Altcoin

Here’s this analyst’s argument that LINK’s price will hit a low soon

Credit : ambcrypto.com

- Analytical charts indicated that LINK/BTC had reached its lowest level, indicating a possible upside within the brief time period

- Additional analysis revealed growing curiosity in LINK, indicating a probable upward development in its worth

LINK/USDT has seen a notable enhance recently, rising 13.12% over the previous week. That is not all, nonetheless, as the corporate has continued to construct on this development with features of an additional 2.26% within the final 24 hours alone.

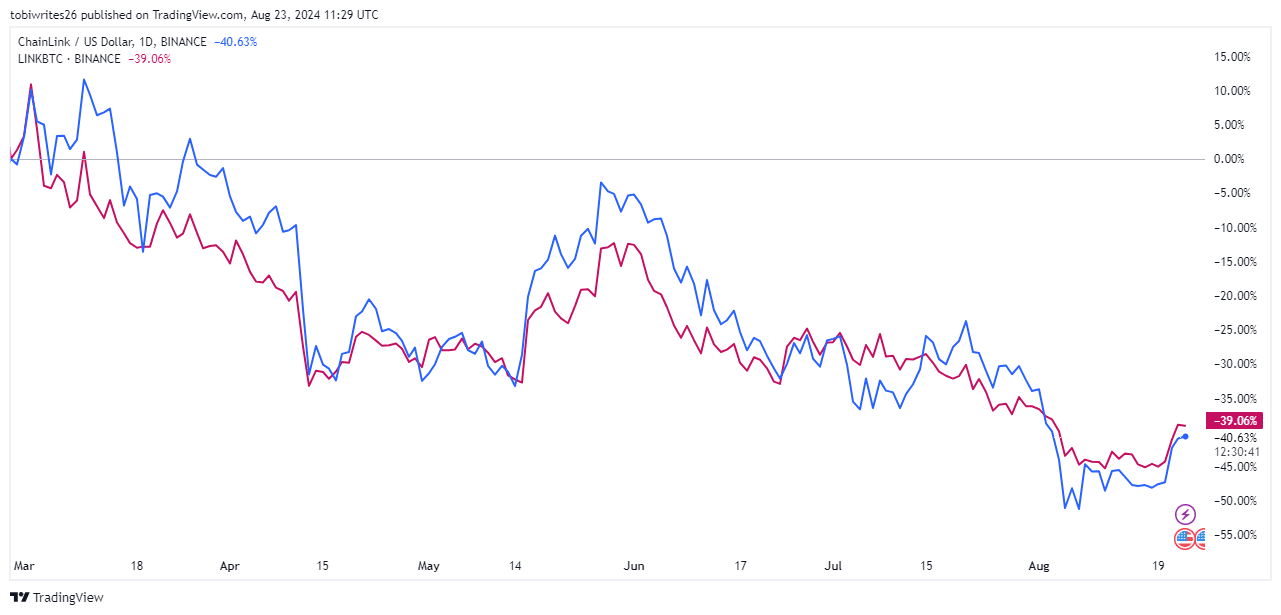

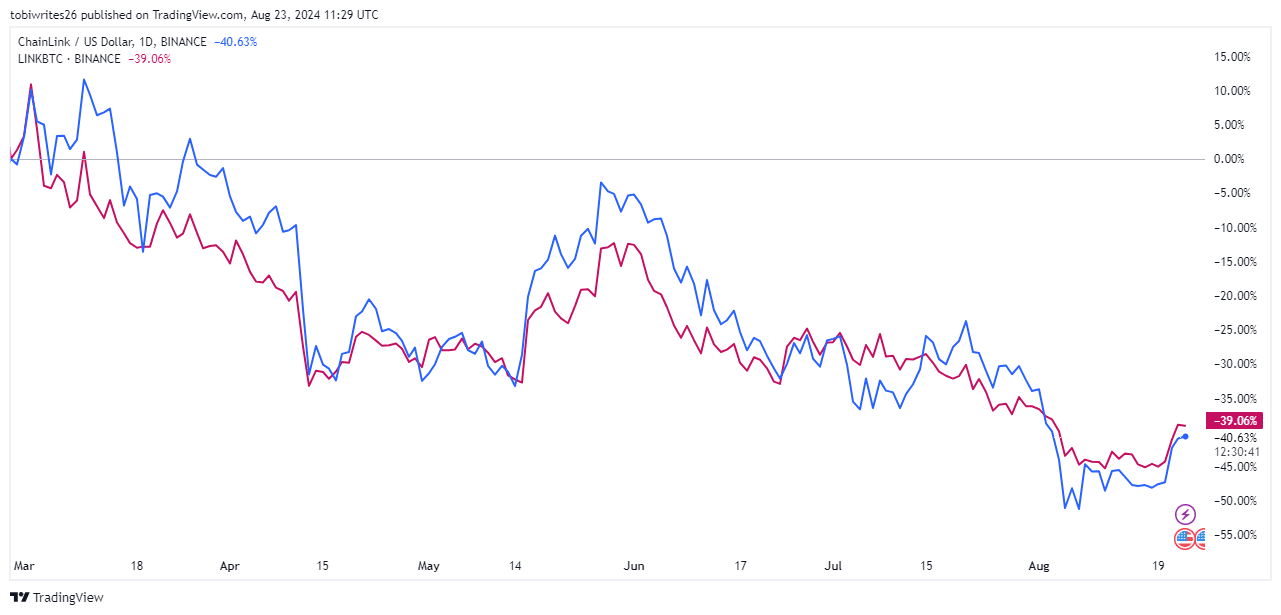

The worth actions of LINK/USDT and LINK/BTC are more and more linked and affect one another’s market habits.

Amid this prevailing bullish sentiment, one other vital issue is the newest perception from a crypto analyst who discovered that LINK is buying and selling inside a key zone.

