Bitcoin

Here’s why Bitcoin’s 15% spike in Open Interest signals caution

Credit : ambcrypto.com

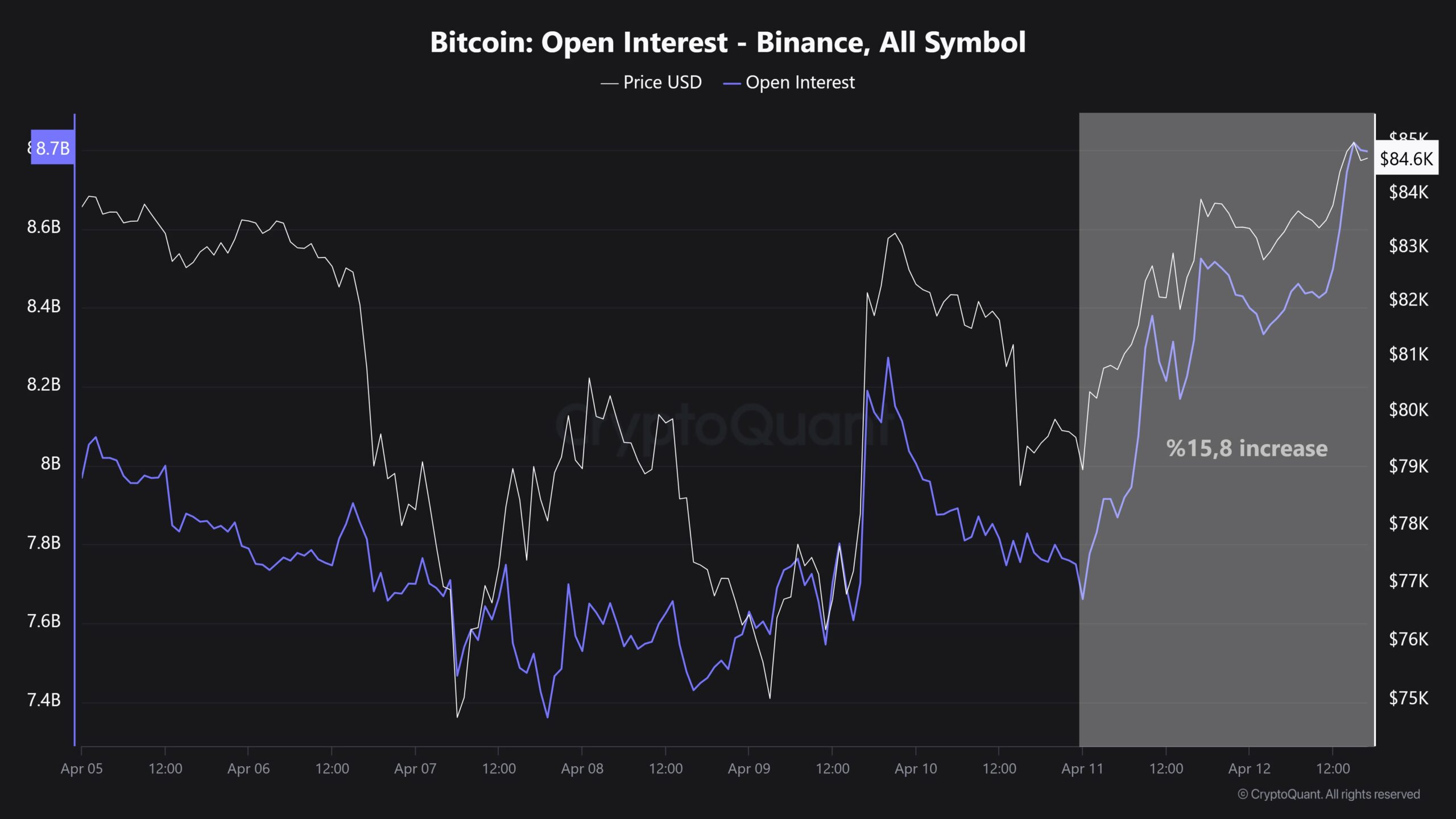

