Bitcoin

Has The Bitcoin Price Already Peaked?

Credit : bitcoinmagazine.com

The worth actions of Bitcoin have all the time been a subject of debate amongst buyers and analysts. With current market tracements, many ponder whether Bitcoin has reached all its peak on this bull cycle. This text investigates the info and on-chain statistics to evaluate the market place of Bitcoin and potential future actions.

Seek the advice of the unique for an in -depth full evaluation Has the Bitcoin price already reached a peak? Full video presentation out there on Bitcoin Magazine Pro‘s YouTube channel.

Bitcoin’s present market efficiency

Bitcoin was just lately confronted with a Retracement of 10% of all time, which led to concern concerning the finish of the bull market. Nevertheless, historic traits recommend that such corrections are regular in a bull’s cycle. Bitcoin often experiences pullbacks from 20% to 40% a number of instances earlier than he reaches the ultimate biking peak.

Evaluation of statistics on chains

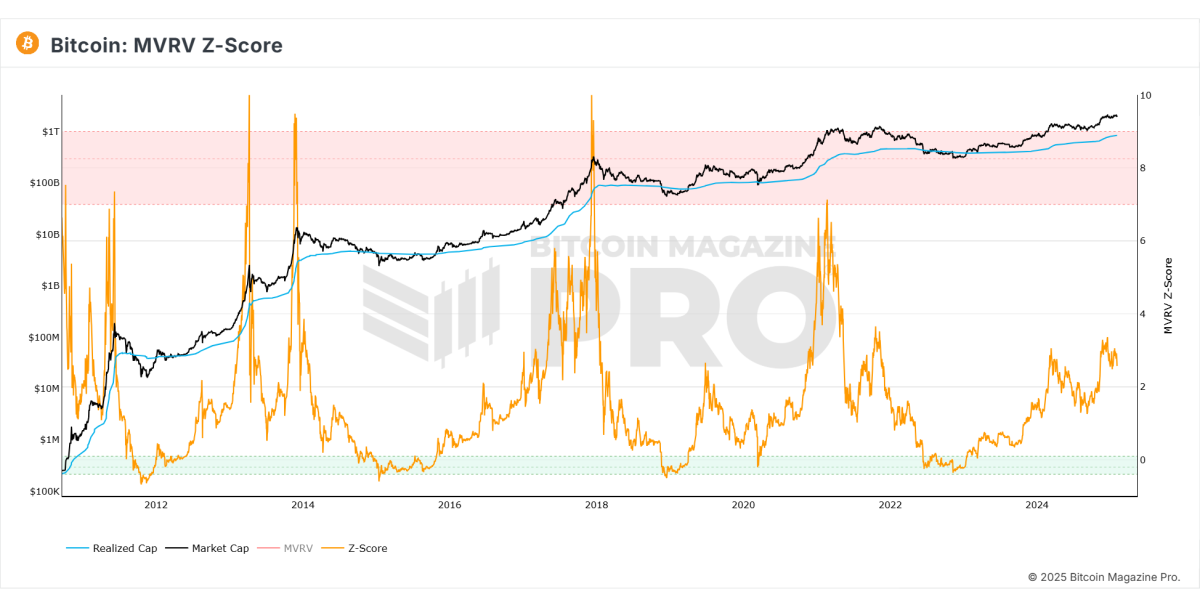

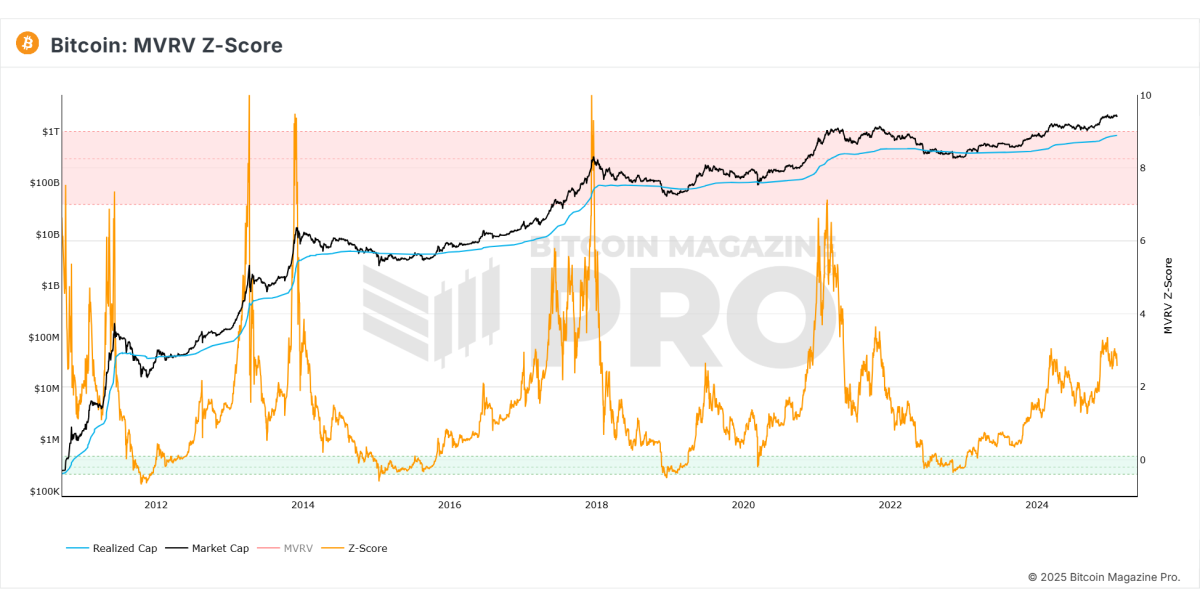

MVRV Z-score

The MVRV Z-scoreThat measures the market worth for the realized worth, at present signifies that Bitcoin nonetheless has a significantly upward potential. Traditionally, the Bitcoin cycle happens when this metric enters the overheated purple zone, which is at present not the case.

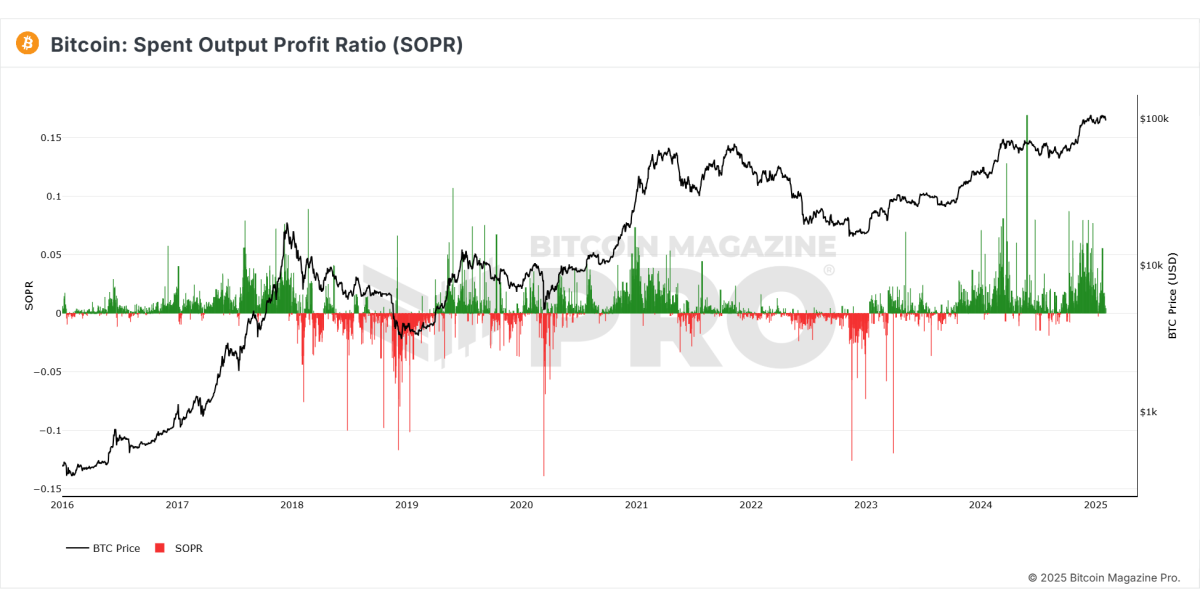

Greatest output revenue ratio (sopr)

This metric reveals the share of the very best revenue outputs. Lately the Soak has proven that lowering realized income recommend, which means that fewer buyers promote their participations, which strengthens market stability.

