Bitcoin

Examining how Bitcoin’s investors are holding up despite global FUD and panic

Credit : ambcrypto.com

- Bitcoin fell beneath $ 106k, making his bias Bearish

- On-chain statistics emphasised an absence of huge sale, which meant that buyers had comfy

Bitcoin [BTC] Beneath the actual worth hole fell to $ 106.5k-one signal that the bias was within the brief time period arary on the time of the press. In truth, it most likely appeared to fall to $ 102.5k and as deep as $ 100k. Nonetheless, a breakdown below $ 100k could also be unlikely.

Geopolitical tensions and the potential of warfare develop by the day whereas Nations alternate rockets within the center -east. Inflation is delayed within the US, however it isn’t but in opposition to the goal rate of interest of the Federal Reserve. Charges and financial uncertainty are additionally exhibiting up. These elements have led buyers to flee to gold as a price storage.

Regardless of the FUD in conventional markets, Bitcoin has remained sturdy above the $ 100k mark. Because of this buyers more and more deal with the crypto activum as a price of worth.

Bitcoin buyers are in a ready mode

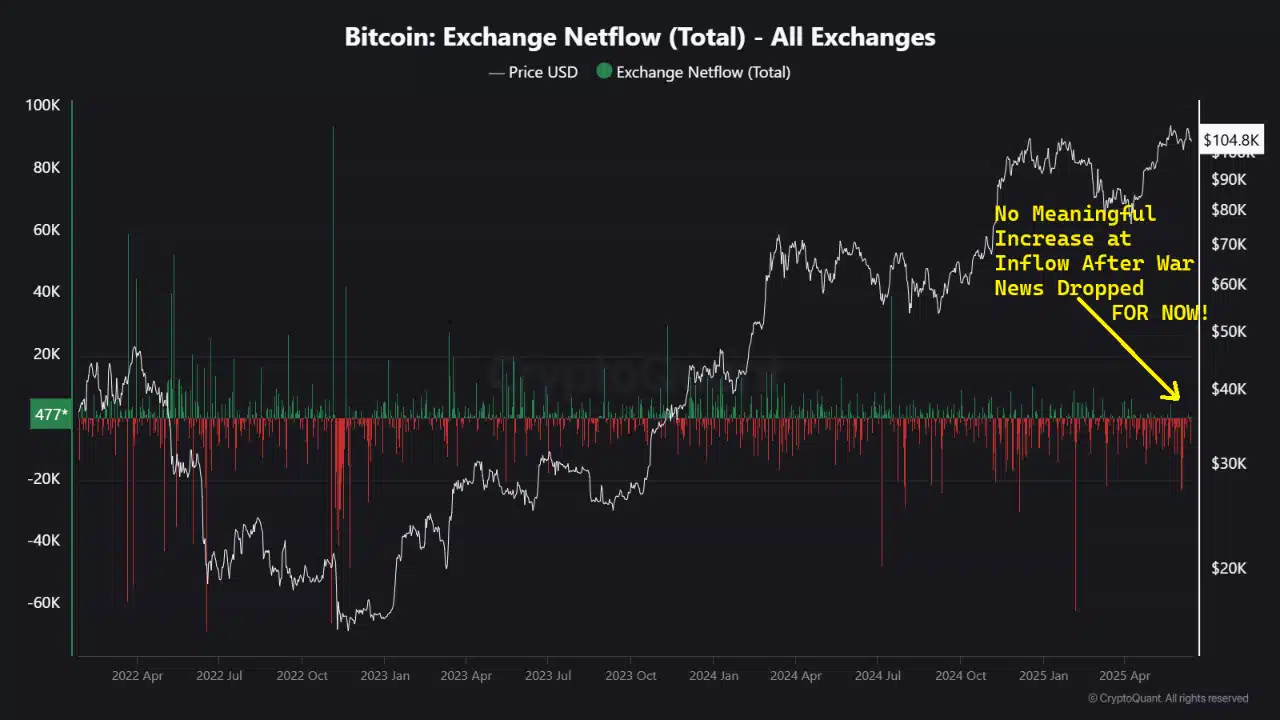

In a put up Cryptoquant insightsperson Cryptome famous that the change in Netflows was not excessive. There was no vital constructive change within the Netflows, which didn’t imply excessive inflow as a result of holders realized revenue and left the market.

