Bitcoin

Have Bitcoin miners triggered a consolidation phase post BTC’s ATH?

Credit : ambcrypto.com

- Bitcoin held regular above $90,000 regardless of elevated miner promoting and profit-taking.

- Knowledge from the chain pointed to a possible consolidation section earlier than the subsequent doable outbreak.

Bitcoin [BTC] has maintained sturdy bullish momentum, remaining above $90,000 and approaching new all-time highs.

Nevertheless, latest on-chain information reveals that bitcoin miners have offered greater than 3,000 BTC within the final 48 hours, doubtlessly signaling a near-term pullback.

Whereas profit-taking by miners may result in elevated provide, Bitcoin’s means to maintain above $90,000 indicated sturdy market confidence, along with the beginning of a consolidation section.

Bitcoin miners take earnings

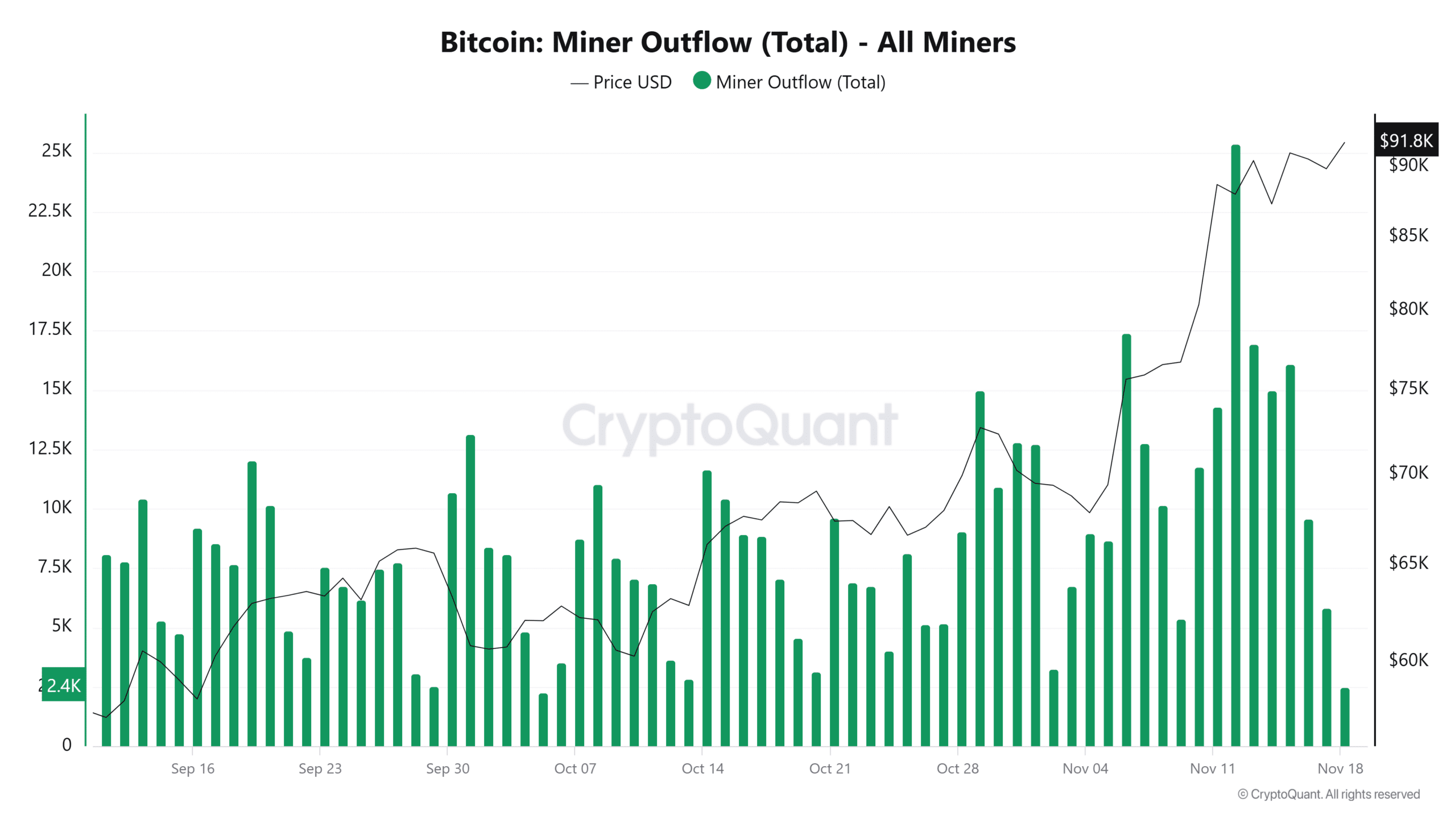

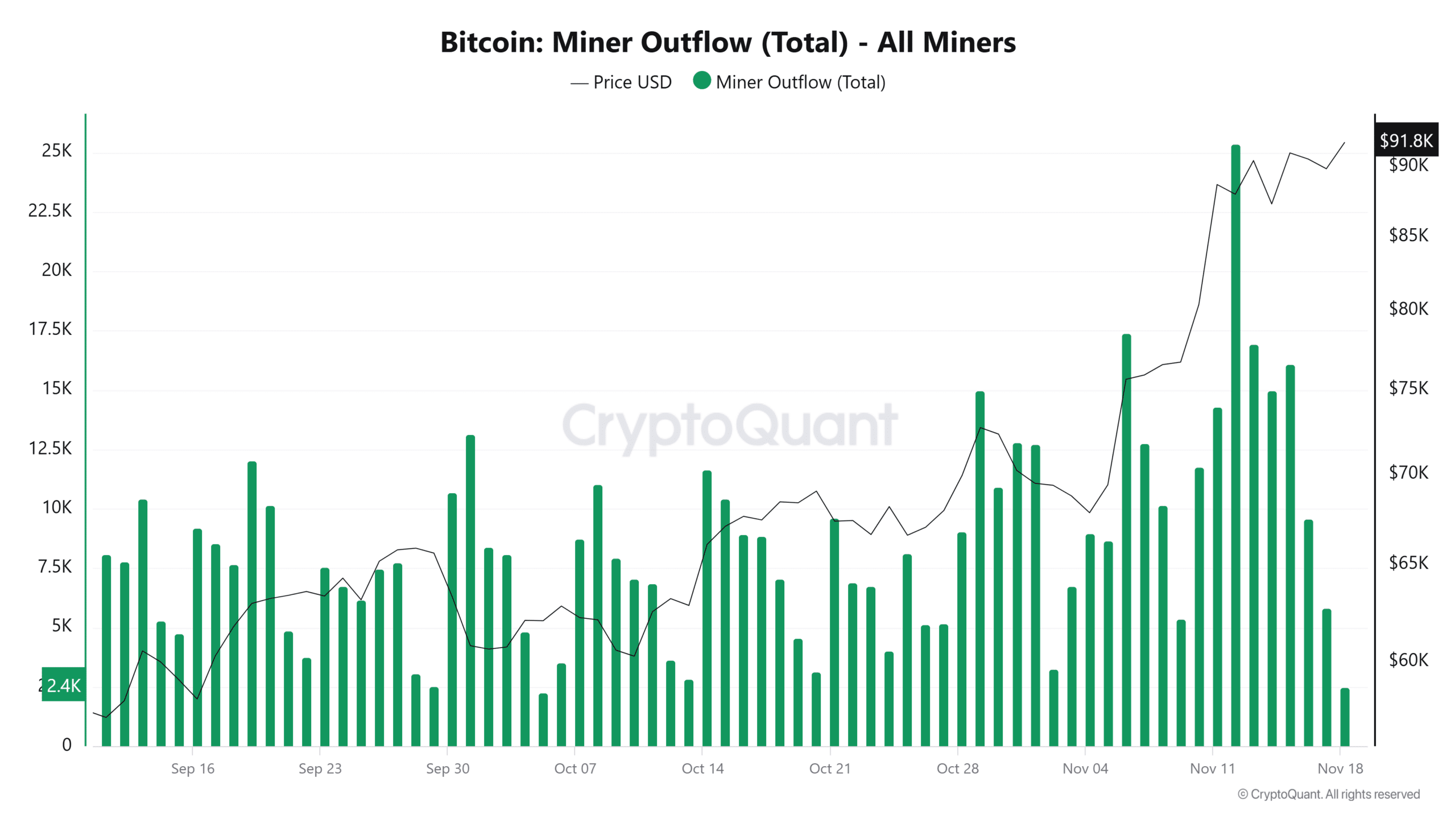

Crypto analyst Ali Martinez lately identified that Bitcoin miners offered greater than 3,000 BTC, value about $273 million, within the final 48 hours.