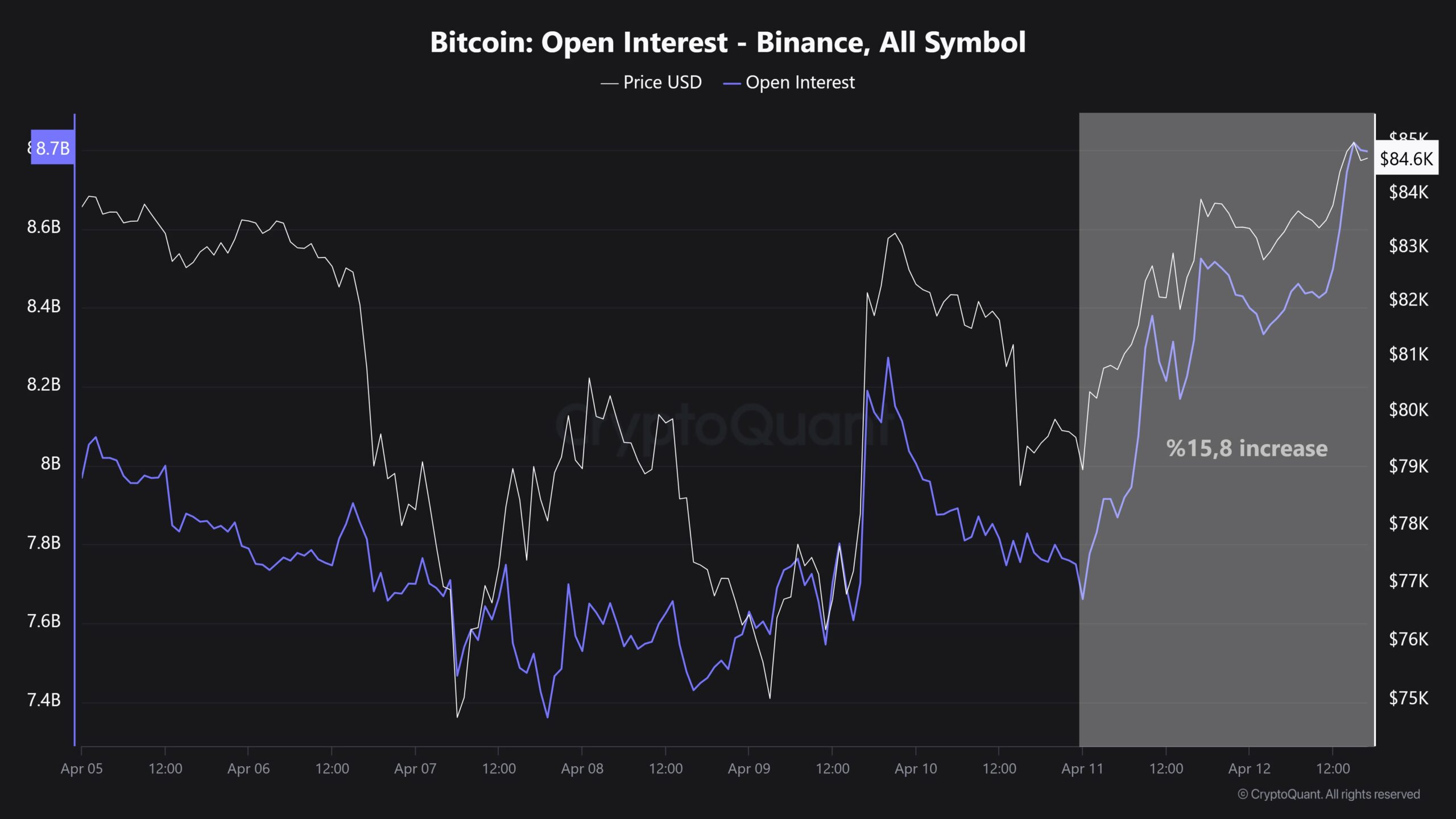

- Bitcoin’s OI made a outstanding leap of 15.8% when the weekly CME Futures closed at $ 84k.

