Policy & Regulation

GENIUS Act scrutinized for stablecoin yield ban as TradFi tokenization gains steam

Credit : cryptonews.net

The latest approval of the US Genius Act was celebrated on a big scale as an vital step ahead for the acceptance of Stablecoin, however an vital provision can curb the enchantment of digital {dollars} in comparison with cash market funds, which raised questions on whether or not the authors of the account had been pressed by the stress of the financial institution business.

The Genius Act explicitly prohibits expenditure to supply returns-bearing stablecoins, in order that each retail and institutional buyers successfully earn curiosity on their digital greenback possession.

That’s the reason Temujin Louie, CEO of Croschain Interoperability Protocol Winchain, warned towards contemplating laws as an unqualified victory for business.

“This may be true in a vacuum,” Louie instructed Cointelegraph. “However by explicitly forbidding the expenditure of Stablecoin to supply yield, the Genius Act truly protects an enormous benefit of cash market funds.”

US President Donald Trump indicators Genius Act on July 18. Supply: Related Press

As Cointelegraph reported, cash market funds or MMFs are on the rise as a solution from Wall Avenue to Stablecoins, specifically when they’re printed in Tokenized type. JPMorgan -Strategist Teresa HO famous that Tokenized MMF’s new use can unlock, corresponding to serving as a margin -underly.

Louie agrees and claims that “tokenization permits cash market funds to imagine the pace and suppleness that made Stablecoins distinctive, with out sacrificing security and supervision of the regulatory.”

Paul Brody, international blockchain chief at EY, instructed Cointelegraph that tokenized MMFs and Tokenized Deposits “might discover an vital new probability,” particularly within the absence of proceeds on Stablecoin Holdings.

“Cash market funds can function and lots of resemble finish customers, however with the distinction that they provide yield,” mentioned Brody.

Supply: Padditor

In line with the Brody Van EY, the supply of yield could be a decisive issue between cooled MMFs and Stablecoins. But he famous that Stablecoins retain sure advantages:

“Stablecoins are permitted as belongings of service, which signifies that they’ll simply be positioned in Defi companies and different Onchain Monetary Providers with out sophisticated administration of entry and switch checks. If tokenized cash market funds have many restrictions that stop such use, that the attraction of the return shouldn’t be adequate to compensate.”

Associated: Crypto -execs Central as Trump Stablecoin Invoice indicators within the legislation

The Banking Sector’s grip on the Stablecoin debate

The prohibition of the Genius ACT on proceeds -bearing stablecoins was so little shock, with Cointelegraph reported earlier that the financial institution foyer appears to have had a substantial affect on the present coverage debate round Stablecoins.

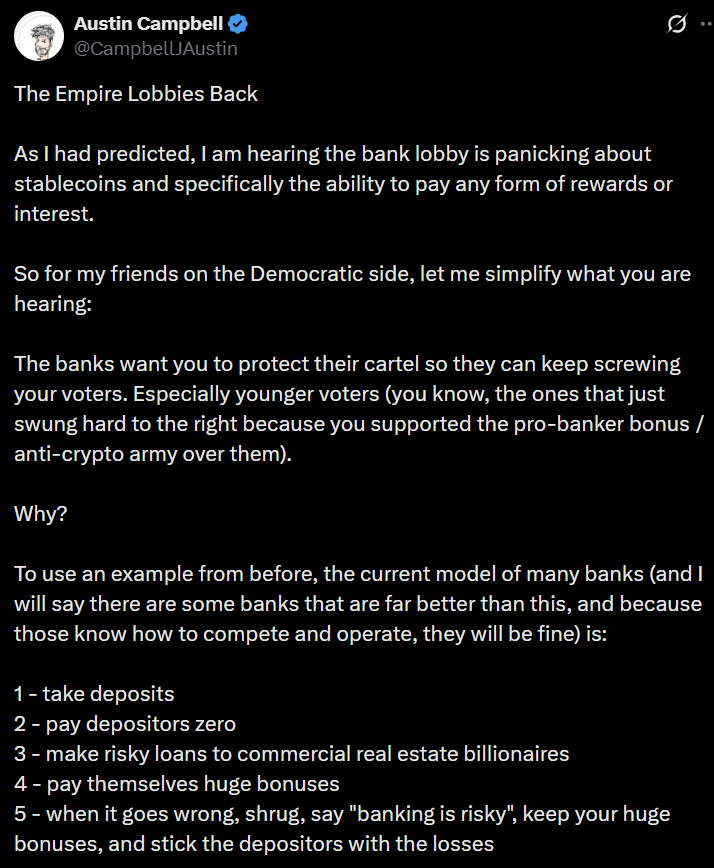

In Might, NYU professor and blockchain guide Austin Campbell talked about sources inside the banking sector, which exhibits that monetary establishments are actively lobbying to dam interest-bearing Stablecoins to guard their long-term enterprise mannequin.

Supply: Austin Campbell

After a long time of providing deposits of minimal curiosity, banks feared that their competitiveness can be threatened if Stablecoin’s expenditure was allowed to supply themselves on to holders, Campbell mentioned.

Nonetheless, there are income -bearing digital belongings within the US, albeit underneath the obvious authority of securities laws. In February, the Securities and Change Fee authorized the primary return-bearing Stablecoin safety of the nation, printed by figures markets. The token, known as ylds, provided a yield of three.85% on the launch.

Associated: Genius units new stablecoin guidelines, however stays imprecise for international emennials

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now