Supply: Ali Martinez on X

This enhance in miner gross sales sometimes alerts a cooling off interval as miners, typically seen as long-term holders, take earnings in periods of speedy value development.

Such conduct is widespread in sturdy bull markets and signifies that the market could possibly be getting ready for a short pause or value correction within the close to time period.

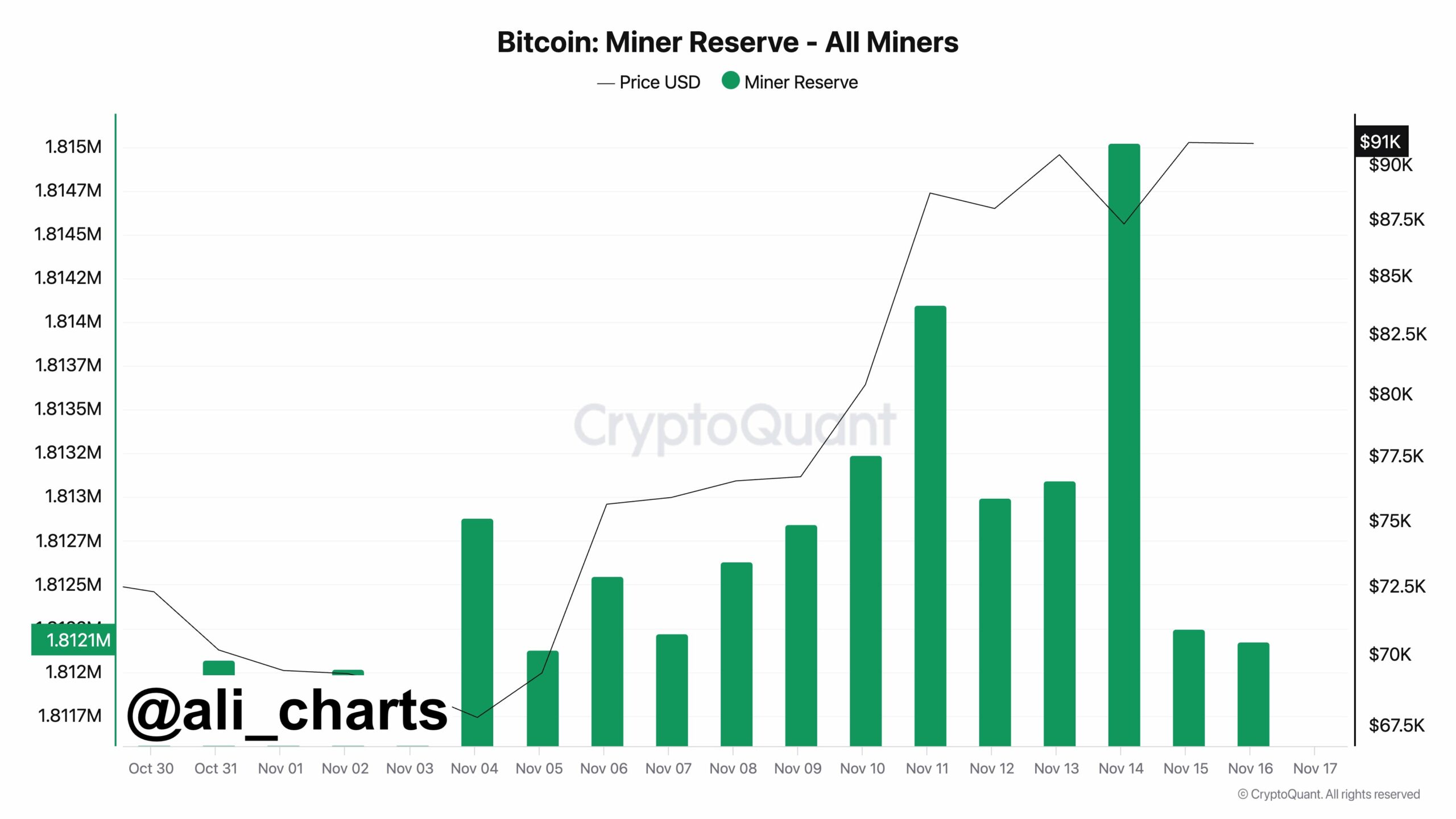

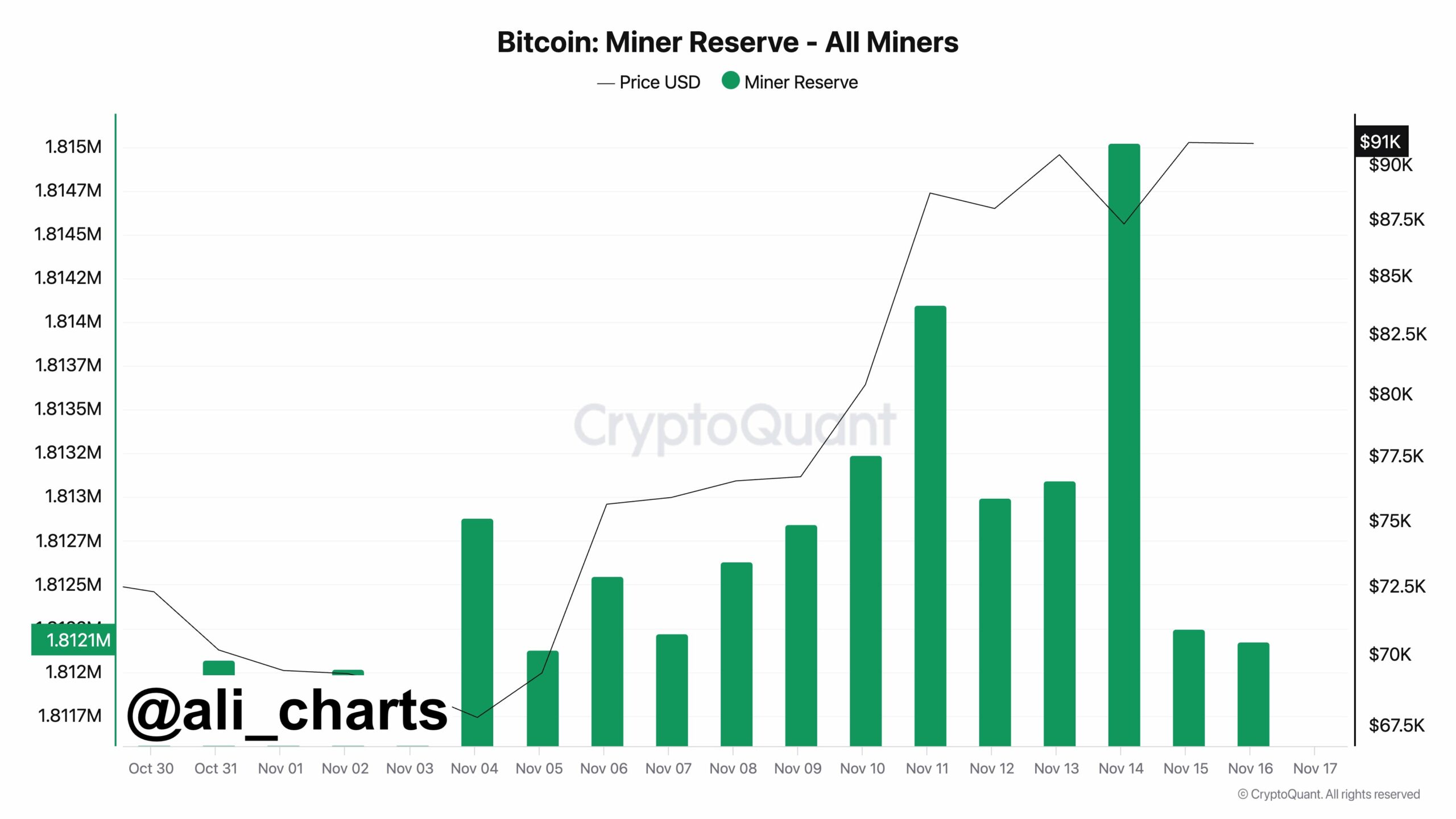

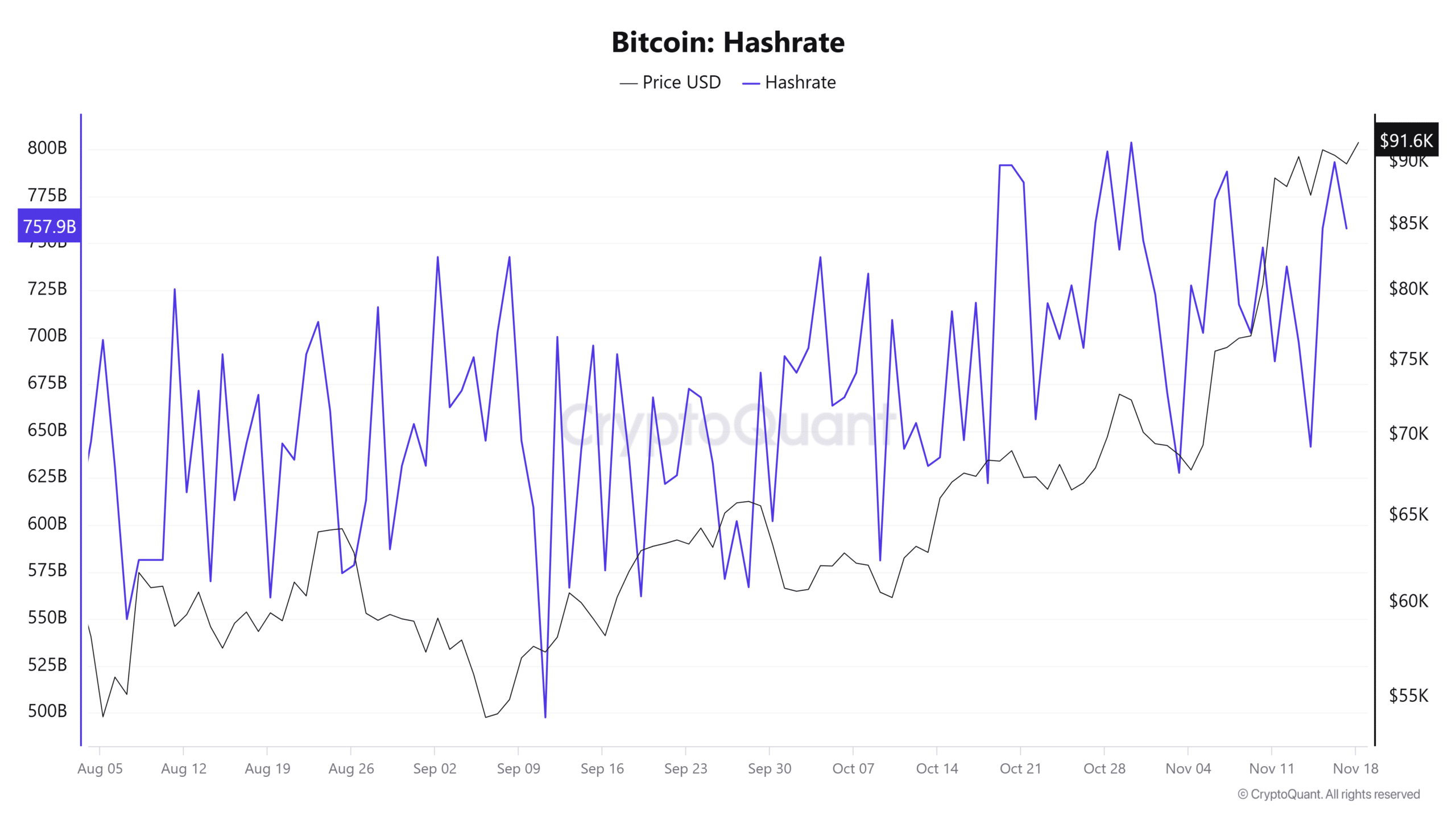

Supply: CryptoQuant

The miner outflow chart confirmed important spikes in Bitcoin leaving miners’ wallets, coinciding with the latest value enhance.

Traditionally, such sell-offs point out miners are tying up their earnings, presumably signaling a cooling-off interval.

