Policy & Regulation

‘European SEC’ proposal sparks licensing concerns, institutional ambitions

Credit : cryptonews.net

The European Fee’s proposal to broaden the powers of the European Securities and Markets Authority (ESMA) raises considerations in regards to the centralization of the bloc’s licensing regime, regardless of signaling deeper institutional ambitions for the capital market construction.

On Thursday, the Fee revealed a bundle proposing to grant “direct supervisory powers” over key components of the market infrastructure, together with crypto asset service suppliers (CASPs), buying and selling platforms and ESMA central counterparties, Cointelegraph reported.

Worryingly, ESMA’s jurisdiction would prolong to each the supervision and licensing of all European crypto and monetary expertise (fintech) corporations, doubtlessly resulting in slower licensing regimes and hindering the event of startups, mentioned Faustine Fleuret, head of public affairs at decentralized credit score protocol Morpho.

“I’m much more involved that the proposal makes ESMA accountable for each the authorization and supervision of CASPs, and never simply supervision,” she advised Cointelegraph.

The proposal nonetheless requires approval from the European Parliament and the Council, which is at the moment underneath negotiation.

If adopted, ESMA’s function in overseeing EU capital markets would extra intently resemble the US Securities and Alternate Fee’s centralized framework, an idea first proposed by European Central Financial institution (ECB) President Christine Lagarde in 2023.

Associated: Financial institution of America helps a crypto allocation of 1% to 4%, opening the door to Bitcoin ETFs

The EU plan to centralize licensing underneath ESMA raises considerations in regards to the slowdown of cryptocurrencies and fintech

The proposal to “centralize” this oversight underneath one regulatory physique seeks to deal with variations in nationwide supervisory practices and unequal licensing regimes, however dangers slowing down the general improvement of the crypto trade, Elisenda Fabrega, common counsel on the Brickken asset tokenization platform, advised Cointelegraph.

“With out adequate sources, this mandate might change into unmanageable, resulting in delays or overly cautious assessments that would disproportionately have an effect on smaller or modern corporations.”

“In the end, the effectiveness of this reform will rely much less on its authorized type and extra on its institutional implementation,” together with ESMA’s operational capability, independence and channels of cooperation with Member States, she mentioned.

Associated: Grayscale Chainlink ETF Raises $41 Million in Debut, However Not a ‘Blockbuster’

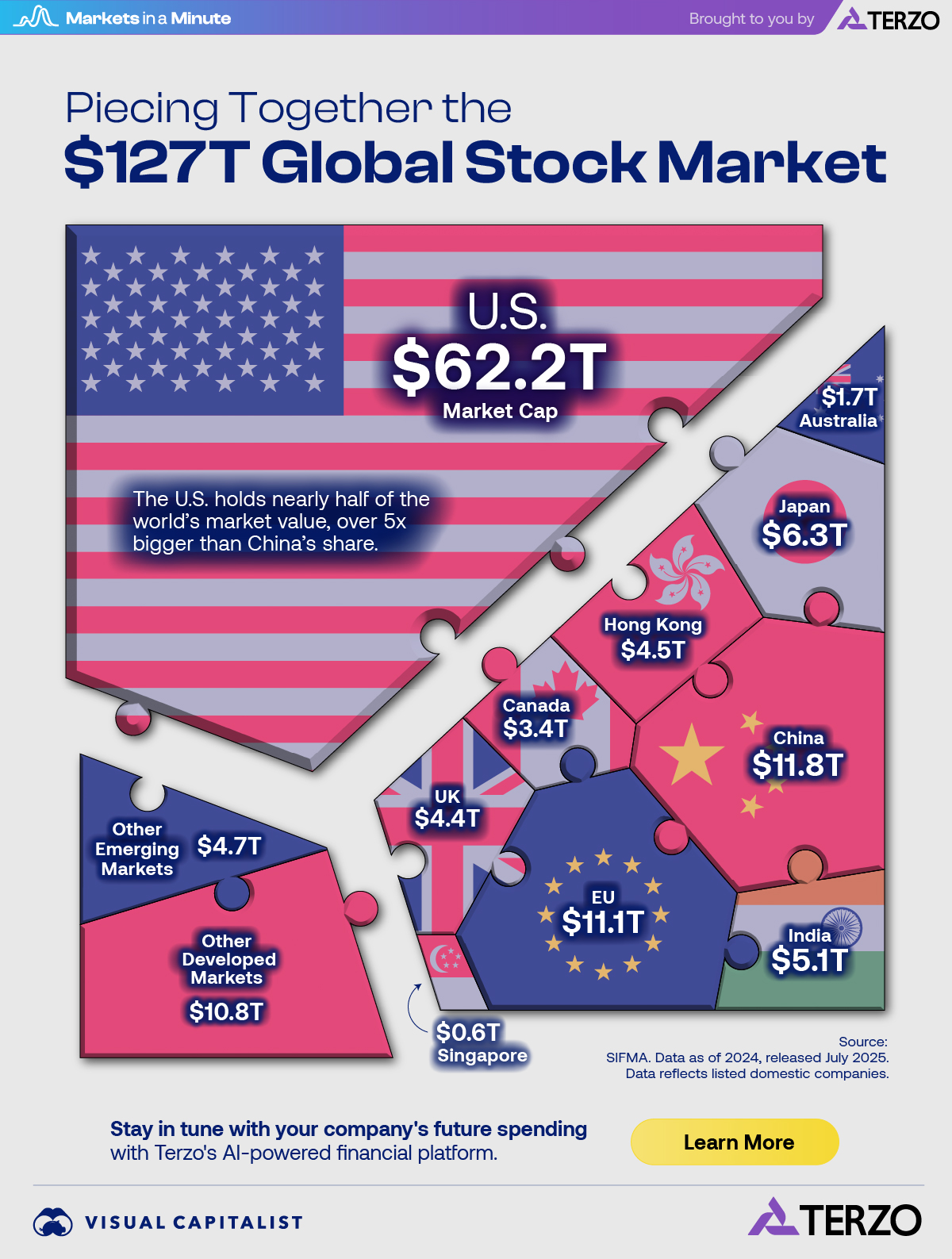

International inventory market worth by nation. Supply: Visible Capitalist

The broader bundle goals to spice up wealth creation for EU residents by making the bloc’s capital markets extra aggressive with these of the US.

The US inventory market is price about $62 trillion, or 48% of the worldwide inventory market, whereas the cumulative worth of the EU inventory market is round $11 trillion, representing 9% of the worldwide share, in keeping with knowledge from Visible Capitalist.

Journal: The EU’s privacy-killing Chat Management invoice has been delayed, however the struggle shouldn’t be over

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now