Bitcoin

FOMC Rate Cuts Loom As Bitcoin Holds Above $109,500 EMA

Credit : bitcoinmagazine.com

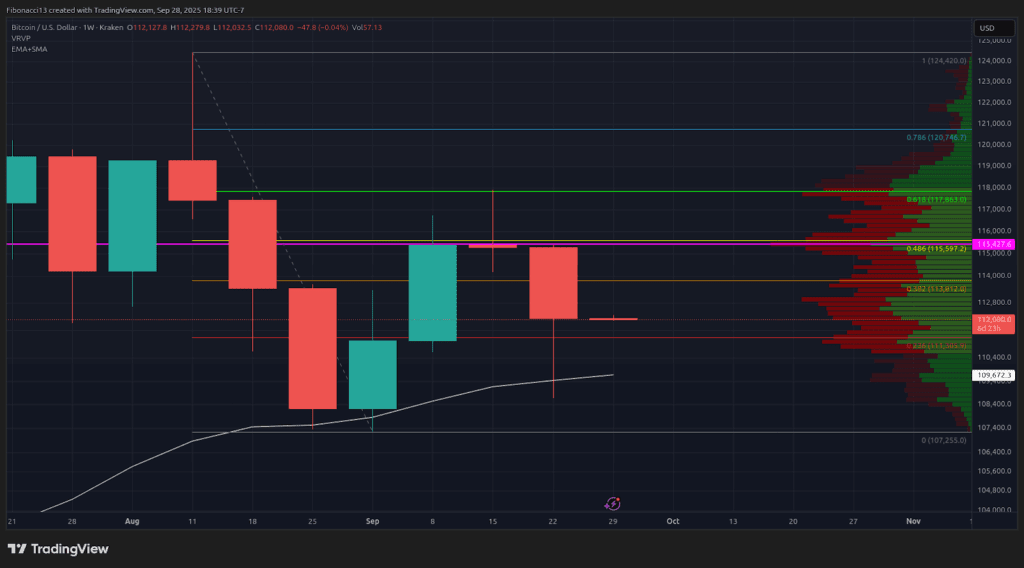

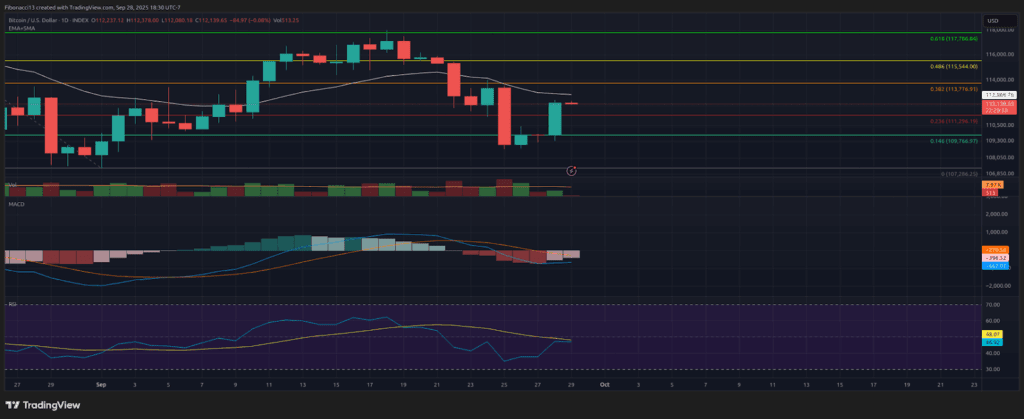

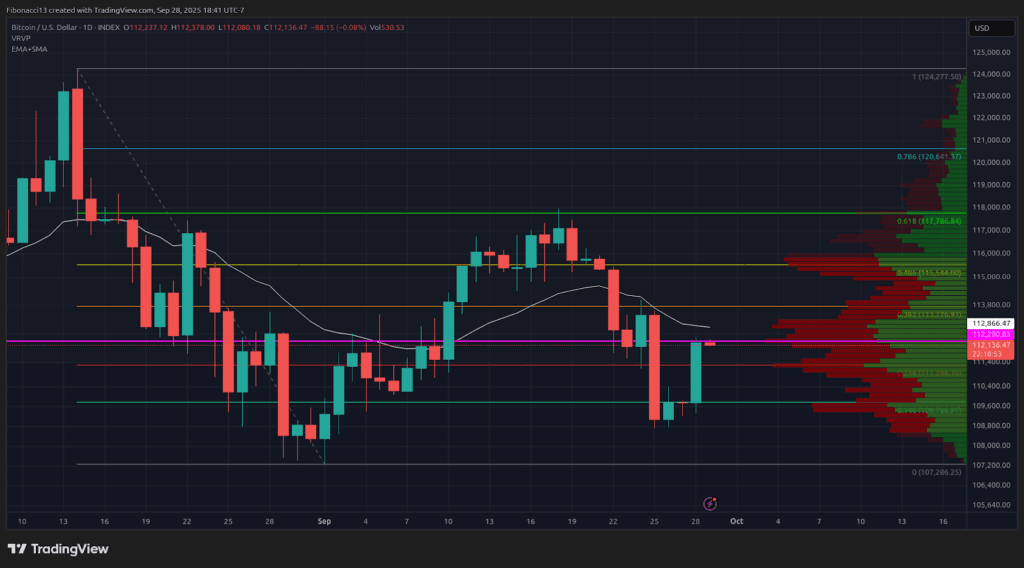

As emphasised in final week’s evaluation, Bitcoin had an enormous drop final Sunday night, as much as $ 111,800. The worth then bounced again to re-test the resistance degree of $ 113,800 and the 21-day EMA at $ 114,000, however was rejected there and dropped again to the assist degree of $ 111,300. This degree nonetheless produced a bouncing for the Bulls again to the 21-day EMA, however was once more refused entry to the resistance degree of $ 113,800 and dropped just under the weekly assist at $ 109,500 on Thursday. Worth got here from that Thursday low to exclude the week at $ 112,225.

Most necessary assist and resistance ranges now

As a result of the value above the 21-week EMA was closed at $ 109,500 to finish the week, the Bulls will search for this assist to proceed. $ 109,500 ought to be the ground that’s on its manner this week if the bulls have to supply a weekly larger layer and might flip issues round. $ 105,000 is the following assist degree decrease, and there’s potential for a big reversal from there to round $ 102,000. Shedding $ 102,000 opens the door to giant lengthy -term assist, for $ 96,000.

On the prime, Bulls will search for the value above the resistance degree of $ 115,500 to revive the upward development. This could provide bulls confidence to withstand $ 118,000 resistance and possibly transfer above it. $ 121,000 is above this when the gateway to new highlights, however will in all probability not maintain lengthy if we get a weekly closure above $ 118,000.

Outlook for this week

Search for the value to re -test the $ 109,500 low firstly of the week, with potential to ensure this degree as assist for a bullish motion again to $ 113,800. It could in all probability require a really sturdy buying strain to push this week above the resistance degree of $ 115,500, so anticipate this degree to retain a lid if $ 113,800 will be conquered. Bulls will place this week in a inexperienced candle to substantiate final week as a better layer.

