Altcoin

Here’s what could happen next

Credit : ambcrypto.com

- Ethereum’s worth is down almost 9%, buying and selling at $2,460, after peaking at $2,696 only a day earlier.

- Analysts are divided on ETH’s subsequent transfer, with some predicting a possible restoration and others warning of additional draw back.

Ethereum [ETH] has mirrored that of Bitcoin [BTC] current sharp decline, dropping virtually 9% of its worth within the final 24 hours.

This downturn has pushed the value of ETH to $2,460, a notable drop from the $2,696 peak only a day earlier.

This market efficiency has sparked a wave of research and hypothesis amongst cryptocurrency consultants, with various opinions on what might occur for the second-largest cryptocurrency by market capitalization.

Massive upturn or subsequent downtrend?

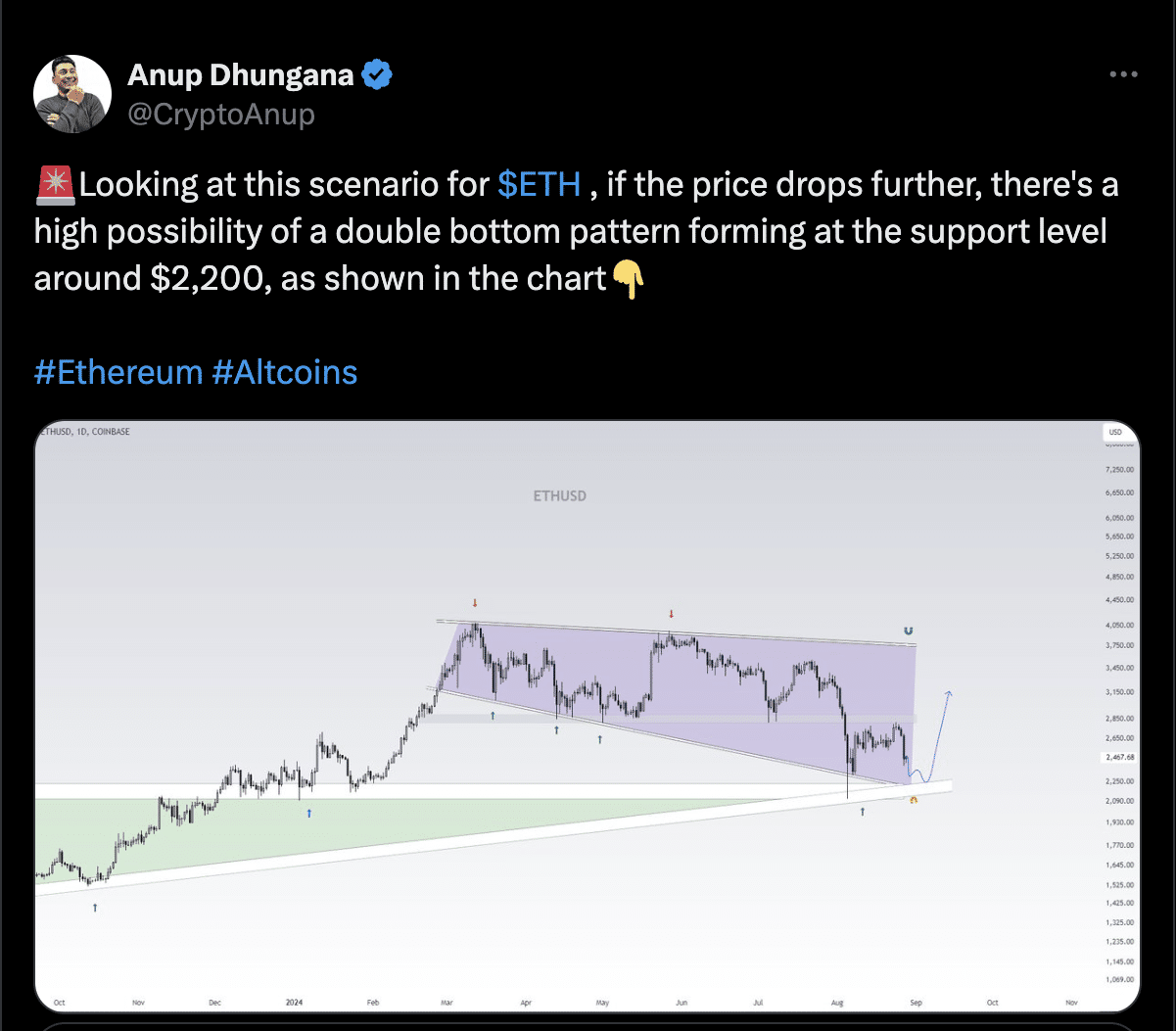

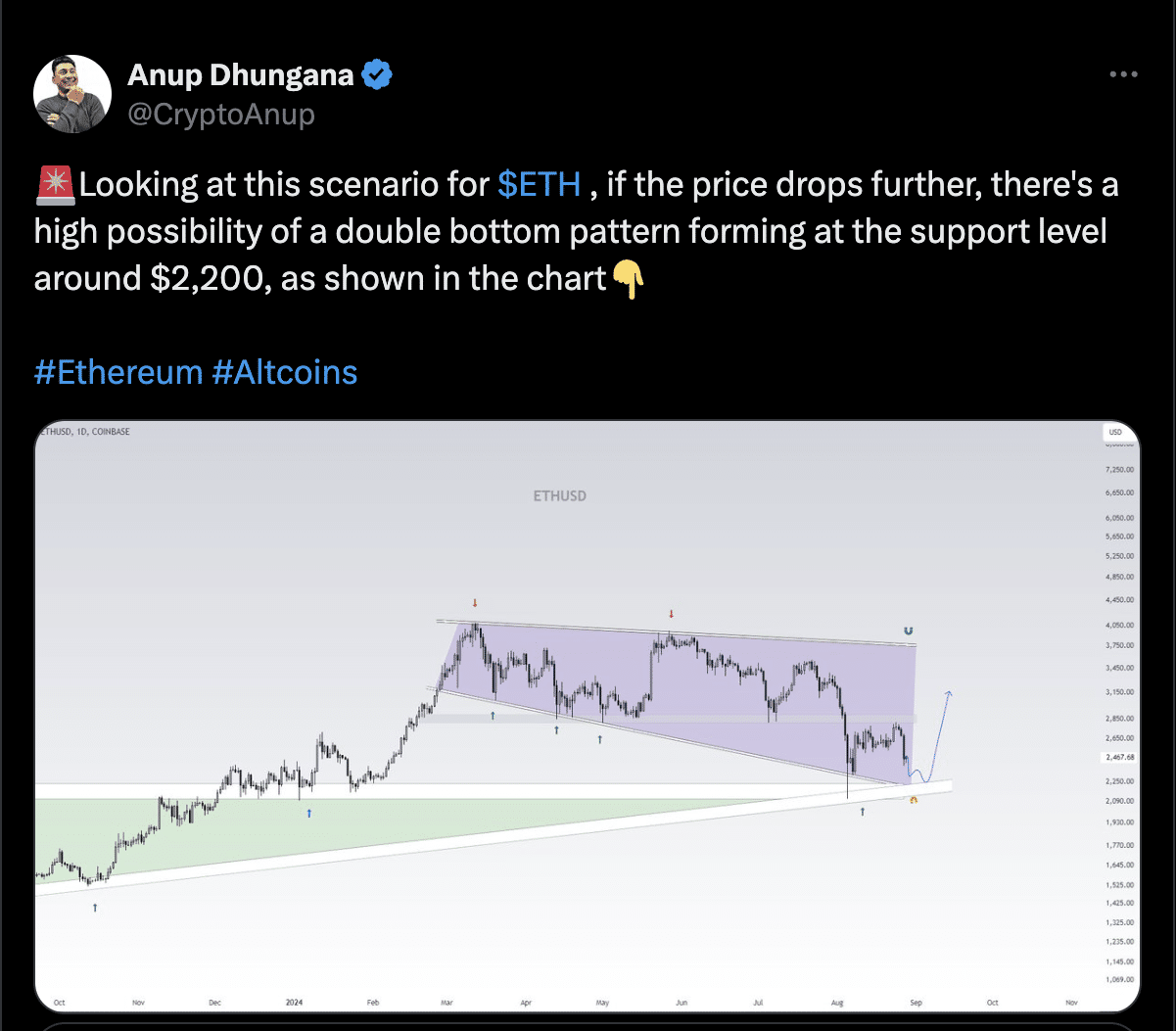

A outstanding crypto analyst, Anup Dhungana, marked the potential for an additional downward development within the worth of Ethereum.

Dhungana instructed that if the present downturn continues, Ethereum might kind a double backside sample on the $2,200 assist degree.

Supply: Anup Dhungana/X

This sample, which is commonly seen as a bullish reversal sign, might point out that Ethereum might discover a sturdy assist degree at this worth earlier than a potential restoration.

Nonetheless, this state of affairs depends on Ethereum not breaking the $2,200 assist, which might result in additional losses.

