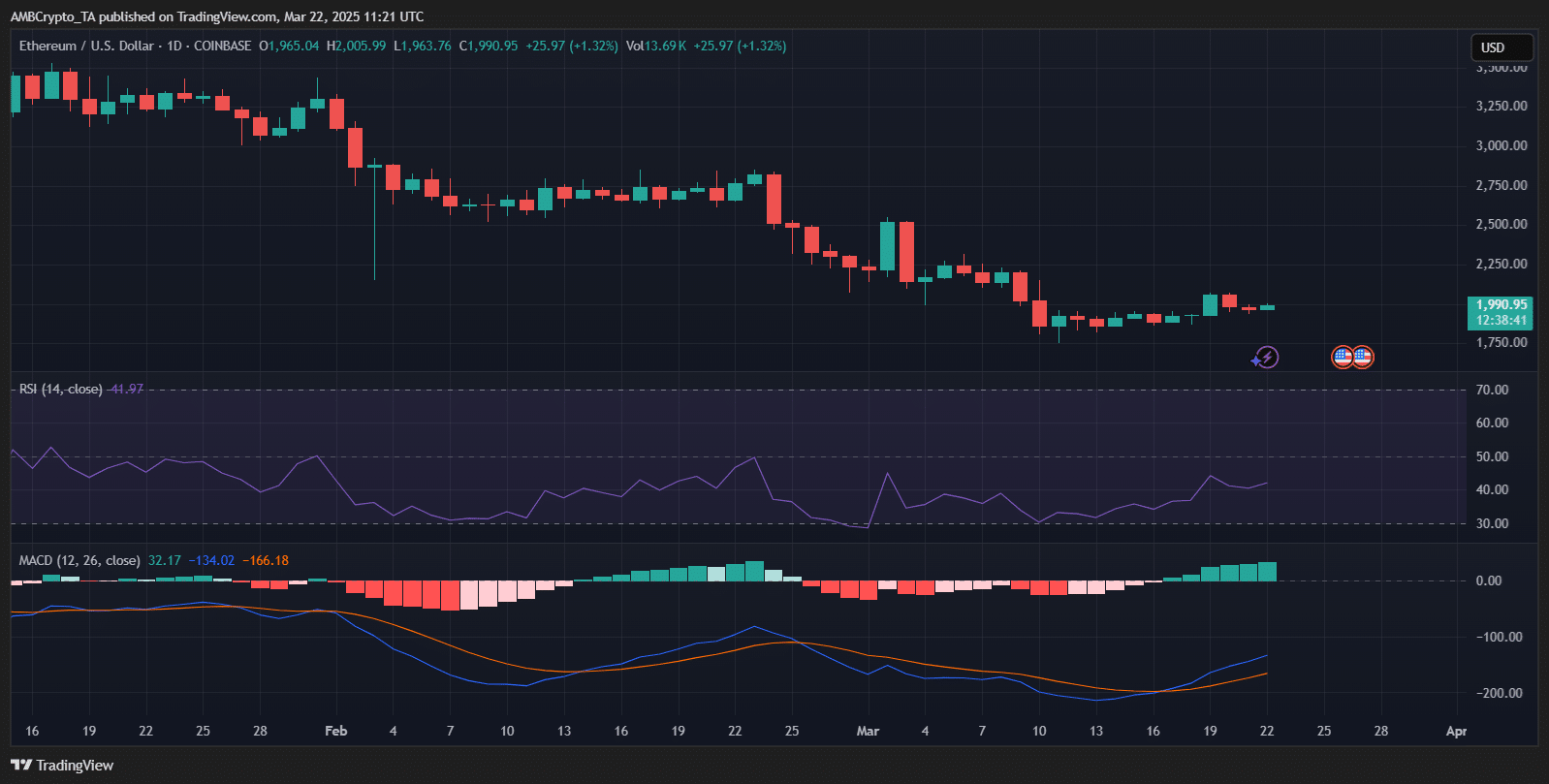

Ethereum

Ethereum’s shift to PoS faces backlash after SEC’s PoW ruling – Why?

