Ethereum

Grayscale Stakes 857,600 Ethereum Worth $3.83B As Institutional Confidence Grows

Credit : www.newsbtc.com

Ethereum is buying and selling at important ranges after a interval of elevated volatility that has left merchants and buyers on edge. The value has fluctuated between key resistance and assist zones, reflecting a market torn between optimism about one other transfer increased and warning about potential short-term corrections. Whereas sentiment stays blended, behind-the-scenes information in regards to the chain paints a extra assured image.

Associated studying

In response to latest reviews, main holders and establishments proceed to build up ETH, reinforcing the concept that the present market uncertainty is seen by many as a chance slightly than a risk. On the identical time, wagering exercise stays persistently sturdy, indicating long-term conviction amongst Ethereum’s most dedicated individuals. The continued rise in ETH stakes highlights confidence within the community’s safety, income potential, and function as a basis for decentralized finance.

As Ethereum hovers round decisive worth ranges, the market seems to be getting ready for a breakout in both course. Whether or not the following transfer favors bulls or bears, one factor is obvious: Ethereum’s fundamentals stay resilient, and continued accumulation by main gamers may function a robust anchor for the following huge development as soon as market sentiment aligns.

Grayscale Stakes Ethereum: a powerful sign of confidence

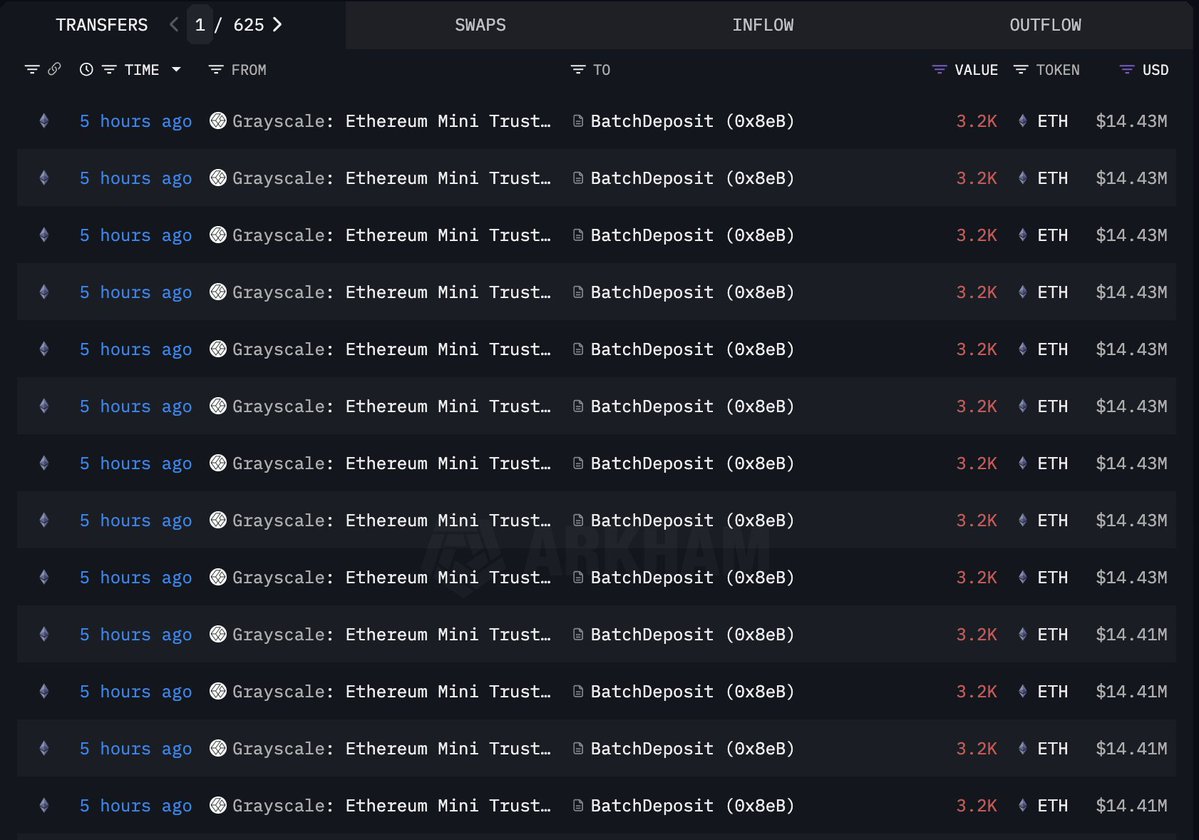

In response to Lookonchain, Grayscale (ETHE and ETH ETF) does deployed one other 857,600 ETH, value roughly $3.83 billion, which is one other signal of sturdy institutional perception in Ethereum’s long-term potential. This transfer underscores the rising alignment between conventional finance and blockchain infrastructure as large-scale gamers proceed to embrace Ethereum’s proof-of-stake mannequin not simply as an funding, however as a return-generating and network-participating technique.

This large deployment operation has a number of implications for the market. First, it successfully reduces circulating provide, as staked ETH is locked and can’t be simply bought. These dynamics amplify Ethereum’s deflationary pressures, particularly in a context the place community exercise and fuel consumption stay excessive. On the identical time, the size of this transfer exhibits rising institutional participation in Ethereum’s ecosystem, indicating that the asset is being seen much less as a speculative instrument and extra as digital infrastructure – a key a part of the rising tokenized financial system.

From a market perspective, this resolution comes throughout a interval of volatility and consolidation, the place Ethereum’s worth motion has struggled to ascertain a transparent course. Nevertheless, such sustained institutional dedication serves as a stabilizing drive, reflecting confidence that the asset’s intrinsic worth will proceed to develop no matter short-term fluctuations.

Primarily, Grayscale’s renewed dedication strengthens Ethereum’s place because the institutional cornerstone of DeFi and Web3, whilst market sentiment stays blended. If accumulation traits proceed and community fundamentals stay sturdy, Ethereum could possibly be setting itself up for a major breakout within the coming weeks – supported not by retail hypothesis, however by deep long-term capital positioning itself for the following section of the cycle.

Associated studying

Worth Motion Element: Bulls Defend Key Help Ranges

Ethereum is at the moment buying and selling round $4,340 and displaying indicators of stabilization after a risky session with a pointy rejection round $4,700. The 4-hour chart exhibits that ETH has returned to the 200-period transferring common, a important dynamic assist zone that usually acts as a pivot level for the market’s course. Regardless of the latest close to 2% dip, the broader construction stays constructive so long as bulls can hold the value above $4,300-$4,250.

This space coincides with a serious confluence of the 50, 100 and 200 transferring averages, suggesting that the present pullback may merely be a technical retest earlier than one other try and reclaim the $4,500 zone. A confirmed rebound from this area may set the stage for Ethereum to regain momentum and doubtlessly retest the $4,700-$4,800 resistance vary within the coming days.

Associated studying

Nevertheless, if promoting stress will increase and ETH closes under $4,200, the market may see an prolonged correction in the direction of $4,000 and even $3,850, the place earlier consolidation occurred. Whereas volatility continues, Ethereum continues to indicate resilience general, supported by sturdy on-chain accumulation and institutional dedication – elements that reinforce the broader bullish narrative regardless of near-term market fluctuations.

Featured picture of ChatGPT, chart from TradingView.com

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?