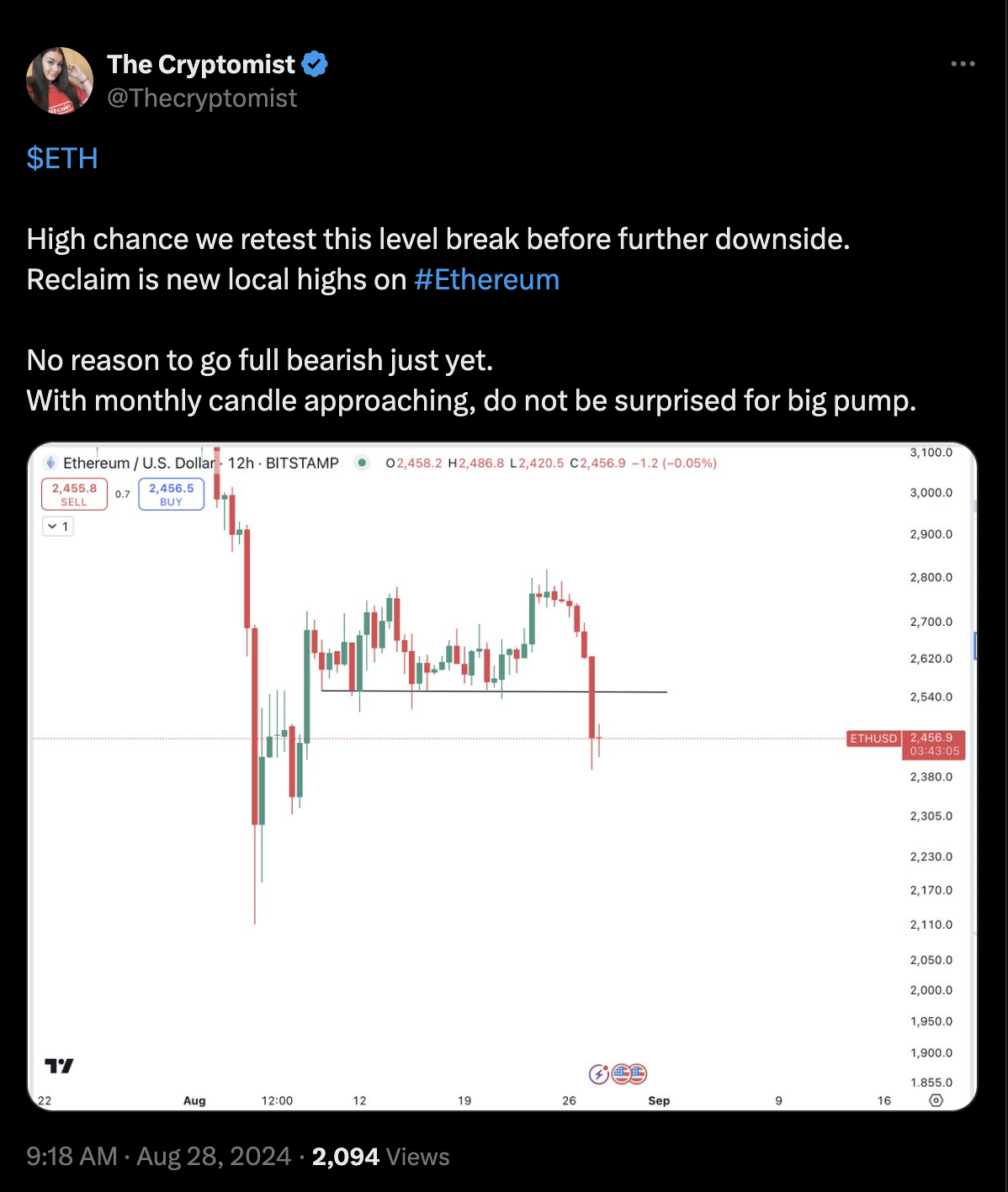

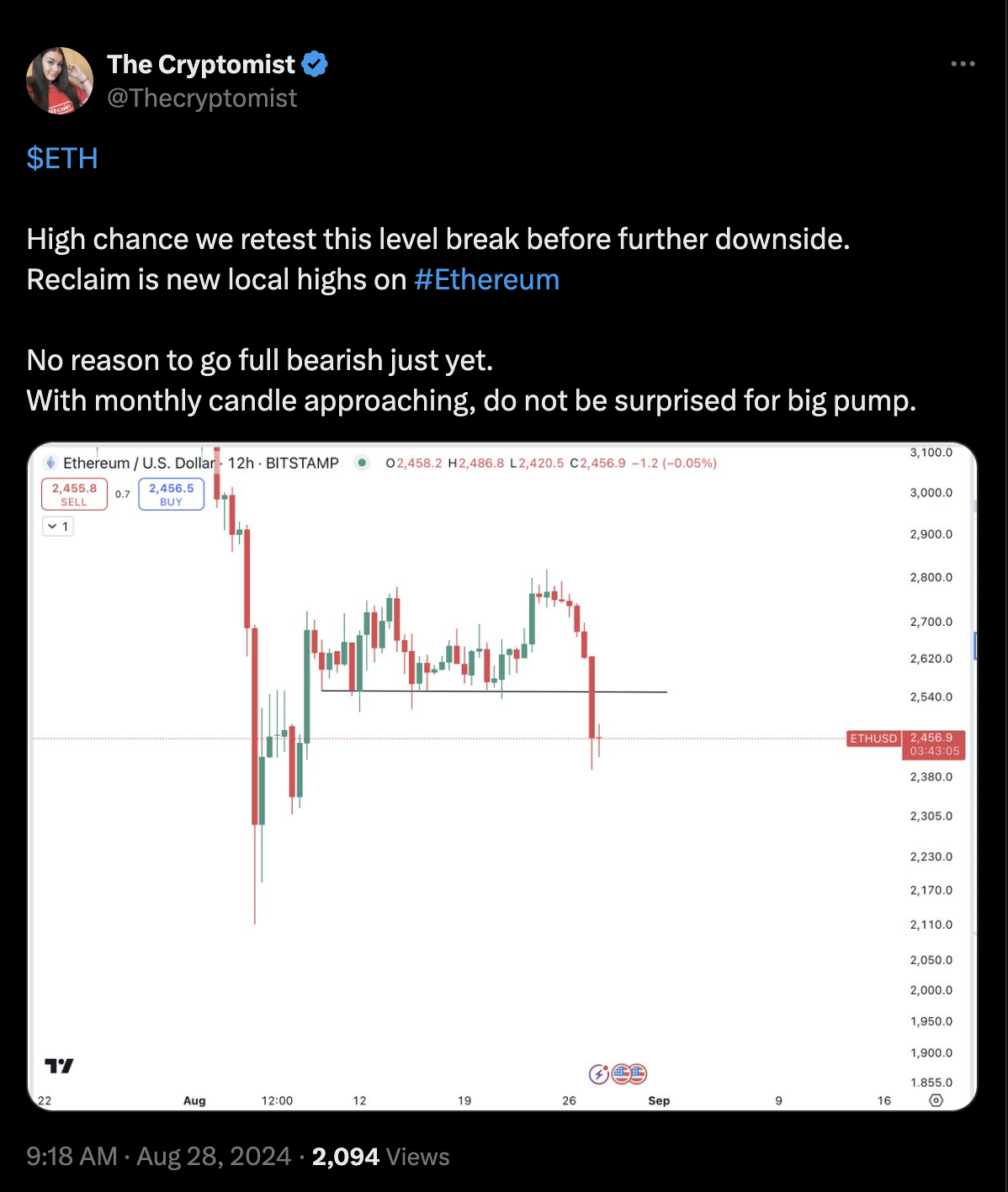

One other well-known analyst, referred to as ‘The Cryptomist’ on X (previously Twitter), offered from a distinct perspective, cautioning towards turning into too bearish but.

The Cryptomist famous that whereas there was a excessive probability that Ethereum would retest its current low, the upcoming month-to-month candle might set off a big worth enhance.

Supply: The Cryptomist/X

This view means that Ethereum might expertise a short lived restoration earlier than additional declines, particularly because the market anticipates the tip of the month-to-month buying and selling interval.

What Do Ethereum’s Fundamentals Recommend?

