The Federal Reserve has bent the knee to President Donald Trump’s request amid the continuing US authorities shutdown that has lasted almost 30 days. On Wednesday, October 29, the Fed minimize the fed funds price by 1 / 4 of a proportion level to between 3.75% and 4%.

The Fed famous that quantitative easing (QE) will start on December 1, 2025. In the meantime, Fed Chairman Jerome Powell famous that December’s rate of interest choice might be influenced by the provision of financial knowledge, urging a fast answer to the continuing authorities shutdown.

The vast majority of Fed members voted in favor of financial motion, excluding Stephen Miran and Jeffrey Schmid. Specifically, Miran, who was elected by President Trump, advocated a 50 foundation level price minimize. Alternatively, Schmid argued in favor of an unchanged federal funds price.

What’s the Impression of the Fed’s Coverage Change on the Crypto Bull Market?

Worry and uncertainty unleashed within the medium time period: the results of presidency shutdowns

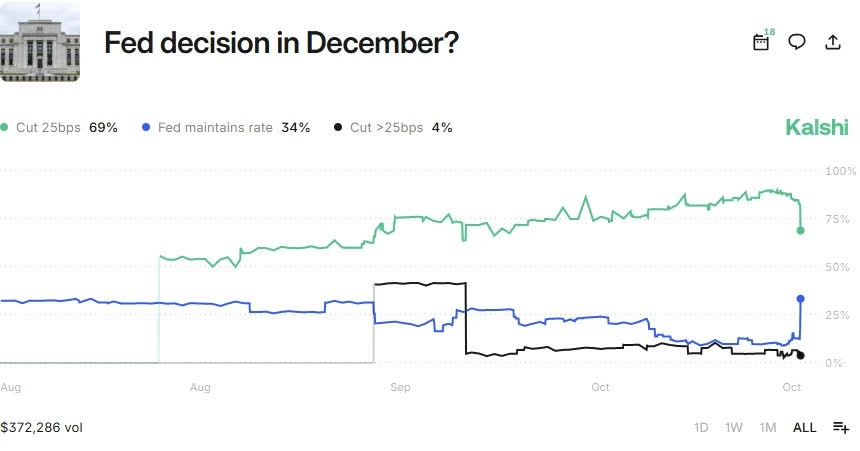

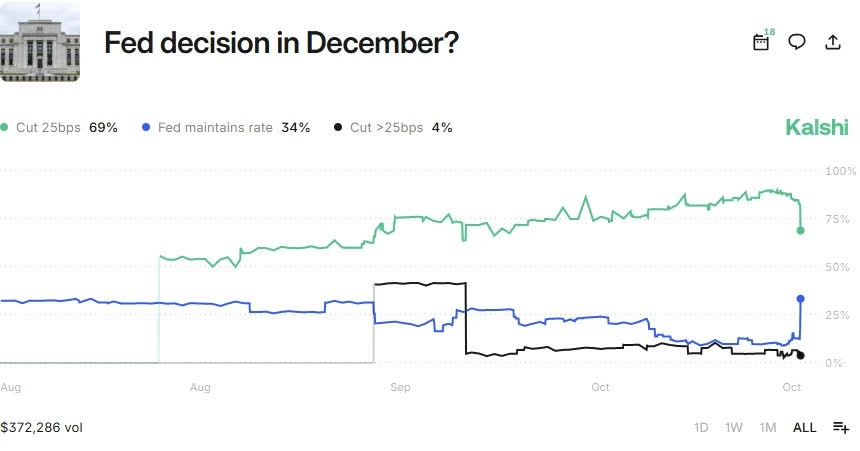

Following Fed Chairman Powell’s announcement that the December rate of interest choice might be influenced by out there knowledge, medium-term fears and uncertainty elevated. Furthermore, Kalshi merchants have decreased their conviction of an impending Fed price minimize in December.

On the time of writing, Kalshi merchants have been betting on a 69% likelihood that the Fed will implement a 25 foundation level price minimize in December. As well as, Kalshi merchants have been betting on a 34% likelihood, up from 13% earlier on Wednesday, that the Fed will keep its rate of interest in December.

As such, the broader crypto bull market might expertise a uneven medium-term consolidation within the coming weeks.

The long-term bullish sentiment has solidified

In the meantime, the long-term crypto bull market has solidified, just like the crypto summer season of 2017, which additionally concerned President Trump’s management. The now confirmed QE is a serious enhance to the crypto bull market amid the anticipated capital rotation of gold, which is closely overbought.