Altcoin

Ethereum’s Q1 Gains vs. $10 Billion Liquidation Risk – What’s Next?

Credit : ambcrypto.com

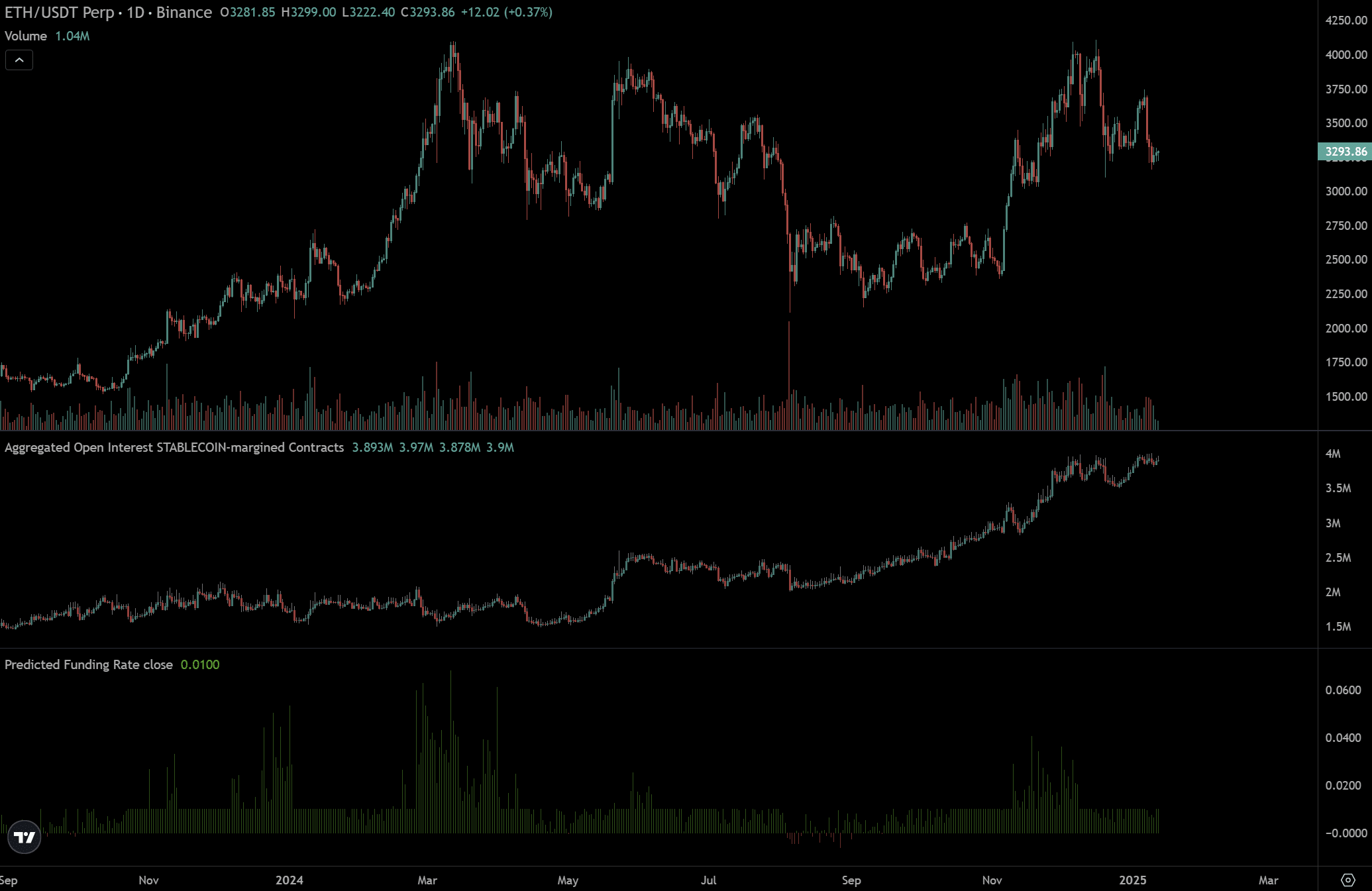

- ETH’s leverage has elevated to $10 billion in two months.

- Historic traits indicated that top leverage might negatively affect the worth of ETH.

