Ethereum

Here Are 2 Reasons Why Ethereum Correction Might Be Nearing an End

- Ethereum confirmed indicators of restoration, though remaining under earlier highs, amid cautious market sentiment.

- Rising outflows from Ethereum exchanges indicated investor confidence, presumably indicating a bullish pattern forward.

Ethereum [ETH]the second-largest cryptocurrency by market capitalization, has not too long ago undergone a modest worth restoration and was buying and selling at $2,661 on the time of writing.

This represented a rise of 1.6% in comparison with the day before today.

Earlier than that, Ethereum was on a downward trajectory, reaching a low of $2,545 final week.

Regardless of the latest improveEthereum’s worth remained considerably under its March excessive of $4,070 and was nonetheless about 45% decrease than the all-time excessive of $4,878 recorded three years in the past.

Present market circumstances increase questions on whether or not Ethereum is on the verge of a extra sustainable restoration, or whether or not the latest worth actions are only a non permanent correction.

To this extent, CryptoQuant analyst Burak Kesmeci advised that Ethereum could also be within the late levels of its correction, citing on-chain metrics that point out a potential shift in market sentiment.

Market sentiment

In his latest analysisBurak Kesmeci highlighted two key knowledge units, which indicated that Ethereum was nearing the tip of its correction section.

