Policy & Regulation

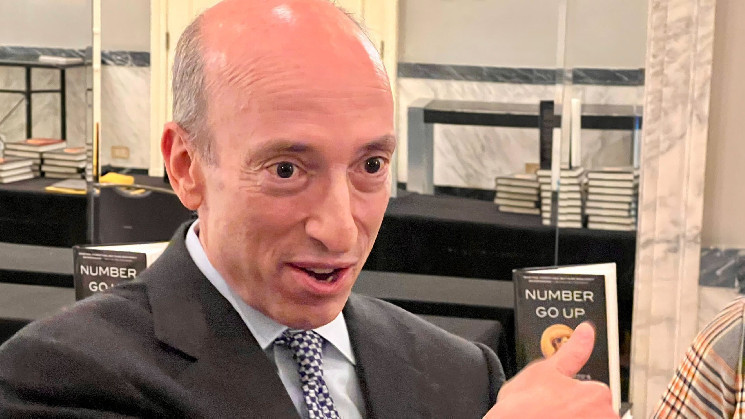

Gary Gensler’s Contentious Reign Over Crypto Approaches Its Twilight

Credit : cryptonews.net

Most Securities and Change Fee chiefs step down after a brand new president arrives, and for the crypto {industry}, Chair Gary Gensler’s ultimate second is some extent of excessive curiosity.

Digital property leaders have battled him in court docket, and their buddies in Congress have attacked Gensler for standing in the best way of innovation, however his time is operating low.

Gensler has choices for the way he desires to finish issues, and he nonetheless has a while left to interact in crypto coverage and enforcement earlier than he goes.

Sometime quickly, anyone apart from Gary Gensler might be calling the pictures on the U.S. Securities and Change Fee, and many of the crypto {industry} will rejoice.

Greater than another determine within the U.S. authorities, this SEC chair performed an unflinching antagonist to its goals. That no-holds-barred opposition to the best way crypto firms wish to do enterprise is prone to stop, a method or one other, within the coming yr, when the securities company will get a brand new boss.

However the countdown for Gensler raises quite a lot of questions, leaving one ultimate chapter of drama in his reign over crypto (and the remainder of securities regulation within the U.S.). And if there is a frequent feeling amongst those that watch the SEC intently, it is uncertainty.

Gensler’s five-year SEC time period expires on Jan. 5, 2026, however custom suggests a chair will step away if the opposing get together takes the White Home. Nonetheless, they do not need to. A second time period for President Donald Trump would not mark an computerized finish to Gensler’s tenure. If he determined to make a stand, he might end out his time period as a commissioner and keep a Democratic majority on the company for so long as it takes for the brand new president to make appointments and the Senate to verify them.

When not too long ago requested by a reporter whether or not he’d resign if Trump gained, Gensler laughed quietly and stated he would not touch upon the elections. However he added, “Elections have penalties.”

A former Goldman Sachs Group Inc. banker and Massachusetts Institute of Expertise professor who lectured on crypto, Gensler has a deep properly of monetary and even digital-assets data. And because the chair of the Commodity Futures Buying and selling Fee after the worldwide mortgage implosion in 2008, he lower his authorities enamel crafting novel, high-stakes regulation. However when he took the helm of the SEC in 2021 and located crypto on his plate, he made a consequential name: The SEC did not want new guidelines. Present securities regulation gave loads of leeway to police this house.

That is not the overall sense of the SEC’s overseers in Congress. A giant majority of the Home of Representatives handed a invoice earlier this yr that may create guidelines particularly tailor-made for digital property – together with how the SEC ought to strategy what could be a extra explicitly outlined array of crypto securities. And whereas that invoice has languished as a result of it nonetheless wants approval within the Senate, crypto did see a win in that chamber, too. A robust majority of senators voted this yr to overturn a key SEC crypto accounting coverage, exhibiting they believed the company was overreaching and rebuffing Gensler’s arguments that the industry-targeting commonplace was a pure response to the crypto sector’s investor-harming bankruptcies.

The lawmakers who make up subsequent yr’s Congress, which is able to seemingly have no less than two dozen members who can partly thank aggressive crypto marketing campaign giving for his or her presence on Capitol Hill, is prone to be busy with digital property. That is in all probability true regardless of which get together controls every chamber; Democrats look poised to have a majority within the Home, in accordance with electoral math and polling traits, whereas Republicans could win management of the Senate. But when the Democrats hold the Senate, crypto progress could stay challenged.

“I believe there’s a actual probability that the laws will get handed subsequent yr,” Michael Piwowar, a former performing chair of the SEC, stated throughout an interview with CoinDesk. That might create a “good, authorized regulatory framework” for crypto that places the securities company in an outlined lane that leaves much less room for the authorized interpretations the SEC and crypto companies are nonetheless preventing over in federal courts, he added. “There’s not clear authority on a few of these issues, which is why Congress must get entangled.”

