Ethereum

Has Ethereum hit bottom? – What THIS metric says about ETH’s future

Credit : ambcrypto.com

- Ethereum fell greater than 55% in 14 months within the midst of persistent gross sales aspect.

- The assist stage of $ 1,800 applies regardless of bearish sentiment and worth volatility.

Ethereum’s [ETH] Origin of a peak of $ 4,000 in February 2024 to barely lower than $ 1,800 in April 2025 tells a narrative that’s a lot deeper than a easy worth crash.

There are indicators that the worst could be behind us

After 14 months of steady gross sales stress, the Ethereum market appears to be approaching a turning level.

Latest cryptoquant analysis Emphasizes a substantial bullish divergence that pops up beneath the floor. Though the value of Ethereum has fallen to lows of a number of months, completely different statistics point out that sellers lose momentum.

An vital issue is the Internet Taker quantity of Ethereum (NTV). Traditionally deeply destructive, NTV peaked up -$ 360 million, on account of intense and lengthy -term gross sales stress. Nonetheless, this stress is now relaxed.

NTV just lately began forming increased lows regardless of the falling worth of Ethereum, which signifies a traditional bullish sample that’s usually seen at giant market bending factors.

This divergence means that sellers are shedding management, pointing to a attainable shift within the dynamics of the market energy and the potential of tendencies.

