Bitcoin

Fed Rate Cut Boosts Bitcoin Price Ahead Of Q4 Melt-Up

Credit : bitcoinmagazine.com

Traditionally, the worth of Bitcoin peaks about 20 months after a Bitcoin and half. The final Bitcoin -Halving befell in April 2024, which signifies that we may see a Cycle TOP by December of this yr.

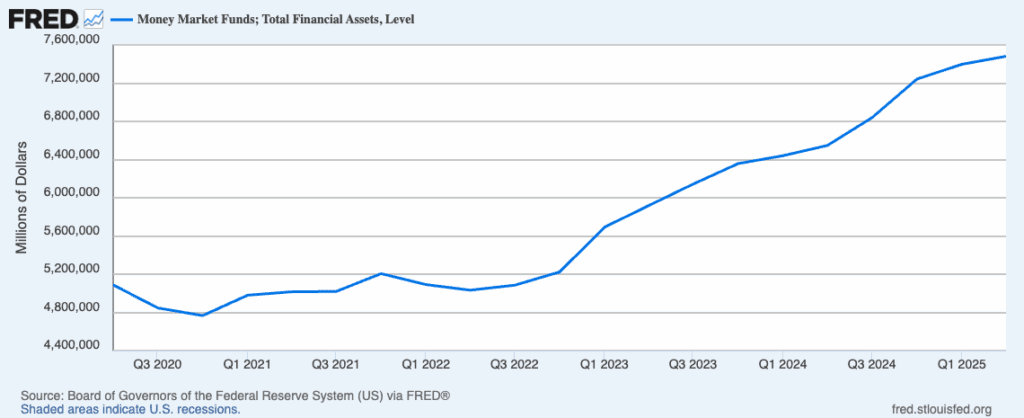

The possibilities of this have gotten more and more probably, because the FED chairman Powell -rates these days depart with 25 BPS, in order that the approx $ 7.4 trillion are in money market funds A purpose to get off the sidelines and go to exhausting belongings like Bitcoin, particularly now that it’s simpler to acquire publicity to Bitcoin through spot Bitcoin ETFs and proxies resembling Bitcoin Treasury firms.

Powell additionally indicated that as we speak There may be two more rate reductions before the year is outWhat would solely cut back the return in cash market funds, which signifies that traders could also be pushed into exhausting belongings resembling bitcoin and gold, in addition to dangerous belongings resembling expertise and AI-related shares.

This might catalyze the final stage of a “soften” that’s similar to what we noticed on the finish of 1999 with technical shares earlier than the Dot Com Bubble Burst.

Additionally, identical to folks like Henrik Zeberg And David HunterI consider that the stage is ready for the final parabolic leg of a bull run that began on the finish of 2022.

With the assistance of a conventional monetary index as a reference level, Zeberg sees that the S&P 500 is greater than 7,000 earlier than the yr, whereas Hunter sees rising to eight,000 (or higher) Throughout the similar time-frame.

Furthermore, we might witness the demolition of a 14-year help degree for the US Greenback, based on the Macro strategist Octavio (Tavi) Costa, which signifies that we may see a clearly weaker greenback within the coming months, one thing else that will help the bull store for exhausting and danger sights.

What occurs 2026?

Each Zeberg and Hunter consider that at the start of subsequent yr we are going to see the best bust in all of the markets that now we have seen since October 1929, when the monetary markets within the US collapsed, inflicting the start of the nice despair.

Zeberg’s drove for this consists of the true economic system that involves a cease, partly evidenced by the quantity of homes in the marketplace.

Hunter believes that on the finish of half a century lengthy secular debt cycle that can finish with leverage in distinction to every little thing now we have seen in fashionable historical past, based on what he has shared Mint stories.

Different indicators resembling delinquencies for loans additionally point out the concept that the true economic system involves a halt, which can inevitably impact the monetary economic system.

The Bitcoin -Nonetheless shouldn’t be assured, however it’s probably

Even when we’re not on our technique to a world macro bust, the worth of Bitcoin will hit HIT in 2026 if historical past repeats itself.