- BTC minimize via the 50-day SMA, with the subsequent vital impediment because the 200-day SMA for $ 87k.

Binance’s Bitcoin [BTC] Open curiosity (OI) noticed a progress of 15.8% in someday, which elevated it from $ 7.6 billion to $ 8.8 billion on the press. The involvement of the market and the dealer has elevated significantly as a consequence of this fast improve of $ 1.2 billion.

Binance remained dominant within the commerce in cryptodivates, as a result of the OI place takes 31.4% of the overall OI capital of $ 28 billion.

Shortly rising OI meant the danger of market volatility, as a result of these broad liquidations can affect each lengthy -term lengthy and brief positions with excessive leverage.

Supply: Cryptuquant

A rise in OI typically signifies a rising bullish sentiment; Nevertheless, it will probably additionally activate reverse market actions or settle a fast aggressive place.

A pointy rise in OI can result in brief value fluctuations, primarily pushed by shifts in market sentiment or failed makes an attempt to take care of crucial resistance ranges.

Leverage powered pump and exercise

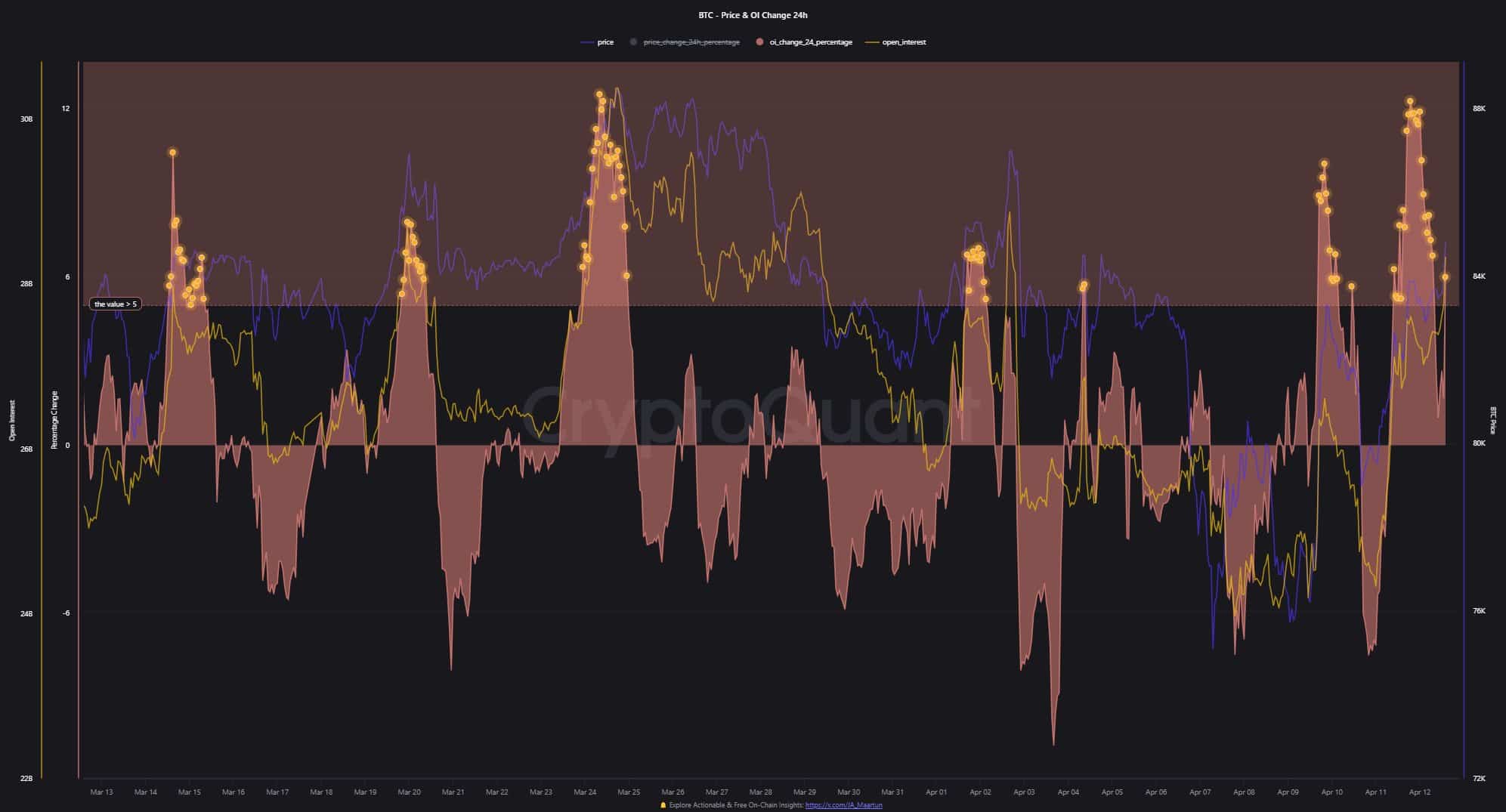

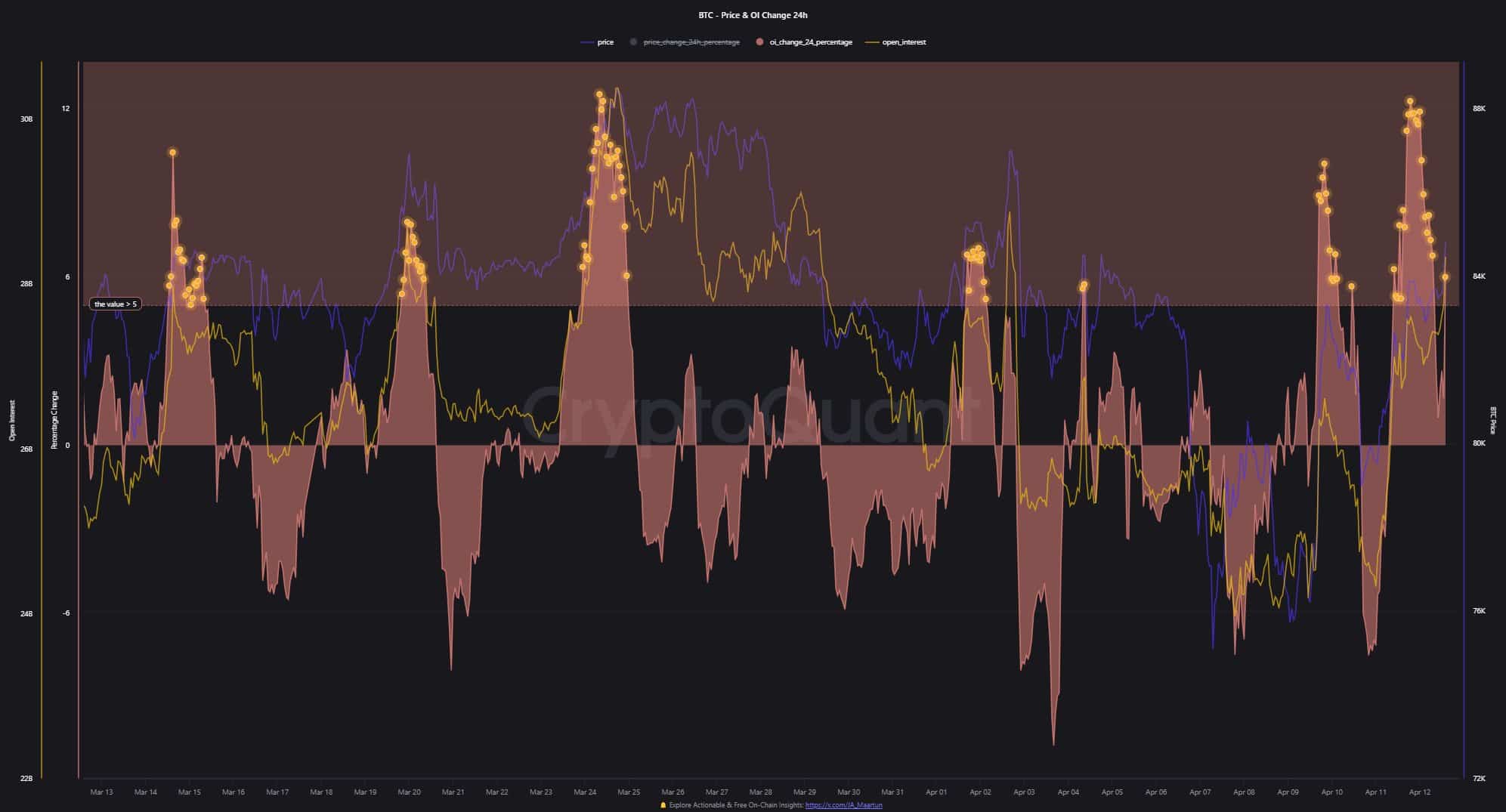

After this, the BTC spot costs closed on the degree of $ 84k, as laid down within the weekly CME Futures. The pump was because of the improve in extreme leverage, though this motion induced dangers for brief -term advertising and marketing merchants.

This robust upward development within the 24-hour share adjustments in OI confirmed a number of factors of greater than +5, which signifies an especially lengthy sentiment.

Supply: Cryptuquant

The current value die, powered by positions with excessive leverage, emphasised the danger of quickly pressured sale, just like developments that have been noticed up to now. This degree of market leverage underlined the significance of warning for merchants.