Quantity outputs solely contribute to this evolving story

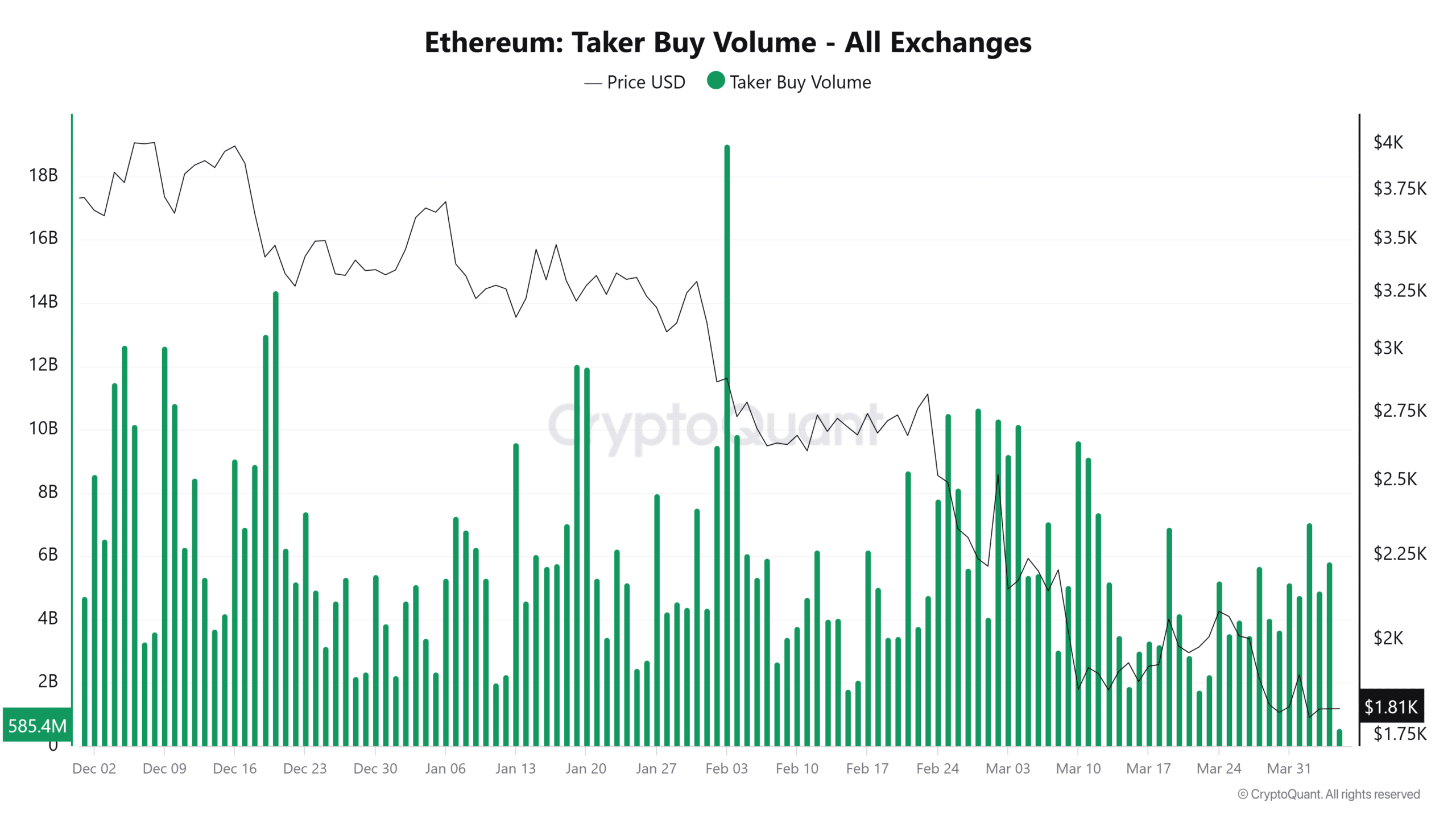

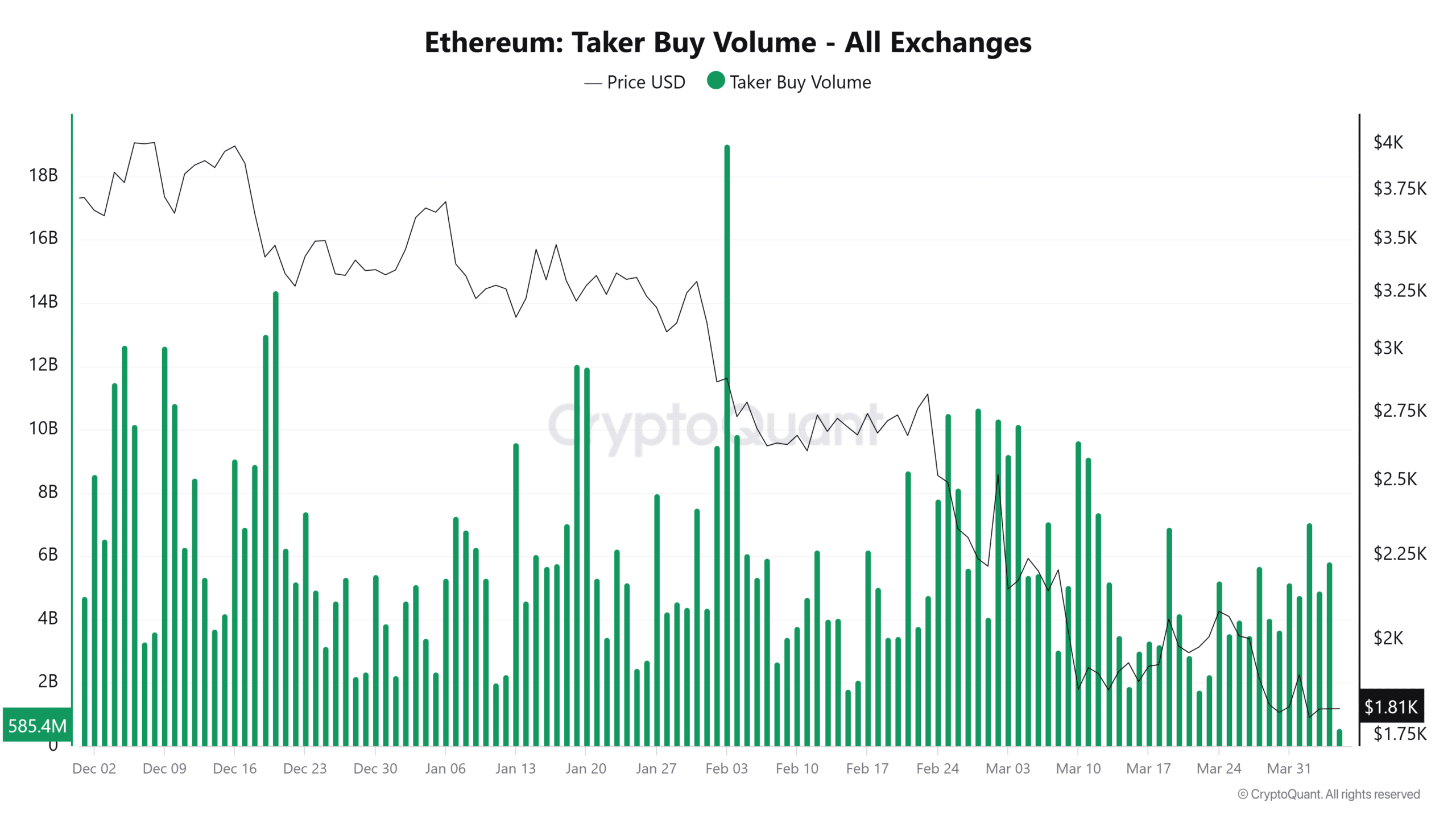

Between December 2024 and April 2025, Ethereum’s Taker Purchase Quantity noticed irregular however vital peaks.

Supply: Cryptuquant

For instance, on 3 February, the Taker Purchase Quantity struck $ 19 billion when ETH floated round $ 2,882.93.

Though the value didn’t meet, the height displays patrons who attempt to take up the pressure-side stress. By April 1, that quantity had fallen to $ 4.75 billion, with ETH priced at $ 1,905.17.