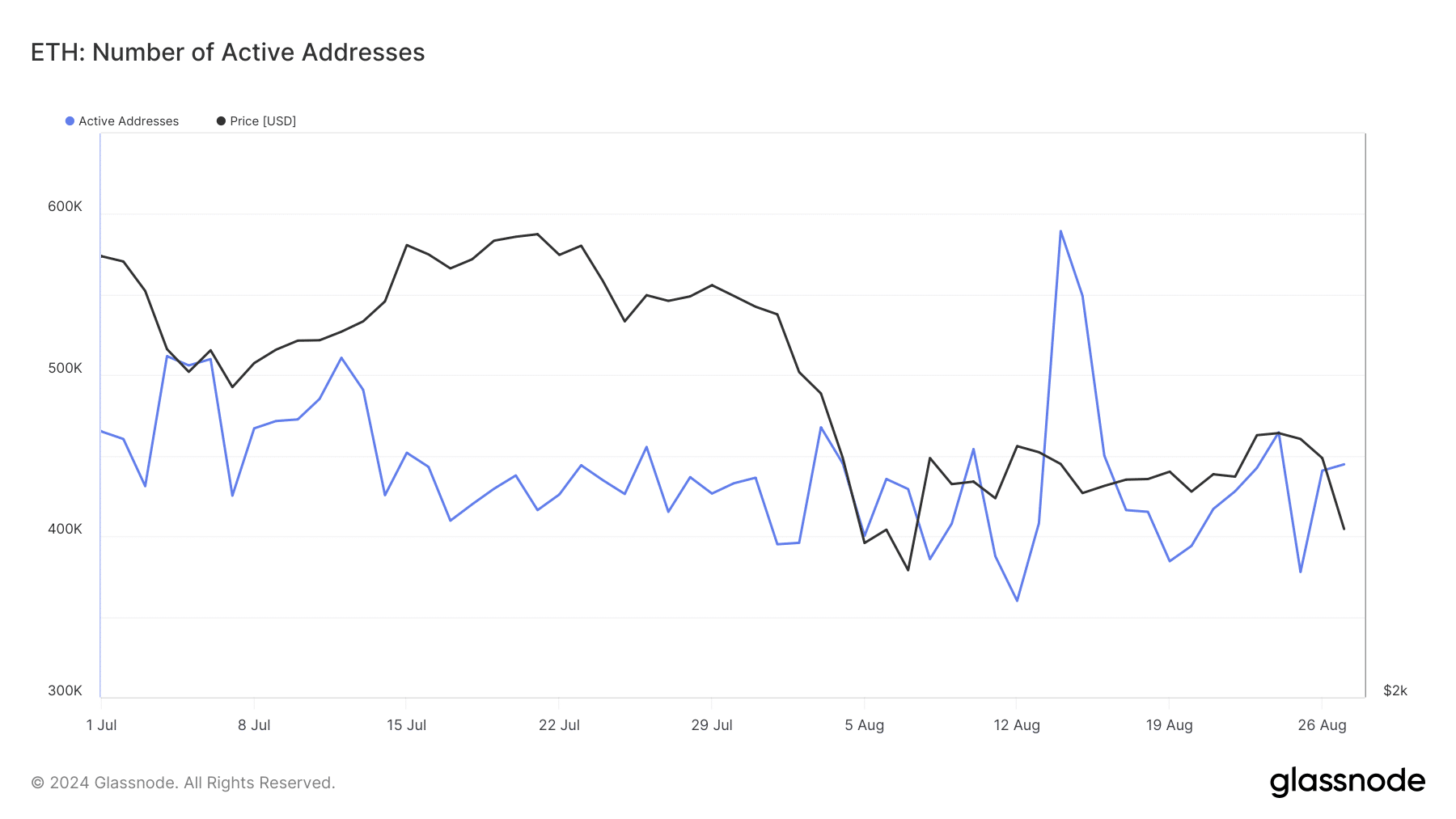

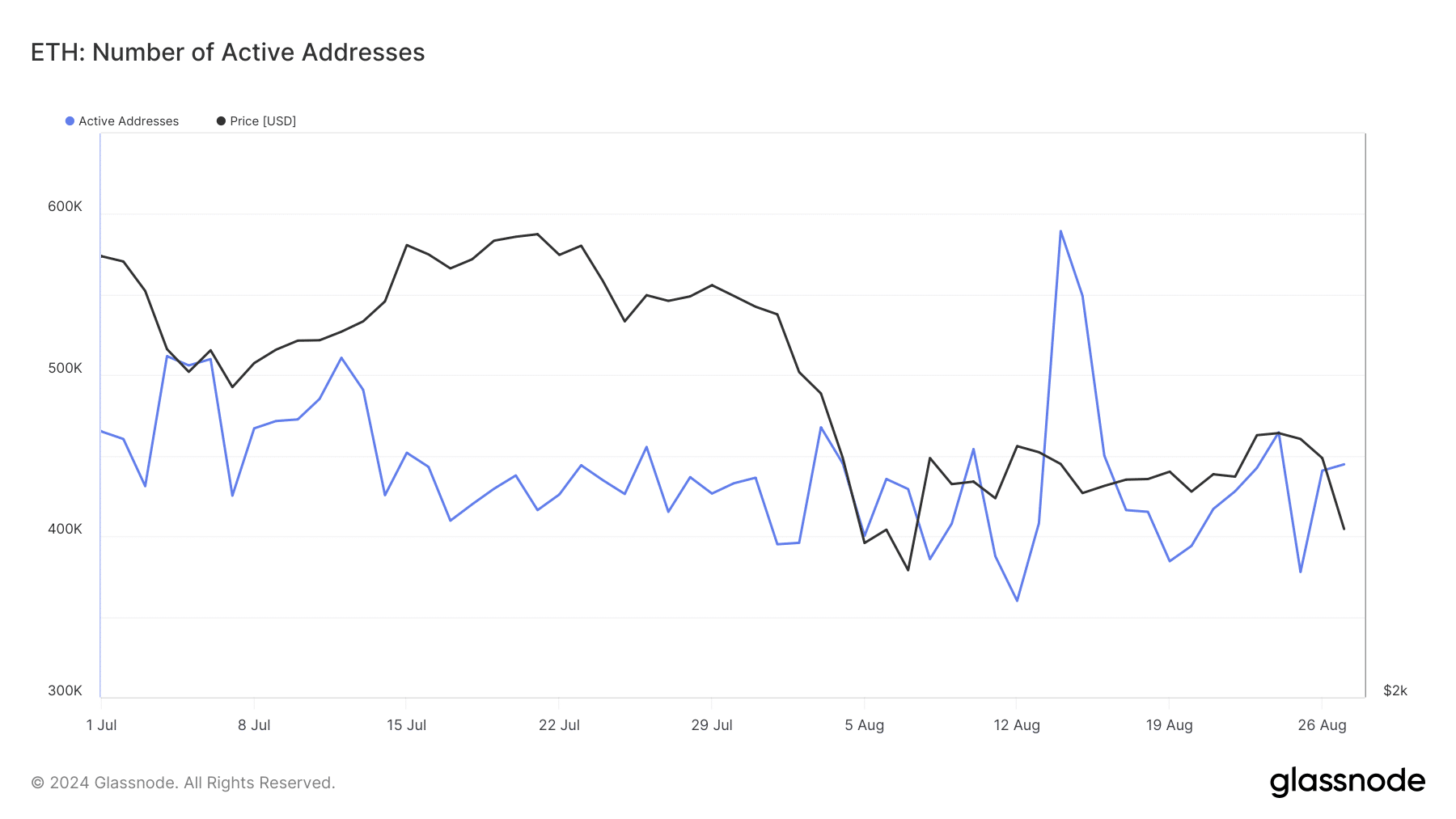

Past the technical evaluation, Ethereum’s fundamentals are exhibiting combined indicators. In line with facts from Glassnode, Ethereum’s variety of lively addresses has fluctuated over the previous month.

After a interval of consolidation, this worth peaked to 589,000 on August 14.

Supply: Glassnode

Since then, nevertheless, the variety of lively addresses has regularly decreased, to 444,000 on the time of writing.

This decline within the variety of lively addresses might point out a weakening of community exercise, which might put downward stress on Ethereum’s worth as fewer individuals interact with the community.