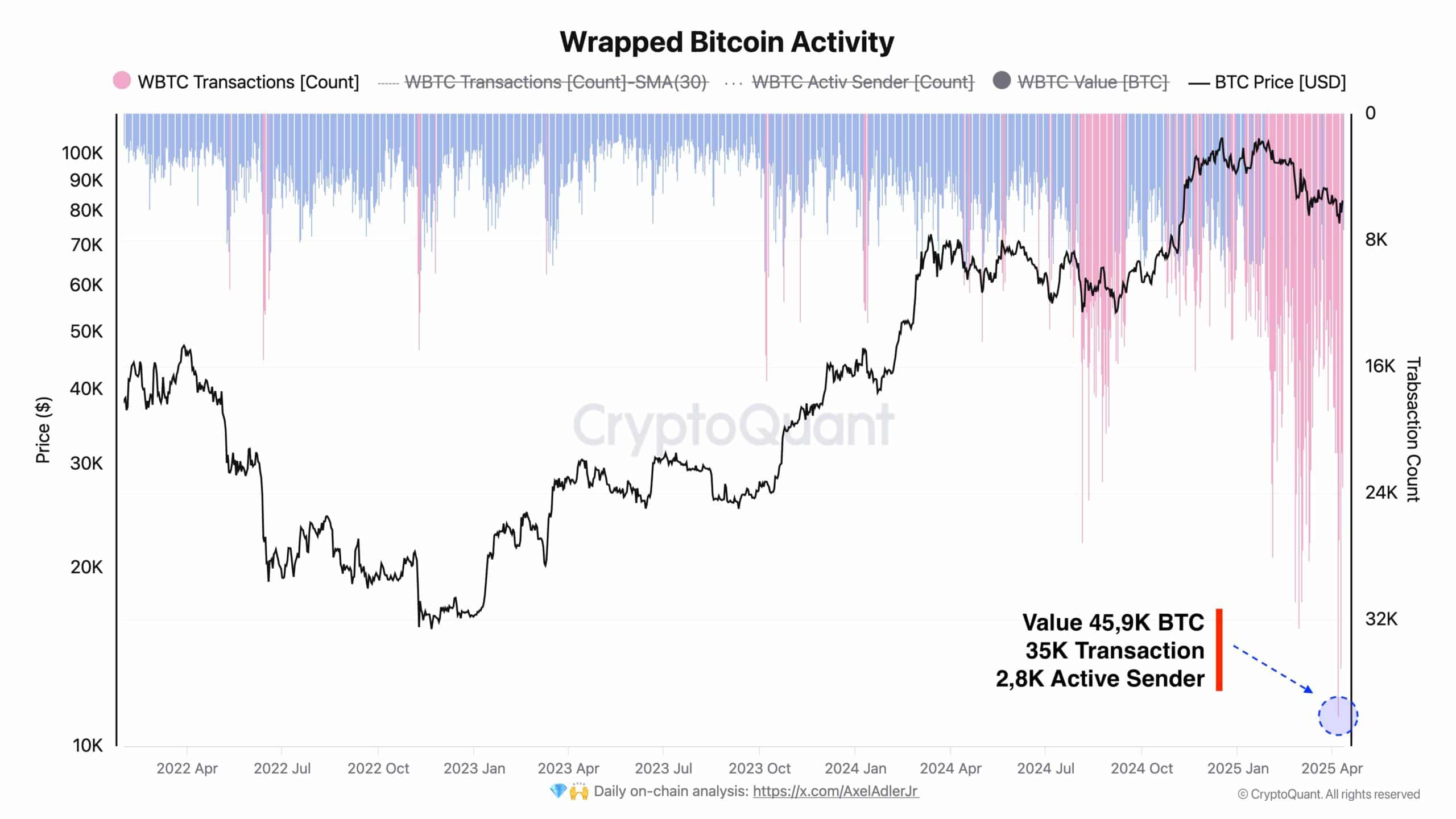

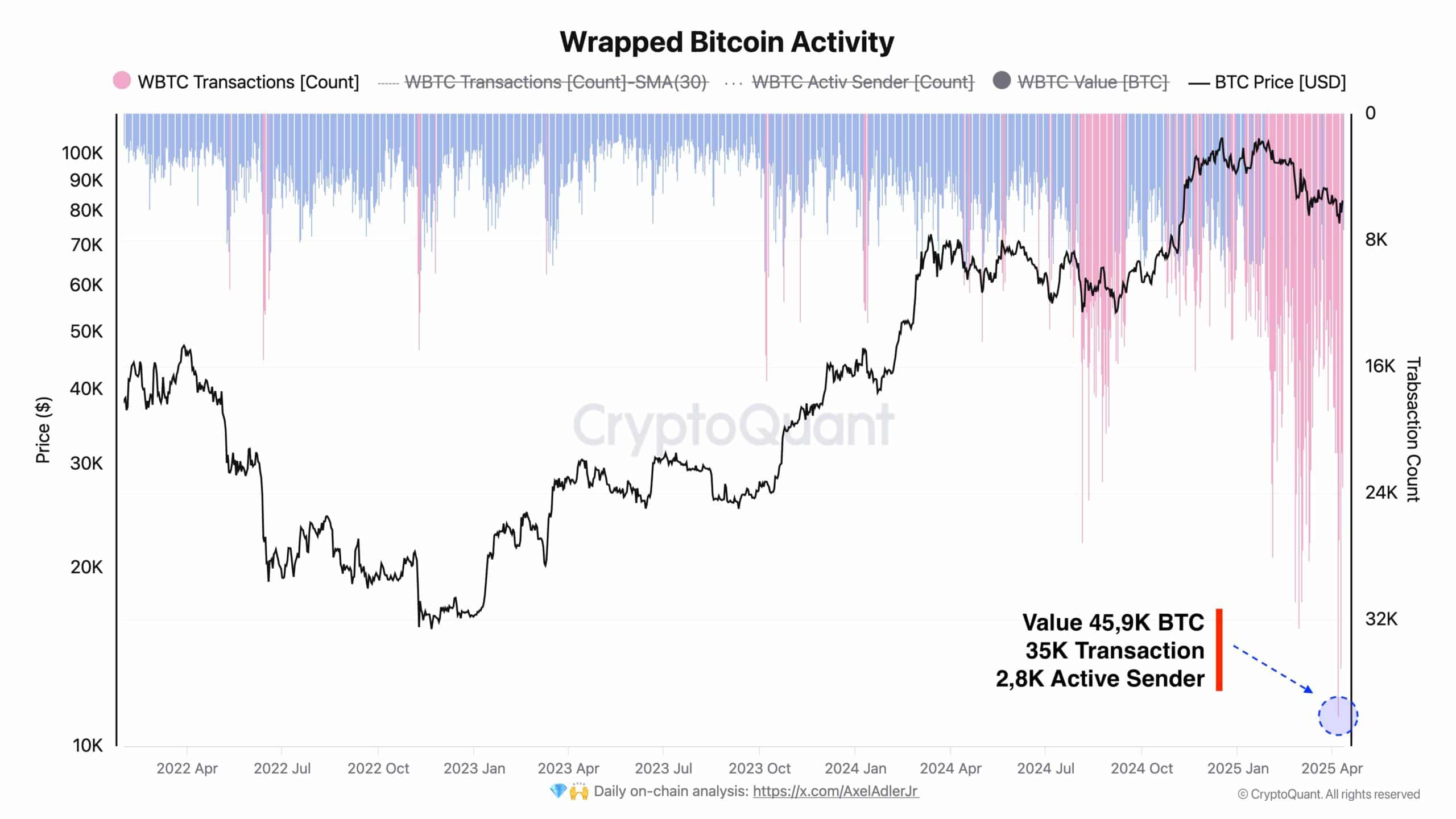

On the identical time, packed BTC [WBTC] Exercise reached a file excessive, with 35,000 transactions carried out over 2,800 lively portfolios and a complete motion of 45.9k BTC.

These developments occurred within the midst of elevated market volatility attributable to geopolitical crises and commerce conflicts between nations. Regardless of this macro -economic stress, WBTC customers confirmed resilience and continued to stimulate a outstanding improve in transactions.

Supply: Cryptuquant

Regardless of the 2 oppositional evaluations through which lifting tree positions appeared to trigger value fluctuations within the brief time period, WBTC exercise meant sustainable performance within the BTC area.

