Altcoin

Ethereum’s strike Surge: attracts Pectra more than just retail investors?

Credit : ambcrypto.com

- ETH outcome turned from outflow to influx instantly after the announcement of Pectra in February – not on the launch.

- The influx hints on early institutional coordination with the yield-friendly, validator-oriented future future after-upgrade of Ethereum.

Ethereum [ETH] Lovers had known as for the pectra improve, anticipating that his validator-friendly adjustments would reform the dynamics of the significance.

However the shift began sooner than anticipated, however from the second the Route Card of Pectra was introduced in mid-February.

A Recent report It revealed that ETH expanded from months of outskirts to the web entry nearly instantly after the improve was introduced.

Now that Pectra formally lives, the rebound raises a larger query: is that this only a quick -term response, or the primary sign of rising institutional confidence within the story of Ethereum and Infrastructure?

Timeline strike

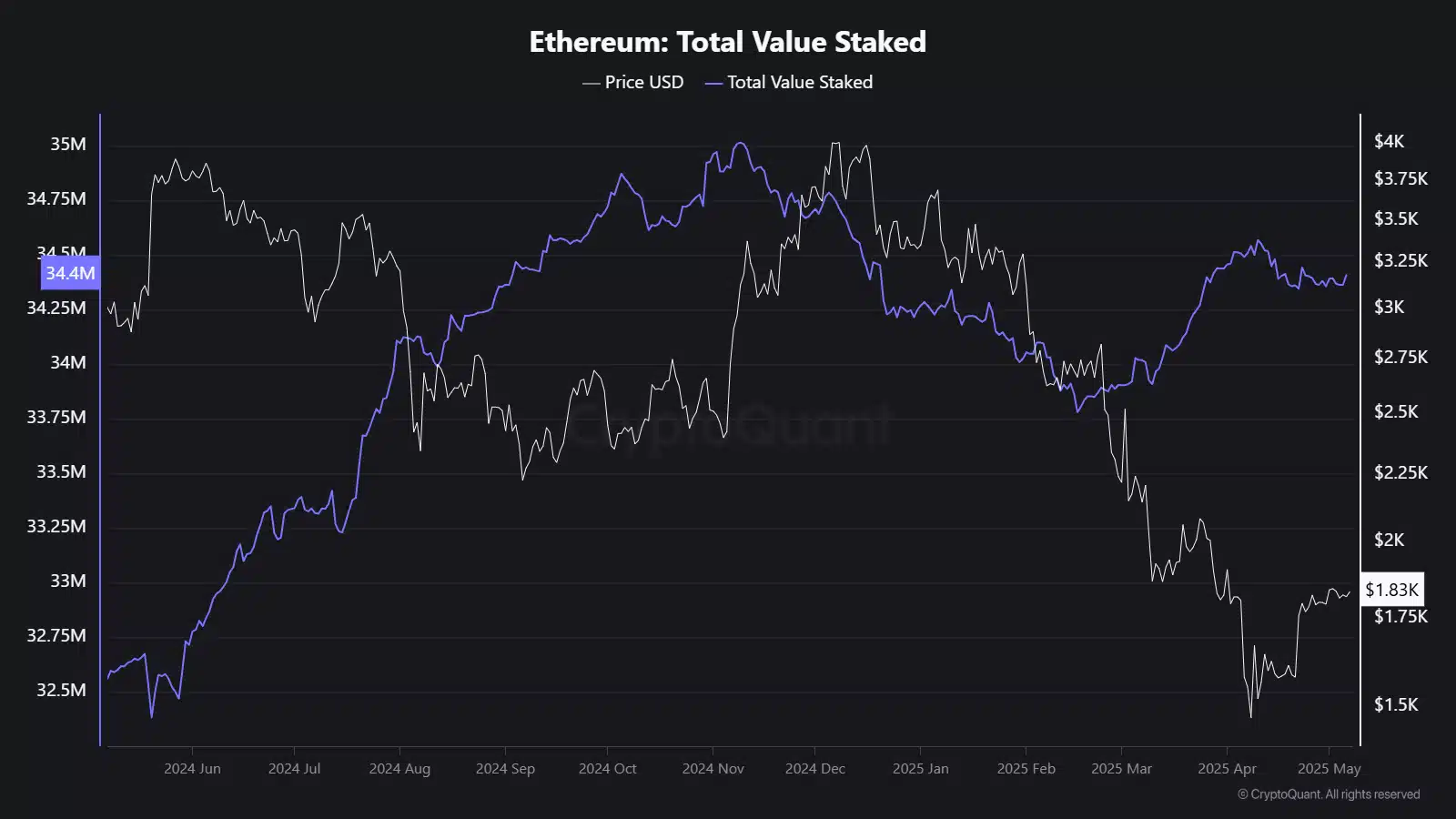

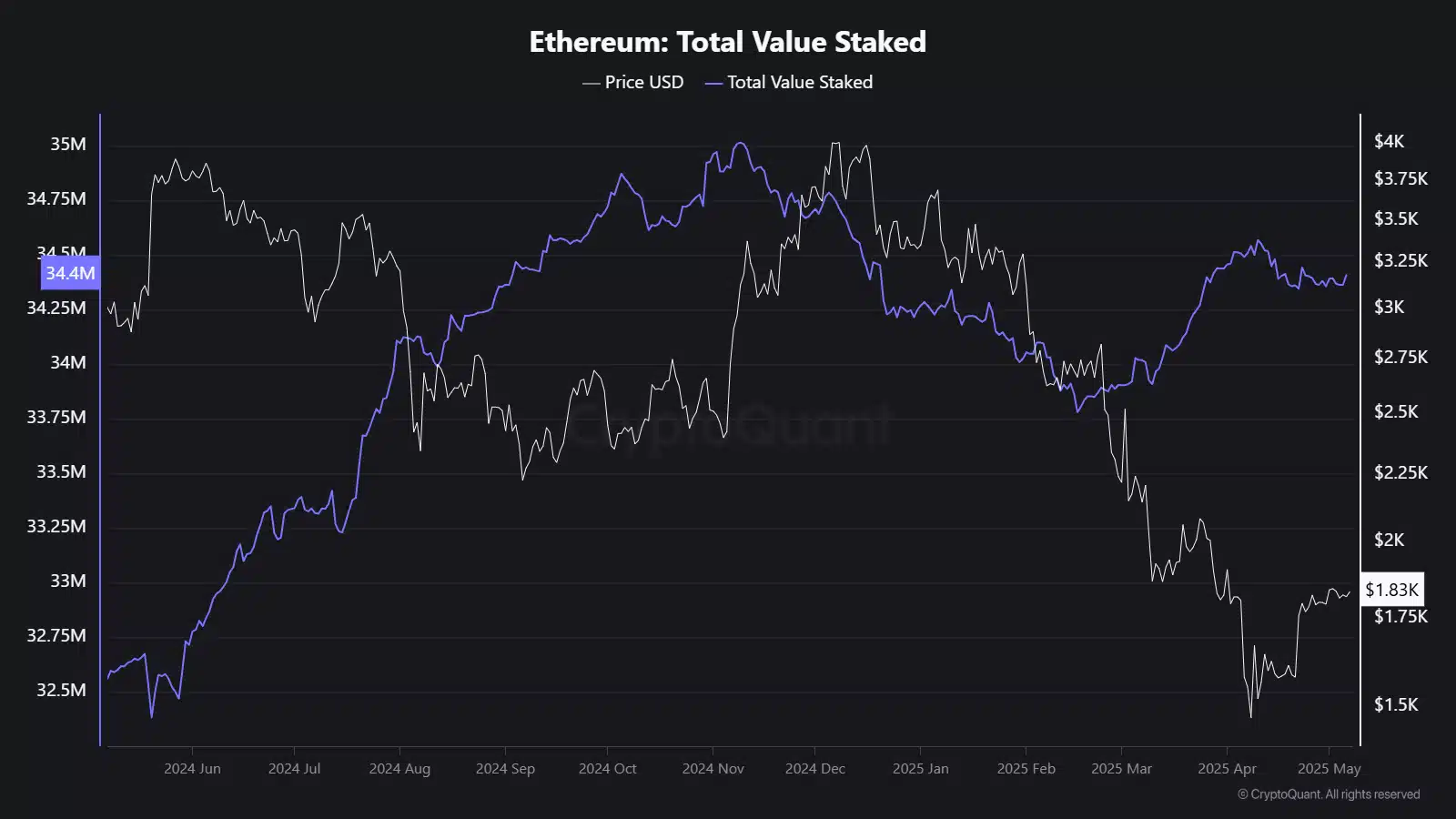

Supply: Cryptuquant

From November 16 to February 15, participation specifically fell – from roughly 34.88 million ETH to 33.86 million ETH.

These 1.02 million ETH outflow mirrored market jitters, most likely because of the regulatory strain and the broader risk-off sentiment that dominated the primary quarter.

However the announcement of Pectra round mid -February modified that pattern. From 16 February to 16 Might, ETH deployment recovered with a web inflow of 627,000 ETH.

