Ethereum

Ethereum’s promised upgrades could aid price recovery, but until then…

Credit : ambcrypto.com

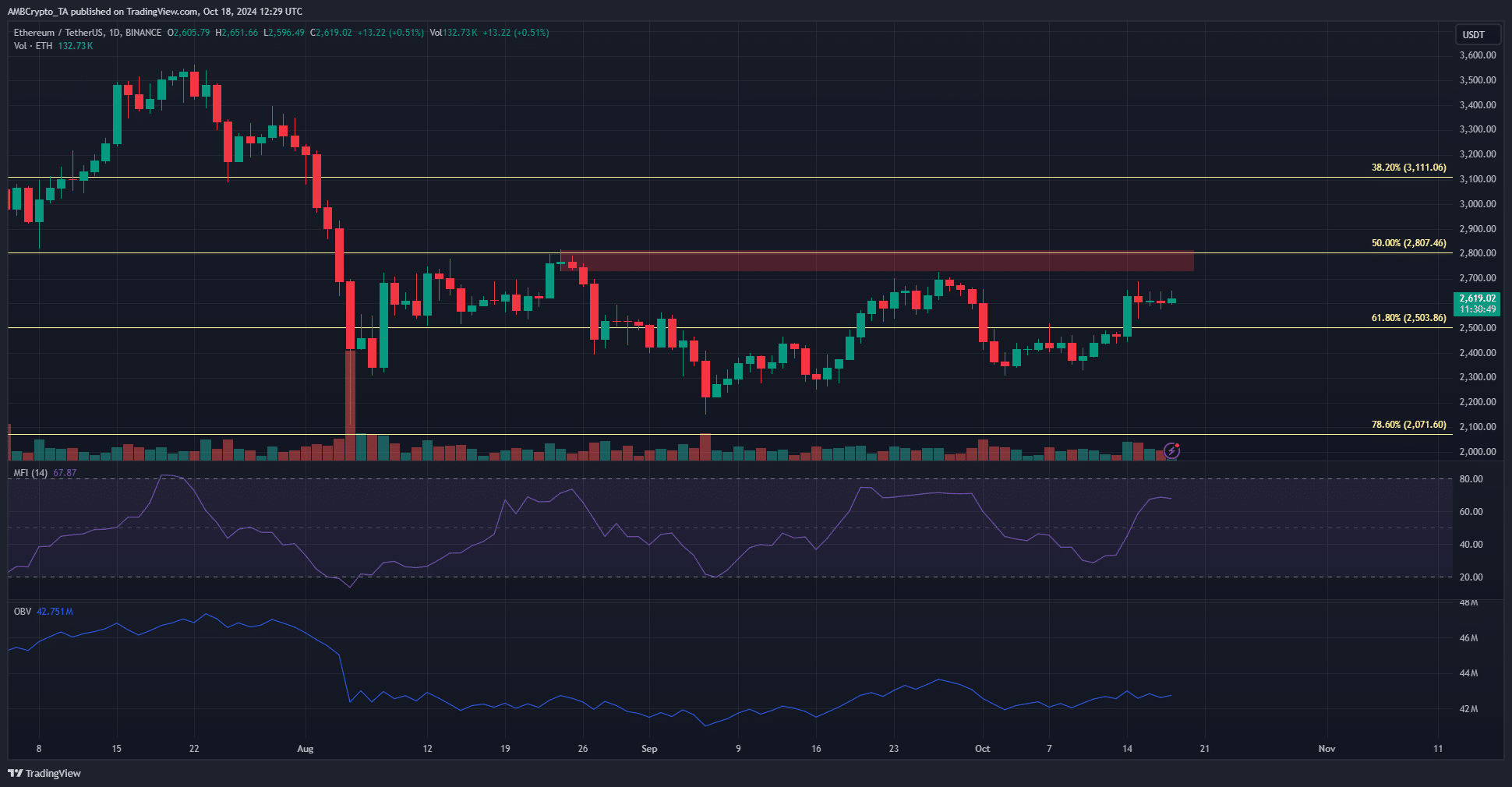

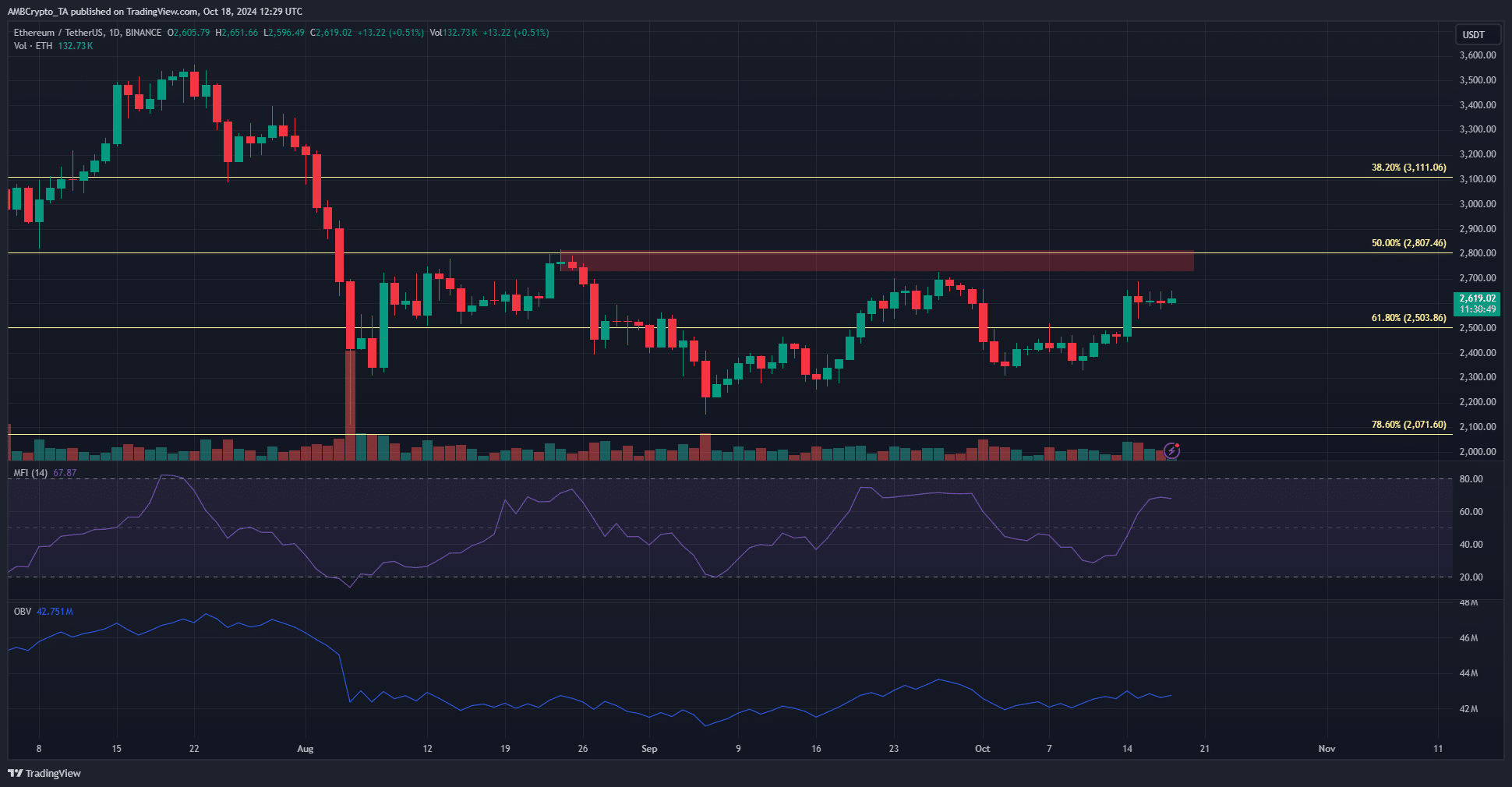

- Ethereum has been rejected by the $2.7k resistance zone since August

- The rising leverage ratio metric highlighted why a breakout could possibly be unlikely

Ethereum [ETH]On the time of writing, it was buying and selling inside a spread of $2.8k to $2.2k. The $2.8k area particularly has been performing as a secure provide zone since early August. It additionally converges with the 50% Fibonacci retracement stage.

Analysis into the worrying value developments

The ETH/BTC chart has been trending south for simply over 18 months. Whereas Bitcoin [BTC] buying and selling 8% beneath its ATH, Ethereum is 46.3% away from its ATH. The altcoin’s efficiency ought to be considered within the context of Vitalik Buterin’s imaginative and prescient for the subsequent doable improve: “The wave.” Significantly a few of the targets relating to transactions per second and maximizing interoperability between L2s.

Supply: ETH/USDT on TradingView

The efficiency of an asset is a transparent understanding of what the market thinks the worth of the asset is, and what it could possibly be. Typically hype and misinformation can distort these beliefs, resulting in overvalued or undervalued property.