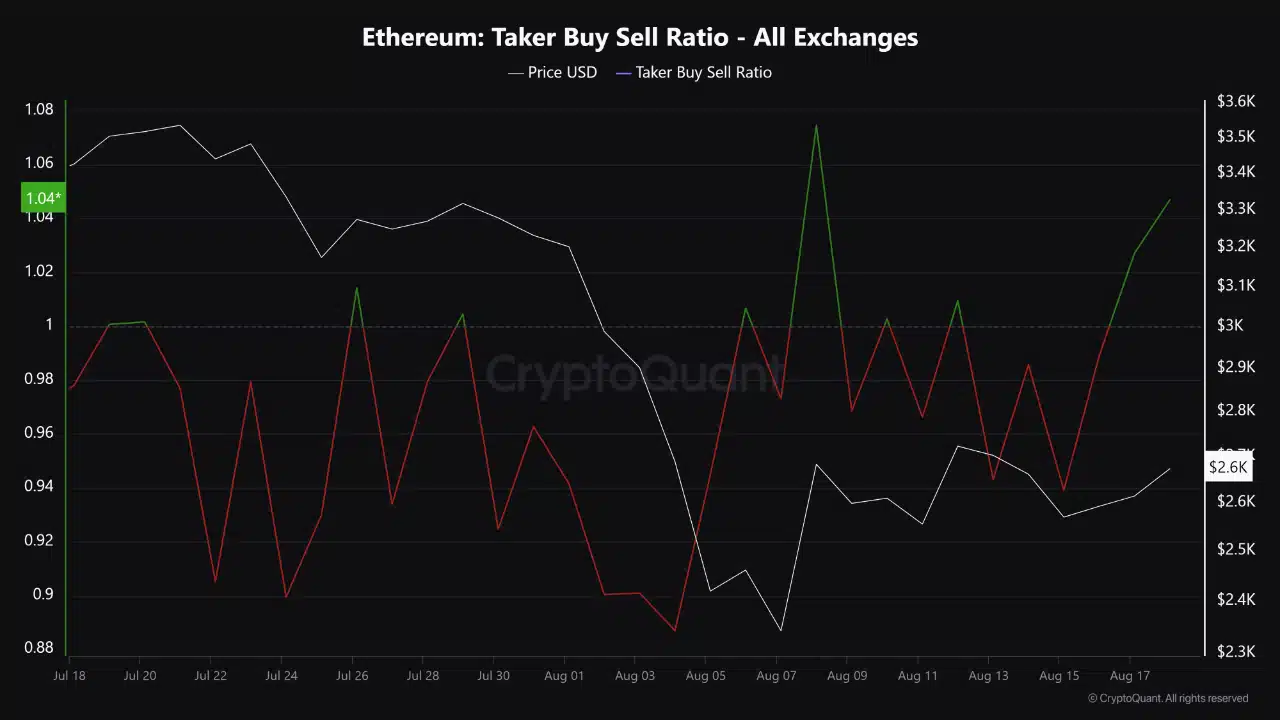

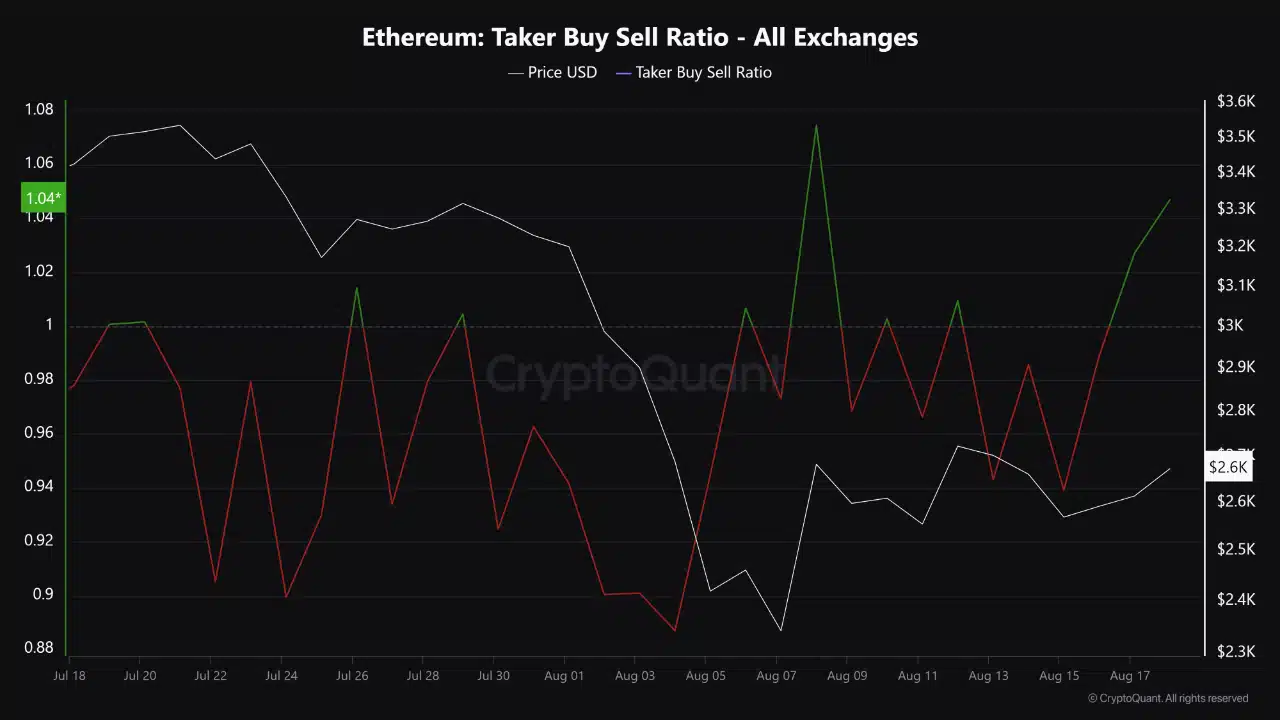

The primary is the Taker Purchase Promote Ratio, which measures the ratio of consumers to sellers throughout all exchanges.

Supply: CryptoQuant

Based on Kesmeci, this ratio has turned optimistic, indicating that consumers are beginning to regain their power.

This shift in buyer-seller dynamics might be an early signal of a possible rally, particularly if the pattern continues into subsequent week.

