Altcoin

Here’s how Bitcoin’s three-month high volatility fueled crypto liquidations

Credit : ambcrypto.com

- Bitcoin volatility hit a three-month excessive on the charts

- Shopping for stress on the foreign money elevated, indicating that the worth would quickly rise

As Election Day approaches in the US, totally different industries have responded otherwise. And crypto wasn’t remoted from it both.

In reality, because of the identical Bitcoins [BTC] Worth volatility reached a three-month excessive. Therefore the query: will this have a broader influence on the crypto market?

US elections affecting crypto?

Crypto market volatility began to rise earlier than the US election date. AMBCrypto found that your entire crypto market inconstancy skyrocketed, reaching 66.7 on the time of writing. As anticipated, Bitcoin led this altering pattern, with BTC volatility hitting a three-month excessive.

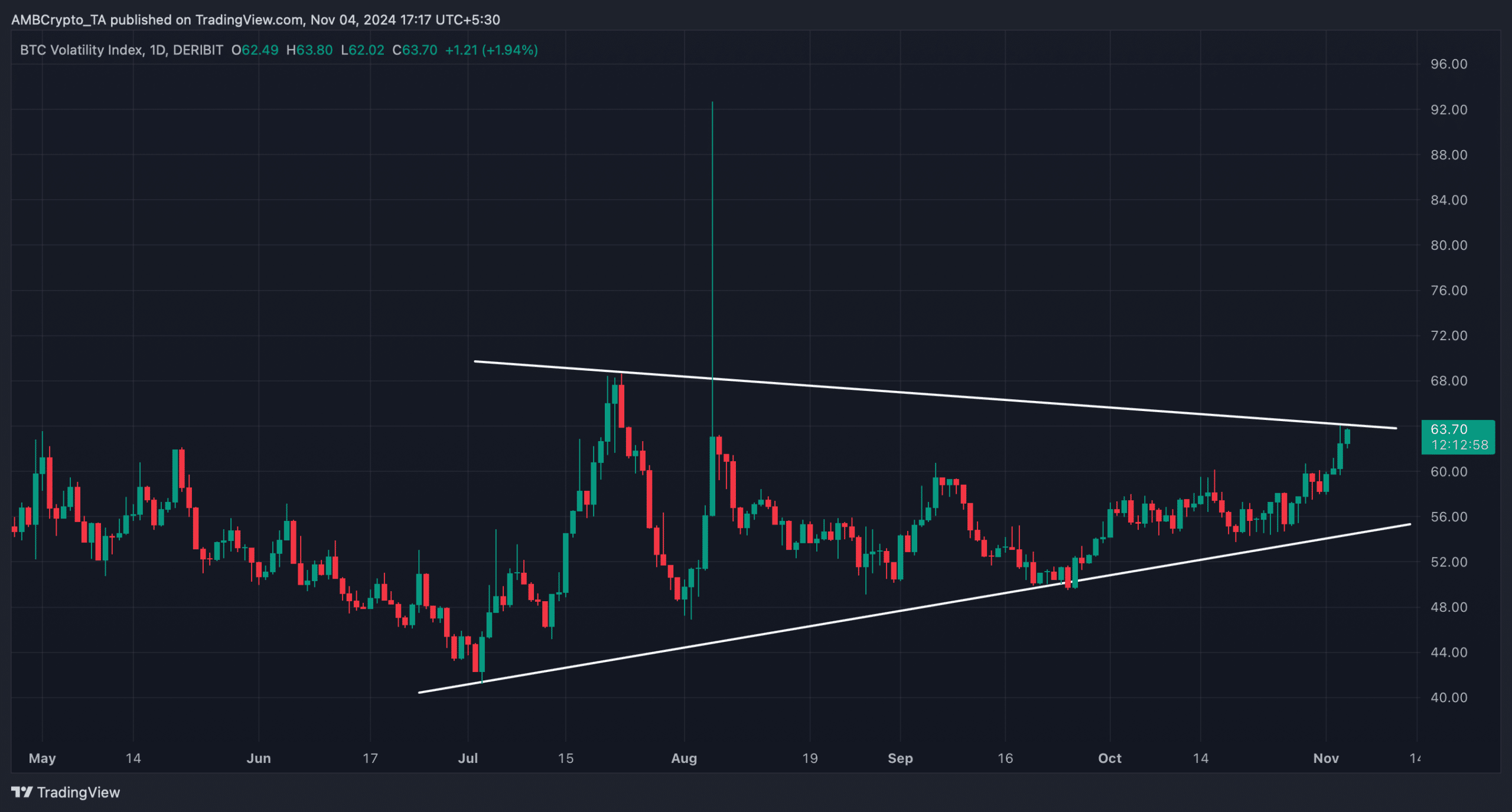

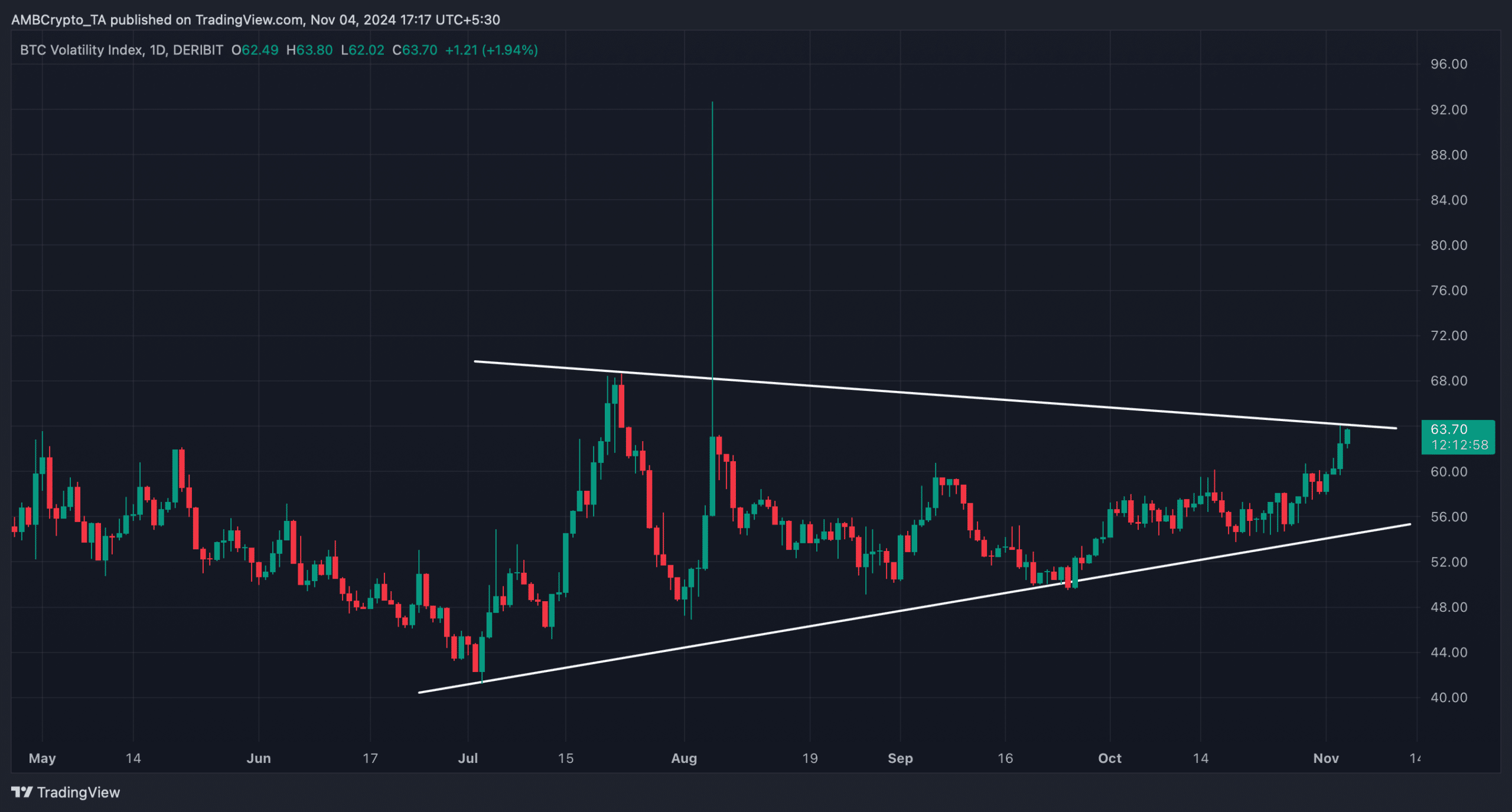

The fascinating factor right here was {that a} sample appeared on the volatility chart. To be exact, the sample appeared in July and since then the volatility chart has been consolidating into it.

