Policy & Regulation

FBOT registry won’t bring offshore crypto exchanges to the US — Attorney

Credit : cryptonews.net

The latest Commodity Futures Buying and selling Fee (CFTC) Recommendation on offshore exchanges that serve American residents underneath the Overseas Board of Commerce (FBOT) framework won’t cut back offshore crypto exchanges to the US, in response to Eli Cohen, normal adviser at Actual-Worlue Asset.

Cohen advised Cointelegraph that settlement, clearing and different authorized necessities designed for the standard monetary system, which is important to serve American prospects within the context of the FBOT framework, usually are not tailor-made to crypto exchanges and can be troublesome or unattainable to meet.

The rules of the CFTC additionally stipulated that solely exchanges with a Futures Fee license (FCM), that are dealer’s sellers for futures contracts and different extremely regulated entities, are certified to register underneath the FBOT framework, Cohen mentioned. He added:

“The largest downside is that solely regulated gala’s outdoors the USA can apply for the FBOT. So you will need to have an current regulatory framework in your house nation.”

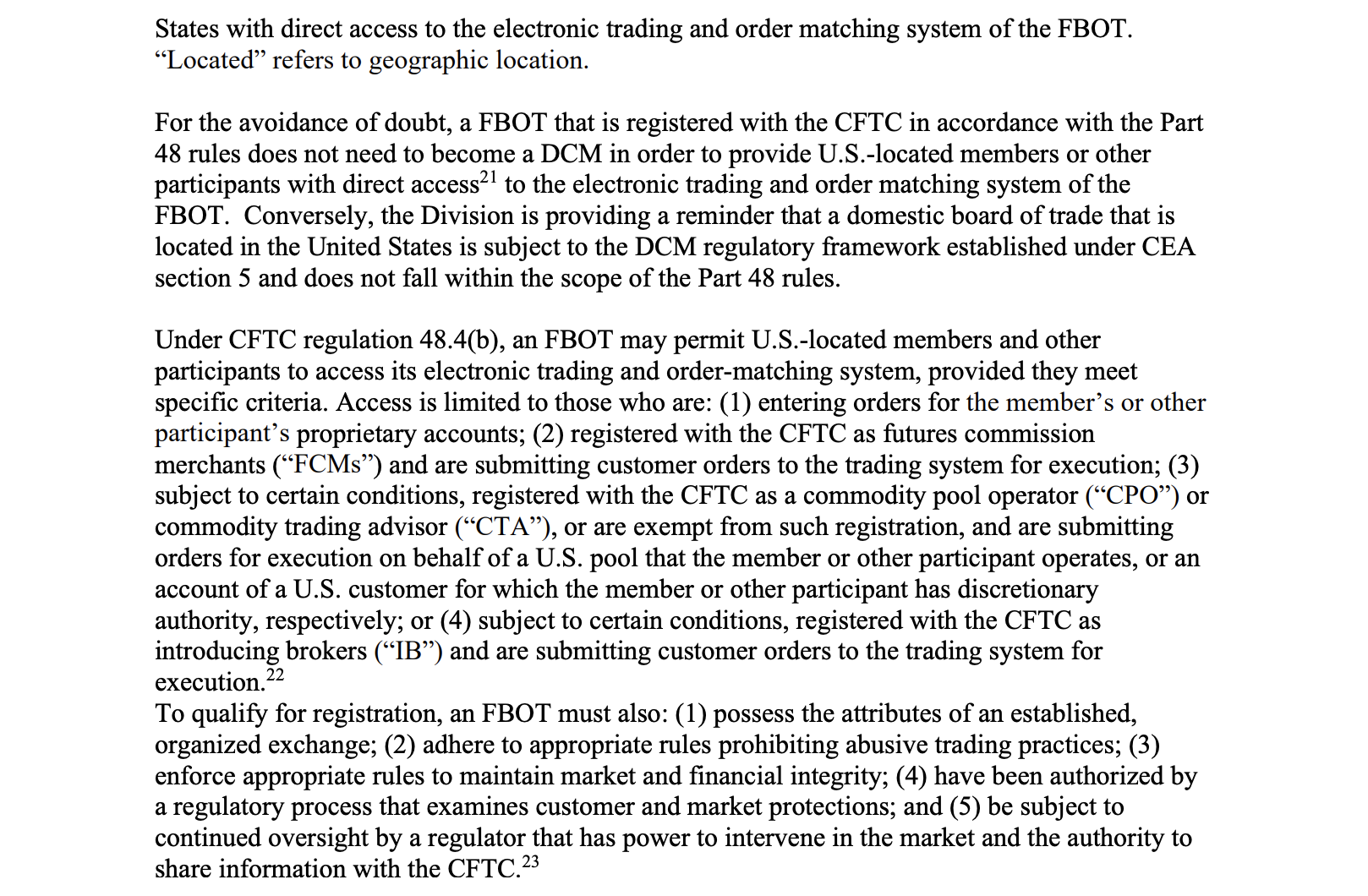

CFTC workers of personnel schedules define qualifying standards for registering underneath the FBOT framework and the service of American residents. Supply: CFTC

Many inventory markets select to arrange corporations in Seychelles or different non -regulated areas of regulation to stop such a framework within the first place, Cohen added.

The easiest way to supply readability for crypto exchanges is to simply accept a crypto market construction within the congress, to codify crypto directions within the regulation and to create everlasting change that doesn’t shift from administration to administration, Cohen mentioned.

Associated: “Too few guardrails,” warns CFTCs Johnson in regards to the threat of forecast market

CFTC’s “Crypto Dash” guarantees readability about laws and a revision of the monetary system

The “Crypto Dash” of the CFTC is an initiative to revise Crypto laws to meet the agenda of US President Donald Trump to make the US the world chief in crypto.

Numerous coverage suggestions have been offered within the Crypto report of the Trump administration, which was revealed in July, together with giving the Securities and Change Fee (SEC) and the CFTC -Upvisable Supervision of Crypto.

Each regulatory authorities have proposed varied efforts for cooperation coverage, together with the potential for monetary markets to change into everlasting, making a 24/7 commerce cycle in activa courses.

The proposed change could be a substantial deviation from the monetary markets for older individuals, who’re presently not engaged on nights or weekends and are shut by throughout sure holidays.

Journal: Coinbase and base: is Crypto simply conventional funds 2.0?

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024