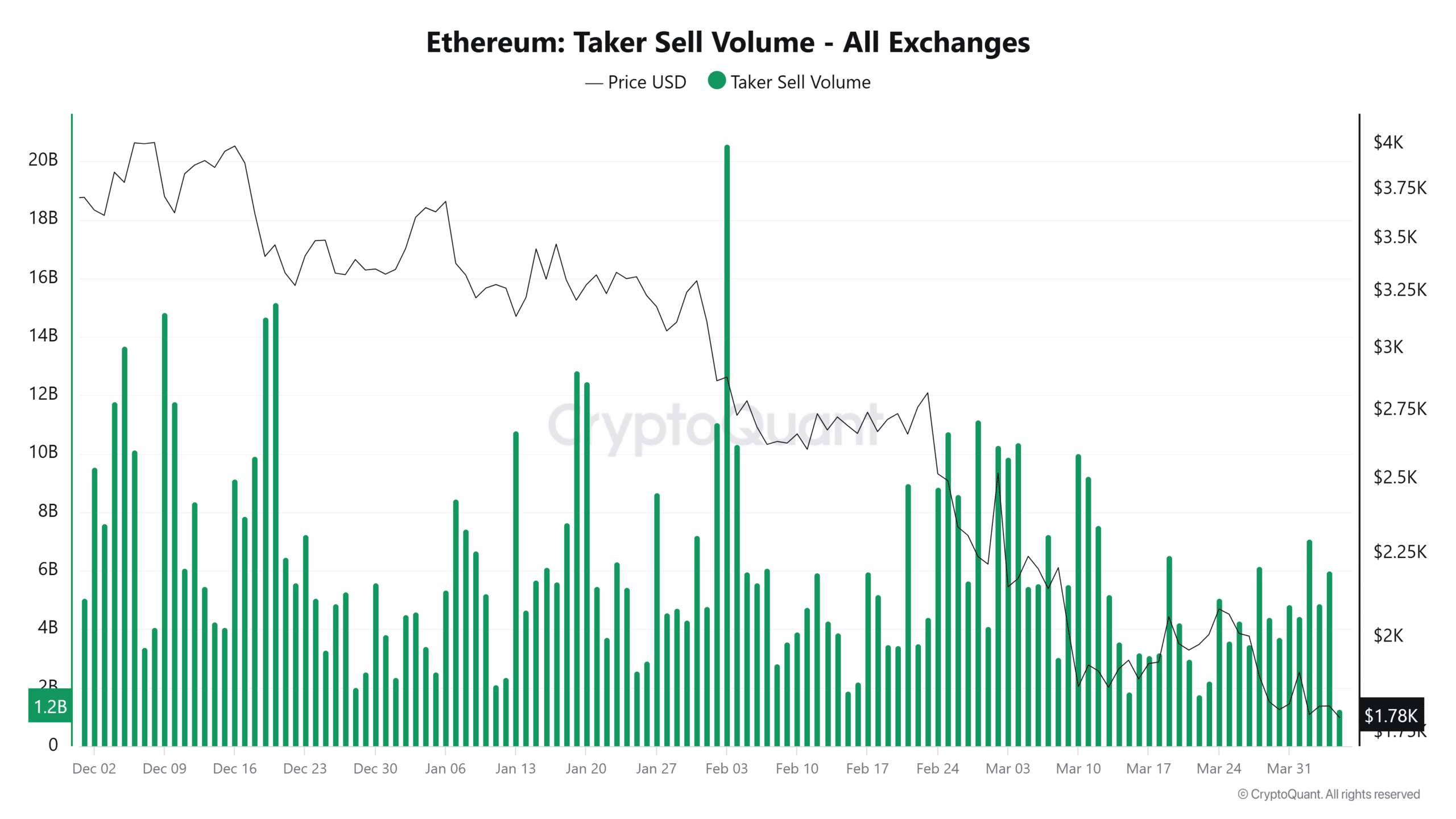

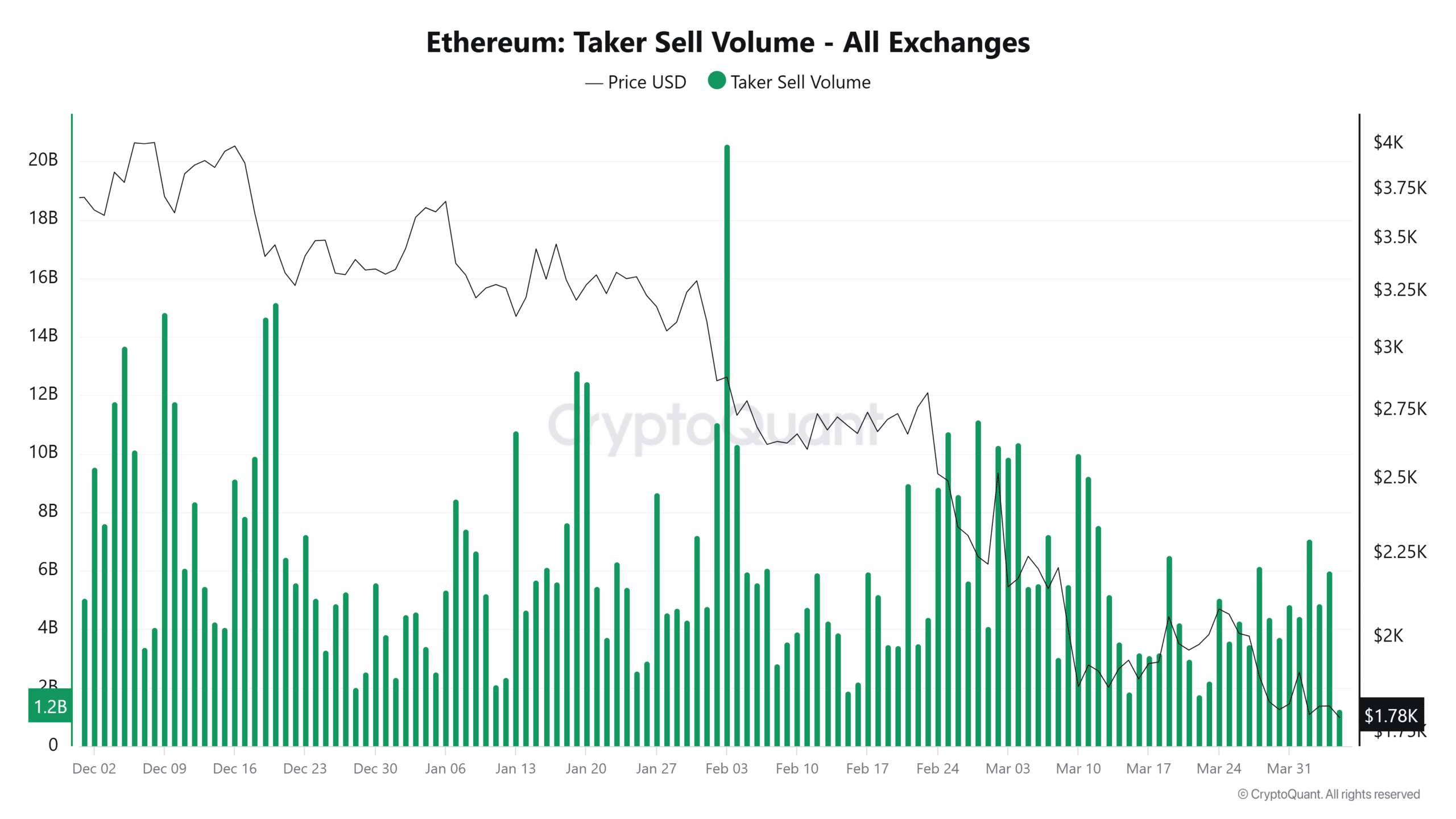

Within the meantime, the gross sales quantity of Taker can be tapered.

