Web 3

Fractional NFTs Explained: Shared Ownership, Liquidity & Future of Digital Investing

Credit : nftnewstoday.com

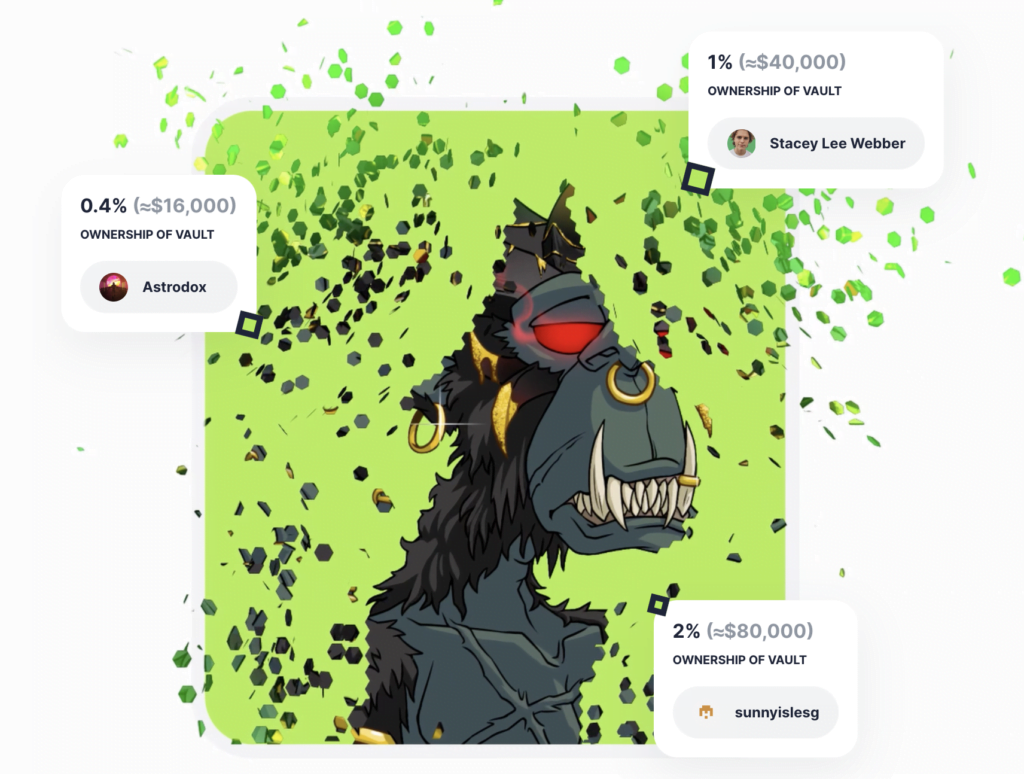

Fractional NFTs make high-value digital possession accessible by dividing a single NFT into smaller, tradable shares. As tokenized belongings acquire momentum in 2025, fractionalization is reshaping NFT markets, enabling collective funding, deeper liquidity, and a better bond between digital artwork. DeFiand rules.

Key Takeaways

-

Fractional NFTs divide possession of a single digital asset into fungible tokens.

-

Shared possession will increase accessibility and liquidity for collectors and traders.

-

Platforms use sensible contracts to handle vaults and buyouts.

-

Authorized recognition stays unsure, with some tokens probably being categorized as securities.

-

The rise of AI analytics and DeFi integration will increase the utility of fractional NFTs.

What are fractional NFTs?

Definition and function

A fractional NFT represents shared possession of 1 digital asset, whether or not it’s a digital murals, a collectible, or tokenized media. The underlying NFT is saved in a sensible contractand the contract points fungible tokens akin to possession shares.

Fractionalization permits a number of traders to personal elements of the shares high-quality NFTsrising participation in an asset class beforehand restricted to massive consumers.

How do fractional NFTs work?

The method usually follows these steps:

-

The NFT is deposited in a sensible contract secure.

-

The vault coin ERC-20 tokens representing proportional possession.

-

These tokens are traded or deployed on supported platforms.

-

A buyout mechanism might permit full takeover if bids meet the minimal worth set.

This mechanism converts illiquid digital belongings into divisible, tradable models – an essential step in the direction of extra fluid NFT markets.

Credit: Fractional.artwork

Credit: Fractional.artwork

Can NFTs be cut up into elements?

Sure. Fractionalization divides property rightsnot the visible or useful merchandise itself. The NFT stays intact whereas tokenized fractions are distributed amongst traders.

The mechanisms of fractional possession

How are NFTs distributed to traders?

Possession is decided by the variety of fractional tokens you personal. Token holders can obtain governance rights, voting rights, or income shares relying on the vault design. Transparency is achieved via knowledge within the chain that’s seen to all individuals.

