Web 3

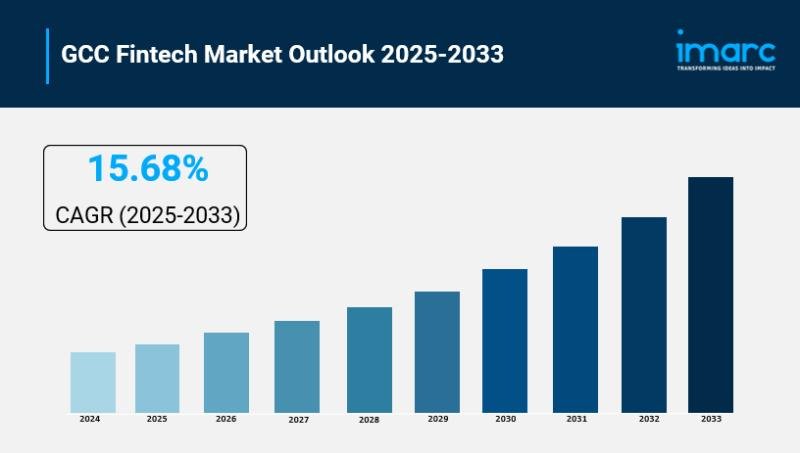

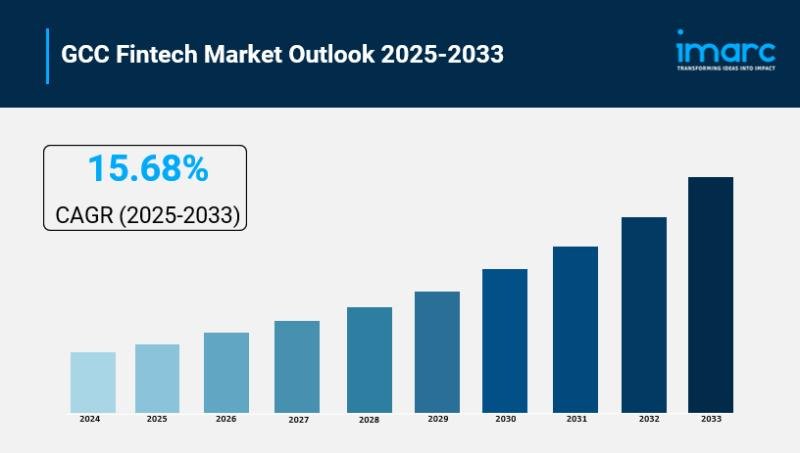

GCC Fintech Market Size to Expand at a CAGR of 15.68% during 2025-2033

Credit : web3wire.org

GCC Fintech Market

GCC Fintech Market Overview

Market progress 2025-2033: 15.68%

In line with the newest analysis publication from Imarc Group, “GCC Fintech Market Trade Traits, Dimension, Development, Alternative and Forecast 2025-2033”, the GCC Fintech-Market measurement is anticipated to indicate a progress price (CAGR) in 2025-20%.

How AI the way forward for GCC Fintech Market reformed

● AI transforms the GCC Fintech market by encouraging the effectivity of effectivity in banking actions, automating customer support and making data-driven decision-making attainable, which significantly reduces the prices.

● Governments within the VAE, Saudi Arabia and Bahrain assist AI-driven fintech innovation via regulating sandboxes and fintech hubs, selling startups and streamlining product launches.

● AI-driven instruments enhance the detection of fraud and customized monetary companies within the GCC, in order that banks and fintechs can higher perceive the wants of the shopper and on the identical time shield transactions.

● The rise of AI-Native Fintech startups within the GCC, supported by investments and innovation hubs reminiscent of Dubai’s DIFC, challenges conventional banks and hastens digital monetary transformation.

● AI integration with Open Financial institution -APIs makes extremely customized monetary merchandise and seamless buyer experiences attainable, which stimulates each monetary inclusion and competitiveness of the market within the area.

Seize an instance PDF of this report: https://www.imarcgroup.com/gcc-fintech-market/requestsample

GCC Fintech Market Traits & Drivers:

The GCC FinTech market is flourishing because of the rising digital acceptance and the penetration of smartphones within the area. Customers embrace cell portfolios, digital funds and on-line banking options for his or her comfort and velocity. This improve in digital monetary actions is supported by governments that launch initiatives, reminiscent of Saudi -Arabia Fintech Saudi and the regulatory sandboxes of the VAE, which encourage innovation and the graceful rollout of fintech companies. Each banks and startups use AI and Huge Information to create seamless buyer experiences, making monetary companies extra accessible, particularly for the youthful, technically educated inhabitants stimulans.