BTC Potential value actions

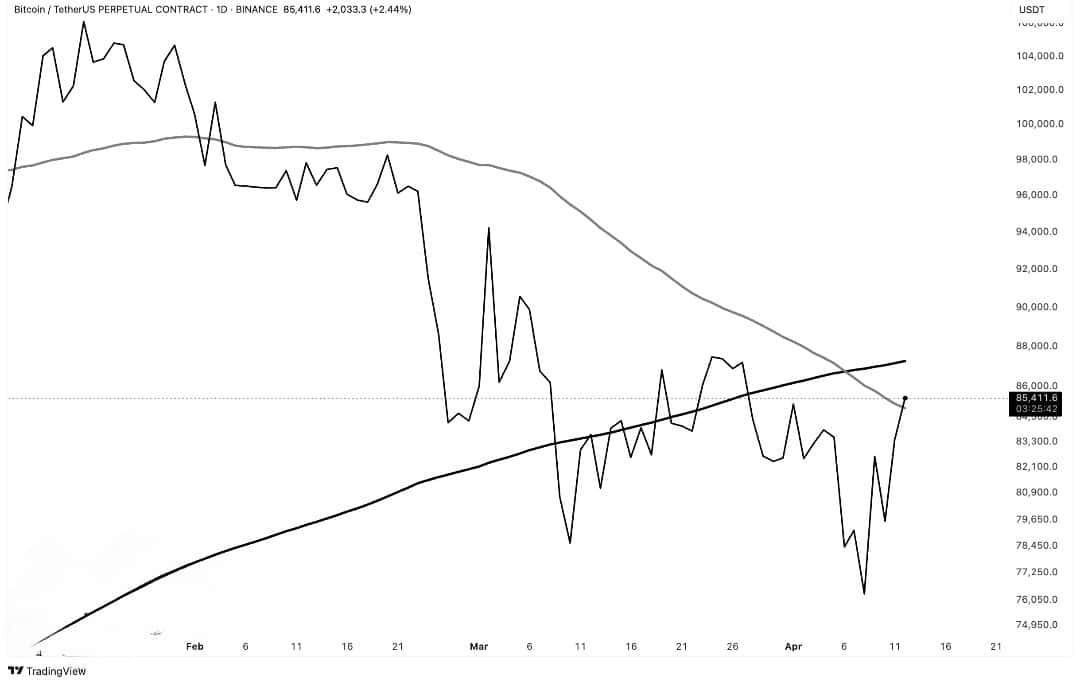

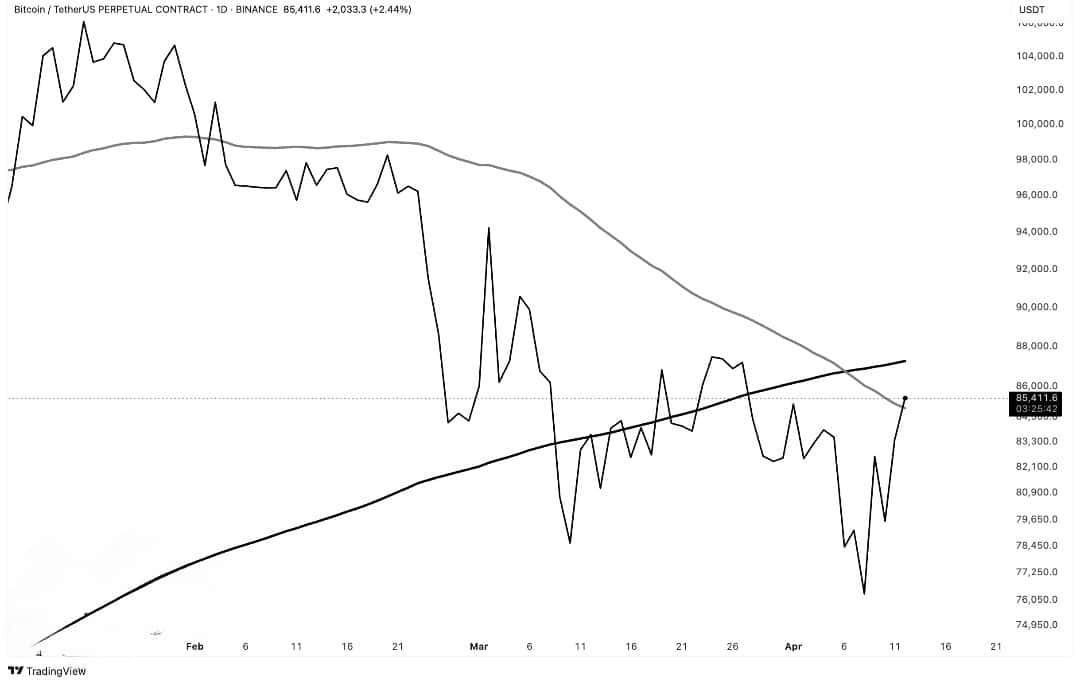

BTC additionally minimize the 50-day easy advancing common (SMA) whereas it approached the resistance on the 200-day SMA.

This outbreak confirmed an rising bullish development and a motion above $ 87k might most likely validate the present progress to $ 94k, whereas the vendor’s intervention is feasible close to that degree.

If the worth stays beneath $ 87K, this could verify the warnings associated to current leverage -based pump campaigns.

This will imply that it’s as little as $ 79k or $ 76k if costs fall beneath $ 84k, which might recommend that additional bearish Momentum could be.

Supply: X

The indecision of the market was confirmed by the stationary motion, which remained between two elementary advancing averages.

Buyers needed to observe robust value actions on either side to get the long run course of BTC.

Market sentiment can flip Bullish if costs are larger than $ 87,000, however steady Bearish efficiency beneath that degree will most likely retain a consolidation section or lengthen the present correction interval.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024