How is possession verified?

Good contracts document token balances and vault exercise in public ledgers. This unchanging knowledge confirms the significance of every investor and the general distribution of possession.

How are the earnings shared?

When a buyout happens or the NFT is resold, the proceeds are routinely distributed to the token holders in proportion to their shares. Some tasks lengthen this to royalty revenue or staking rewards.

The right way to spend money on fractional NFTs

Funding course of

Investing in fractional NFTs usually entails:

-

Connecting a appropriate pockets (e.g. Metamask).

-

Choose a vault or assortment on a verified platform.

-

Assessing the supply, compensation and governance guidelines.

-

Purchase fractional tokens with accepted cryptocurrencies.

-

Monitor token worth and liquidity on varied marketplaces.

Well-liked platforms

Notable platforms embrace:

-

Fractional art: Focuses on vault creation and administration.

-

Assortment: Specialised in cultural and collectibles.

Every platform affords totally different governance frameworks, buyout guidelines and compensation fashions.

Resale and liquidity

Fractional tokens are traded decentralized exchanges and marketplaces. Liquidity will depend on demand and recognition of the secure – blue-chip NFTs have a tendency to draw energetic markets, whereas area of interest belongings permit restricted buying and selling.

Advantages and Dangers of Fractional NFTs

Foremost advantages

-

Accessibility: Permits small-scale participation in premium NFTs.

-

Liquidity: Permits quicker, smaller transactions as a substitute of promoting via a single purchaser.

-

Diversification: This enables traders to unfold their publicity throughout a number of belongings.

-

Neighborhood Involvement: Encourages collective possession and governance.

-

Innovation: Connects NFTs to DeFi, staking and DAO board.

Foremost dangers

-

Vulnerability of sensible contracts: Coding errors can put funds in danger.

-

Administration conflicts: Disagreement between token holders can block choices.

-

Regulatory uncertainty: Classification as securities stays a risk.

-

Low liquidity: Small buying and selling volumes could make exits troublesome.

A balanced danger evaluation and platform analysis stays important earlier than taking part.

Authorized and Regulatory Issues

Are fractional NFTs thought of securities?

Supervisory our bodies such because the SEC and FCA consider fractional NFTs underneath securities frameworks. Tokens that symbolize funding intent or revenue expectation might qualify as regulated belongings.

Are fractional NFTs authorized?

The authorized standing will depend on the jurisdiction and design. Some platforms restrict participation by geography or log affords to adjust to monetary rules. Tasks that emphasize utilities or group use might face fewer regulatory hurdles.

Transparency in construction, disclosure and governance is a robust indicator of long-term compliance.

Actual-world use instances and platforms

Outstanding examples

-

PleasrDAO’s Doge NFT: Fractionated into $DOG tokenspermitting hundreds of individuals to grow to be co-owners of an iconic meme merchandise.

-

Unicly collections: A number of NFTs mixed into managed vaults with governance tokens.

-

Assortment platform: Gives fractional entry to cultural artifacts and collectibles.

Supported blockchains

Ethereum stays the core infrastructure as a result of its symbolic requirements and liquidity depth. Layer-2 networks corresponding to Arbitrum, Base and Polygon lengthen these capabilities by lowering transaction prices and rising accessibility.

The way forward for fractional NFTs

Are fractional NFTs the way forward for NFT investing?

Fractionalization is predicted to stay a serious power in digital investing. Wider participation, improved liquidity, and integration with DeFi point out a maturing ecosystem moderately than a short-term pattern.

How AI and DeFi can form the market

AI-driven analytics are starting to dynamically worth fractional tokens primarily based on rarity, transaction historical past, and market sentiment. DeFi protocols combine fractions as collateral for credit score and liquidity swimming pools, linking NFT possession to on-chain financing.

These traits point out a convergence between digital collectibles, monetary infrastructure and data-driven markets.

Steadily requested questions

Listed below are some incessantly requested questions on this subject:

What’s a fractional NFT?

A fractional NFT divides one NFT into fungible tokens that symbolize partial possession, permitting a number of traders to share an asset.

How do fractional NFTs work?

A wise contract shops the NFT in a vault and coin tokens representing shares of possession, which will be traded or redeemed.

Are fractional NFTs authorized?

Legality will depend on jurisdiction and construction. Some could also be topic to securities legal guidelines if revenue sharing is concerned.

Can fractional NFTs be resold?

Sure. Fractions are traded on supported decentralized exchanges and NFT platforms, topic to liquidity circumstances.

What dangers do fractional NFTs pose?

Bugs in sensible contracts, low liquidity and altering rules are the primary dangers that traders must assess.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024