Ethereum

Fidelity’s 64.9K ETH dump worth $213 million – Assessing its impact

Credit : ambcrypto.com

- Constancy added to the weekly promoting strain by promoting $213 million price of ETH

- There could already be some short-term bullish aid

Ethereum [ETH] could also be on the verge of rebounding after its newest rally, however an enormous selloff has put that risk into doubt. In actual fact, a Constancy tackle reportedly transferred a big quantity of ETH.

A latest Lookonchain evaluation revealed that Constancy transferred 64,997 ETH to Coinbase. This occurred on Friday and the ETH transferred was reportedly price greater than $213 million. This switch occurred after a bearish week and after the cryptocurrency had already skilled a serious pullback in the course of the week.

The switch from a personal pockets to an trade means that Constancy is offloading ETH. This occurred on the identical day that Ethereum ETFs recorded a complete of $159.4 million in internet outflows. Not surprisingly, Constancy’s FETH ETF had the very best variety of outflows of all Ethereum ETFs on Thursday at $147.7 million.

Is Constancy’s ETH Promoting Reflective of Market Sentiment?

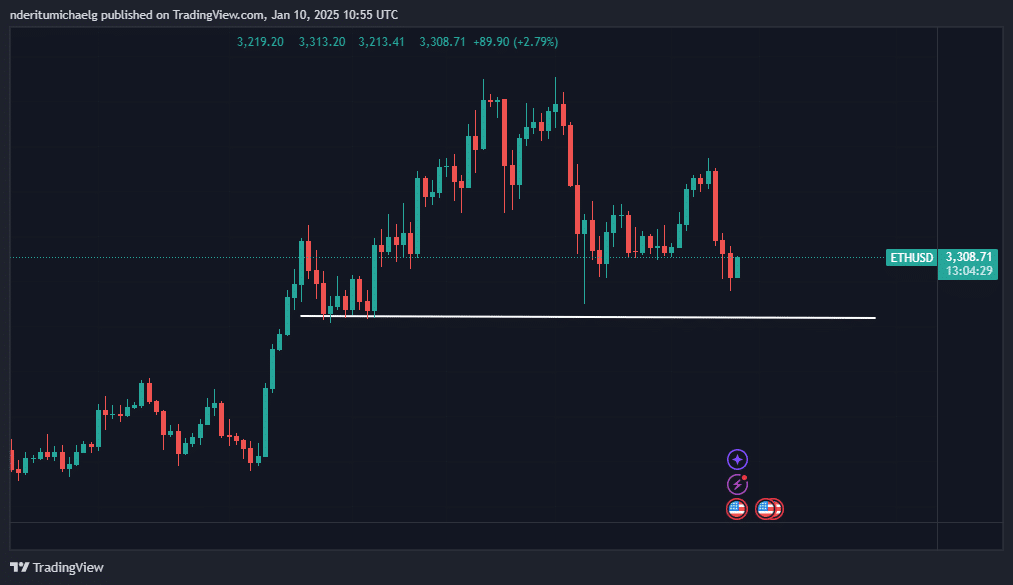

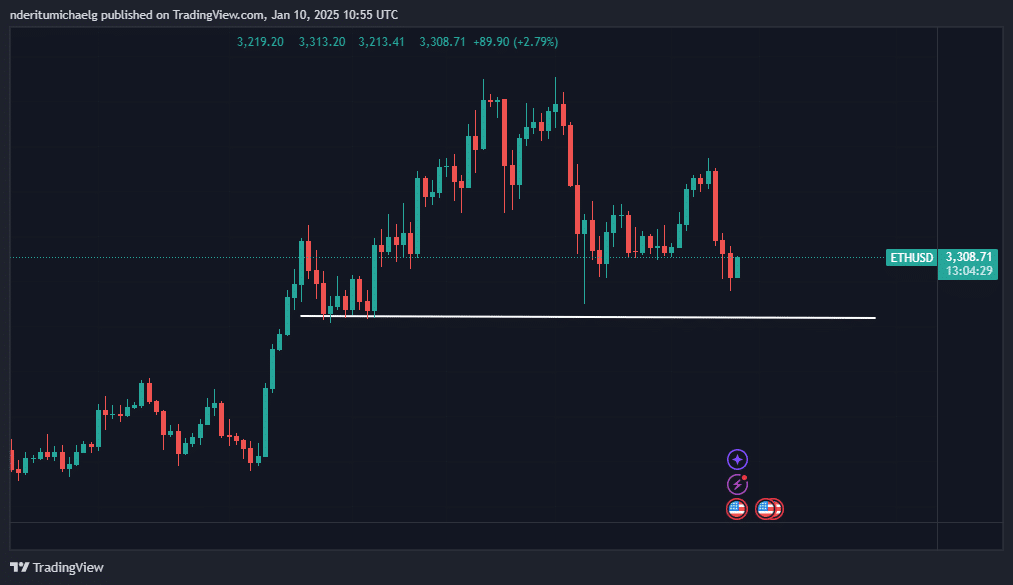

ETH has maintained internet promoting strain since Tuesday, and this development was maintained on Friday – the identical day Constancy transferred the aforementioned cash. This resulted in a 15.54% drop from the weekly excessive to the weekly low.

supply: TradingView

ETH was valued at $3,308 on the time of writing, due to a 2.89% improve prior to now 16 hours. This slight restoration prompt demand was making a comeback after Friday’s shut. So there was some accumulation after the weekly dip.

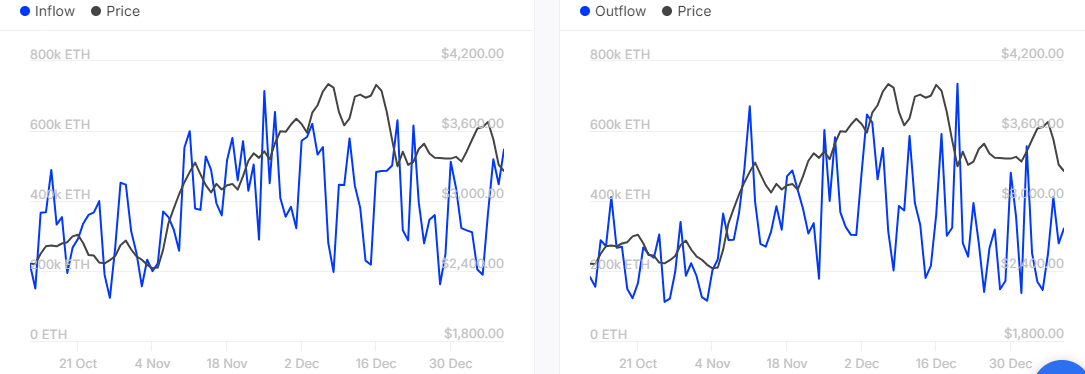

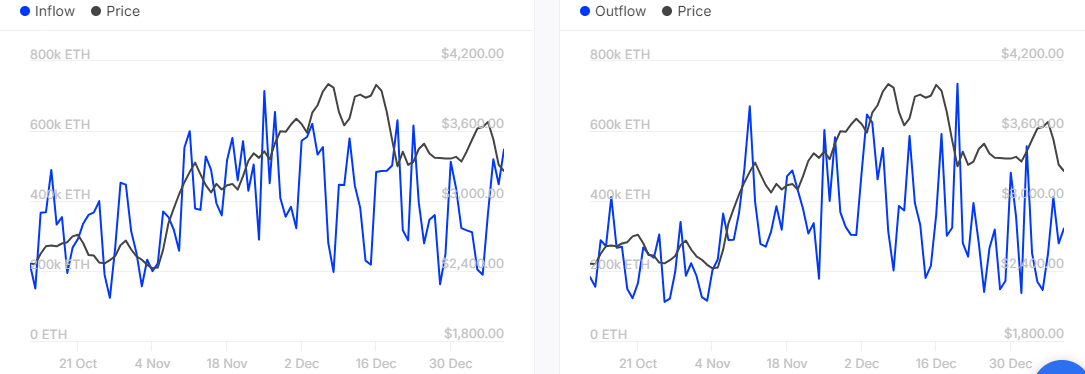

Nonetheless, can the cryptocurrency maintain this rise? That may depend upon the extent of demand and who’s shopping for. Onchain information confirmed that whales purchased the newest dip. For instance, the influx from giant holders was 547,230 ETH, whereas the outflow from giant holders on January 9 was 321,650 ETH.