Ethereum’s efficiency may be partly defined by inflation considerations for the reason that Dencun improve, however it’s only a small a part of the puzzle. The proposed enhancements to the Proof of Stake system and the upgrades being thought of for the community total, when applied, may handle community income, person progress, adoption, and different points.

This might in flip enhance demand. As issues stand now, there could possibly be a tough trip for ETH on the worth charts.

Clues from the derivatives market

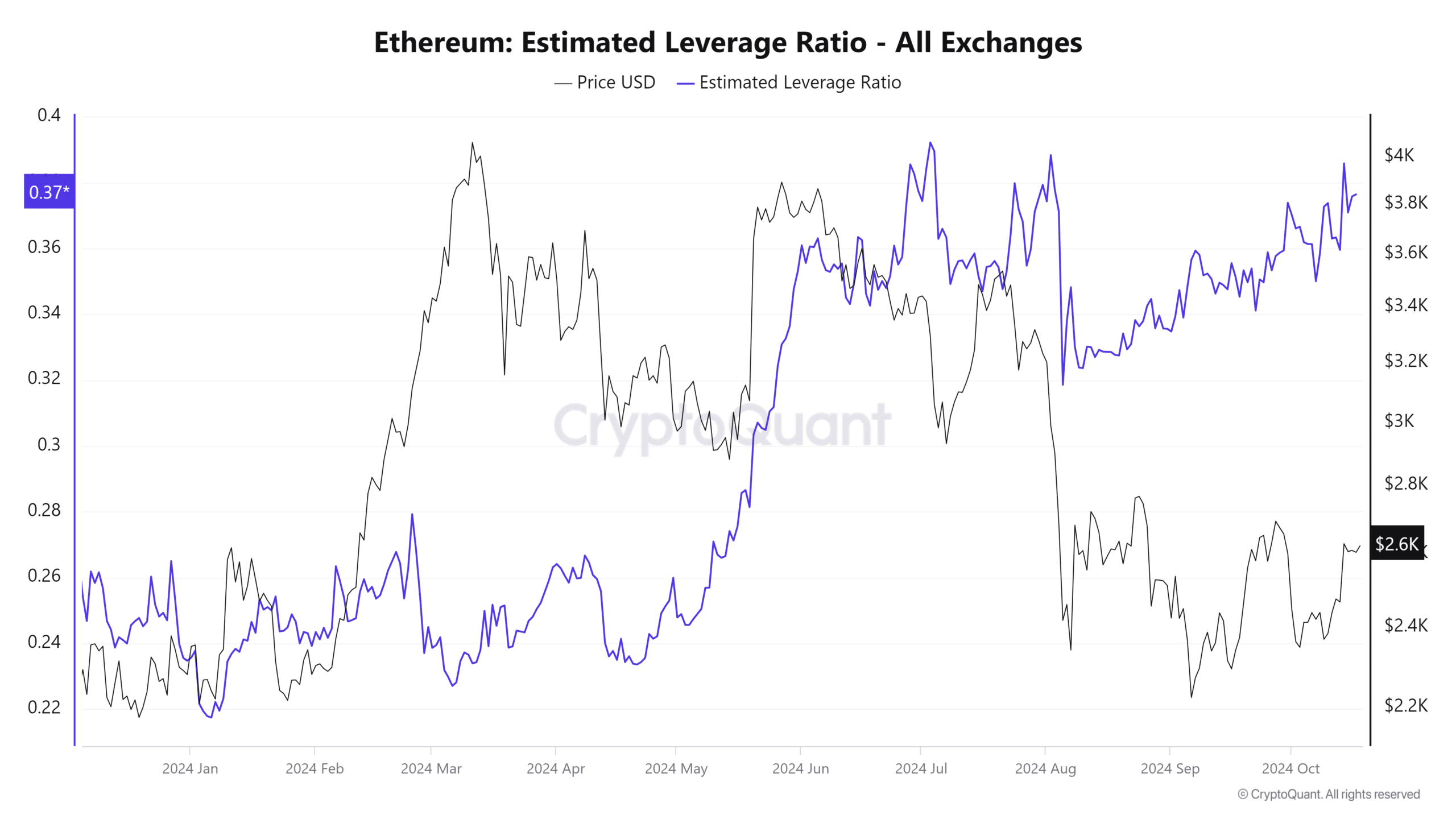

The estimated leverage ratio (ELR) is calculated by dividing the Open Curiosity by the trade’s coin reserves. Coinglass knowledge additionally reveals that Open Curiosity has elevated from $10 billion to $13 billion for ETH for the reason that second week of August.