Understanding the bottom-out of LINK

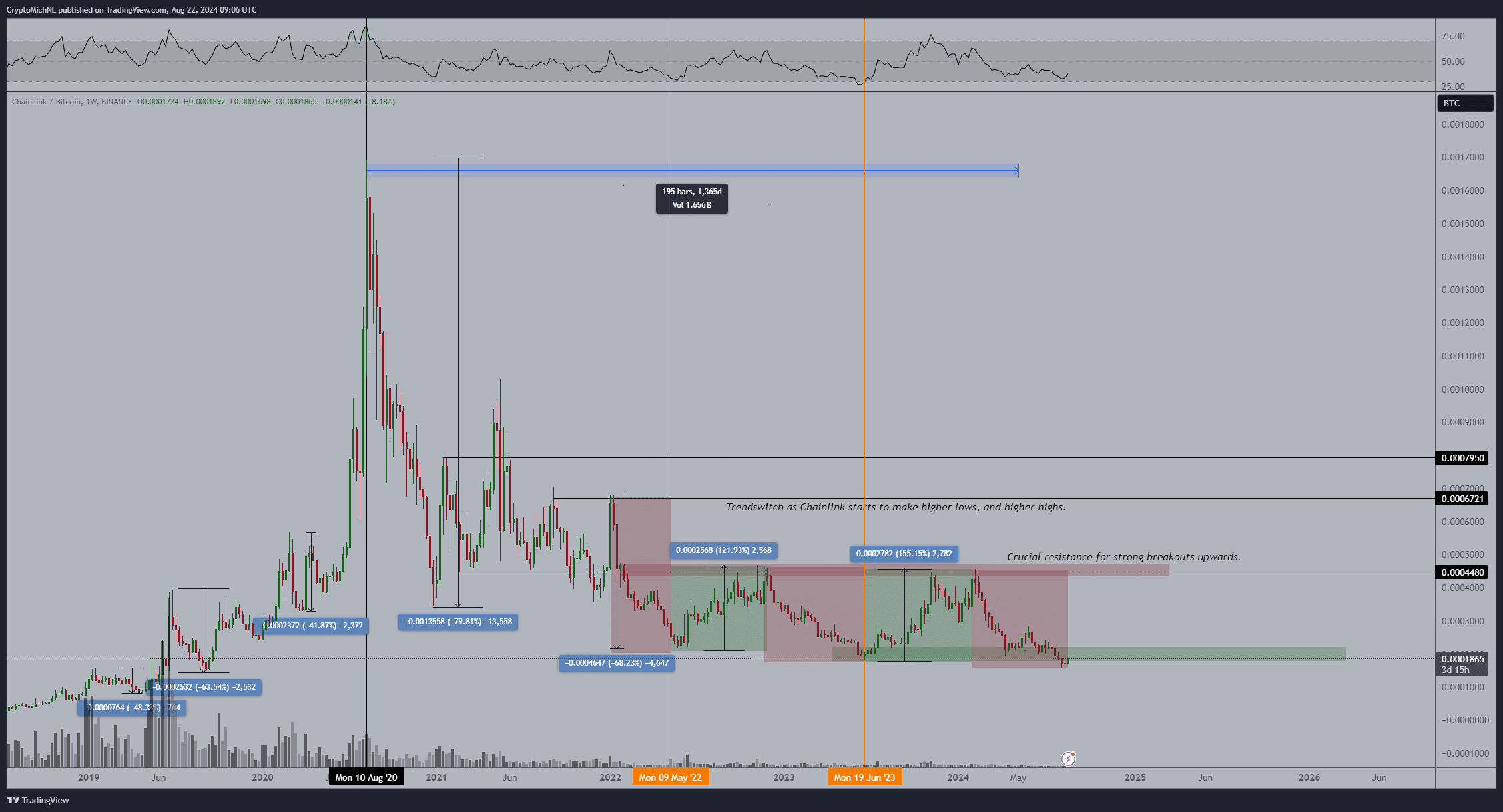

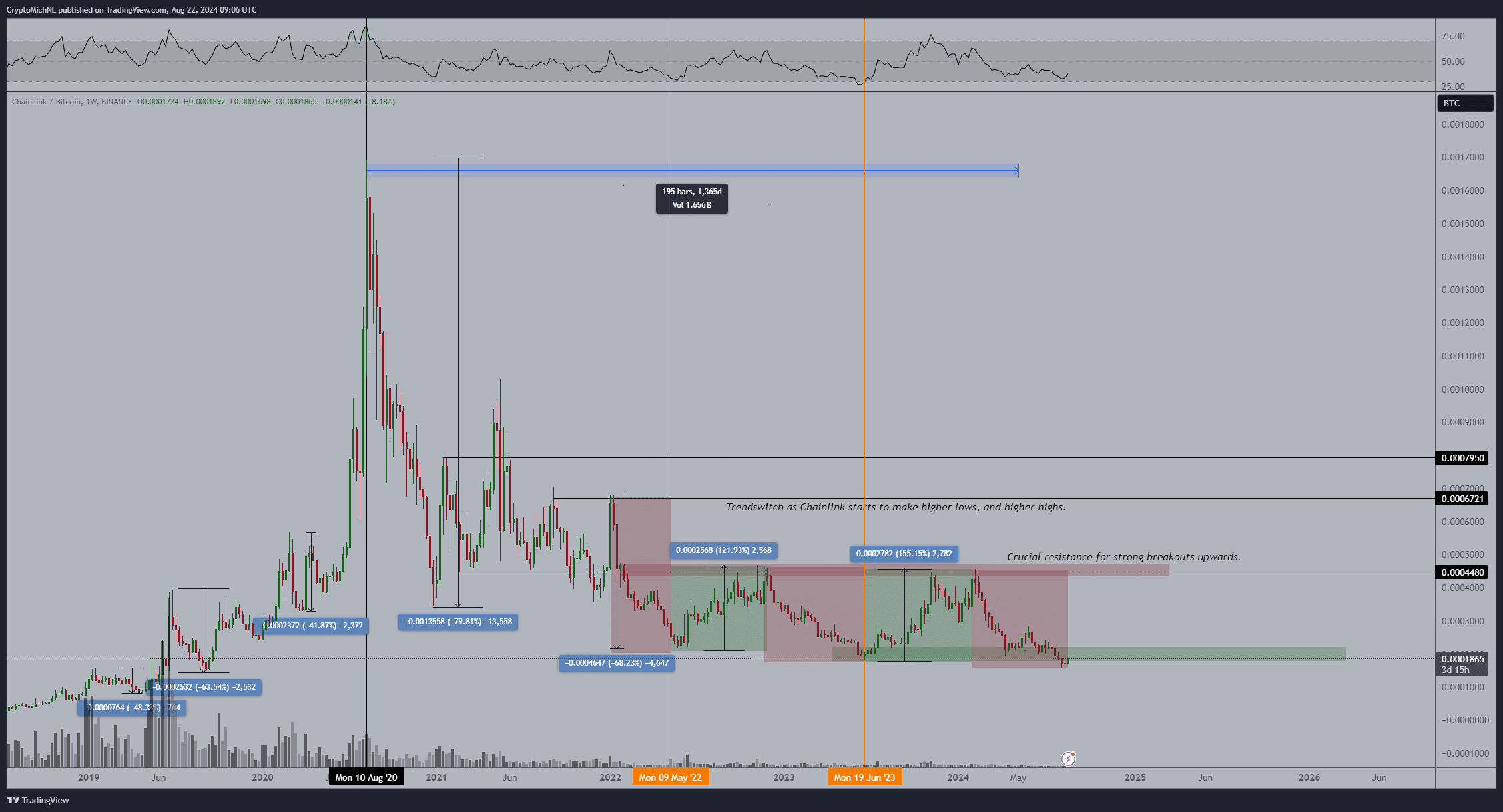

Common crypto analyst Michaël Van de Poppe emphasized a ‘bottom-out’ for the LINK/BTC buying and selling pair, indicating that LINK could start an upward trajectory. By doing so, it might additionally doubtlessly attain new highs, he claimed.

At the moment, LINK is buying and selling at a decrease assist stage, however LINK might be poised for a reversal that may push it straight to the crucial resistance level at 0.0004480. At this level, LINK could face important promoting strain that it should overcome to proceed its rise.

Supply:

When LINK/BTC rises, it signifies that the value of Chainlink (LINK) is gaining energy in opposition to Bitcoin (BTC). Such features in LINK/BTC are sometimes mirrored by comparable strikes in associated pairs corresponding to LINK/USD, which means {that a} rise in LINK/BTC normally results in a parallel rise in LINK/USD.

Supply: TradingView

For instance, the accompanying chart compares the day by day worth actions of LINK/BTC (in purple) and LINK/USD (in blue) from March. It underlined constant patterns between the 2 pairs, with small variations that finally converge.

Assist for on-chain metrics?