Credit : ambcrypto.com

- The SEC of america doesn’t connect Bitcoin Miners and POW Swimming pools to the a lot wanted regulatory readability

- The POS transition from Ethereum is at present confronted with rising criticism

In a welcome flip of the readability of the laws, the SEC of america has drawn a set line within the digital Zand-Bitcoin Miners and Proof-of-Work (POW) Polish usually are not results.

It’s a long-awaited distinction that gives reduction to a nuclear a part of the crypto ecosystem, particularly as that of Ethereum [ETH] The transition to proof-of-stake (POS) continues to divide the opinion. With one foot of stability and the opposite in experiments, the business is now at an regulatory intersection – however not less than, for Pow, the trail grew to become a little bit clearer.

SEC pulls the road on Pow Mining

In a protracted -awaited clarification, the SEC’s Division of Corporation Finance Confirmed that POW -Mining – each solo and pooled – doesn’t fall below American securities laws. The assertion emphasised that mining exercise on public, permissionless block chains corresponding to Bitcoin is an administrative place, not an funding contract.

“It’s the opinion of the division that” mining actions “… don’t embody the provision and sale of results …”

Since miners depend on computing energy as an alternative of a central entity to generate revenue, the “efforts of others” of the Howey take a look at doesn’t apply. The choice offers regulatory lighting to POW -my staff and indicators a extra clear strategy below the brand new SEC management.

Calls to rethink the POS mannequin of Ethereum

After the clarification of the SEC on Pow -Mining, critics of the POS transition from Ethereum reinforce their requires a return to the previous consensus mannequin. For instance – distinguished industrial voice Smeltem Demirors believes that the shift from Ethereum to POs has watered down the core worth of the community by rushing up the rise of Layer -2 (L2) options.

“The proof of curiosity was a mistake. Ethereum may have been a trillion greenback protocol with its personal sturdy vitality to calculate the ecosystem. As a substitute, MEV achieves billions of worth from customers and apps.”

In accordance with her, posed the Ethereum ecosystem and missed an opportunity to construct a trillion greenback protocol, powered by an energy-to-computer economic system that resembles Bitcoin’s. She additionally claimed that Ethereum may have leaded below Pow Innovation in GPU Computing and {Hardware} gear.

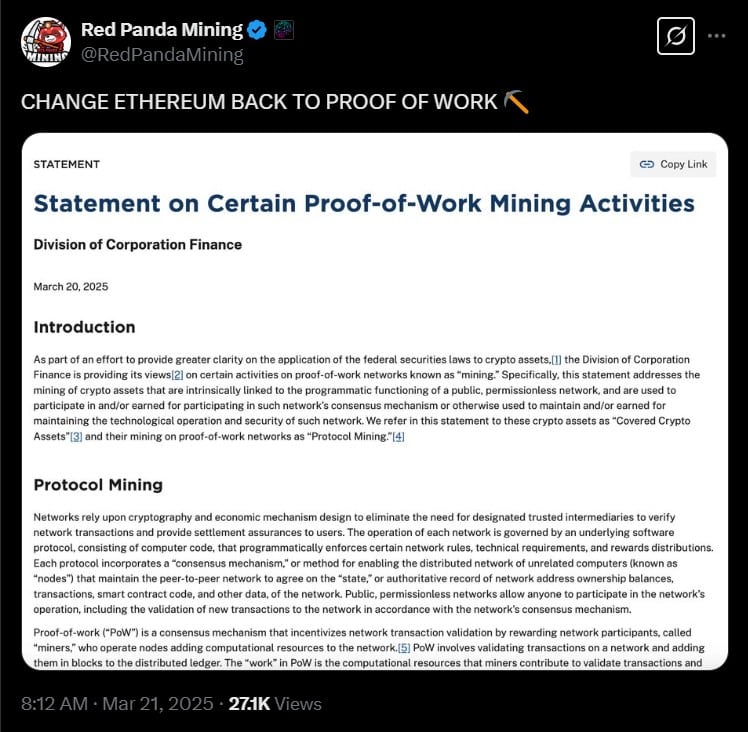

Following this sentiment, Red Panda Mining shared a quite silly rationalization on X.

Supply: X

With Pow now having fun with the readability of the laws, the controversy across the architectural path of Ethereum is warmed up once more.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024