Supply: Cryptuquant

Gross sales volumes for Ethereum reached $ 601.6 million on the finish of December and rose to $ 17.6 billion firstly of February. Nonetheless, by April 1, they’d cooled significantly to round $ 4 billion, indicating a lower in panic -controlled sale.

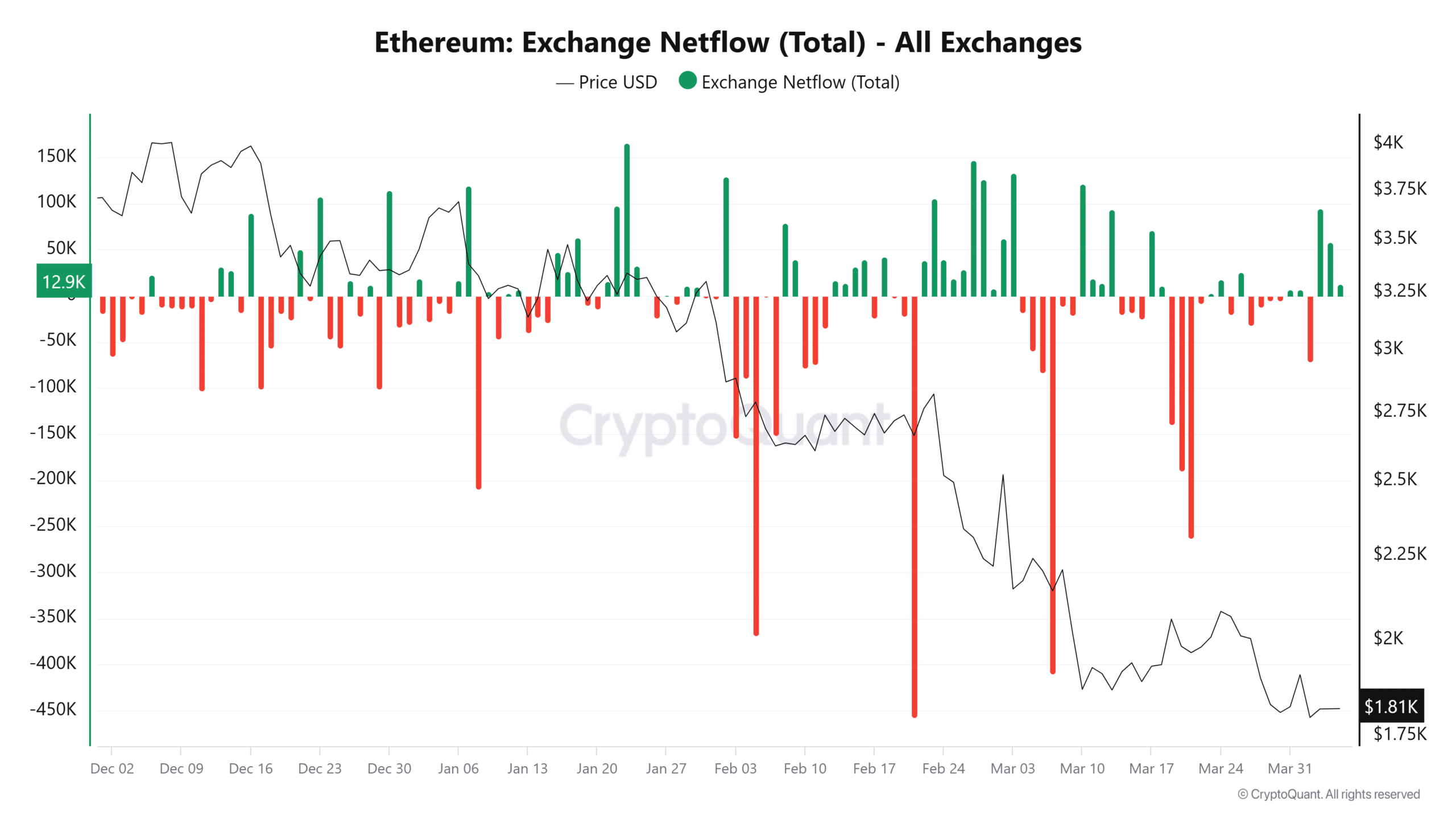

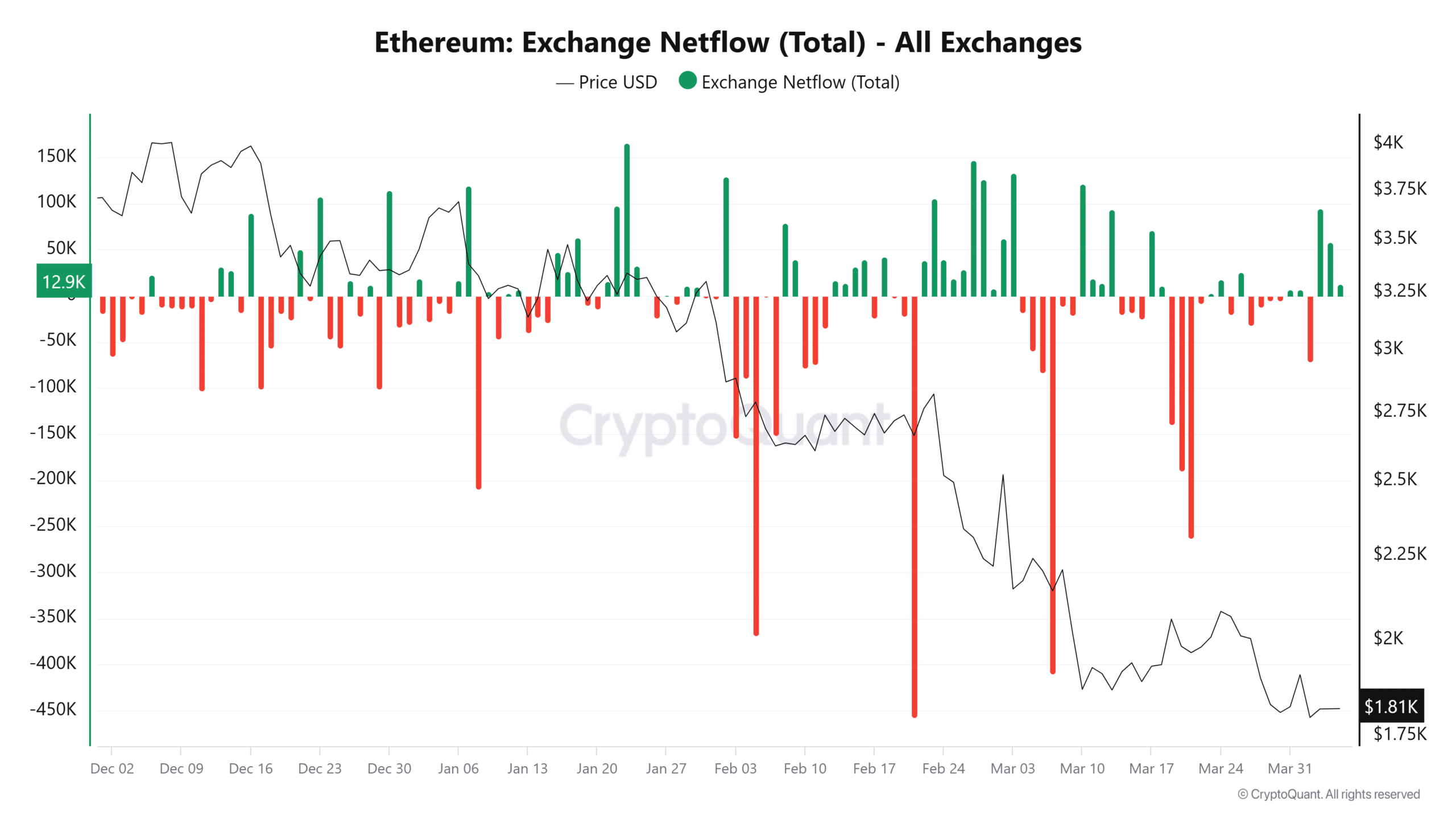

As well as, the Etheum Trade Internet Flows provide further insights into shifting market dynamics.

