Altcoin

Ethereumwalvissen buy the dip – more than 130k ETH added on one day

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum trades underneath the extent of $ 1,900 and is confronted with steady gross sales strain as the broader crypto market continues to weaken. After a pointy rejection of the $ 2,500 marking on the finish of February, Bulls didn’t reach getting the momentum again and ETH has steadily fallen – many buyers disappointing who’ve mentioned excessive expectations for a bullish development. The lack of necessary help ranges has additional broken sentiment and the worth motion of Ethereum stays Beerarish within the brief time period.

Associated lecture

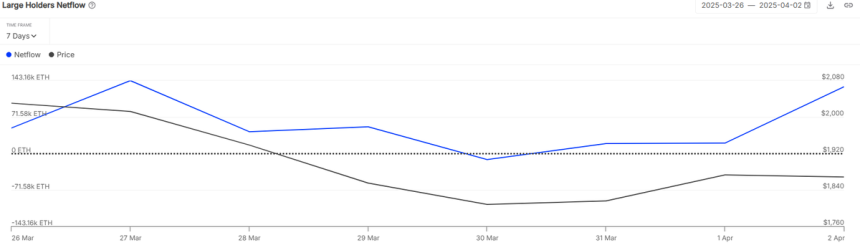

Regardless of the unfavorable prospects, there are indicators of accumulation underneath the floor. In line with information from Intothelock, Ethereumwalvissen purchase the dip. The biggest ETH portfolios yesterday added greater than 130,000 ETH to their participations-a motion that means the belief of gamers in the long run, even whereas the retail sentiment is faltering.

This accumulation can point out a shift in Momentum whether it is maintained, particularly if whales proceed to soak up the supply whereas the costs stay low. For each actual restoration, nevertheless, Ethereum should get well vital resistance ranges and present a stronger shopping for exercise throughout the board. For now the market stays underneath strain, however whale habits can provide a touch of what’s coming as quickly as the present Neerwaartse development begins to light up.

Ethereum Nice gamers purchase within the midst of market insecurity

Ethereum presently drops 55% in comparison with his excessive in December, which displays the broader ache within the cryptomarkt. Sale is basically fed by the rising macro -economic uncertainty, with the aggressive commerce coverage of US President Donald Trump and unpredictable fee bulletins that contribute to international monetary instability. Whereas conventional markets have problem discovering foot, a dangerous belongings akin to Ethereum are probably the most troublesome.

Bulls have a tough time defending a very powerful help ranges, and worth motion means that the downward development can happen within the brief time period. With Ethereum who acts far beneath $ 1,900 and no clear indicators of Bullish Momentum, the outlook stays susceptible.

But not all indicators are Bearish. In line with Data from IntotheblockEthereumwalfissen appear to assemble. In sooner or later, the biggest ETH portfolios added greater than 130,000 ETH to their participations – a motion that means a relaxed belief amongst massive gamers. This degree of accumulation, particularly during times of concern and weak point, usually refers to a protracted -term bullish look.

Though the worth stays decrease developments, the habits of those massive holders contributes to the speculative setting, indicating that some buyers might place early for a doable improve. If macro circumstances start to stabilize or shift sentiment, Ethereum may gain advantage from this quiet battery part – however for now the market stays in correction mode.

Associated lecture

Technical evaluation: ETH Bulls defend vital help

Ethereum is traded at $ 1,830 after a wave of heavy gross sales strain that pushes the worth strongly beneath a very powerful degree of $ 2,000. Panic gross sales has seized the market, with bulls which have problem recovering management within the midst of a wider decline over the crypto area. The breakdown underneath $ 2,000 marked a big shift in sentiment, in order that what was as soon as seen as a consolidation part transformed right into a deeper correction.

At this stage, Bulls should comprise the help degree of $ 1,800 – a vital threshold that, if misplaced, may result in an extra lower to $ 1,750 or decrease. Holding above $ 1,800 would make stabilization doable and the possibility of constructing a foundation for restoration. To establish a significant reversal, nevertheless, Ethereum should reclaim the extent of $ 2,100, which now acts as a resistance within the brief time period.

Associated lecture

Solely a decisive push above would affirm renewed power and presumably restore bullish momentum. Till then, ETH stays susceptible for additional drawback. With broader market circumstances nonetheless unsure, the following step from Ethereum round these help ranges will probably be essential to find out whether or not it could actually get well within the brief time period or can slide deeper right into a correction space.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024