Although the primary quarter was traditionally bullish Ethereum [ETH]The altcoin’s huge $10 billion leverage might expose it to liquidation dangers and restrict its upside potential.

Andrew Kang, co-founder of crypto VC agency Mechanism Capital, predicted that ETH might stay tied ($2K-$4K) as a result of this leverage danger. He declared,

“$ETH has added over $10 billion in leverage for the reason that election. This settlement will probably be painful, however $ETH won’t go to zero. It can simply vary from $2,000 to $4,000 for a really very long time.”

Supply:

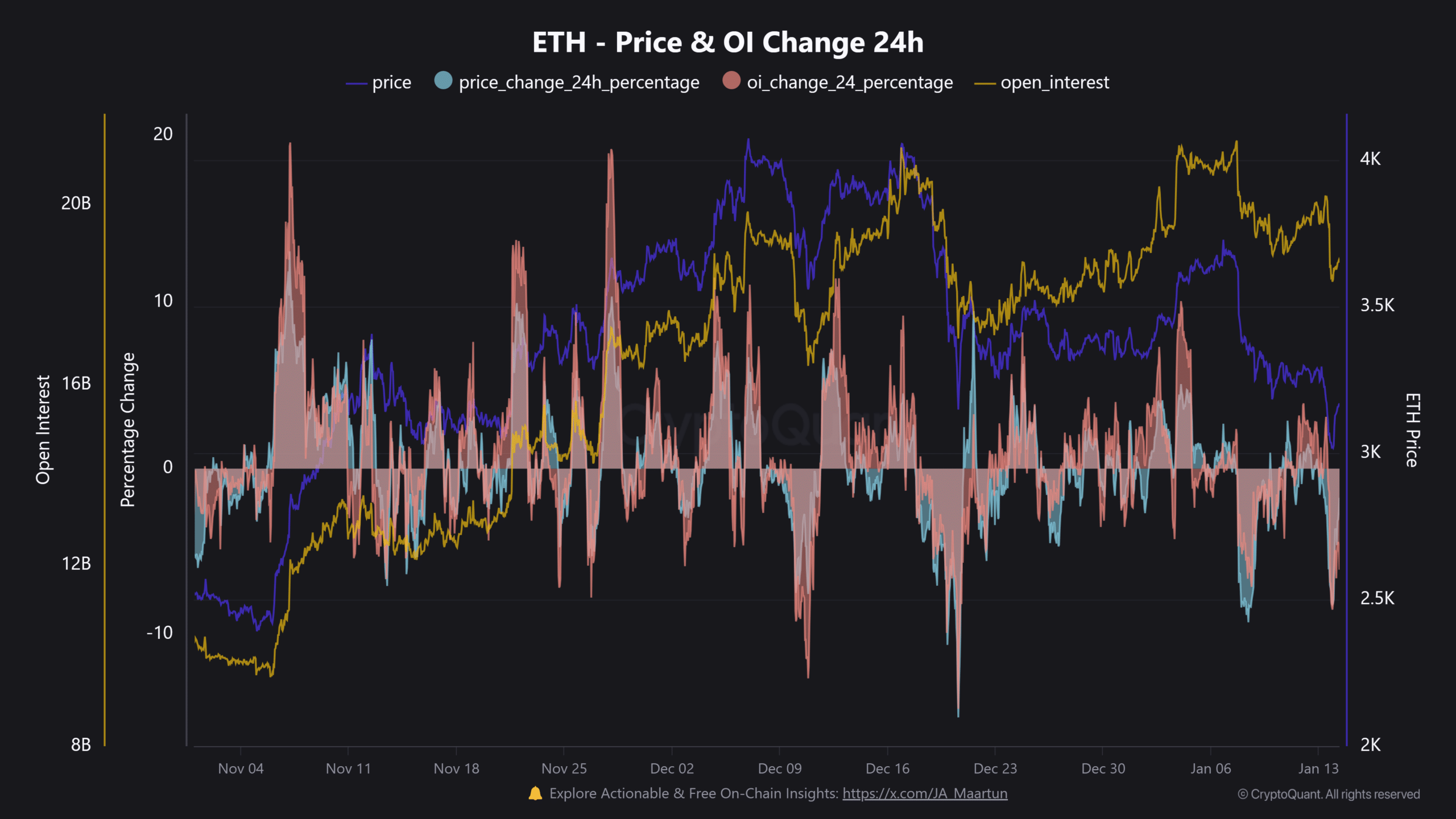

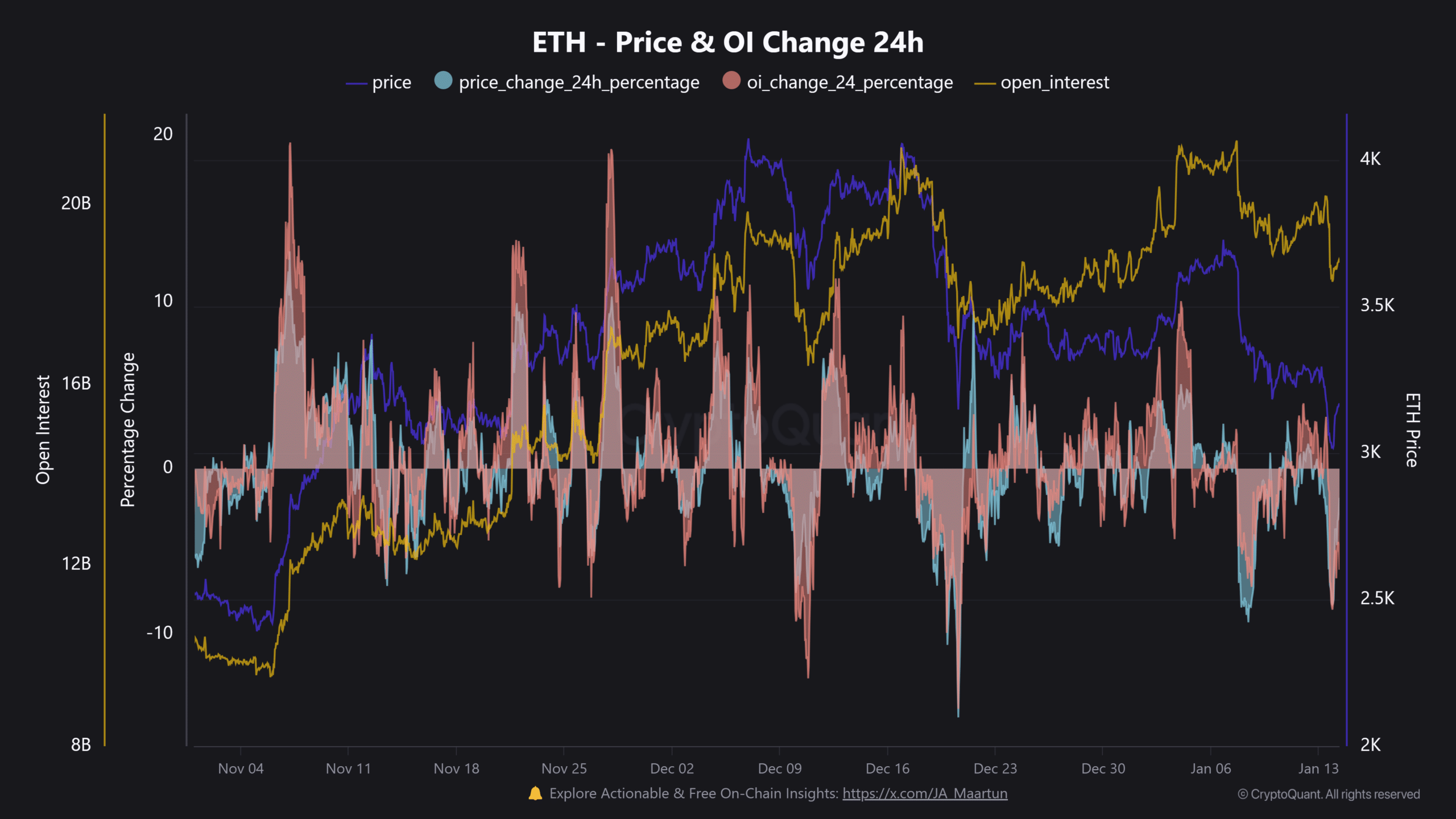

Earlier than the US election, ETH (borrowed property for speculative buying and selling) leverage was $9 billion. In December, it shot as much as greater than $19 billion.

Afterwards, the sharp worth drop liquidated a number of positions and dragged ETH to round $3.1K.