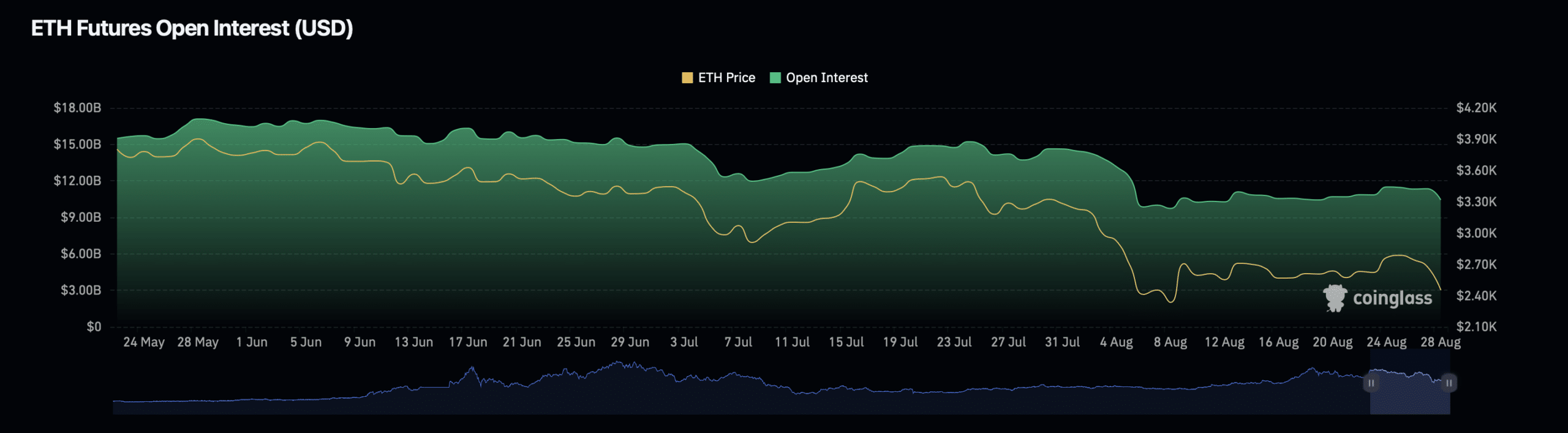

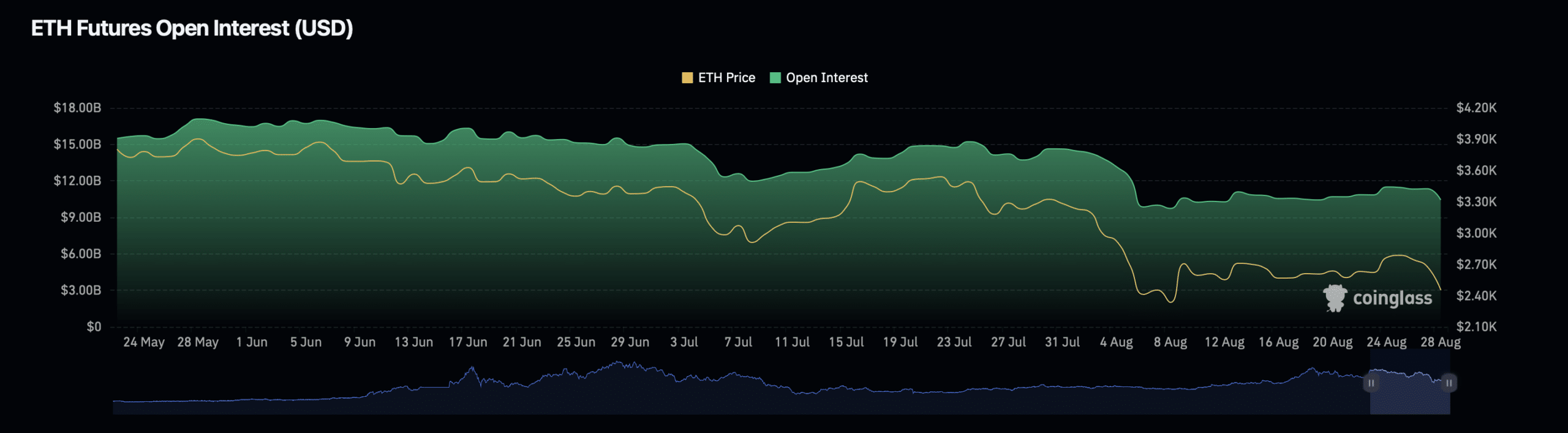

Alternatively, there’s Ethereum’s Open Curiosity facts painted a extra advanced image.

Coinglass information confirmed that Ethereum’s Open Curiosity – a measure of the full variety of excellent derivatives contracts on the asset – fell 7.42% over the previous day, leaving its valuation at $10.60 billion on the time of writing got here.

Supply: Coinglass

This drop in Open Curiosity normally signifies that merchants are closing their positions, presumably as a result of uncertainty or a insecurity within the short-term worth route.

Nonetheless, Ethereum’s Open Curiosity quantity has seen a big enhance, by greater than 100% to $38.97 billion.

Learn Ethereum’s [ETH] Value forecast 2024 – 2025

This enhance in quantity, regardless of the decline in Open Curiosity, indicated an elevated degree of buying and selling exercise, presumably pushed by speculative strikes in response to the current worth decline.

Excessive buying and selling volumes typically result in higher worth volatility, that means Ethereum might expertise additional sharp strikes within the close to time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024