On the time of writing, BTC’s volatility was testing the sample’s resistance because it was at 63.72. If the chart rises above resistance, buyers may even see extra volatility after the election outcomes.

Supply: TradingView

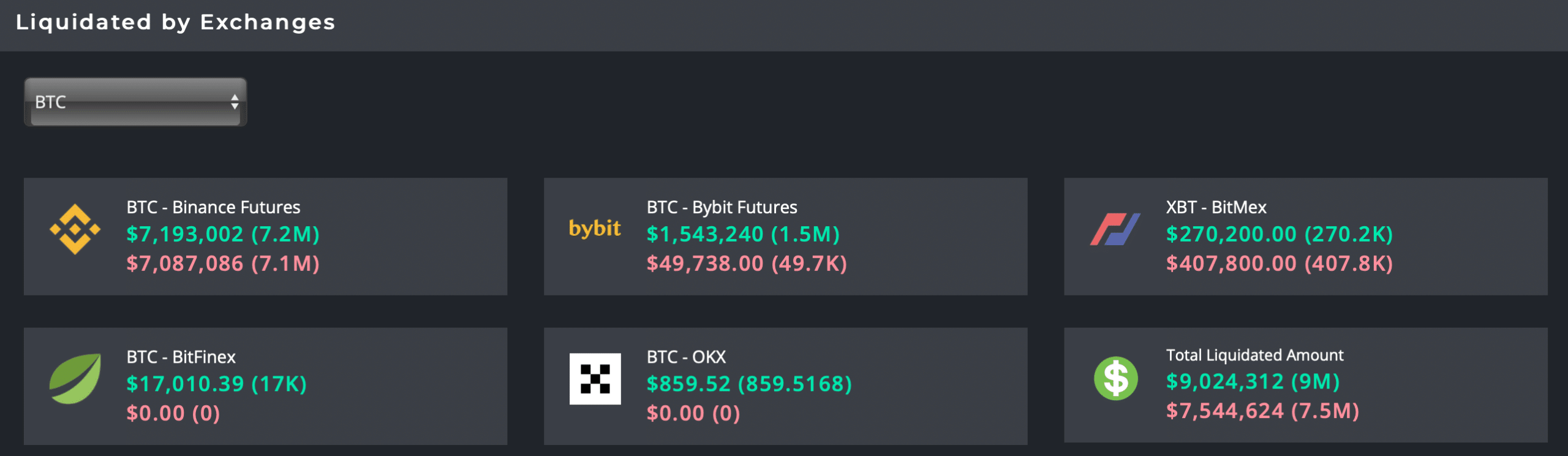

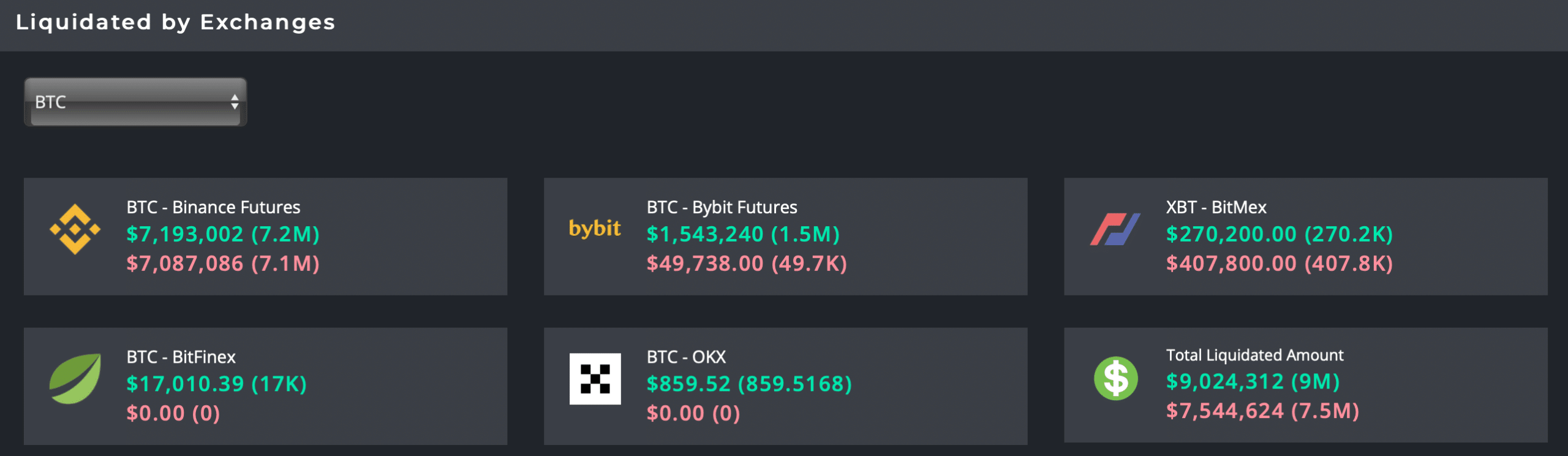

As well as, AMBCrypto additionally discovered that liquidations within the crypto market had been growing.