Supply: Cryptuquant

From December to March, whereas EHH 45percenttumbled – from $ 3,278 to $ 1,810 – with trawals from festivals elevated.

For instance, February 21 noticed a web circulate of 257,700 ETH, with the value for $ 2,661.

That mentioned, there was a outstanding exception.

On March 10, 120,900 ETH flowed into festivals as the value dropped to $ 1,866-probably, short-term merchants who liquidated.

But the broader development tends to strategic accumulation

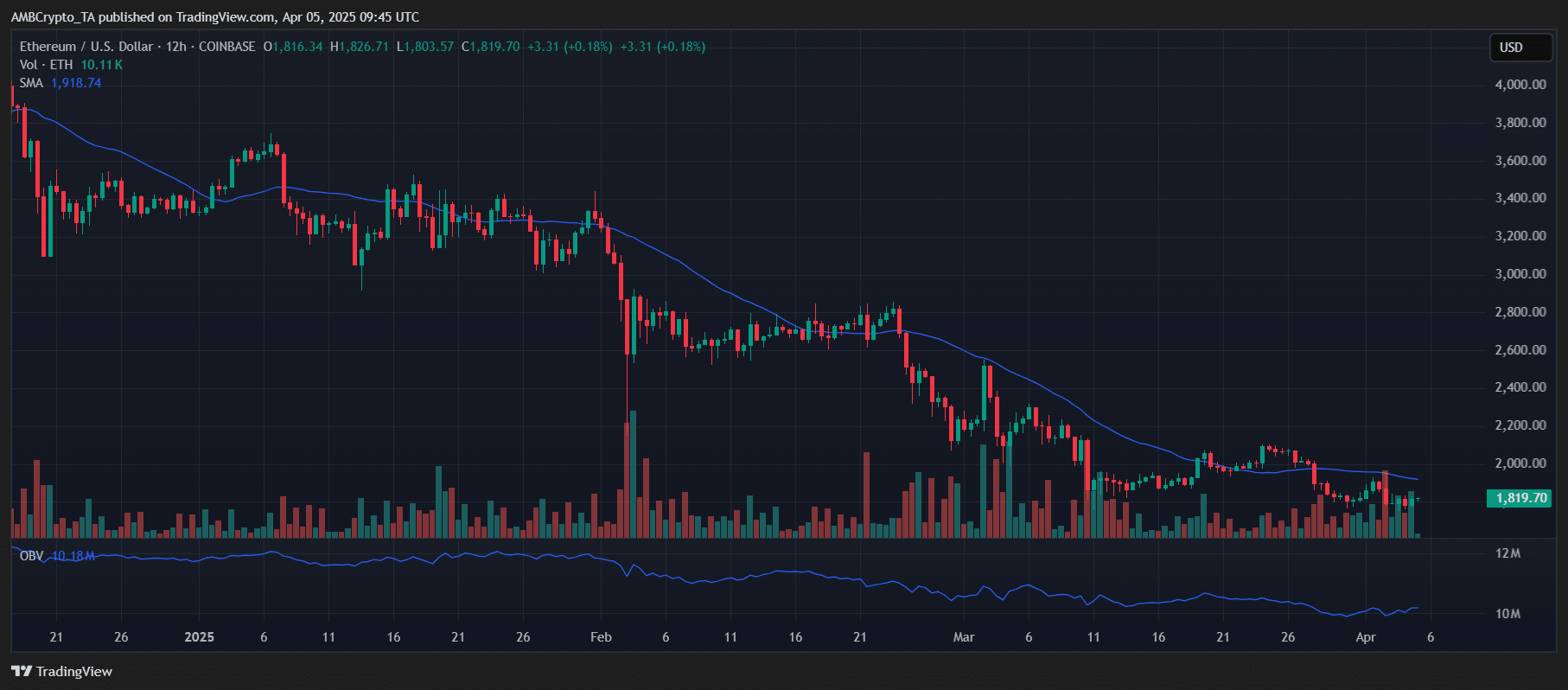

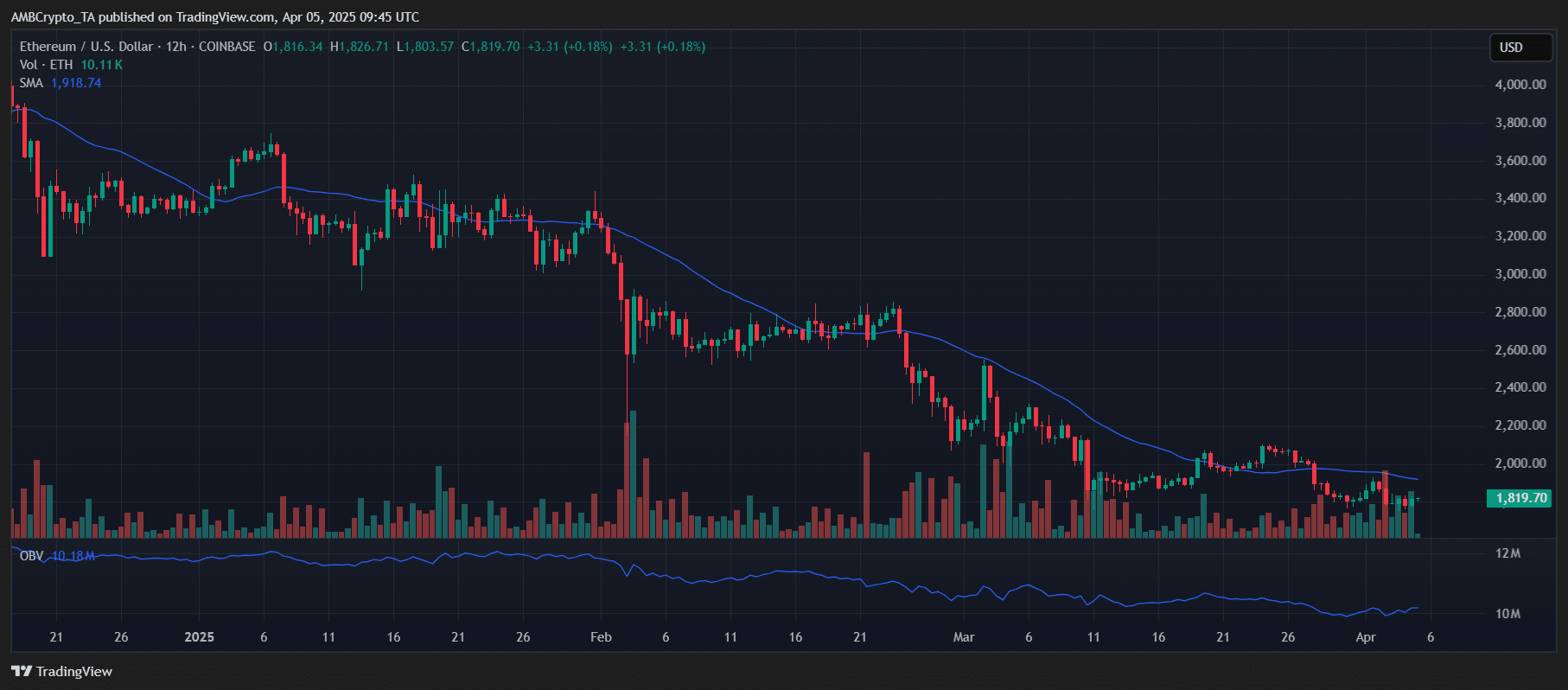

From a technical standpoint, Ethereum stays anchored in a downward development.

Worth promotion stays the underside of the straightforward advancing common (SMA), which has shared as dynamic resistance since January 2025.

Varied failed rallies – particularly as much as $ 2,700 in February and $ 2,000 in March present persistent overhead stress.

Supply: TradingView

Nonetheless, there’s a flip.

Ethereum persistently held the $ 1,800 assist zone throughout a number of exams in March and April. Each rebound of this stage, mixed with lowering quantity throughout worth dips, signifies that sellers might lose momentum as an alternative of accelerating their efforts.

A very powerful components such because the flattening of OBV, Trade outflows and promoting chilly -makers recommend that $ 1,800 might develop right into a vital battery zone.

If Ethereum returns the vary of $ 2,000 – $ 2,200, this could point out a development distant. For now, $ 1,800 stays the central battlefield, steadiness between bearish continuation and bullish construction.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024