Ethereum

Ethereum’s Vitalik Buterin is worried – Here’s why

Credit : ambcrypto.com

- Vitalik Buterin warned of AI-driven information centralization and insisted on stronger privateness safety for human autonomy.

- Whereas promoting whales ETH, one pockets buys $ 6.87 million within the midst of ETF tracments and rising market uncertainty.

Whereas AI makes its grip on private information, Ethereum makes [ETH] Co-founder Vitalik Buterin requires stronger privateness protectors warning for a future through which centralization is a social problem.

His feedback come to a turbulent second for Ethereum: Whale discharges Hundreds of thousands, the volatility rises and the regulatory uncertainty hangs within the air after the delay of the SEC on the Etheum ETF of Grayscale.

However within the midst of the sale, a deep investor swims in opposition to the tide with a daring Eth-Purchase of $ 6.87 million.

Buterin warns of centralized AI threats

Buterin has repeated his dedication to privateness and emphasizes its significance as a elementary human proper in a world that’s more and more shaped by AI and information assortment.

In his weblog put up,“Why I support privacy,” He argues that management over private information corresponds to manage over people. He claims that privateness is important for freedom, innovation and social stability.

He warns that centralized information programs pose a menace to decentralization. To forestall this, he insists on builders to imagine privacy-improving applied sciences corresponding to ZK-Snarks, absolutely homosexual coding (FHE) and rising obfuscation aids. These options guarantee safe programs with out jeopardizing performance.

Buterin expands the dialogue that goes past cryptocurrency, and hyperlinks privateness to broader human autonomy. With out privateness, individuals drives self -censor and society to supervisory conformity.

He even emphasizes the interfaces of the mind laptop as a rising threat, and emphasizes the necessity to combine privateness into future applied sciences not solely to guard information, but additionally to guard particular person ideas.

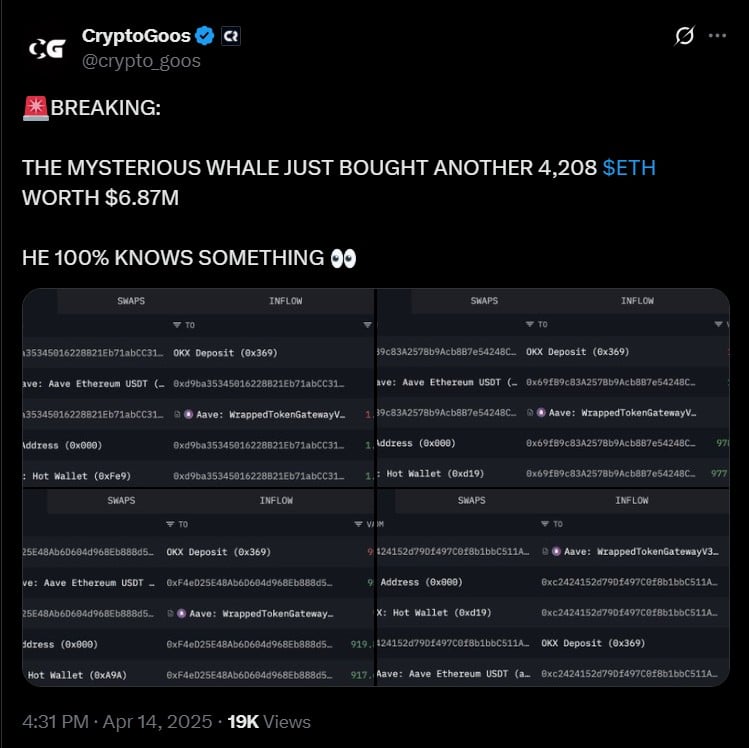

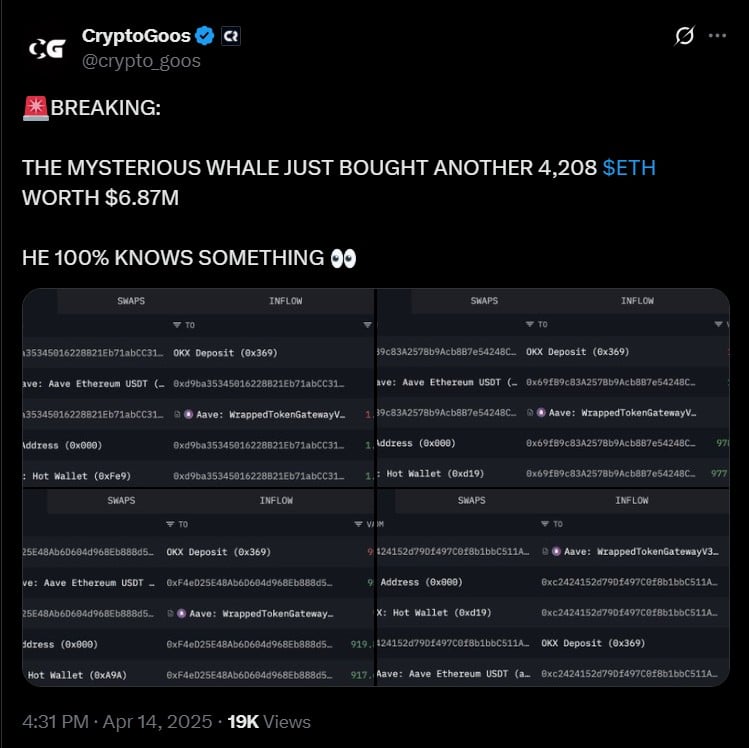

When whales dumped, one pockets makes a daring gamble

Supply: X

Within the hours previous to the most recent weblog put up about Privateness, Ethereum markets have been something however quiet.

Two massive whales unloaded A mixed 16,923 ETH, price virtually $ 28 million, on Kraken and AT-Market, which signifies that contemporary volatility is fueled and ETH is dragged underneath $ 1,640.

The synchronized outputs hinted with rising uncertainty, probably certain to regulating jitters.

Supply: X

Whereas many buyers offered, A mysterious investor took the alternative method. In a shocking motion, an unknown pockets acquired 4,208 ETH – rated at $ 6.87 million – solely peaked as a gross sales strain.

The timing of this accumulation, so near the privateness assertion of Buterin, raises questions. May the present trajectory of Ethereum be greater than what is straight away seen?

Buterin emphasizes the significance of embedding privateness in future applied sciences. He argues that guaranteeing privateness shouldn’t be solely about defending information, but additionally in regards to the preservation of particular person ideas.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now