Analysis

Fundstrat’s Tom Lee Says US Stock Market Still in a Bull Run, Thinks S&P 500 Has Hit Price Lows This Year

Credit : dailyhodl.com

Investor Tom Lee says that US shares are nonetheless in the course of a bull’s cycle after finishing a standard worth correction.

In a brand new video replace for traders on the YouTube channel of Fundstrat, the principle funding officer of the corporate that he’s satisfied that the S&P 500 has already printed his layer, however he merely doesn’t know for certain whether or not a fast V-shaped restoration comparable to 2020 will happen or whether or not a consolidation will unfold in 2011.

Lee says that the interpretation of traders of various dangers, comparable to charges and inflation expectations, will in all probability decide the subsequent step of the inventory market.

“I feel we’re nonetheless in a bull market. I simply am not clear whether or not it’s a V-shaped restoration comparable to 2020 or it’s a attain market like 2011.

Intuitively I’ll say that it is sensible that we’ve made a backside, however we could also be a bit tied. And that’s as a result of individuals are fearful that there are different sneakers to drop. The speed battle with China may grow to be a chilly battle. Traders are going to fret concerning the wrinkle results of this shock, resulting in a world recession. These are additionally excessive views.

[Or] That some individuals are going to fret a few monetary disaster of all this delepaaging, and that inflation expectations can rise to a sure extent that we get ‘Greedflation’. That’s the place corporations really improve costs, and it’ll power the FED to stroll. And naturally, if estimates fall greater than 20%, shares have a draw back as a result of the inventory market already had a marking of 20%. “

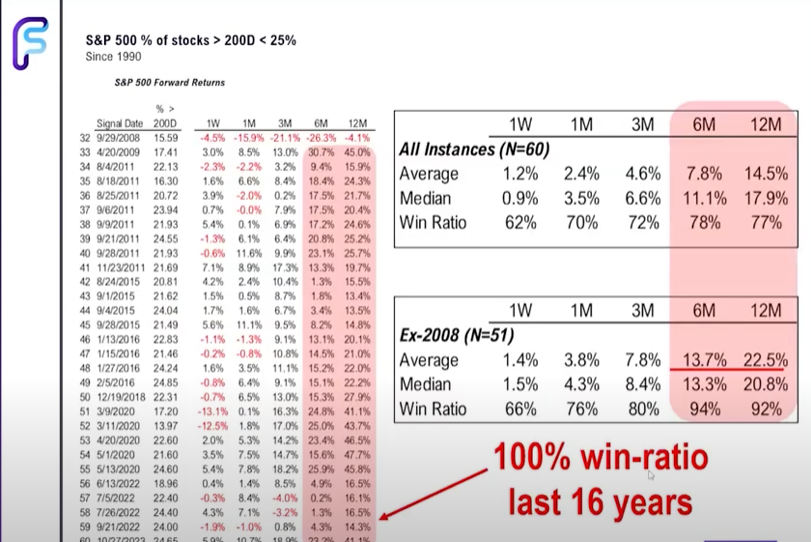

Lee shares a graph that reveals that solely 6% of the shares within the S&P 500 are above their 50-day advancing common and is simply 19% above their 200-day progressive common. The investor says that the set -up has had excessive revenue costs for bulls traditionally.

“That is the proportion of shares above the 50-day advancing common on the prime, and above the 200-day advancing common on the backside. Underneath 20% is a significant drawback, as a result of within the final 16 years the S&P was six months and 12 months later greater. The truth is, in the event you have a look at three months later, exterior 2022, the inventory market was greater three months later.” ”

From the tip of Friday, the S&P 500 acts at 5,282 factors.

https://www.youtube.com/watch?v=C15D8F3SUMW

Observe us on X” Facebook And Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Verify worth promotion

Surf the Day by day Hodl -Combine

Generated picture: midjourney

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now