Policy & Regulation

FTX users bolster lawsuit claiming law firm was ‘key’ to FTX fraud

Credit : cryptonews.net

Clients of the bankrupt Crypto trade FTX wish to replace their lawsuit towards Fenwick & West, one of many regulation corporations who have been as soon as contracted by the corporate, and claims that new data demonstrates that it was central to the collapse of FTX.

The felony trial of former FTX CEO Sam Bankman-Gruituurde and investigations within the chapter process of the inventory trade “produced particular proof that Fenwick performed an necessary and essential position in an important elements of why and the way the FTX fraud was achieved”, wrote FTX-Klanten.

“Merely put, the FTX fraud was solely potential as a result of Fenwick provided” substantial assist “by creating the constructions and approving that numerous fraud made potential,” the group stated.

They accused the regulation agency of the settlement with creating, managing and representing “clearly conflicting corporations” equivalent to FTX’s sister buying and selling company Alameda Analysis and its subsidiary North Dimension, “who intentionally had no ensures to forestall the billions of {dollars} that have been allowed.”

FTX’s fraud was as soon as described by officers as one of many largest in American historical past.

The applying is a part of a large multi-district Class-Motion lawsuit filed by FTX customers after it collapsed on the finish of 2022 that claims made towards the inventory market, celebrities accused of selling FTX and several other corporations that may have labored with, amongst others, with the corporate.

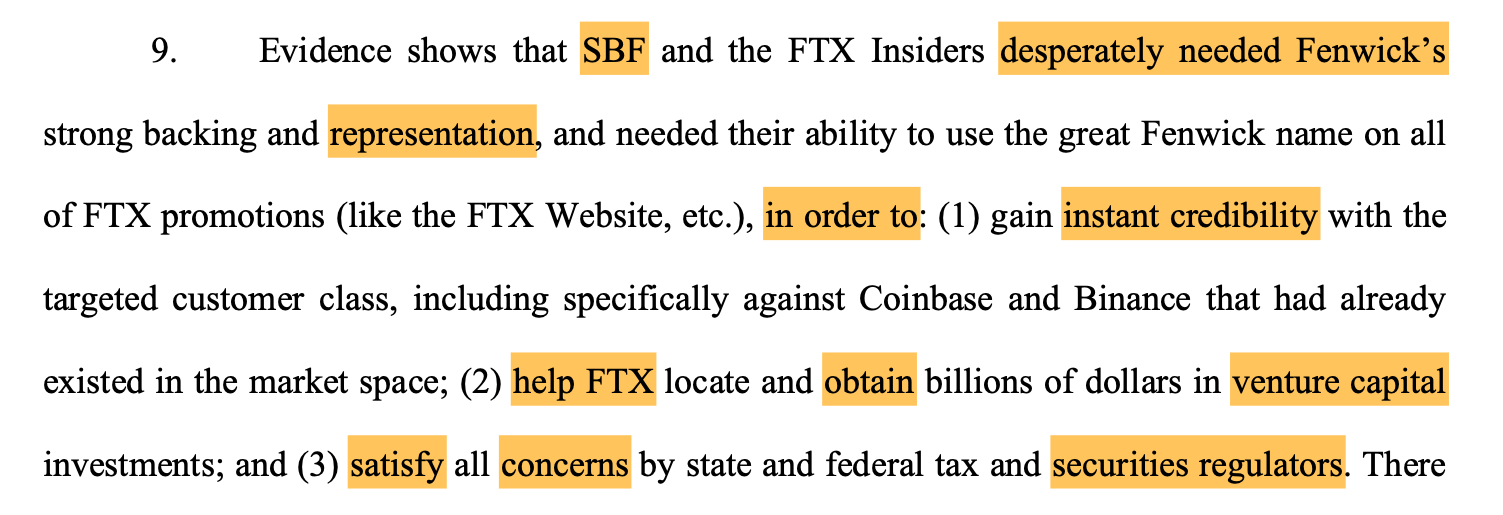

A marked fragment of a part of the accusations of the category group towards Fenwick. Supply: Courtlistener

Fenwick has denied and copied to reject allegations in an earlier criticism submitted in August 2023. Fenwick & West didn’t instantly return Cointelegraph’s request to remark.

Bankman-Frieds’ trial discovers new data, says criticism

The proposed amended criticism claimed that the felony proceedings of Bankman-Fried had found new data final yr about how Fenwick had helped FTX.

FTX co-founder Zixiao “Gary” Wang, former CEO of Alameda, Caroline Ellison and FTX’s ex-engineering director Nishad Singh argued responsible and testified towards Bankman-Bakken, with a jury responsible of seven prices with regard to fraud and Geldwitte.

“Throughout SBF’s felony trial, FTX Insider and co-founder Nishad Singh testified that he knowledgeable Fenwick of the abuse of buyer funds, inappropriate loans and false representations, and who suggested Fenwick on how he might facilitate and conceal these actions,” stated the submission.

The group claimed in a separate software that “it has realized rather more particulars about Fenwick’s relationship with FTX, based mostly on the interviews collaboration of the fastened FTX insiders.”

Chapter Court docket finds Fenwick “deeply interwoven” with FTX, declare prospects

The submission claimed that an unbiased examiner appointed by the court docket who dealt with the chapter process of FTX “greater than 200,000 inside paperwork (many instantly with Fenwick) and concluded that Fenwick was particularly woven into nearly each facet of the errors of FTX Group.”

In accordance with the group, the researcher found that Fenwick had “exceptionally shut relationships” with the chief crew of FTX and “facilitated conflicting intercompany transactions that buyer property abused”.

In addition they stated that the Examinator Fenwick accused of making Shell corporations “to cowl up asset actions” and behind the implementation of automated decoupling messages that have been despatched between FTX executives through the coded Message app sign.

The group accused Fenwick of the additionally implementing “different concealing practices that supervisors and prosecutors had later cited as an obstruction” and claimed that the regulation agency knew that these actions would mislead traders and supervisors. “

Fenwick hit with two new securities claims

The proposed criticism provides two new state regulation claims and accuses Fenwick of violating securities legal guidelines in Florida and California on the cryptocurrency of the Trade, FTX token (FTT).

The group accused the regulation agency of enjoying ‘an lively position in designing, selling and facilitating the sale’ of FTT, income accounts provided by FTX and ‘Pursuits in different devices managed by FTX’, of which they claimed they have been unregistered results.

Fenwick argued in his movement to reject the earlier criticism that was submitted in September 2023 that it can’t be held liable for serving to a buyer so long as the “conduct inside the scope of the consumer’s illustration falls.”

The group had additionally sued Sullivan & Cromwell, one other regulation agency that had contracted FTX, and accused it of serving to the trade, however they later dropped the criticism resulting from an absence of proof for his or her claims.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September