This lack of gross sales, for now, generally is a constructive signal that buyers might not panic.

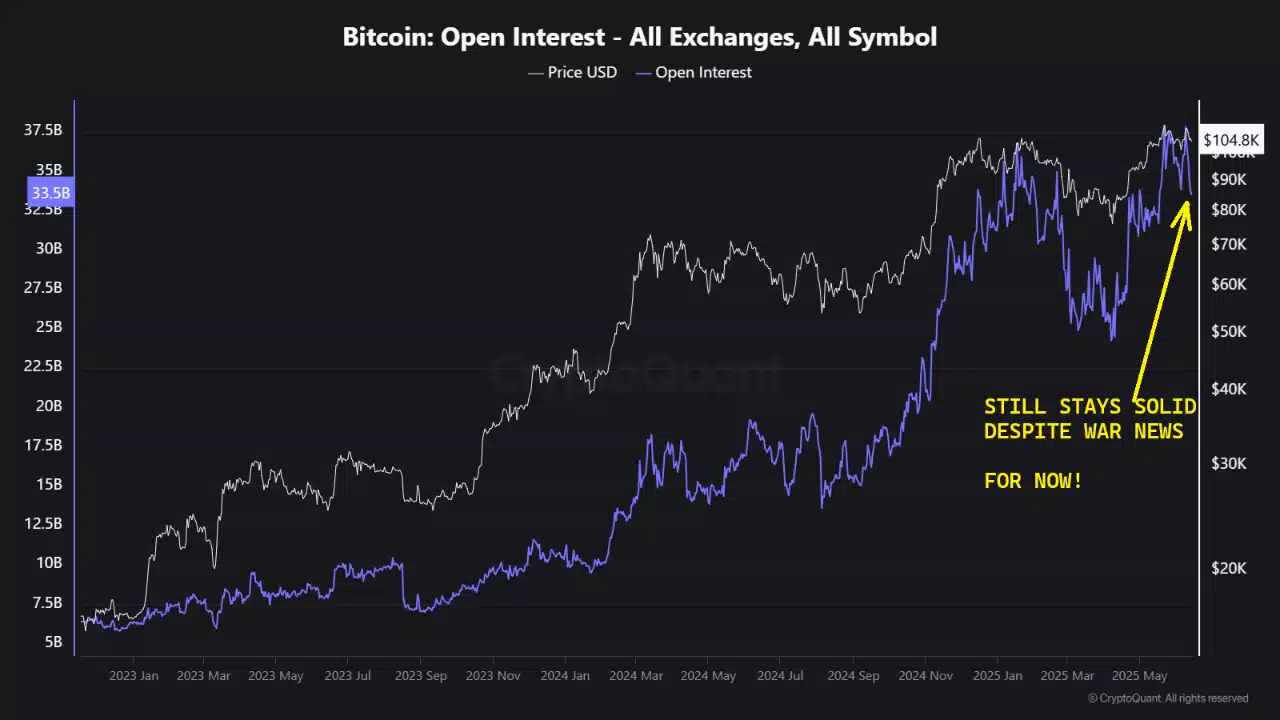

The open curiosity in centralized gala’s didn’t present an enormous drop. The correction from $ 110k to $ 105k noticed lengthy liquidations, which meant that lengthy positions had been closed with violence, which declared a very good a part of the OI lower.

Nonetheless, it was not a big -scale sale. Excessive OI ranges meant that speculative curiosity was remarkably excessive, regardless of the worry and uncertainty out there. It may be one other signal that buyers at the moment are awaiting the ready time.

In a single Post on XCrypto analyst Axel Adler JR famous that studying was at 46%, slightly below the impartial threshold of fifty%.

To renew the upward pattern that it noticed earlier in June, the index should climb greater than 60%-65%. This could be needed on persistent demand and capital influx.

Supply: BTC/USDT on TradingView

The 1-day graph revealed {that a} bearish bias was justified for Bitcoin within the coming days. Final Friday there was an extended Southward Wick, whose low of $ 102.6k might be shortly revised. The CMF revealed that the gross sales strain was dominant, with the nice Oscillator steered {that a} downward momentum has.

On the whole, market members should count on volatility within the brief time period. Within the mild of Fud, nevertheless, the facility of the holders is encouraging. It might be sensible for retail buyers to additionally undertake this wait -and -see perspective.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September