Analysis

Global M2 Money Supply is Booming— Here’s What it Means for Bitcoin & Crypto Markets

Credit : coinpedia.org

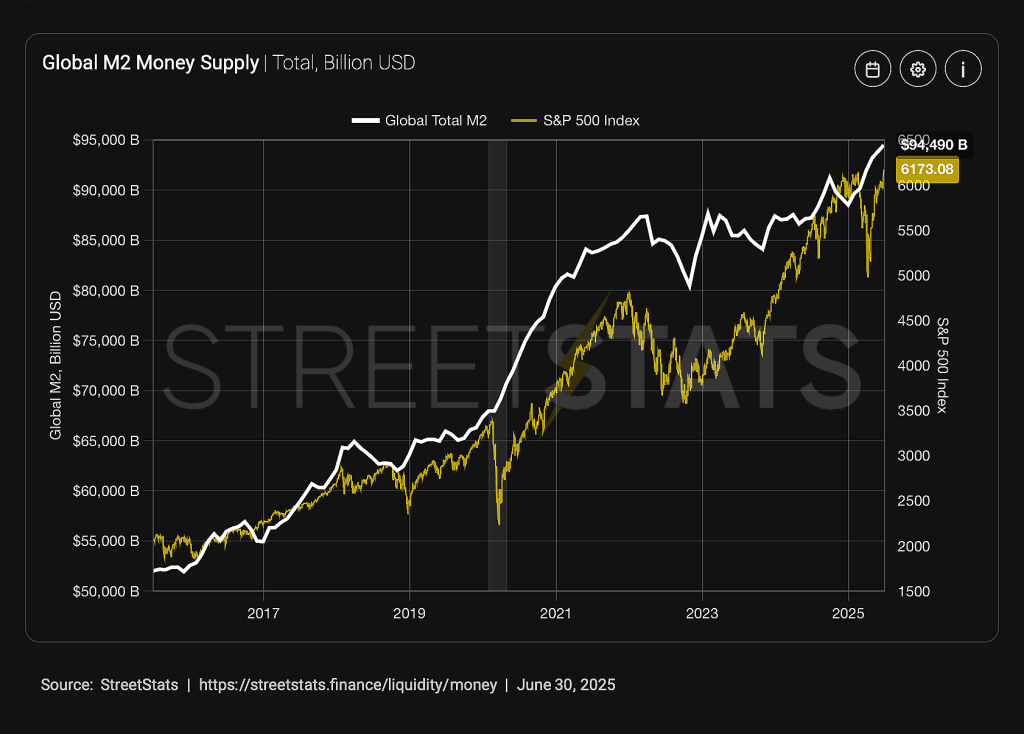

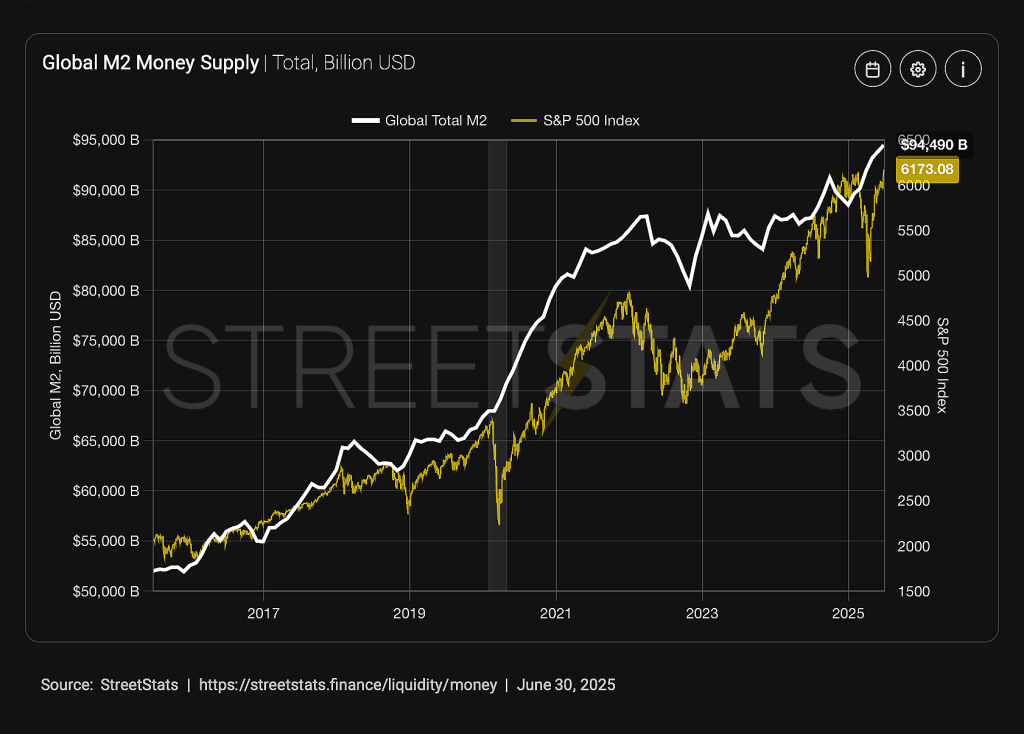

World M2 provide refers back to the whole quantity accessible for expenditure and investments in crucial economies on the planet. A rise in ranges means that extra accessible cash, whereas a drop means that much less liquidity is on the market throughout the markets. In an fascinating replace, the degrees of 8.77% develop on an annual foundation, which appears to be a giant drawback, particularly for Bitcoin.

In easy phrases, the turnout suggests a rise within the whole cash that flows via the world economic system, together with money, checking deposits, financial savings and different nearly cash property. When this quantity grows quickly, which means that central banks are pumping liquidity within the system, usually to stimulate or handle progress that has historically been for Bitcoin.

Correlation between M2 Progress & Bitcoin

Because the central banks inject liquidity, the actual yields are inclined to compress and even turn into unfavourable, making non-building property akin to Bitcoin extra engaging. Furthermore, the crypto with a provide hood of 21 million has zero financial inflation, which means that it’s not diluted as Fiat -Malutas. That’s the reason BTC’s shortage within the instances that Fiat expands by nearly 9% per 12 months, a operate however not a bug.

