Analysis

Here’s the Next ETH Price Trend

Credit : coinpedia.org

Ethereum has had a turbulent begin to the week and knowledge suggests additional declines are on the best way. With Bitcoin shedding momentum in latest hours and falling beneath the instant help degree, promoting stress on Ethereum is growing. This downward development is bolstered by a number of on-chain metrics, which now level to a doubtlessly sharp 10% drop for Ethereum within the coming hours.

Ethereum Eyes for a ten% Drop

In response to knowledge from Coinglass, Ethereum liquidations have elevated considerably, reaching greater than $42.7 million in whole. Of this quantity, roughly $40 million resulted from the liquidation of lengthy positions.

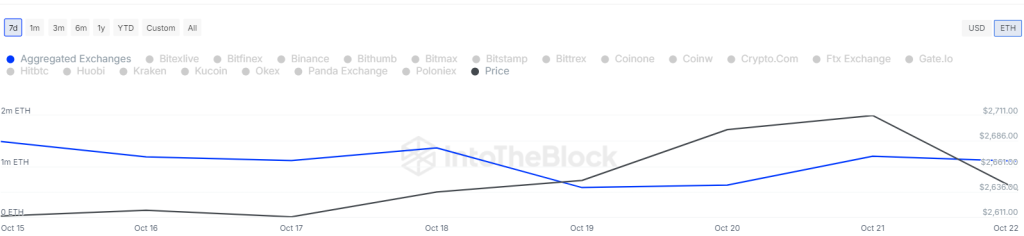

A bearish indicator is the growing provide of ETH on exchanges. In response to extra knowledge from CryptoQuant, Ether balances on exchanges reached a four-week excessive of 15.8 million ETH on October 21. The online stability between inflows and outflows amongst centralized alternate portfolios reveals a pointy improve between October 15 and October 20, when deposits to buying and selling platforms started to rise.

Growing ETH provide on exchanges means that buyers are transferring their tokens from self-custodial wallets to exchanges, indicating an intention to promote.

Moreover, Ethereum’s general worth has fallen since mid-June, as proven within the DefiLlama chart beneath.

TVL on the tier 1 community fell from a peak of $66 billion on June 3 to this point, falling 57% to $42.3 billion on August 5 earlier than rising to the present degree of $48 billion. Extra knowledge from DefiLlama signifies that Ethereum’s TVL has declined by greater than 2% over the previous 30 days, inflicting it to underperform different high layer 1 protocols similar to Solana, which noticed a 22% improve in TVL over the identical interval has seen.

The rising TVL in Solana displays merchants’ curiosity within the DeFi ecosystem and highlights Ethereum’s incapacity to draw new customers as a result of its comparatively larger transaction charges, particularly for these trying to launch new tasks.

This has strengthened the bearish dominance in Ethereum’s worth chart, pushing the worth in direction of a possible 10% decline.

What’s subsequent for the ETH worth?

The worth of ether confronted robust promoting stress as bears dominated the worth round $2,800, indicating that the market had rejected the earlier breakout. Promoting stress elevated, pushing the worth beneath the 200-day Exponential Transferring Common (EMA) at $2,552. On the time of writing, ETH worth is buying and selling at $2,517, down greater than 4% within the final 24 hours.

There’s slight help on the 50-day Easy Transferring Common (SMA) at $2,487; Nevertheless, if this degree doesn’t maintain, the ETH/USDT pair might drop to $2,400 after which to $2,330.

Conversely, if the worth displays the 50-day SMA, it might point out robust demand at cheaper price ranges. In that case, the bulls might attempt to push the worth in direction of $2,850, which is able to doubtless function a major resistance barrier.

With the RSI degree approaching oversold territory, we might quickly see a restoration within the ETH worth chart.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024