Supply: IntoTheBlock

The surge in demand for whales may imply a weekend restoration for ETH. Even the trade flows prompt that the cryptocurrency may very well be able the place demand is more likely to make a comeback.

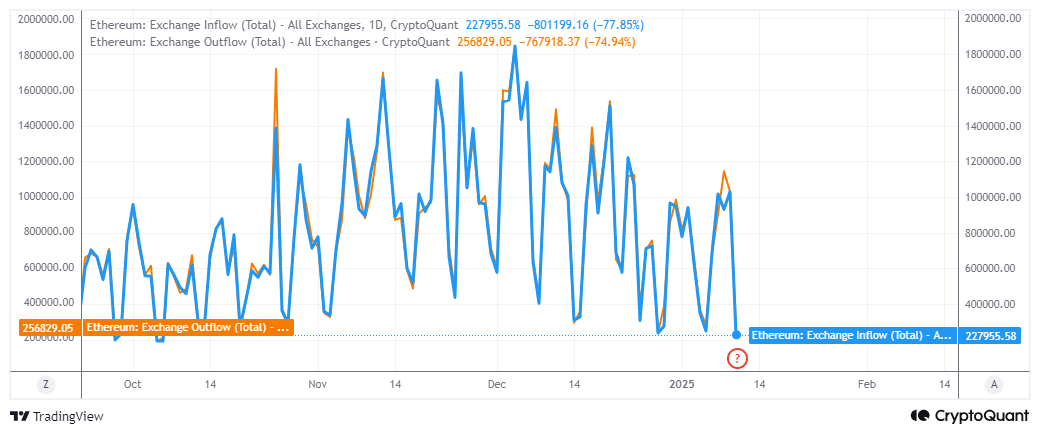

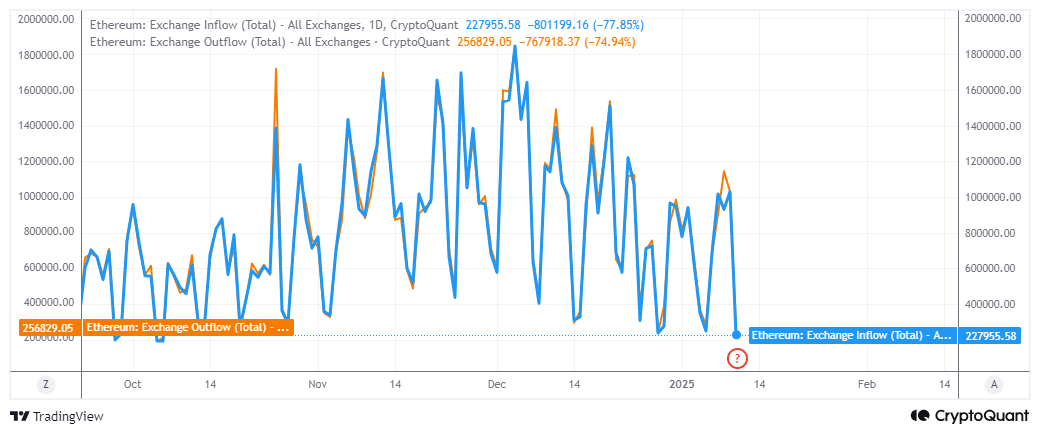

Foreign money flows lately fell to ranges final seen in early November. In accordance with CryptoQuant, outflows on the trade have been barely larger at 256,829.05 ETH, in comparison with 227,955.58 ETH on the time of writing.

supply: CryptoQuant

The trade fee information seemed to be consistent with the latest rebound and pointed to the opportunity of a restoration rebound. Nonetheless, traders ought to think about the opportunity of additional adverse penalties.

In actual fact, ETH’s each day chart positioned the subsequent main assist stage on the $3,033 value stage. If sufficient demand shouldn’t be secured at press time, ETH may probably capitulate to the aforementioned assist stage.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now