Bitcoin

Gold’s Outperformance in 2024 ‘May Not Be a Good Sign’ for Bitcoin and Other Risk Assets, Says Bloomberg Analyst

Credit : dailyhodl.com

Bloomberg Intelligence senior macro strategist Mike McGlone warns that gold’s sturdy efficiency in 2024 may very well be a bearish sign for Bitcoin (BTC) and different dangerous belongings.

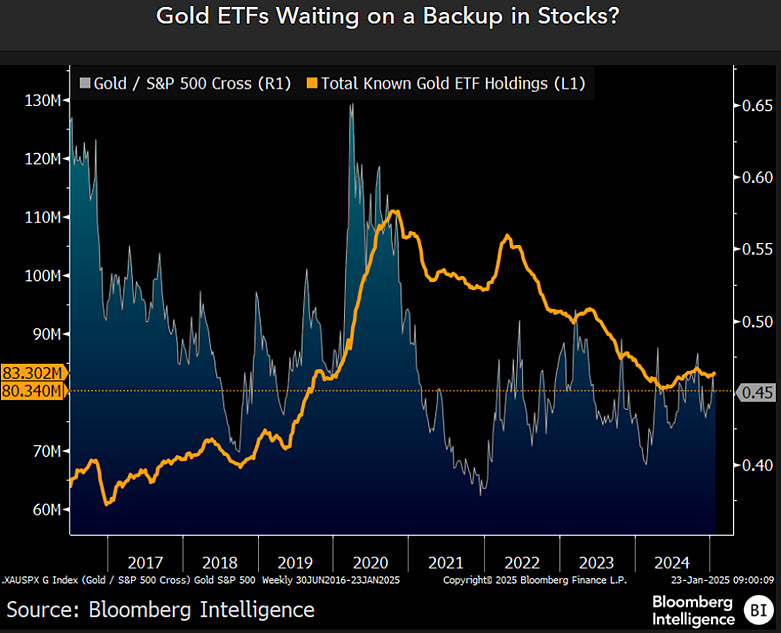

McGlone say that gold has outperformed the markets, indicating that buyers are shifting their wealth to the valuable steel as a protected haven of selection amid issues about deteriorating macroeconomic circumstances.

“The Quantity Must Go Up” Dangers: The Drawback of Bitcoin and Beta vs. Gold: It is probably not an excellent signal for threat belongings that gold, regardless of vital competitors from Bitcoin, beats the record-breaking inventory market in 2024. Is the steel getting too scorching? or inform us one thing? My prejudice is the latter, primarily as a result of [US President Donald] Trump Administration Uncertainty and Promotion, and the Dangers of Extremely Speculative Digital Property.”

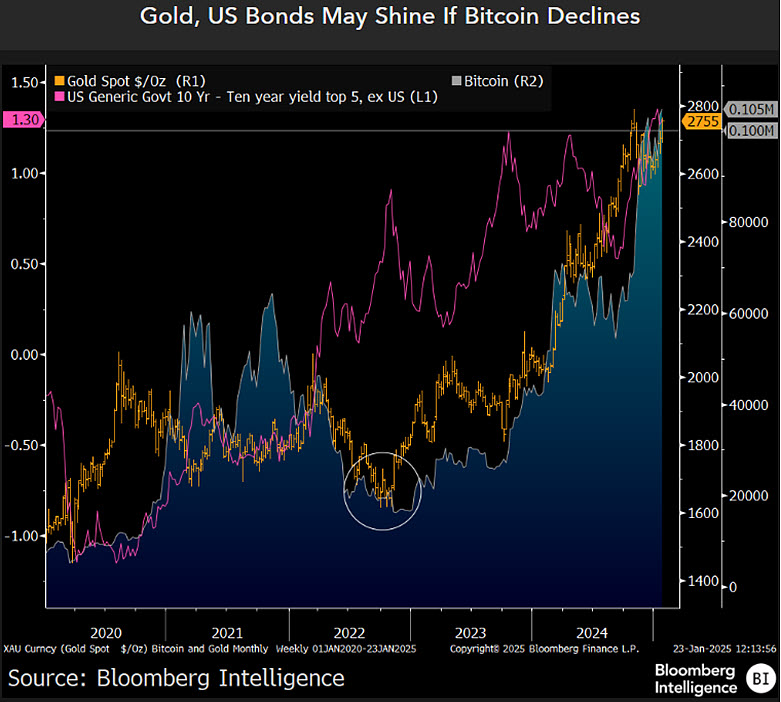

McGlone too believes whether or not Bitcoin can maintain $100,000 as assist may very well be the deciding issue as as to if the flagship crypto asset will stay in an uptrend.

“Bitcoin could have to remain above $100,000 or else. On related upward trajectories from the 2022 low, gold and Bitcoin may encounter resistance thresholds, and what could matter most is the crypto versus $100,000. If Bitcoin pulls again, it might recommend the identical for the inventory market, with implications for deflation, decrease bond yields and tailwinds for gold.”

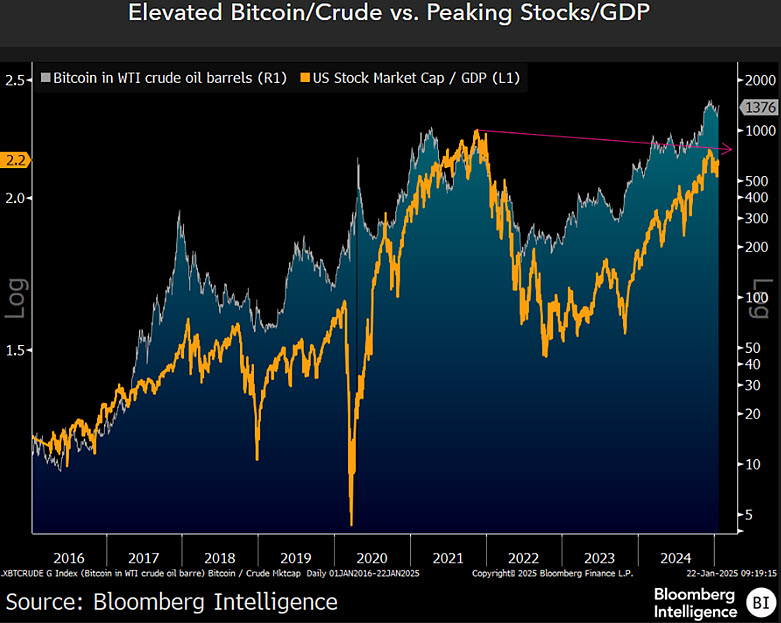

Lastly, McGlone notes how the worth of US inventory market capitalization and Bitcoin relative to US Gross Home Product (GDP) is way greater than when Trump first took workplace in 2017, suggesting market peaks could also be close to.

“Promote When They Cry ‘Threat’: The mixture of elevated US shares and Bitcoin versus crude oil in the beginning of 2025 versus 2017 could spotlight the dangers of over-enthusiasm. When President Trump first took workplace eight years in the past, the US inventory market’s capitalization to GDP ratio was nearer to 1.2x, and crypto was round $1,000. Quick ahead to 2025 and inventory costs are round 2.2x GDP, and Bitcoin is up 100x to $100,000.”

Bitcoin is buying and selling at $106,274 on the time of writing.

Do not miss a beat – Subscribe to obtain e mail alerts straight to your inbox

Verify worth motion

Observe us additional X, Facebook And Telegram

Surf to the Day by day Hodl combine

Generated picture: Midjourney

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now