Nonetheless, Bias remains to be Bearish on the weekly graph, so we have now to anticipate the resistance degree of $ 113,800 to maintain the quick time period. Shedding $ 109,500 on the Every day Chart can result in a brand new grand worth this week, to new lows, which take a look at the $ 105,000 to $ 102,000 assist zone.

Market temper: BEARISH – With a big pink candle to exclude the week, the bears have a powerful management. The Bulls should be sturdy this week to defend the 21-week EMA assist.

Within the coming weeks

The weekly graph remains to be bearish till it has been confirmed in any other case. Bulls should tilt the bias again of their benefit to advertise extra optimistic worth motion sooner or later; It’s attainable for them to do this with a powerful finish of this week. With the rate of interest of September now behind us, markets can be on the lookout for extra rates of interest within the FOMC conferences of October and December to make capital stream. Traders will intently monitor the American monetary experiences within the coming weeks for knowledge assist of additional cutbacks. All obstacles for additional cutbacks within the knowledge will in all probability result in extra Bearish worth motion and promote it additional.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipate the value to be larger.

Bears/Bearish: Sellers or buyers who anticipate the value can be decrease.

Help or assist degree: A degree at which the value for the lively ought to apply, at the least within the first occasion. The extra touches of assist, the weaker it turns into and the better the possibility that it’ll not maintain the prize.

Resistance or resistance degree: Reverse assist. The extent that can in all probability reject the value, at the least within the first occasion. The extra touches in resistance, the weaker it turns into and the better the possibility that it’s not to cease the value.

EMA: Exponentially advancing common. A progressive common that extra weight applies to latest costs than earlier costs, which reduces the delay within the progressive common.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September