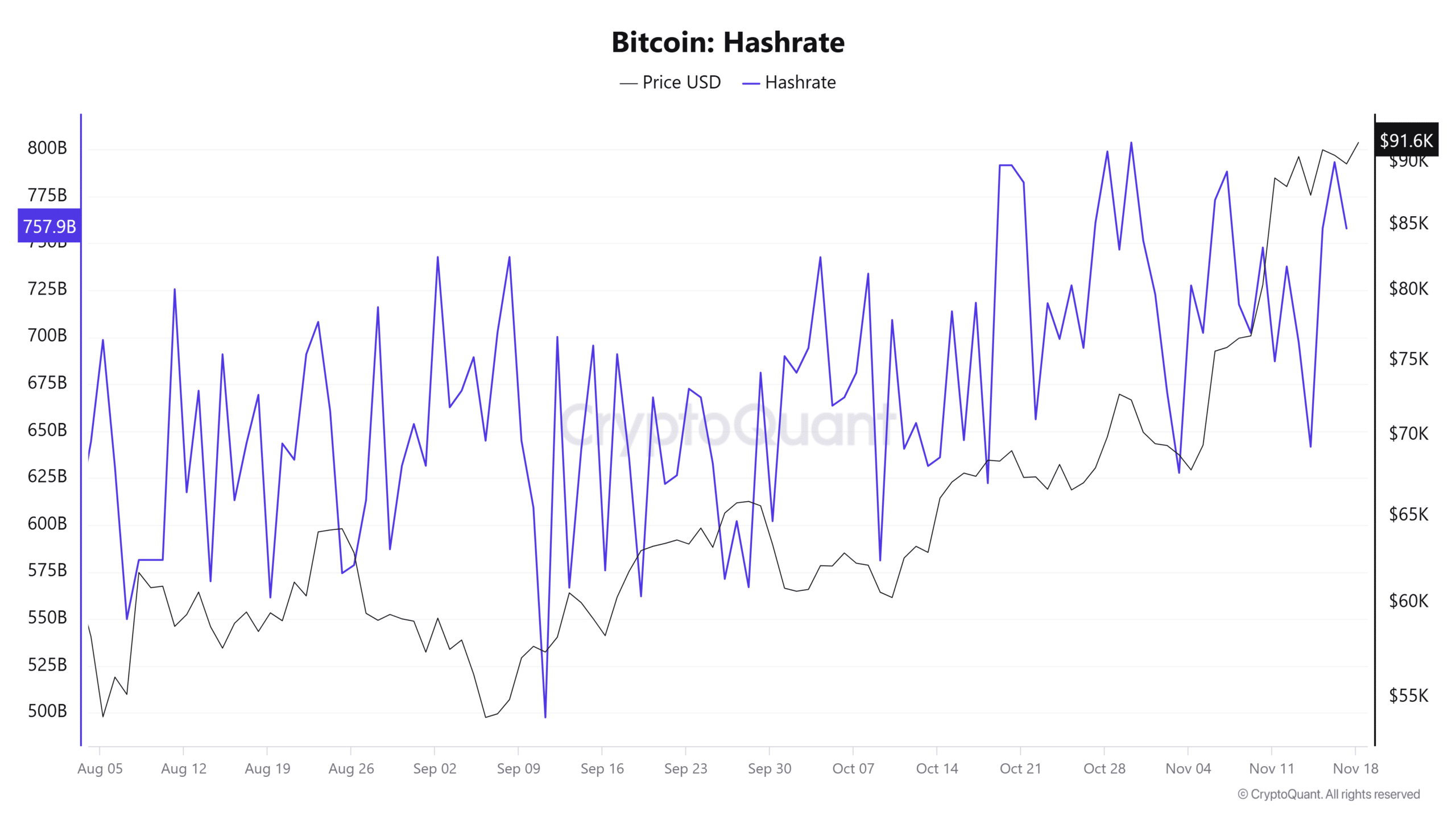

Supply: CryptoQuant

Bitcoin’s sturdy community well being was additionally confirmed, with hashrate ranges reaching new highs.

This development mirrored elevated community safety and competitiveness, highlighting miners’ confidence at the same time as they misplaced a few of their property.

A rising hashrate underlined optimistic long-term fundamentals regardless of short-term promoting strain.