“5 years from now, we’ll look again within the rearview mirror and say, ‘Why could not now we have finished this sooner?'” Piwowar stated.

A part of that reply – critics and allies would agree – is Gensler.

“Chair Gensler’s tenure on the SEC has been marked by missed alternatives,” stated Sheila Warren, who runs the Crypto Council for Innovation. She argued that Gensler has left U.S. companies “working at nighttime” by leaning into enforcement slightly than regulation. “A contemporary begin on the SEC is important for the way forward for innovation on this nation.”

Regulation-by-enforcement

SEC Commissioner Hester Peirce, a Republican appointee who has been essentially the most dependable crypto ally on the company, has lengthy been in open disagreement with the chairman’s choice for whipping digital property companies into line by punishing them.

“It is a very unhealthy strategy to making an attempt to control an {industry}, should you’re making an attempt to guard traders, should you’re making an attempt to shepherd the fee’s assets properly,” she instructed lawmakers at a listening to of the Home Monetary Companies Committee final month. “It’s extremely inefficient, and on the finish of the day, it leaves everybody questioning the place the traces of our authority are.”

However in the identical listening to, Gensler once more cited the so-called Howey check, the Supreme Courtroom commonplace set within the Forties (lengthy earlier than crypto and blockchains have been even a dream) that decides whether or not an asset is a safety. He is wielded it as his chief weapon within the SEC’s epic enforcement battle with the {industry}.

“The time-tested protections are actually necessary,” he instructed the lawmakers, citing a few of the latest federal court docket successes for his company, whereas leaving out the setbacks. “One court docket stated Howey gives clearly expressed assessments for figuring out what constitutes an funding contract. One other court docket stated the SEC based mostly its declare on simple software of a venerable Supreme Courtroom precedent. I might go on and on and skim quote after quote from instances within the crypto discipline.”

Many of the crypto house is breaking the regulation, in accordance with the narrative he stands by, and its practitioners are threatening folks’s cash with dicey enterprise practices whereas they proceed to evade compliance. Simply final week, the SEC sued one of many greatest buying and selling corporations in monetary markets (crypto and conventional property alike), Chicago-based DRW, accusing the corporate of not getting correct permission to commerce crypto property. Gensler, who declined to be interviewed by CoinDesk for this story, has drawn that line within the sand and has spent years proving he will not budge from it.

“The U.S. securities legal guidelines have labored to guard traders for 90 years, and there’s nothing incompatible in regards to the crypto discipline with these time-tested legal guidelines,” an SEC spokesperson instructed CoinDesk.

So, what occurs to Gensler and his crypto marketing campaign after the presidential election subsequent month?

Former President Trump, the Republican candidate for subsequent month’s election, basked in a large surge of applause in July when he instructed attendees at a Bitcoin convention that he’d fireplace Gensler, so a Trump win would promise storm clouds for the SEC chair. When the opposing get together takes the White Home, an SEC chair normally steps down instantly or – on the newest – when the brand new president takes workplace two months after Election Day.

“I do not suppose there’s ever been a boss who’s ever stayed on when there’s been a change of get together,” stated Dennis Kelleher, CEO of Higher Markets, a Washington-based advocacy group that is been vital of the hazards crypto poses to traders. (A Democrat, Joe Biden, at the moment resides within the White Home.)

May linger

However Jaret Seiberg, a financial-policy analyst with TD Cowen, means that Gensler – even when he vacates the highest job – might stick round on the fee, the place he’d sit alongside Democrats Caroline Crenshaw and Jaime Lizárraga. Crenshaw’s time period has expired, and President Biden despatched her re-appointment to the Senate, however she hasn’t but been confirmed because the congressional session winds down. (Within the absence of a alternative, an expired commissioner can keep on one other 18 months.)

“Nothing forces him to depart,” Seiberg wrote in an analyst be aware to shoppers in September. “We anticipate progressives to stress Gensler to protect Democratic coverage wins by depriving the GOP of an SEC majority.”

Kelleher, who stated he’d be “greater than happy” if Gensler stayed on, sees sturdy odds towards that state of affairs enjoying out.

“There could be super worth in Gary Gensler staying till the tip of his time period,” Kelleher stated. “Primarily based on precedent and observe, it is extraordinarily unlikely.”

With out Gensler as chair, Trump might elevate both Republican commissioner – Peirce or Mark Uyeda – as performing chair whereas he seeks a everlasting decide. That interim chair might begin naming new division heads, together with atop Gensler’s cudgel – the enforcement division – and will change how the company is pursuing pending authorized instances. However till the fee has a 3rd Republican confirmed, the Republicans would not get pleasure from a majority that permits them to roll out new insurance policies.