Will Leverage Derail ETH’s Benefit?

Kang added that the ETH foundation buying and selling powered by CME Futures had little affect on the large leverage because it was “delta impartial”: any ETH purchased on the spot market has been shorted on the Futures market. As a substitute, he blamed speculative merchants for the extreme leverage.

The historic ETH leveraged pump confirmed Kang’s issues. Generally, when the leverage Open Curiosity rose greater than the value in the course of the rally, a pullback and a neighborhood high adopted.

Supply: CryptoQuant

This was clearly seen in early November and late December. They each escalated ETH liquidations.

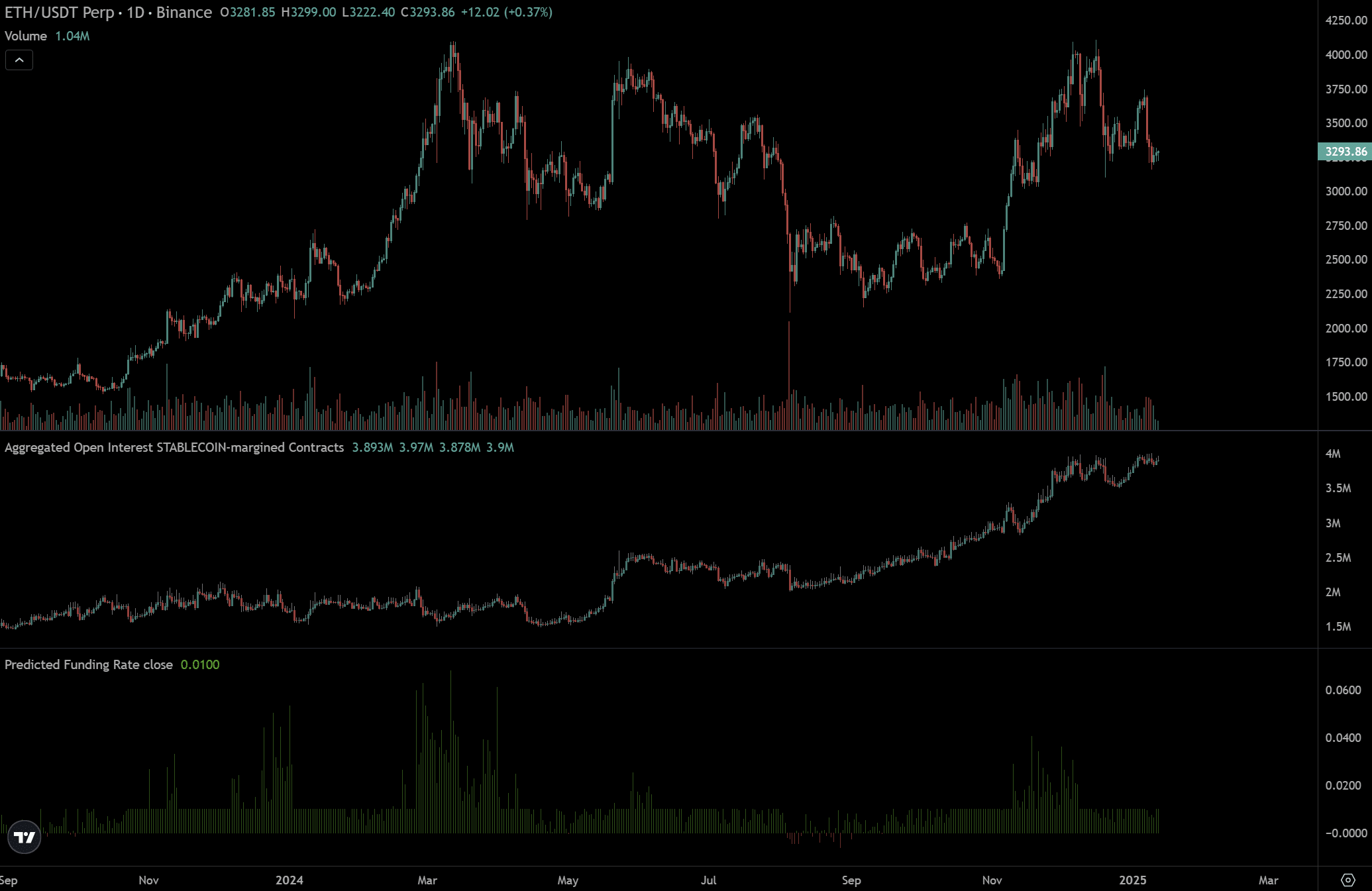

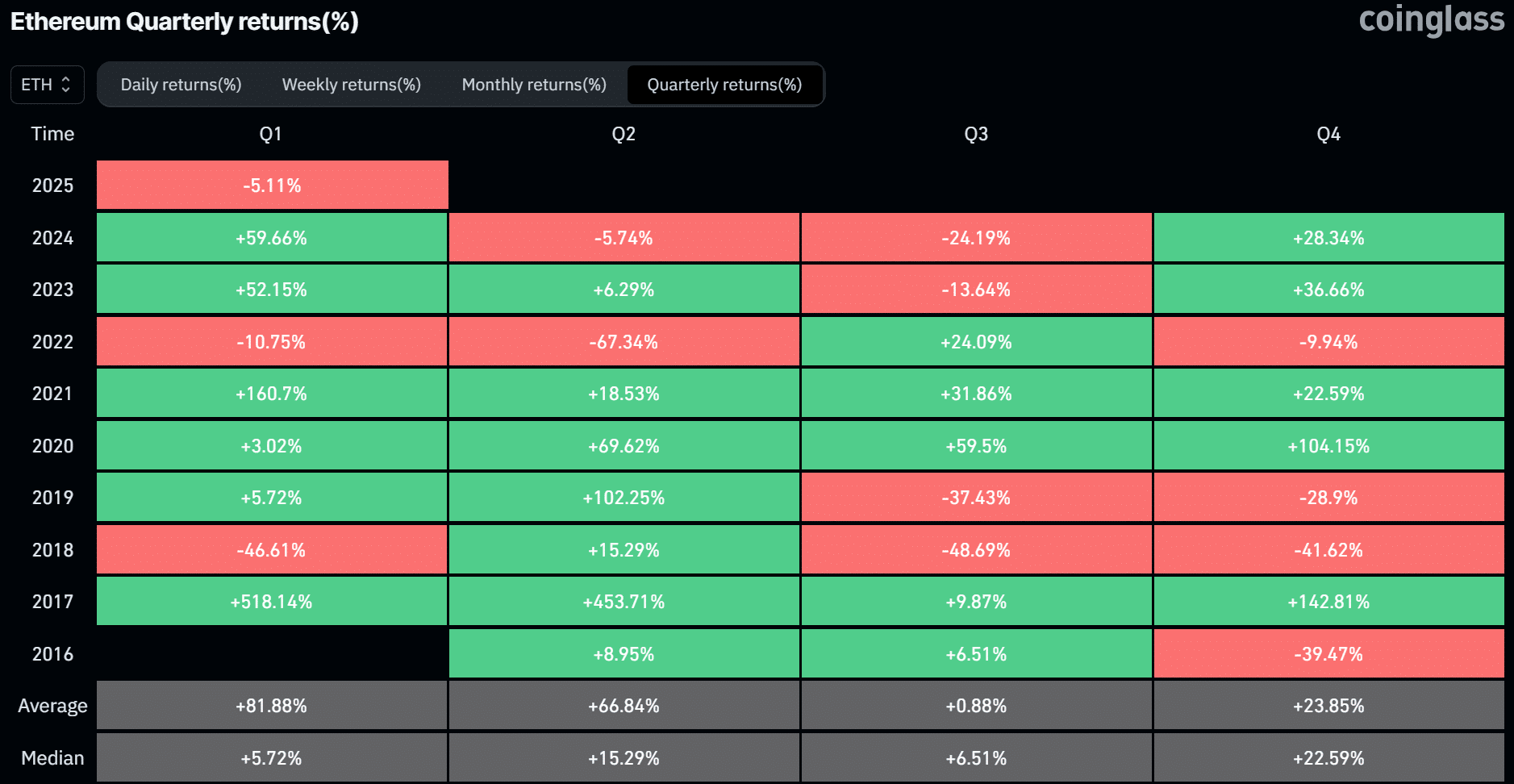

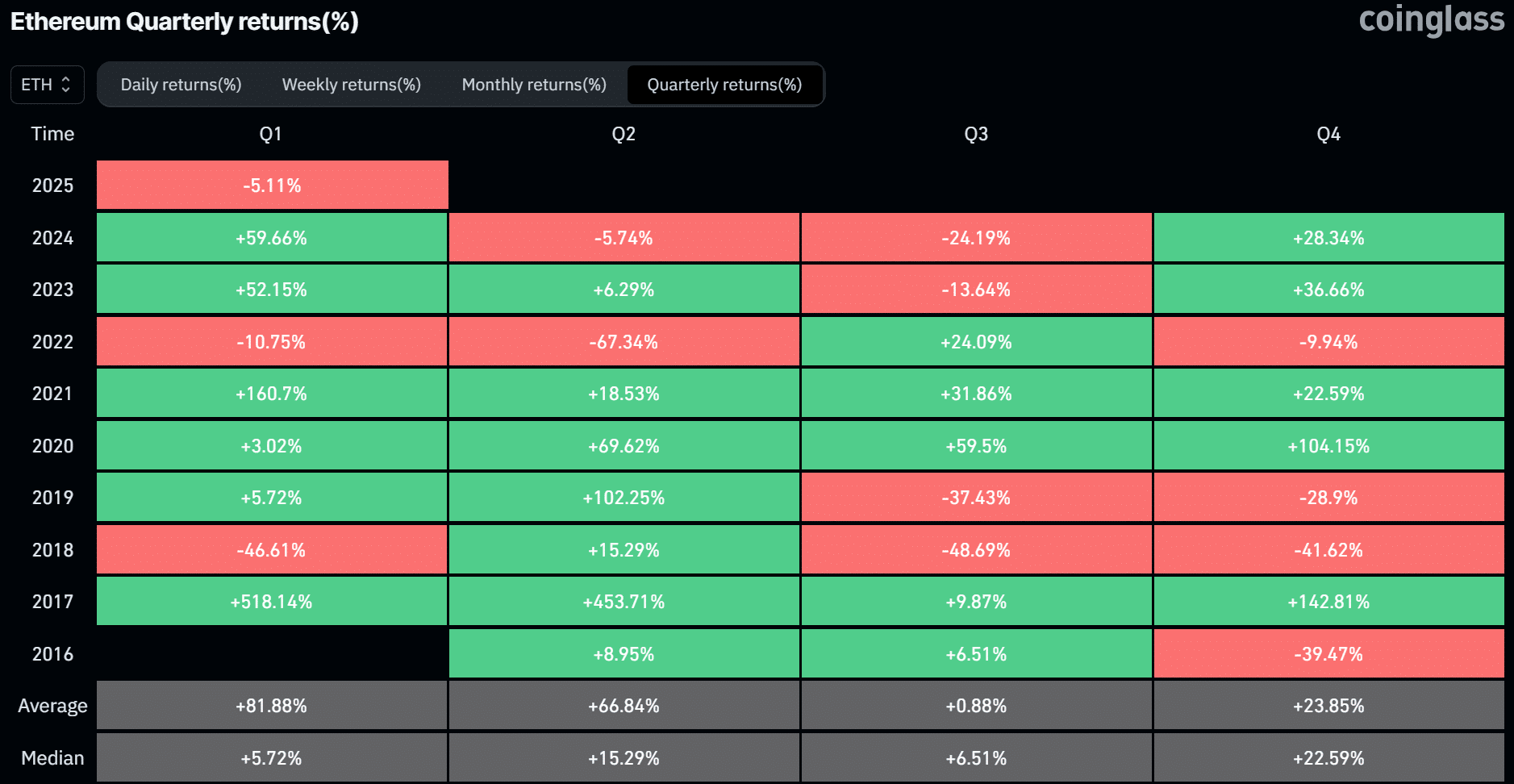

The truth is, on December 20, ETH recorded greater than $300 million in liquidations, with lengthy positions dominating the losses. That mentioned, Coinglass’ information confirmed that the primary quarter has persistently been ETH’s strongest efficiency, with a median achieve of 81%.

Out of the final seven years, ETH closed solely two quarters (Q1s) within the crimson. Merely put, if historic traits repeat, ETH might publish important good points within the first quarter of 2025.

Supply: Mint glass

Nevertheless, the looming liquidation danger might restrict the value upward expectation. On the time of writing, ETH was again above $3K, having fallen sharply to $2.9K following Monday’s bearish transfer.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024