Bitcoin

Hong Kong Investment Firm HK Asia Holdings Sees 103% Surge After Bitcoin Buy

Credit : coinpedia.org

Hong Kong-Based HK Asia Holdings Restricted has formally change into a member of the rising record of public firms investing in Bitcoin and the choice has already paid off. For the reason that buy of its first BTC on 16 February, the corporate’s share value has risen by 103.13%.

Have you ever ever had an funding technique paid so rapidly? Learn on for extra data.

HK Asia will increase Bitcoin Holdings

On February 16, HK Asia did its first Bitcoin -purchase, 1 BTC buy. Just a few days later, on February 20, the corporate added 7.88 extra BTC, which introduced its whole pursuits to eight.88 BTC.

Though it is a comparatively small funding in comparison with industrial giants, the impression on the shares of HK Asia has been exceptional.

Earlier than the Bitcoin buy, the shares of HK Asia acted at 3.19 HKD. On February 17, the primary buying and selling day after the acquisition, the share rose in someday by 72.1%. Since then it has continued to rise and 6.50 HKD has reached, which marks a revenue of 103.13%.

Might the shares of HK Asia hit a brand new excessive?

In the beginning of 2024, the inventory of HK Asia was priced at solely 0.295 HKD. Since then it has risen 2,137.29%, with a rise of 290.07% that’s registered between 13 and 17 February alone.

The share has now surpassed its June 2019 of all time Excessive (ATH) of 6.50 HKD. If the value applies, analysts are of the opinion that the corporate may shut above this key degree.

Yesterday the inventory of HK Asia closed at 6.30 am, after an intraday spotlight of seven.18 HKD. Nevertheless, it’s presently 2.94% underneath in the present day’s opening value.

Why does HK purchase Asia Bitcoin?

On February 23 HK Asia’s The board of administrators formally accredited its Bitcoin funding technique, after the development of listed firms that use BTC to extend the revenue and diversify property.

The sharp rise within the share value of HK Asia After the preliminary Bitcoin buy could have influenced the choice of the board to commit itself to a extra aggressive BTC technique.

Does the MicroStrategy playbook observe?

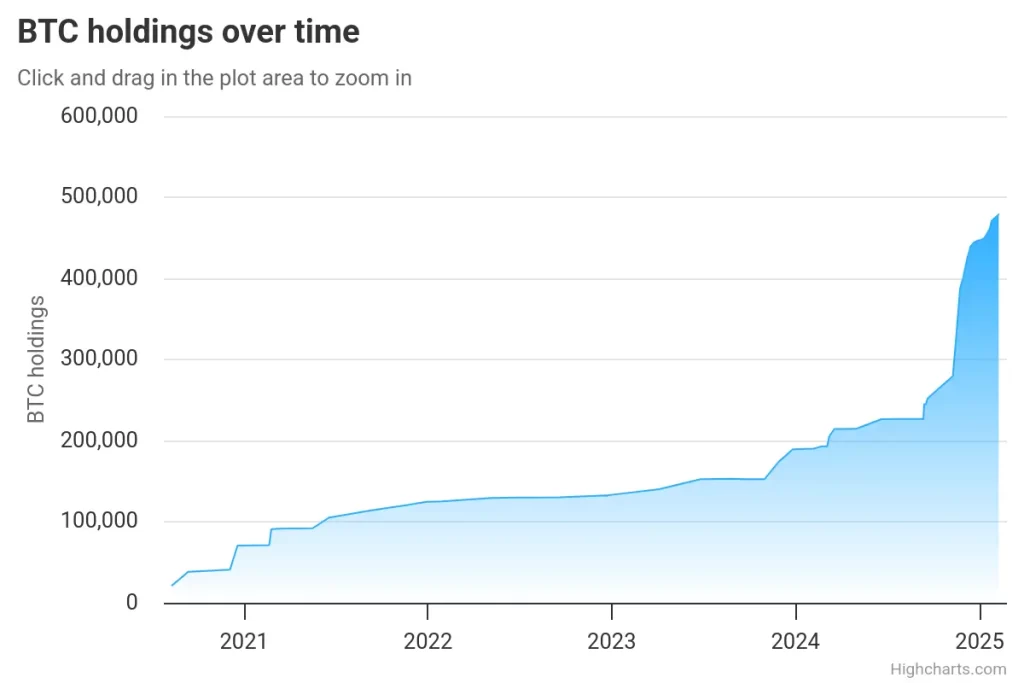

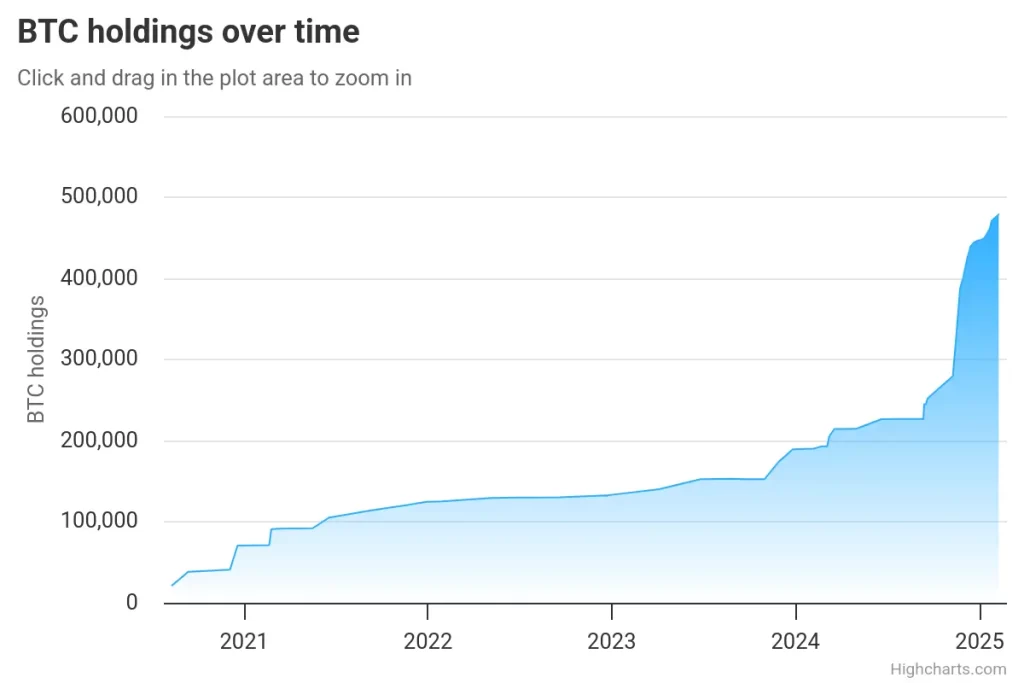

Technique (MSTR), Bitcoin’s largest public holder, is a robust advocate for BTC investments for firms. On the finish of final yr, the corporate inspired giant firms corresponding to Microsoft to observe.

The technique is presently 478,740 BTC, value round $ 45.76 billion. Though the pursuits of HK ASIA are a lot smaller, the share efficiency reveals that even a modest BTC funding could cause appreciable market results.

With Bitcoin on the steadiness sheet, HK Asia now runs on the identical wave as a number of the largest names within the business.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the newest traits in Bitcoin, Altcoins, Defi, NFTs and extra.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now