Bitcoin is robust

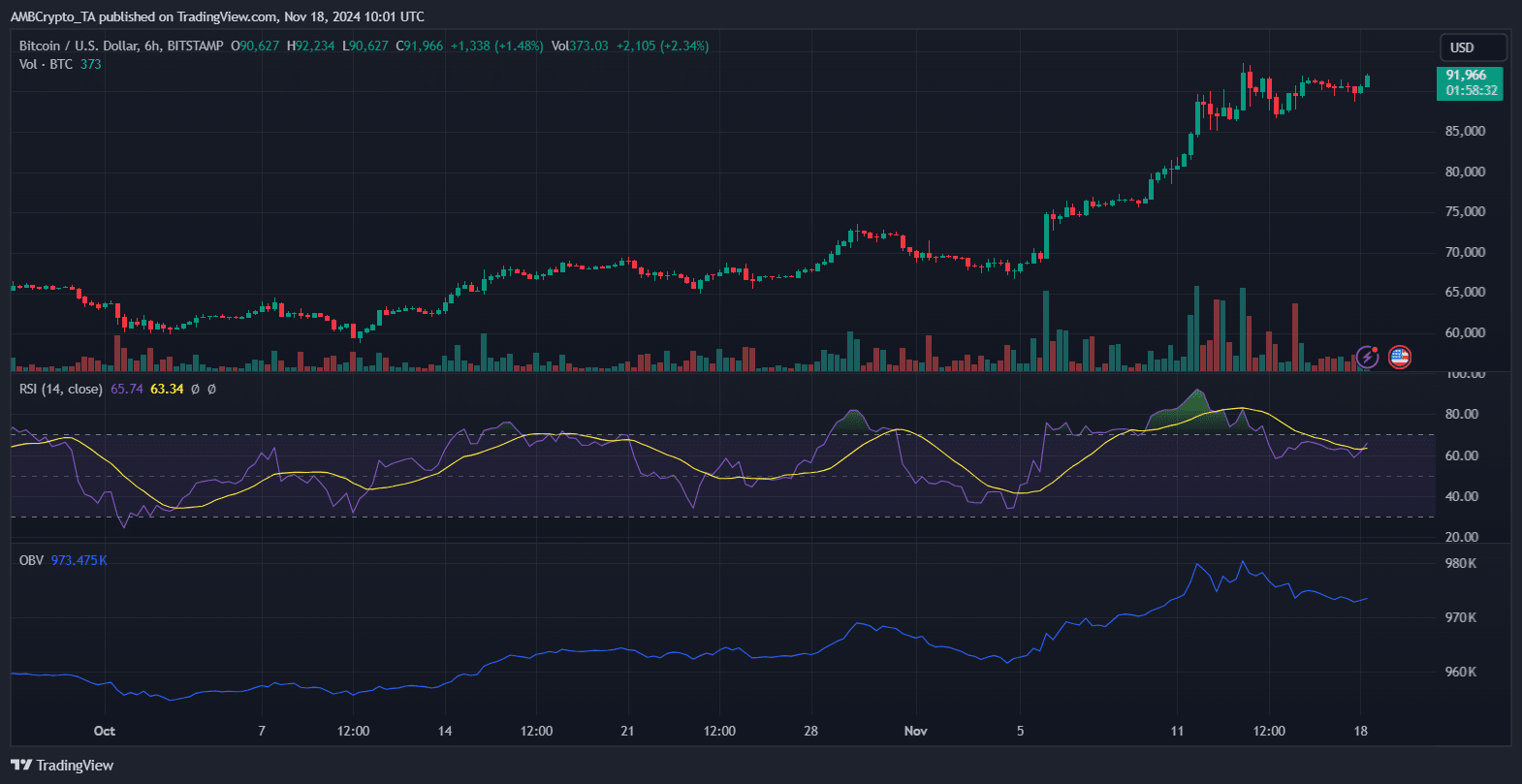

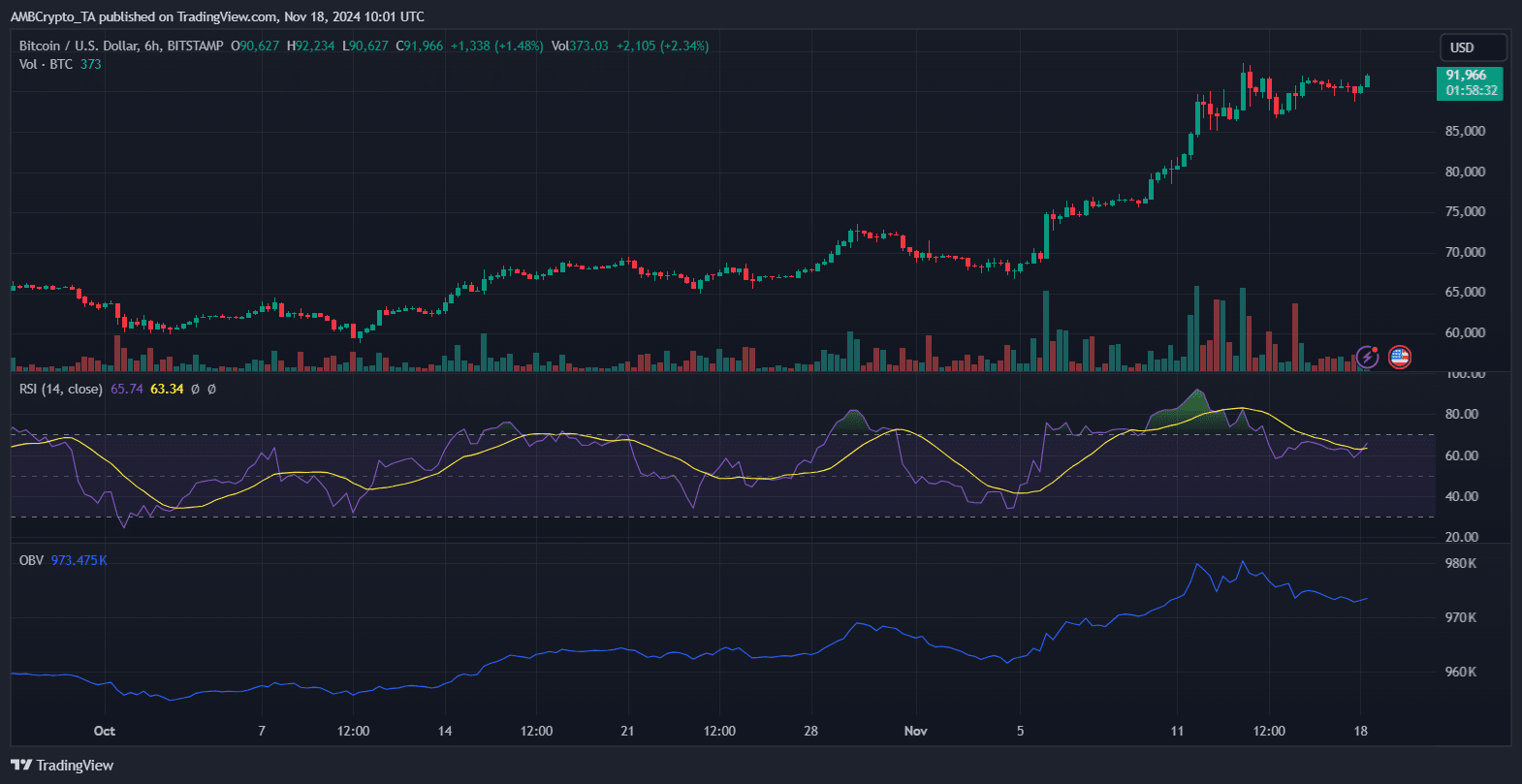

Supply: TradingView

Bitcoin’s value has been rising relentlessly, hitting new all-time highs a number of occasions over the previous eleven days – clear proof of continued bullish momentum as the worth stands strongly above the $90,000 stage.

Nevertheless, after such a robust rally, the market seems to be getting into a consolidation section as profit-taking from each buyers and miners good points momentum.

Consolidation section in sight?

Bitcoin’s present consolidation section above $90,000 is a pure and helpful step after its explosive rally.

Consolidation permits the market to soak up latest good points, shake out weaker fingers and construct a stronger basis for the subsequent step.

Key help ranges, particularly within the $88,000-$90,000 vary, shall be essential for sustaining the bullish construction.

A decline under these ranges may sign elevated promoting strain, doubtlessly triggering a deeper correction, whereas a robust protection of this vary may reaffirm market confidence and pave the best way for additional development.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Regardless of short-term promoting strain from miners and profit-taking from buyers, Bitcoin’s fundamentals stay strong.

Ought to Bitcoin maintain these ranges, the potential for a breakout in direction of $100,000 may turn into more and more probably, positioning the continued consolidation as an important stepping stone to additional value good points.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024