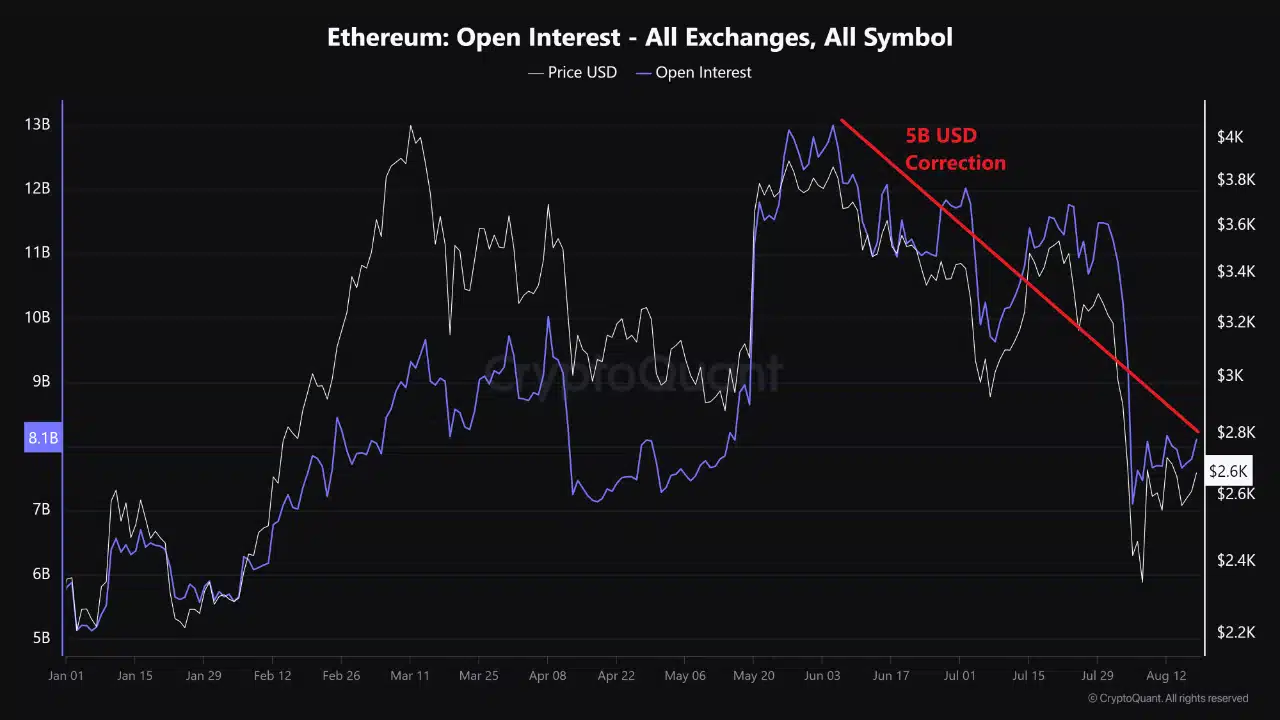

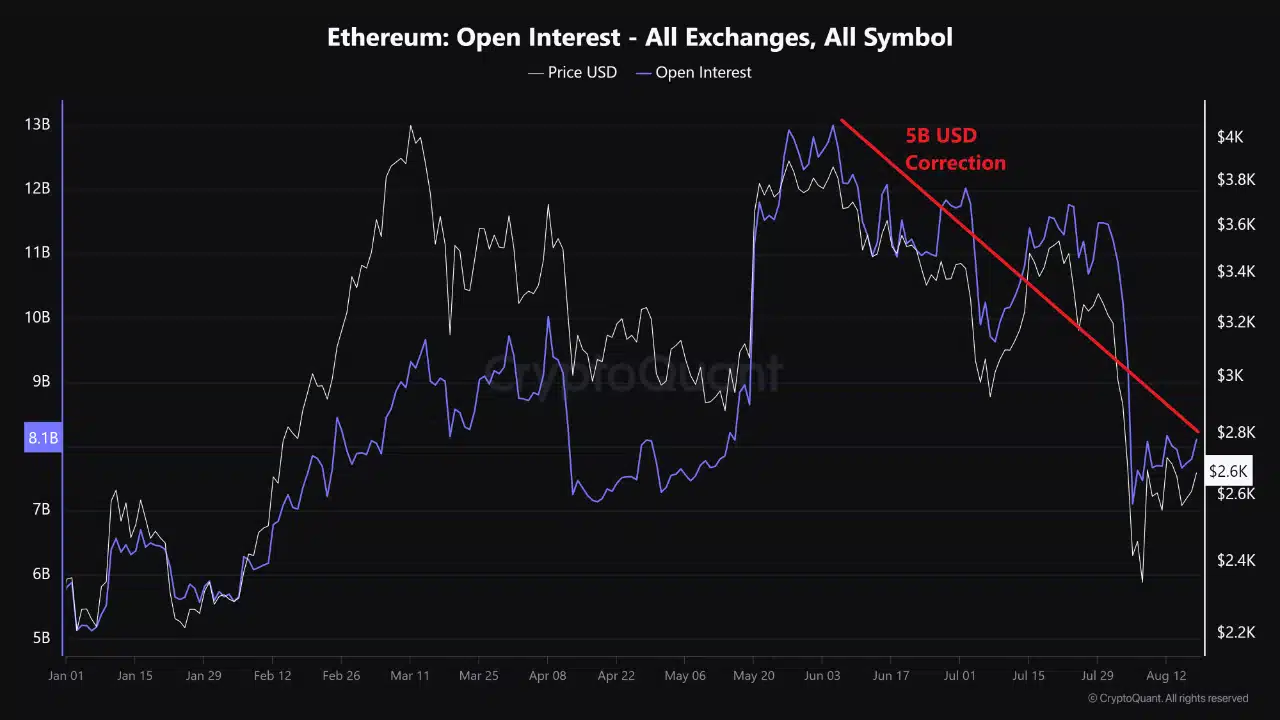

The second metric is Open Curiosity (OI), which represents the overall variety of open lengthy and brief positions out there.

As Kesmeci famous, in June 2024, when Ethereum’s worth reached $3,800, OI reached an all-time excessive of over $13 billion, indicating {that a} market correction was imminent.

Supply: CryptoQuant

This correction occurred on August 5, 2024, when a macroeconomic occasion prompted the OI to plummet to $7 billion.

Kesmeci famous that for Ethereum’s worth to expertise important upward motion, leveraged gamers might want to reenter the market, which may probably set off a brand new wave of shopping for exercise.

Is Ethereum Prepared for a Rally?

Whereas these numbers highlighted by Kesmeci provide a promising outlook, the broader market has borne the brunt of ETH’s 24-hour restoration.