Traditionally, the strongest bull markets from Bitcoin correspond to intervals of aggressive M2 extension. In 2020-21, Put up-Bodem had pushed QE M2 progress into double digits, which pushed the BTC worth with 8x. Moreover, the expansion of M2 delayed in 2022 whereas the Fed walked aggressively, in order that the BTC worth was corrected by nearly 75%. Later in 2024-25, with M2 that once more expands nearly 9%, is the Macro-Bullish setup.

What’s the subsequent step for BTC worth – How excessive can it go in 2025?

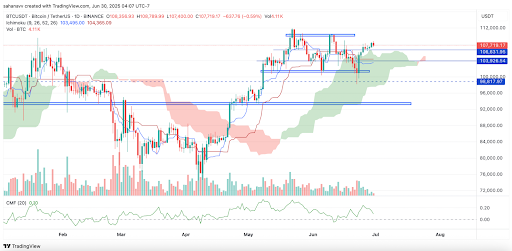

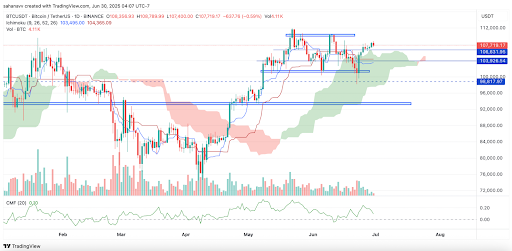

After a slender consolidation alongside the essential assist for $ 106.6k, the Bitcoin worth of palms tried to vary palms above $ 108k, which attracted Beararish consideration. Nevertheless, Token efficiently protects the assist and due to this fact a bullish continuation could be imminent.

As could be seen within the graph above, the BTC worth continues to drift near its highlights above $ 111k, with out the Bearish strain that happens with common intervals. Within the instances that the Ichimoku cloud is Bearish, the degrees are approaching for a bullish crossover and the CMF maintains a steep falling pattern. This retains the bullish and the bearish hope alive for the BTC worth rally.

If the value of Bitcoin (BTC) efficiently rises above present consolidation, Token can attain a brand new Ath. Nevertheless, a failure can in the end drag the degrees beneath the native assist and power it to keep up somewhat extra time a horizontal consolidation.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024