Policy & Regulation

Former SEC official joins Veda as General Counsel amid DeFi expansion

Credit : cryptonews.net

Decentralized Finance Platform Veda has formally appointed a former US Securities and Alternate Fee (SEC) in its ranks, as a result of it supplies efforts to broaden Croschain return merchandise aimed toward institutional traders.

Tuongvy Le, who spent nearly six years with the SEC as chief advisor and senior advisor within the enforcement division and the Workplace of Legislative and Intergovernemental Affairs, joined Veda as a common counsel, the corporate introduced on Tuesday.

Throughout her SEC official interval, Le Congress suggested on early designs on digital belongings and he served within the World Markets Advisory Committee of the Commodity Futures Buying and selling Fee (CFTC).

In accordance with her Linkedin profile, Le was concerned in a few of the earliest crypto enforcement actions of the SEC.

Within the SECs Enforcement Division from 2016 to 2021 – she served an important interval within the prevalence of the Company towards non -registered securities provides sure by preliminary cash provides (ICOs).

Throughout that point, the SEC actions set towards the promoters of BitConnect’s credit score program and towards LBRY, claiming that each non -registered securities provides have carried out. In 2021, the company additionally began one of many earliest Defi-related enforcement actions, through which blockchain credit score companions are accused of securities fraud.

Earlier than he got here to Veda, Le Common Counsel and Company Secretary at Anchorage Digital, a crypto guardianship platform, was earlier than he went to an advisory position.

“What attracted me to Crypto was the possibility to assist construct a monetary system that may be a extra clear, programmable and accessible from the bottom,” Le Cointelegraph mentioned in a written assertion. “Once I heard about blockchain know-how, it was clear that this was not only a new asset class – it was a possibility to suppose once more how markets work.” She added:

“My expertise in Tradefi, the SEC and the in all places within the Crypto {industry} helps me to bridge a number of worlds: bringing regulatory strictness to crypto and on the similar time serving to coverage makers perceive what is actually new and precious right here.”

The appointment of Le got here one month after Veda had obtained $ 18 million in financing from varied traders in enterprise capital, together with Coinbase Ventures, Coinfund and Animoca Ventures.

Veda was launched in 2024 as a protocol for the tokenizing of Defi purposes, together with liquid inputs and yielding stablecoins. The Defi Vault platform has locked nearly $ 4 billion in complete worth.

Veda’s complete worth locked. Supply: Defillama

Associated: SEC -President Atkins regards innovation -exemption to stimulate tokenization

Former supervisors migrated to Crypto, even earlier than the coverage shift from the Trump period

A rising variety of former American regulatory officers has been transferred to roles inside the crypto {industry}, a lot nicely earlier than the current authorized shifts underneath the administration of US President Donald Trump.

Former SEC chairman Jay Clayton, for instance, joined Cryptodian Fireblocks as an adviser after leaving the desk. Since then he has been appointed interim -American lawyer for the southern district of New York.

Ladan Stewart, who beforehand served as deputy Crypto -Rechtszaak Lead within the Enforcement division of the SEC, now advises crypto shoppers as a companion at WHITE & CASE regulation agency.

Extra not too long ago, former CFTC chairman Chris Giancarlo joined Digital Asset Financial institution Sygnum as an advisor. Giancarlo, usually nicknamed ‘Crypto Dad’, has additionally held advisory roles at Paxos and different blockchain corporations.

Regulating veterans for the Trump period are actually Crypto Terrain, whereas three pro-industry accounts make their means via the congress, one in all which, the genius regulation, has signed Trump within the regulation this month.

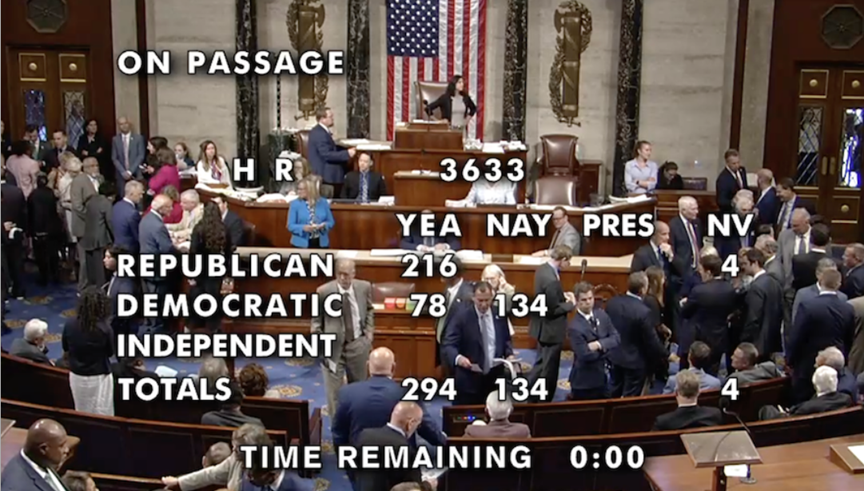

The legislators vote to simply accept the Readability Act on July 17. Supply: US Home of Representatives

The Digital Asset Market Readability (Readability) ACT, the steering and institution of Nationwide Innovation for US Stablecoins (Genius) ACT and the Anti-CBDC Surveillance State ACT is predicted to supply better authorized safety, which presumably lays the inspiration for a broader acceptance in the US.

Associated: Tokenized Cash Market Funds come to the fore as Wall Avenue’s reply to Stablecoins

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024