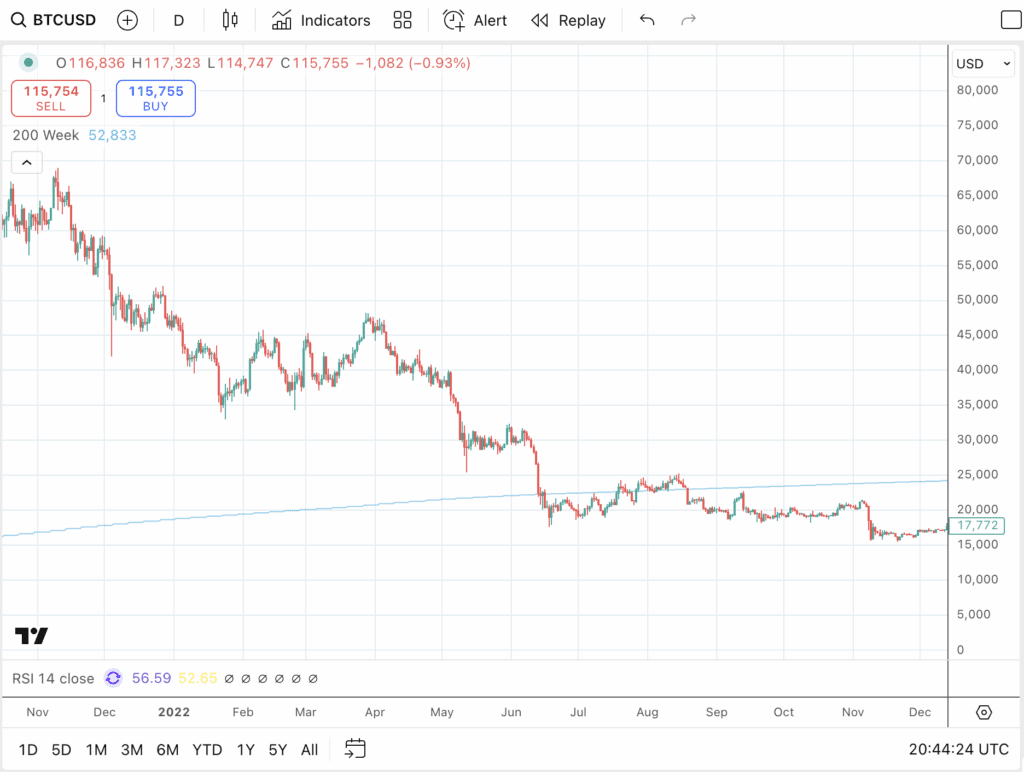

That’s, the worth of Bitcoin fell from nearly $ 69,000 on the finish of 2021 to round $ 15,500 by the tip of 2022 and from nearly $ 20,000 on the finish of 2017 to only over $ 3,000 on the finish of 2018.

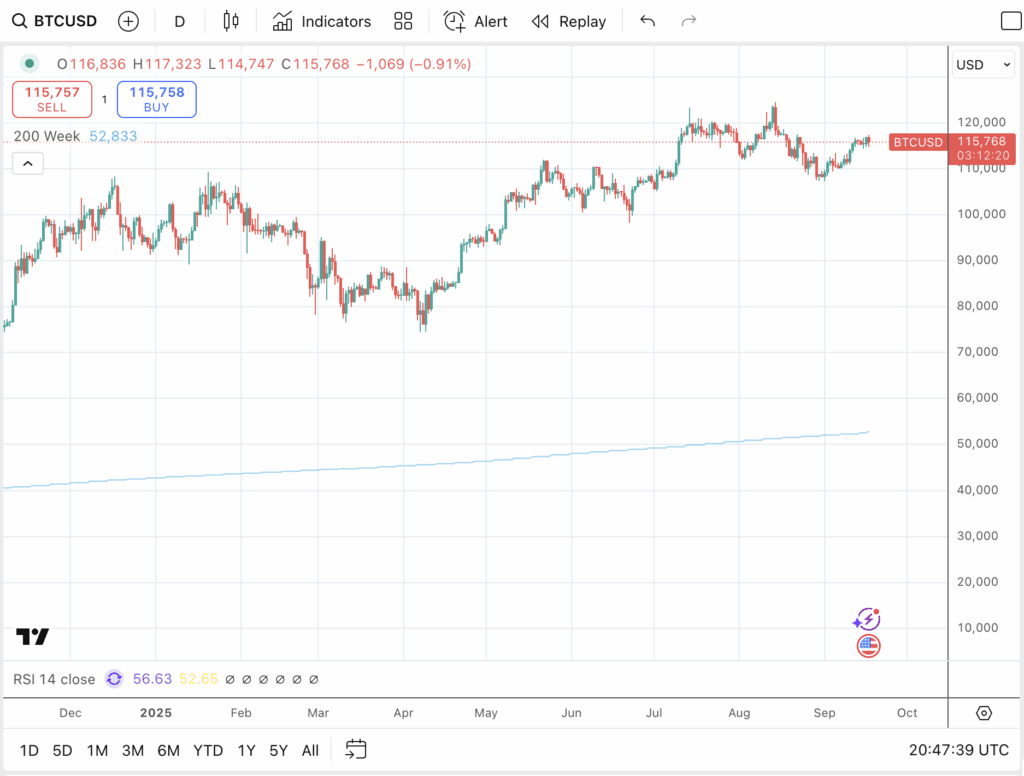

In each instances, or immersed or immersed or below its 200 weeks of ordinary progressive common (SMA), the sunshine blue line on the charts beneath.

Bitcoin’s 200 weeks SMA is at present round $ 52,000. If we see a parabolic enhance in Bitcoin’s worth within the coming months, this could rise to $ 65,000 earlier than the worth from Bitcoin drops to such a worth or is some time decrease in 2026.

If we see the kind of bust that Zeberg and Hunter predict, the worth of Bitcoin can even fall far beneath that threshold.

That mentioned, no person is aware of what the longer term entails and doesn’t interpret something as monetary recommendation on this article.

On the similar time, you could need to remember that, though historical past doesn’t essentially repeat itself, it typically rhymes.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now