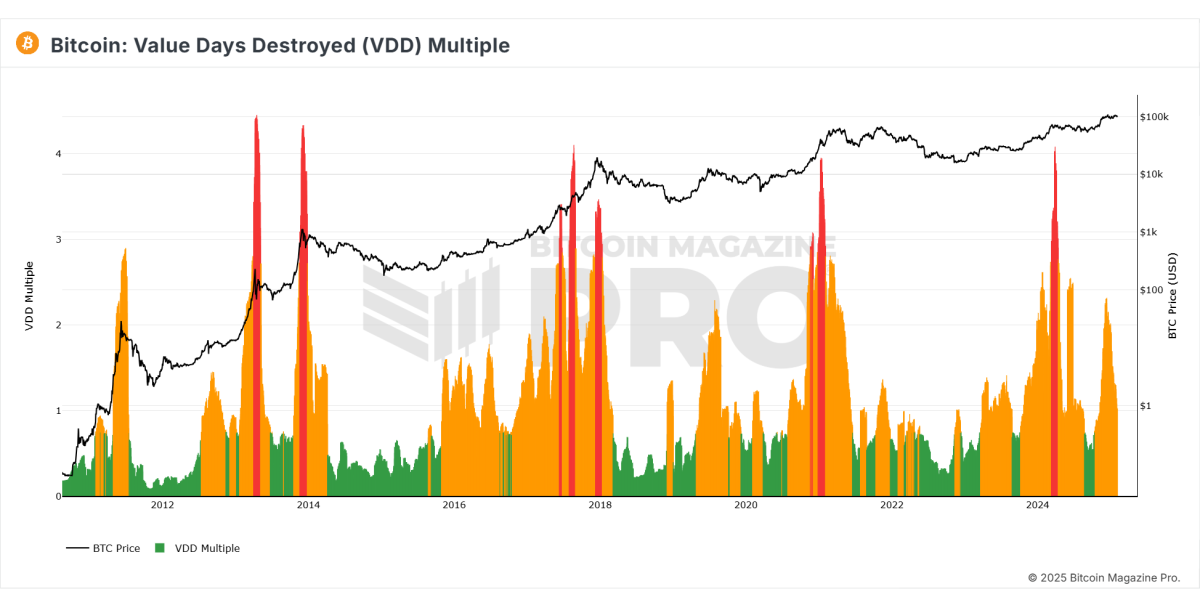

Worth Days Destroyed (VDD)

Vdd Signifies the sale of lengthy -term holders. The metric has demonstrated a lower in gross sales stress, suggesting that Bitcoin stabilizes at excessive ranges as a substitute of stepping into a protracted -term downward development.

Institutional and market sentiment

- Institutional buyers resembling micro technique proceed to build up Bitcoin, which indicators confidence in its lengthy -term worth.

- Derivators market sentiment has change into unfavorable, traditionally indicated on a possible soil within the quick time period, as a result of merchants may be wound up about levers in opposition to Bitcoin.

Macro -economic elements

- Quantitative tightening: Central banks have decreased liquidity and have contributed to the non permanent Bitcoin value fall.

- World M2 cash quantity: A contraction of the cash provide has penalties for threat property, together with Bitcoin.

- Federal Reserve Coverage: There are indications of enormous monetary establishments, together with JP Morgan, that quantitative rest may return in mid -2025, which might most likely stimulate the worth of Bitcoin.

Associated: is $ 200,000 a practical Bitcoin race purpose for this cycle?

Future prospects

- The worth promotion of Bitcoin reveals indicators of getting into a consolidation section earlier than one other potential rally.

- Information on chains recommend that there’s nonetheless an essential area for progress earlier than cyclus peaks are seen in earlier bull markets.

- If Bitcoin experiences additional withdrawal to the vary of $ 92,000, this will provide a powerful accumulation possibility for lengthy -term buyers.

Conclusion

Though Bitcoin has skilled a short lived retracement, on-chain statistics and historic knowledge should not but over. Institutional rate of interest stays robust and macro -economic situations can shift in favor of Bitcoin. As all the time, buyers should fastidiously analyze the info and think about traits in the long run earlier than they make funding selections.

If you’re focused on extra in -depth evaluation and actual -time knowledge, think about trying out Bitcoin Magazine Pro For beneficial insights within the Bitcoin market.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your personal analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024