You can not ignore the timing-the validator-oriented upgrades of Ethereum, together with the versatile withdrawal references of EIP-7002, has been effectively landed with the ecosystem and will have reassured extra superior stakeholders.

Supply: Cryptuquant

Betting of influx can point out a rising institutional belief

Influx deployment typically replicate behavioral excessions. And the latest traits of Ethereum recommend greater than only a retail effectivity.

The restoration of belief within the safety system factors to a shift, probably of establishments that discover or put together the post-upgrade profile of Ethereum.

Most important milestones – such because the Shanghai and Pectra -Upgrades – have pushed historic ETH flows.

Round every we now have seen the location of shift weeks earlier than the technical rollout, which present the long run -oriented method to the market.

With ETFs that are actually changing into extra versatile within the recreation and strike mechanics, the design of Ethereum is more and more pleasant for big capital allocators.

The yield story

The indigenous yield of Ethereum – by increasing – has at all times been a central story. Now, with Pectra in place, that story will get credibility and construction.

The lowered operational friction, together with enhancements on the protocol degree, can appeal to additional influx.

Though the present consumption volumes should not explosive, they’re directionally necessary.

A gradual however regular climb in captured ETH hints on an grownup market that doesn’t re-evaluate the yield potential of Ethereum as a retail yield farm, however as a strategic, regulated and ETF-compatible return product.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now