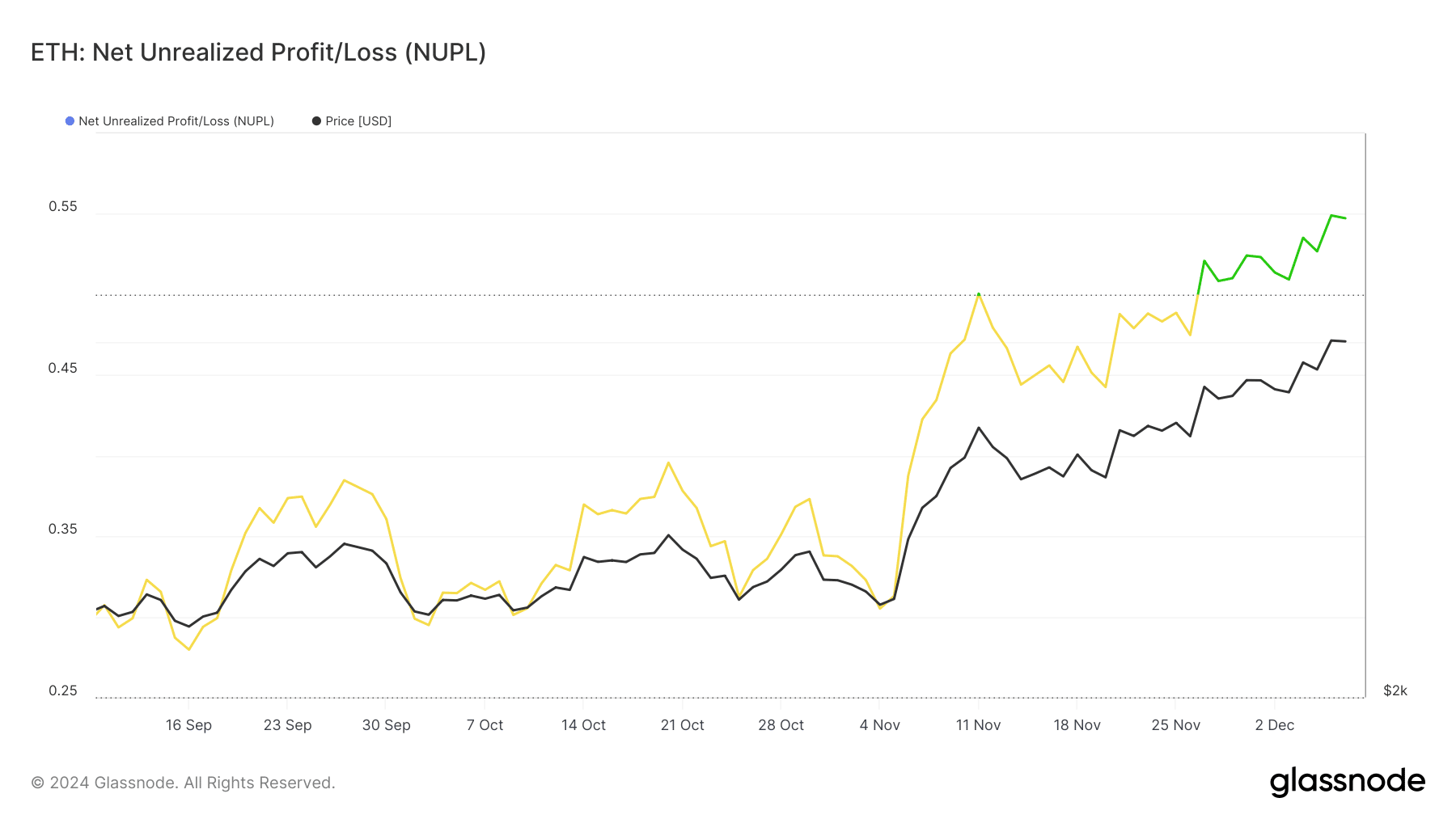

Aside from this, ETH’s web unrealized acquire/loss (NUPL) entered the ‘perception section’.

To start out, the NUPL is the distinction between relative unrealized acquire and relative unrealized loss. Traditionally, worth corrections had been tracked when the metric reached this degree.

If historical past repeats itself, ETH could not rise above $4,000 within the close to time period.

Supply: Glassnode

The issues for ETH had been removed from over. The token’s Relative Energy Index (RSI) was within the overbought zone.

Learn Ethereums [ETH] Value prediction 2024–2025

This might encourage traders to promote their holdings, which has the potential to drive down the value of ETH within the coming days.

However, the MA Cross indicator supported the bulls because the 9-day MA was effectively above the 21-day MA.

Supply: TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024