The excellent news was that within the case of Bitcoin, most of those liquidations got here from lengthy positions – a bullish signal. This was the case as a result of extra lengthy positions indicated better bullish sentiment out there.

Supply: cryptometer

Will BTC’s Rising Volatility Push the Inventory Up?

As BTC volatility will increase, AMBCrypto checked the King Coin’s on-chain information to seek out out whether or not the result of this improvement will convey buyers a revenue or pressure them into losses. Our evaluation of CryptoQuant’s facts revealed that BTC’s international change reserves have fallen, that means shopping for stress on the coin was excessive.

A rise in buying stress normally interprets into worth will increase. Within the final 24 hours alone, BTC witnessed a marginal worth enhance, and it did trade for $68.75k.

Nonetheless, not the whole lot labored in favor of the king’s coin. BTC’s aSORP confirmed that extra buyers offered at a revenue. In the midst of a bull market, this might point out a market high.

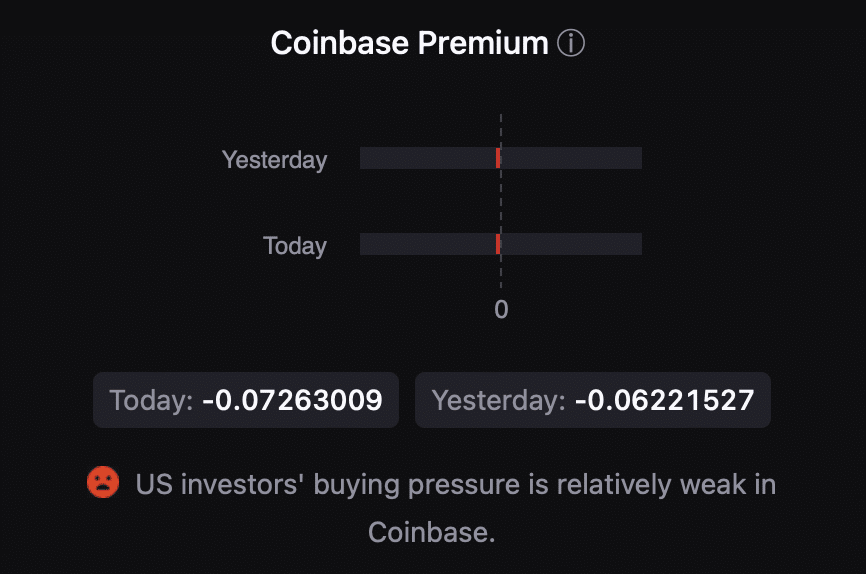

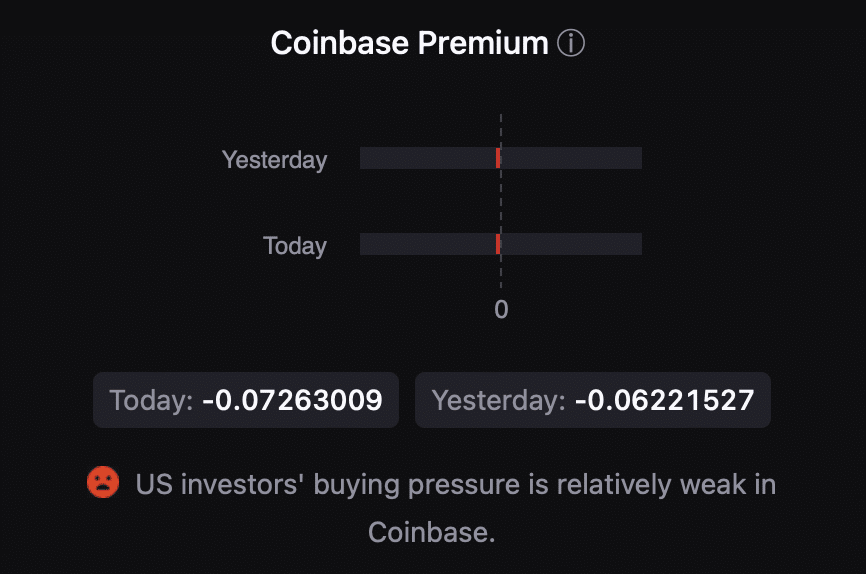

Moreover, amid the continuing buzz surrounding the US elections, buyers usually are not contemplating shopping for BTC, evidenced by the crimson Coinbase bounty.