Regulatory assist and assist from the federal government play a vital position in accelerating fintech progress within the GCC. Governments within the VAE, Bahrain and Saudi Arabia actively create fintech-friendly ecosystems, provide incentives, up to date rules and innovation hubs to draw fintech firms. These efforts enhance compliance processes, promote monetary inclusion and provide protected frameworks for rising digital options reminiscent of blockchain, AI-driven funds and open financial institution APIs. This encouragement not solely reinforces the native fintech prospects, but additionally turns the GCC right into a aggressive fintech hub on the world stage.

One other essential pattern is the rise of embedded funds and AI-driven personalization throughout the GCC FinTech room. Monetary companies are more and more being built-in into non-financial platforms and provide customers instantly credit score, insurance coverage or cost choices the place they work on one another day-after-day, reminiscent of e-commerce or Experience-Hailing apps. AI algorithms analyze person conduct to regulate companies in actual time, to enhance comfort and satisfaction. Corporations reminiscent of Emirates NBD and Community Worldwide lead this wave of innovation, use strategic partnerships and AI to reform how monetary companies are offered, making them extra intuitive and reply to particular person buyer wants.

GCC Fintech Trade Segmentation:

The report has segmented the market within the following classes:

Insights of the implementation mode:

● On-premises

● Cloud-based

Expertise insights:

● Software programming interface

● Synthetic intelligence

● Blockchain

● Robotic course of automation

● Information evaluation

● Others

Software Insights:

● Cost and switch of funds

● Loans

● Insurance coverage and private funds

● Wealth administration

● Others

Finish person insights:

● Banking

● Insurance coverage

● Results

● Others

Land insights:

● Saudi -Arabia

● VAE

● Qatar

● Bahrain

● Kuwait

● Oman

Ask the Historic report analyst: https://www.imarcgroup.com/request?type=report&id=10530&flag=e

Aggressive panorama:

The aggressive panorama of the business was additionally investigated along with the profiles of an important gamers.

Current information and developments within the GCC Fintech Market

● August 2025: GCC Fintech Investments have been reported, with greater than $ 6.1 billion collected in solely the primary half of this year-a 37% soar in comparison with final 12 months. Managing this isn’t solely a robust improve in financing for digital funds and open banking, but additionally the sturdy push of governments and new regulatory sandboxes that welcome startups in sectors reminiscent of digital belongings and AI-driven funds. Consequently, about 65% of regional customers now say that they like digital monetary companies, which marks a big cultural shift to a society with out cashless, expertise.

● July 2025: The VAE stays the startup and fintech tree of the GCC Leiden and register greater than 5,600 startups in yet another not too long ago than some other nation within the area. Fintechs within the VAE profit from investor -friendly free zones and initiatives reminiscent of HUB71, which this 12 months attracted $ 224 million in investments at an early stage and helped to create greater than 400 jobs. Within the meantime, Oman rolled out his regulated Fintech Sandbox, geared toward digital funds, blockchain and open banking to hurry up accountable innovation within the wider golf area.

● July 2025: Fintech platforms specializing in SMEs assist, get actual traction concerning the GCC. Omnipay, a VAE -based digital cost platform for small firms, has offered $ 1.5 million in seed financing to develop its provide for SMEs. Different outstanding actions embrace the partnership between Paymob and Tamara to convey a couple of revolution in SME paying options and the speedy financing success of firms reminiscent of Flapkap ($ 34 million) and Pemo ($ 7 million), which streamlines administration and digital loans within the area.

Word: In case you want particular particulars, knowledge or insights which are presently not included within the context of this report, we’re comfortable to be your request. As a part of our adjustment service, we are going to accumulate the extra info you want, tailor-made to your particular necessities. Tell us your actual wants and we are going to be sure that the report is up to date accordingly to fulfill your expectations.

About us:

IMARC Group is a worldwide administration consultancy that helps essentially the most formidable Changemakers on this planet to create an enduring influence. The corporate gives an in depth collection of market entry and growth companies. IMARC gives embrace thorough market evaluation, feasibility research, help with firm recording, assist for manufacturing facility establishments, approvals for authorized and licensing, advertising and marketing and gross sales methods, aggressive panorama and benchmarking analyzes, costs and price analysis and buying analysis.

Contact us:

Imarc group

134 N 4th St., Brooklyn, NY 11249, USA

E -Mail: gross sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This launch is revealed on OpenPR.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024