This helped clarify the rising ELR. Nonetheless, now that the worth is buying and selling beneath a key resistance, this may be interpreted as a warning sign for merchants.

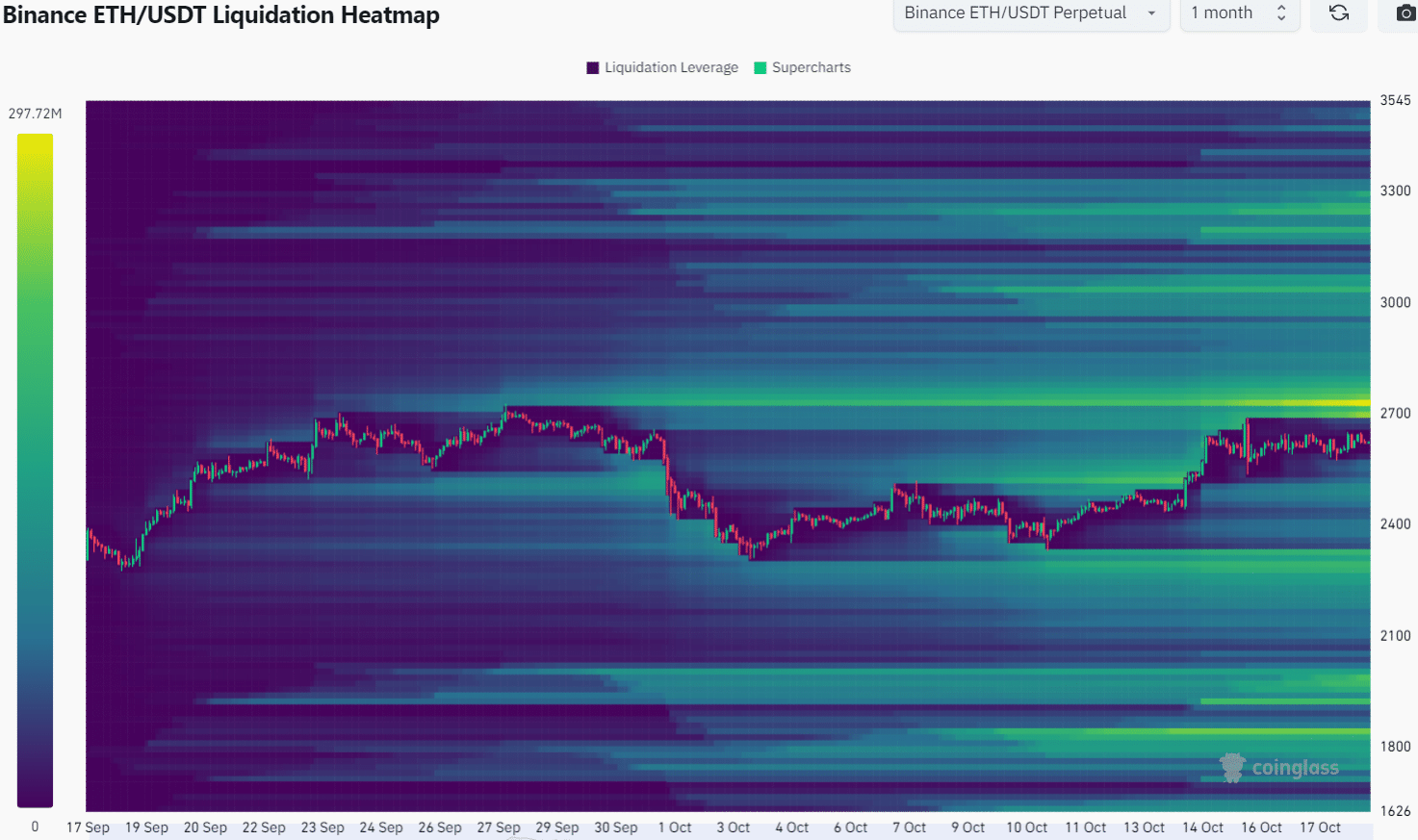

The liquidation heatmap with a one-month lookback interval famous that the $2,730 zone is full of liquidation ranges. The three-month chart confirmed that the realm between $2,730 and $2,850 is vital.

Together with the worth motion, we are able to see {that a} bearish reversal from these ranges is a likelihood that merchants ought to be ready for.

Learn Ethereum’s [ETH] Worth forecast 2024-25

General, the dearth of natural demand and L2s attracting extra contributors and transaction exercise stays an issue for the mainnet and its buyers. Technical evaluation indicated that ETH bulls might not have the energy to push the crypto’s value above $2.9k as effectively.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024