Supply: CryptoQuant

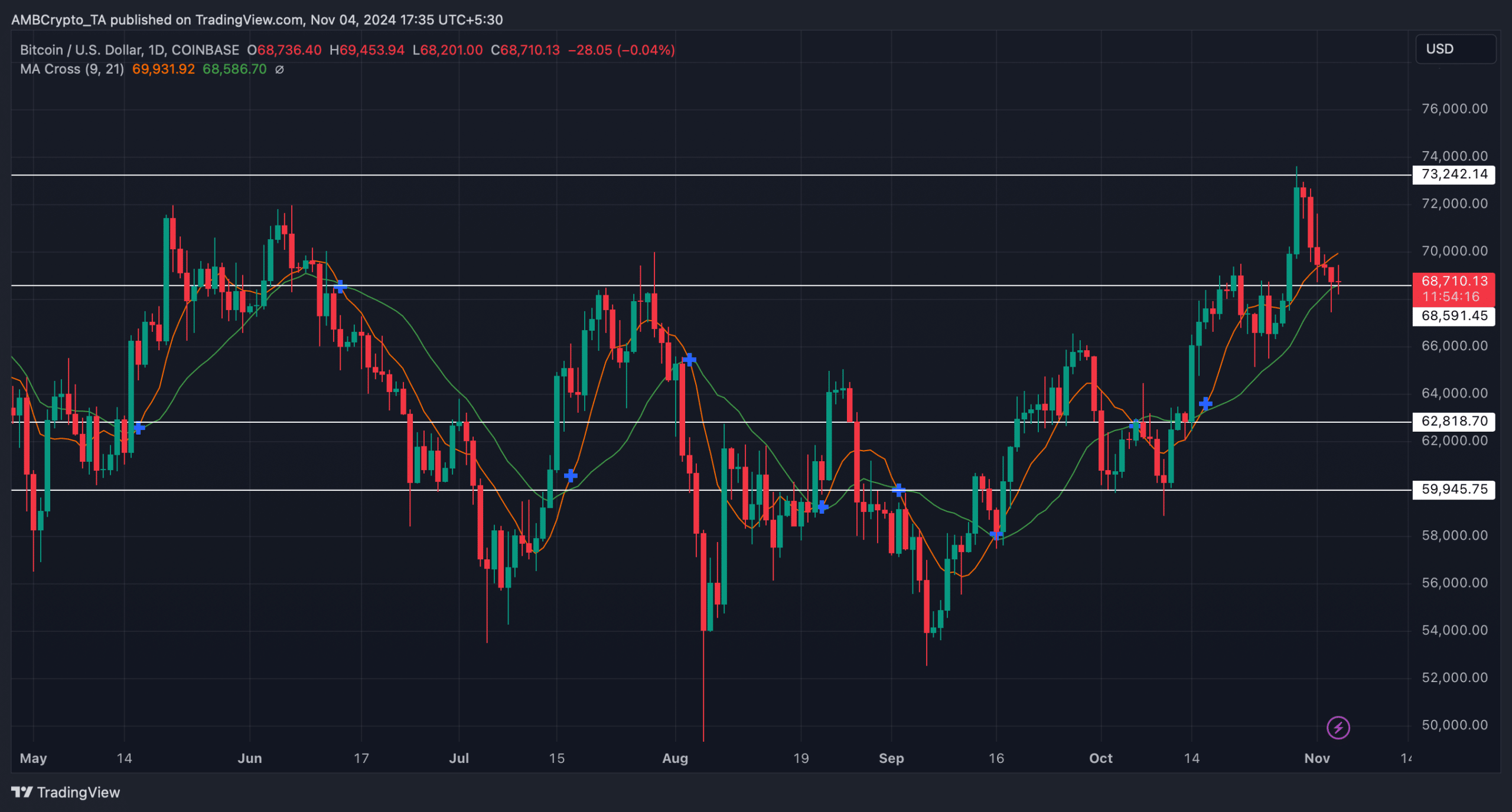

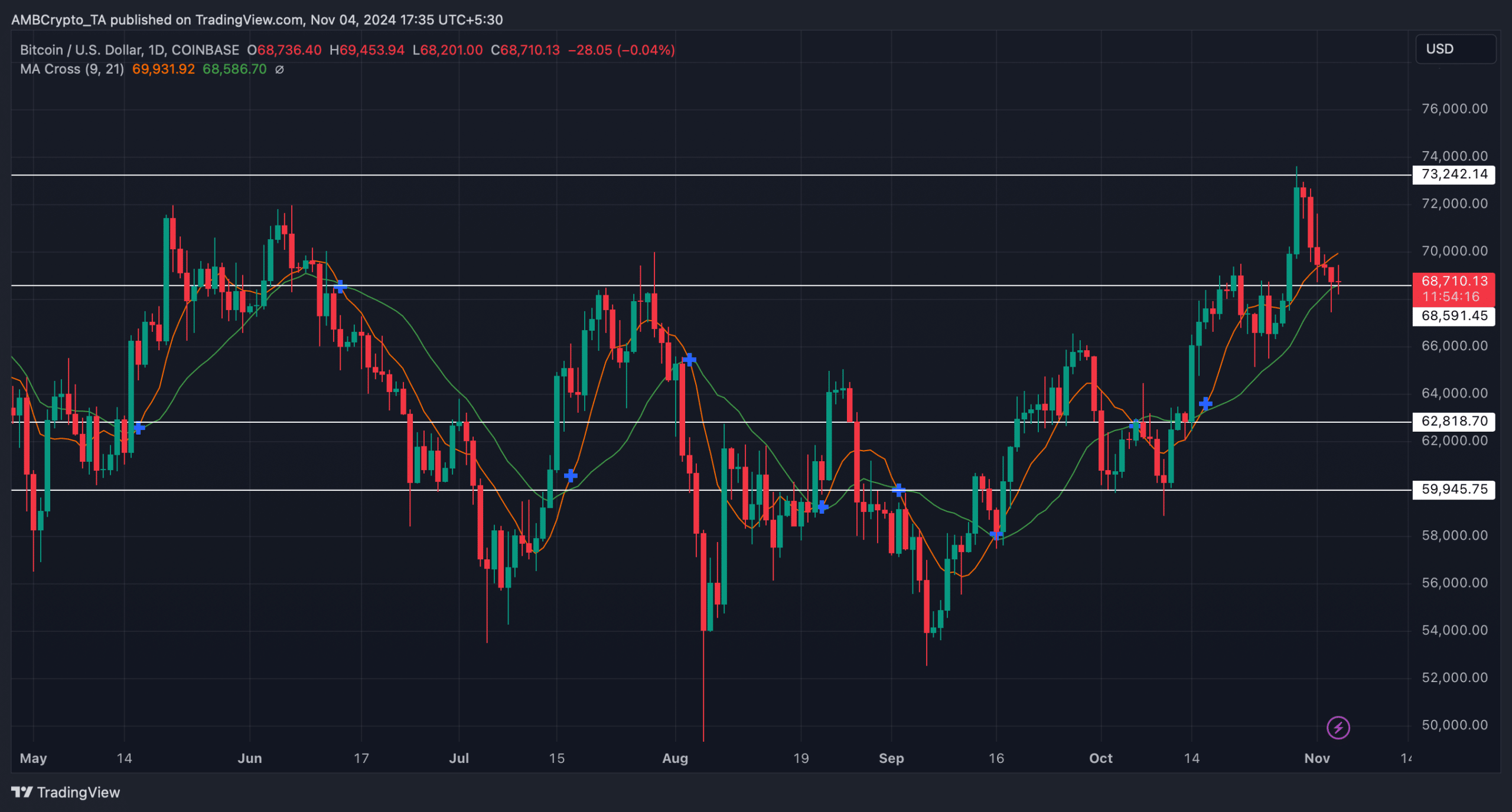

Lastly, we checked BTC’s day by day chart to higher perceive what to anticipate. In response to our evaluation, BTC seemed to be testing a assist degree.

Learn Bitcoin (BTC) worth prediction 2024-25

The technical indicator MA Cross prompt the bulls had been within the lead, indicating a profitable trial. Subsequently, if BTC’s volatility will increase even additional, the worth might transfer in direction of $73,000 once more.

Supply: TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024