The crypto lots have usually favored a Trump presidency, particularly after his full-throated embrace of the expertise this yr, although the U.S. authorities’s adversarial relationship with the sector arguably began on his watch. It was his personal SEC chair, Jay Clayton, who first pursued Ripple. Still, his recent rhetoric paints the government as standing in the way of innovation.

“If Trump wins, crypto wins,” Daniel Gallagher, a former SEC commissioner, predicted when showing at a latest occasion in Washington. Gallagher, whose title has appeared on lists of those that could be thought of for changing Gensler below Trump, has typically spoken of his frustration as a senior lawyer at Robinhood Markets. He stated the company rebuffed the corporate because it tried to adjust to SEC guidelines as a crypto platform.

If Vice President Kamala Harris beats Trump, the alternative of Gensler doubtlessly carries much less urgency. However even her guarded sentiments that her presidency would foster digital property development and new rules recommend a course that diverges from Gensler, who argues his company would not want new rules.

Harris’ marketing campaign has held conferences with crypto insiders and privately satisfied them that the vp would reset {industry} relations which have ranged from stagnant to hostile below her present boss, Biden.

Both manner, the “age of Gary Gensler” will quickly finish, declared Anthony Scaramucci, Trump’s short-lived communications director who has develop into a vigorous critic of the previous president.

“That period of crypto is ending,” Scaramucci, the founder and managing companion at Skybridge Capital, stated in a CoinDesk TV interview. “We’re heading towards a significantly better regulatory framework regardless of who wins the election.”

Time left

Nonetheless, Gensler has a while left earlier than the elections pressure his hand. Regardless of grumbling from the {industry} that his company has refused to make guidelines tailor-made to crypto, he did set and defend crypto accounting coverage within the type of what’s referred to as Employees Accounting Bulletin No. 121, and the fee launched into a number of consequential guidelines.

In February, the company formally widened its definition for what makes a securities supplier, a brand new commonplace that’s meant to incorporate crypto operations amongst companies the company regulates as broker-dealers – doubtlessly together with decentralized finance (DeFi). And the fee has pursued a few ongoing efforts that would hit crypto exhausting: One proposed rule expands the definition of “alternate” to embody digital property platforms in a manner that additionally explicitly included DeFi, and one other proposal would demand funding advisers solely hold shoppers’ crypto property with “certified custodians,” which the company prompt leaves out the massive crypto homes corresponding to Coinbase. Nevertheless, that custody rule is heading again to the drafting board, SEC officers have stated.

If Gensler and his colleagues pull the set off on the alternate rule earlier than he leaves, the nearness of the following congressional session in 2025 would give lawmakers a chance – so long as each chambers wished to make use of it – to reverse something the company approves. That energy is below the Congressional Evaluation Act and is similar authority lawmakers in Congress tapped to attempt to erase the company’s crypto accounting rule, which drove President Biden to step in with a veto to cease them.

Trump’s first administration embraced the CRA energy because it had by no means been used earlier than, however it tends to require a Congress that is pleasant to the president.

Authorized technique

In the meantime, for whichever candidate exhibits up within the White Home in January, there’ll nearly actually be a prolonged transition interval. Rulemaking and enforcement instances are time-consuming endeavors, and an overhauled SEC inherits quite a lot of work already principally completed earlier than new commissioners arrive. An incoming chair – and doubtlessly new high authorized officers, corresponding to the overall counsel and the enforcement director – would have lots of triaging and decision-making to do on a herculean heap of court docket instances.

A few of the foundational crypto instances, corresponding to these concentrating on Ripple and Coinbase, might be elevated within the coming yr by appeals as they doubtlessly wind their manner towards the Supreme Courtroom, the place Gensler’s legacy could actually be determined. New administration must work out how they wish to proceed with these.

Even when the company is beat again by court docket losses or new legal guidelines from Congress that limit its jurisdiction, the SEC will at all times have a serious position within the U.S. crypto sector. Kelleher stated that position will inevitably conflict with the {industry}, as a result of the regulator’s first job is to guard traders, not companies.

And he cautioned the crypto world from seeing Gensler as a villainous Wizard of Oz behind all the pieces it would not like, as a result of Kelleher contended that the fee chair has really finished extra for the {industry} than anyone in authorities. After dropping his court docket battle to forestall the creation of spot bitcoin exchange-traded funds, Gensler acknowledged the loss and went towards his two fellow Democrats to facet with the Republican commissioners in approving the consequential ETFs.

“I believe Gensler’s legacy on crypto goes to be the one man in authorities who actually nearly single-handedly did extra to legitimize and mainstream crypto than anybody else,” Kelleher stated.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024