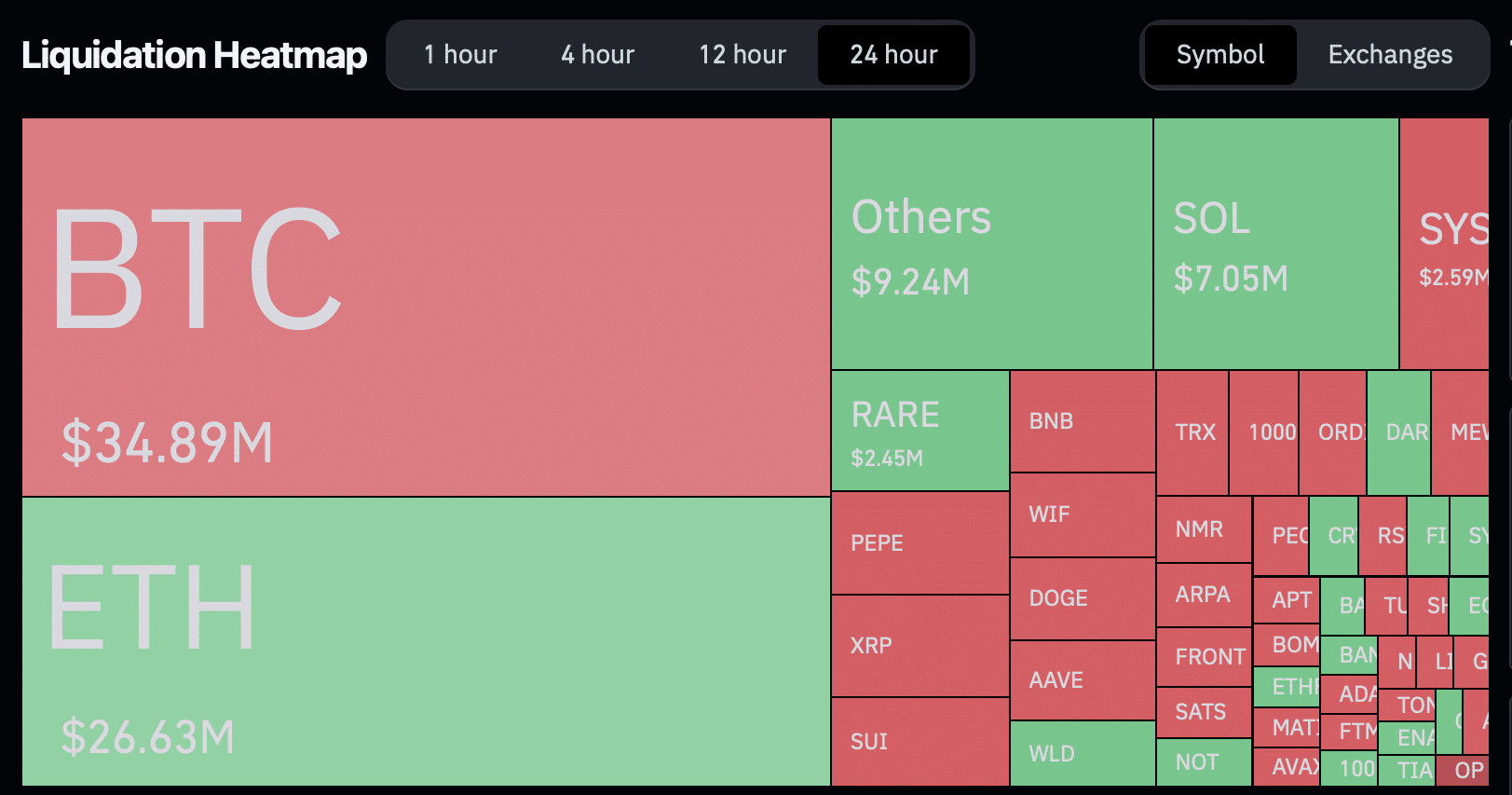

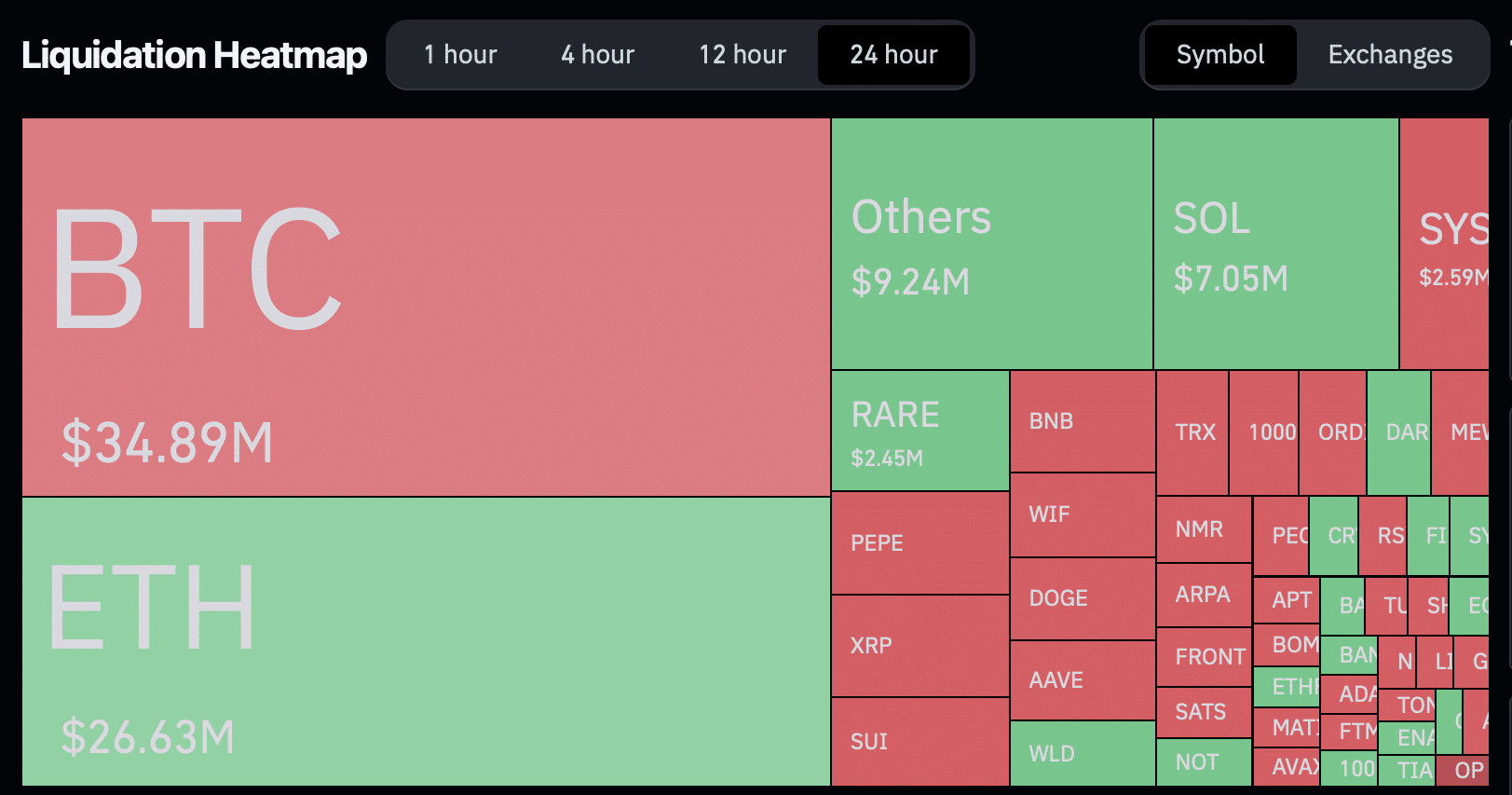

Throughout this era, a complete of 43,521 merchants have been liquidated, with liquidations totaling $111.52 million. Ethereum was accountable for $26.63 million of those liquidations, the vast majority of which have been lengthy positions.

Supply: Coinglass

This means that whereas there’s optimism amongst some merchants, the market stays risky and leveraged positions nonetheless carry important dangers.