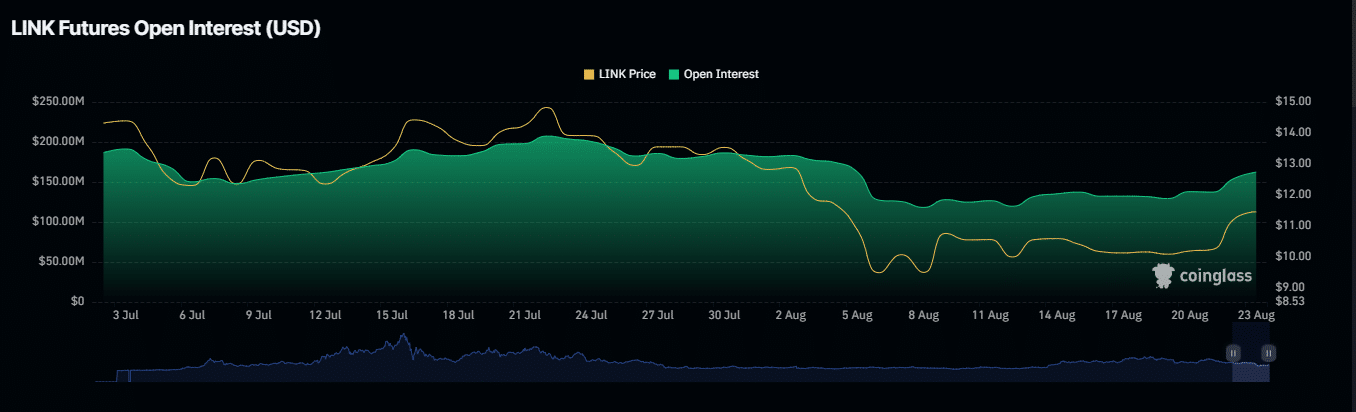

The Open Curiosity (OI) for LINK has step by step elevated, according to Coinglassindicating a rising variety of unsettled by-product contracts available in the market. This metric is essential for measuring the market’s propensity to purchase or promote.

An increase in OI signifies elevated purchaser curiosity, with buyers opening positions in anticipation of LINK’s worth rise on the charts.

Supply: Coinglass

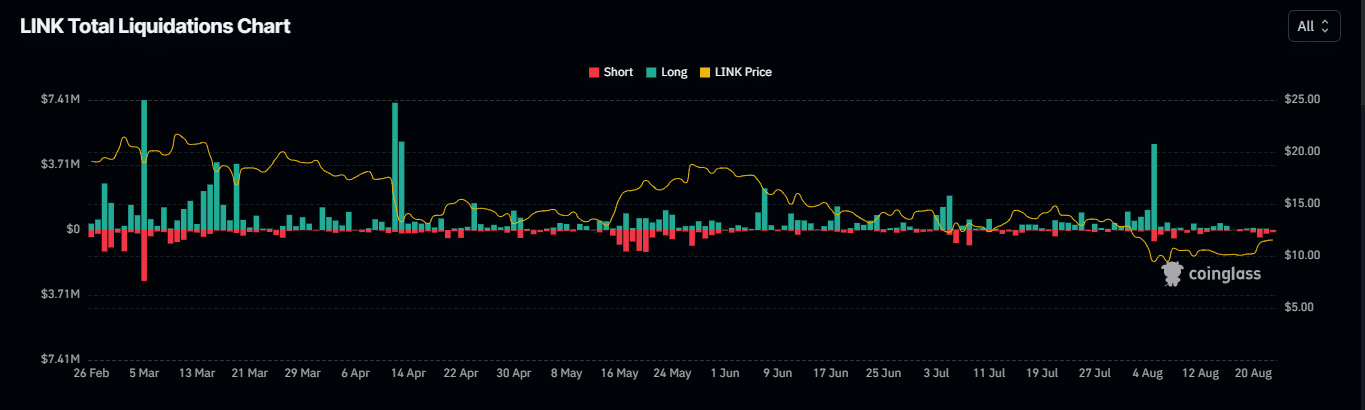

Additional affirmation of this bullish sentiment is the current wrestle of brief merchants. Those that wager on a drop in LINK’s worth have suffered main setbacks. Quick positions price $234,000 have been liquidated within the final 24 hours alone.

Supply: Coinglass

This exercise underscored the dominance of lengthy merchants who basically push up the value, resulting in losses for individuals who take brief positions.

The momentum is growing

Lastly, evaluation of the market worth to realized worth (MVRV) and relative energy index (RSI) urged that momentum is growing for LINK.

The MVRV ratio, which compares market capitalization (market worth) to realized capitalization (realized worth), helps assess whether or not an asset is overvalued or undervalued. On the time of writing, LINK, with an MVRV of lower than 1, could be thought-about undervalued, indicating a potential upward shift in worth quickly.

Likewise, the RSI measures market sentiment and momentum. A studying above 50 usually signifies bullish momentum. LINK’s RSI studying of 54.24 urged that the value might proceed to rise within the close to time period.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now