Blockchain

Hex Trust adds institutional custody for tokenized Uranium

Credit : cryptonews.net

Digital Asset Custody Agency Hex Belief has built-in Ethherlink, the Ethereum Digital Machine (EVM) appropriate layer 2 constructed on Tezos, so as to add institutional detention for XU3O8, a token -organized uraniumactive issued on the community.

The mixing is supported by Trilitech, the Assistic Hub for Analysis and Improvement (R&D) for Tezos and developer of Etherlink, who collaborates with Hex Belief to attach institutional prospects with XU3O8 and different property based mostly in Etherlink, in line with a Tuesday announcement with Cointelegraph.

“Tokenized uncooked supplies corresponding to uranium get institutional significance as extra real-world property transfer onchain,” mentioned Giorgia Pellizzari, head of the custody at Hex Belief.

With XU3O8, it’s talked about at a number of commerce festivals and customers can spend money on bodily uranium -U308, the product made when uranium ore is mined and milled. It’s supported by Uranium Handelsbureau Curzon and Change Archax regulated within the UK.

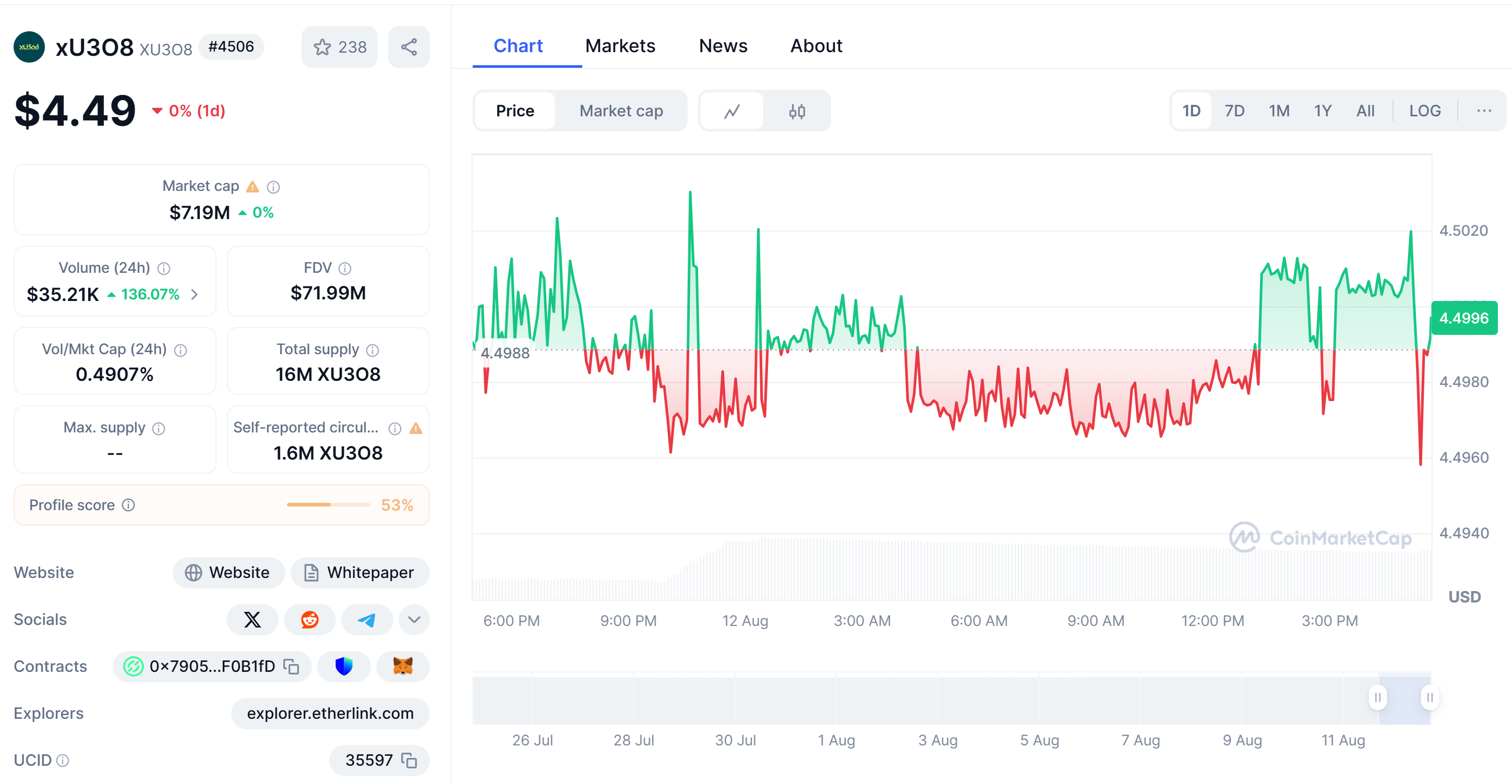

XU3O8 Worth. Supply: Coinmarketcap

Associated: Transak, uranium.io partnership let customers purchase tokenized uranium with crypto

Hex Belief extends RWA companies to Uranium

The addition of uranium extends the Actual-World property (RWA) from Hex Belief right into a items that’s tightly managed and traditionally troublesome for establishments to achieve entry.

Ben Elvidge, Trilitech’s head of business purposes, known as Uranium a “excellent match” for tokenization, stating challenges in market entry and value transparency.

“Now we are able to clear up each issues with blockchain rails. Having an excellent regulated custodian corresponding to Hex confidence within the combine makes it simply a lot simpler for establishments to baptize their toes within the water,” he mentioned.

Hex Belief has a allow in Hong Kong, Singapore, Dubai and Italy. Final yr the corporate introduced that it had in precept authorized the Singapore Monetary Regulator for a serious license for fee establishment (MPI).

Associated: RWA -Tokenmarkt will develop 260% in 2025 as corporations embrace the regulation of crypto

Uranium.io brings uranium commerce with Onchain

Final yr, Uranium.io, the world’s first decentralized request for uranium commerce, was launched on the Tezos Blockchain in collaboration with Curzon Uranium and Archax.

The platform is designed to decrease the entry thresholds within the world uranium commerce, which was traditionally dominated by institutional traders. Beforehand, retail traders might solely expose uranium through ETFs, as a result of direct commerce was largely restricted to institutional gamers with appreciable capital.

Earlier this yr, Transak labored along with Uranium.io to have retail traders tokenized uranium purchase with crypto or bank cards for less than $ 10, a pointy lower within the minimal of $ 4.2 million wanted within the freely obtainable market.

Journal: Tradefi builds Ethereum L2S to Tokenize – Inside Story in Rwas trillions

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?