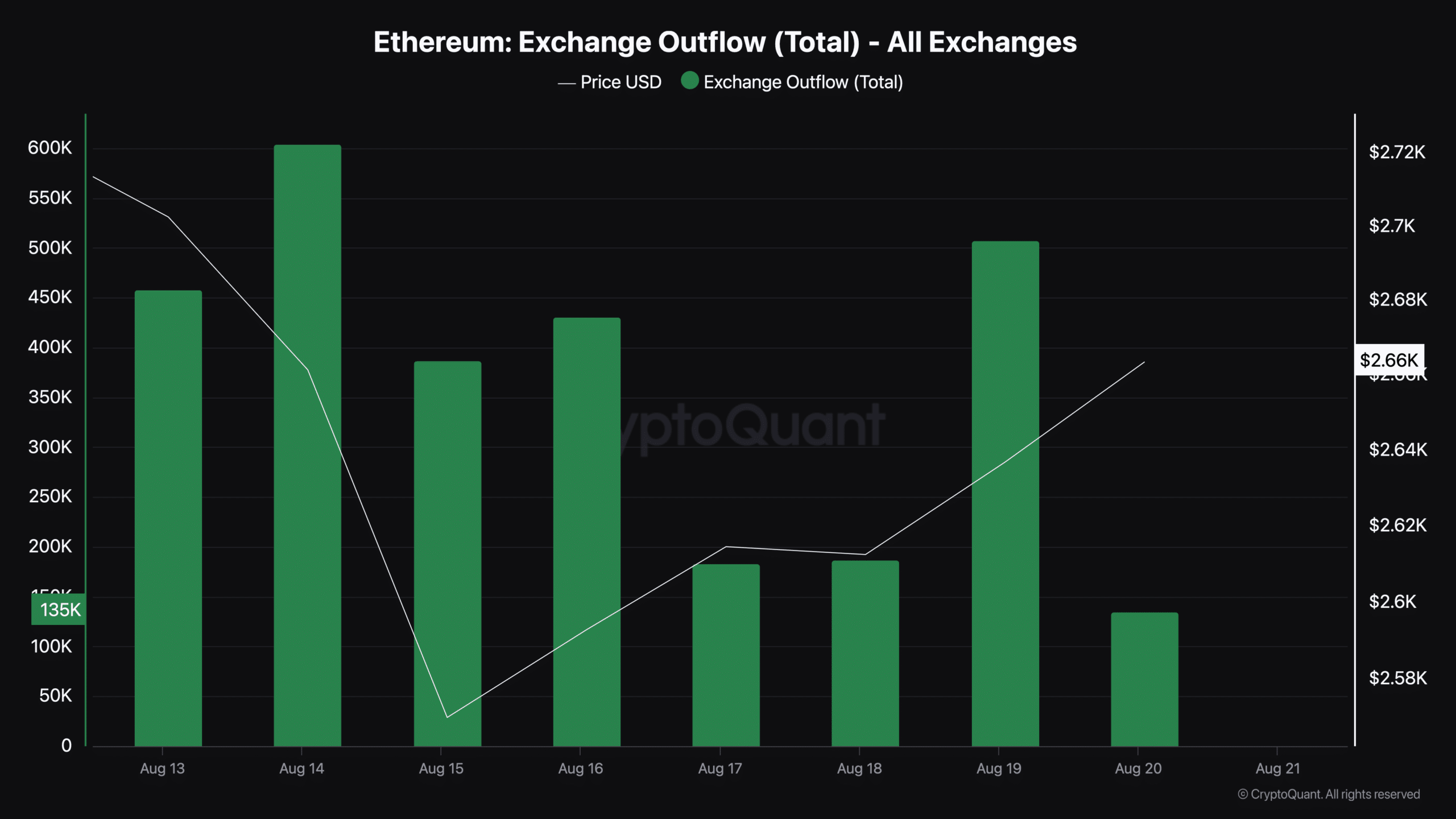

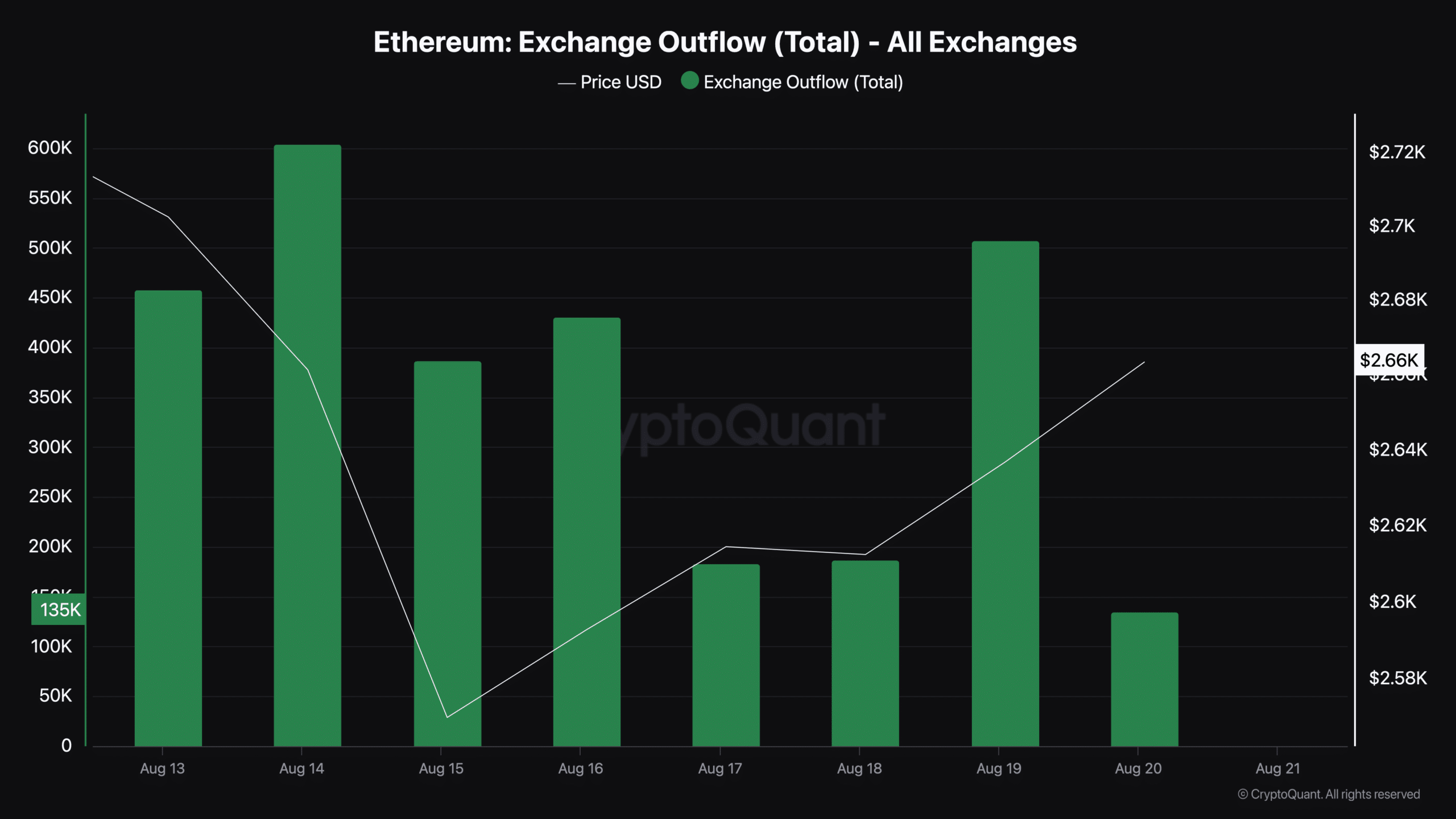

Moreover the on-chain metrics, one other important issue to contemplate is Ethereum’s motion from the exchanges.

Facts from CryptoQuant indicated a constant improve in outflows from Ethereum exchanges over the previous week.

On August 14, greater than 600,000 ETH left the exchanges, adopted by roughly 507,000 ETH on August 19. As of at this time, virtually 200,000 ETH has already been withdrawn from the exchanges.

Supply: CryptoQuant

This improve in outflows from the forex market is usually a sign that buyers are transferring their Ethereum holdings to long-term storage, lowering the availability out there for buying and selling on exchanges.

Such conduct usually signifies an optimistic outlook amongst buyers, as they count on increased costs sooner or later.

Lowered trade provide, coupled with continued demand, may put upward strain on Ethereum’s worth.

Learn Ethereum’s [ETH] Worth forecast 2024-2025

Nevertheless, it stays to be seen whether or not this pattern will result in a major rally or whether or not present market circumstances will proceed to problem Ethereum’s restoration.

Kesmeci concluded the message with the phrases:

“Present knowledge reveals that consumers in Ether are step by step regaining momentum. Nevertheless, time will inform whether or not this can be a non permanent restoration or the beginning of a robust rally led by the bulls.”

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September