Policy & Regulation

Hong Kong pushes forward with stablecoin bill in legislative council

Credit : cryptonews.net

Hong Kong is presenting a stablecoin invoice to strengthen its regulatory framework for digital belongings.

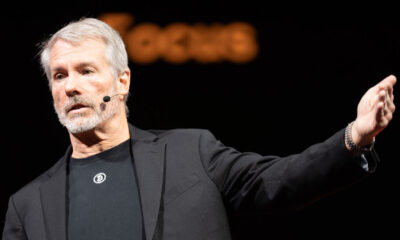

At a gathering of the Legislative Council on December 18, Christopher Hui, the Minister of Monetary Companies and the Ministry of Finance of Hong Kong, offered a stablecoin invoice for second studying. In gentle of the rising significance of fiat stablecoin issuers within the monetary sector, the legislation goals to supply them with a authorized framework.

The proposed laws require stablecoin issuers to have reserves equal to the worth of stablecoins in circulation, made out of liquid, high-quality belongings. The best to redeem stablecoins at face worth with out exorbitant charges or delays would even be assured to holders. The framework additionally contains strict threat administration procedures, disclosure necessities and safeguards towards cash laundering.

You may additionally like: What are stablecoins and the way do they work?

The Hong Kong Financial Authority (HKMA) would have the facility to license stablecoin issuers, monitor compliance and examine violations to make sure monitoring. The broad assist for the invoice throughout final yr’s public session strengthened Hong Kong’s willpower to manage digital belongings sensibly and in keeping with worldwide requirements.

Hui additionally talked about in his speech that “fiat stablecoins have the potential to develop right into a extensively accepted technique of cost, making a extra pressing threat to financial and monetary stability.”

He defined that the speedy adoption of stablecoins, if left unchecked, may disrupt conventional monetary programs, undermine financial coverage and create vulnerabilities resulting from their dependence on personal entities for issuance and reserves.

These considerations are amplified by the rising significance of stablecoins, which on the time of writing have reached a market capitalization of $220 billion. Main the market are issuers like Tether, with a market cap of $142 billion, and Circle’s USDC, valued at $42 billion. Whereas these belongings present stability in a notoriously unstable market, their dimension and dependence on centralized issuers pose systemic dangers.

Hui’s considerations spotlight that such large-scale reliance on personal entities for issuance and reserve administration may disrupt monetary stability, particularly if reserves are poorly managed or reimbursement ensures usually are not met during times of financial stress.

This urgency for regulation is additional highlighted by Hong Kong’s efforts to distinguish its digital asset framework from mainland China’s strict cryptocurrency restrictions.

Mainland China’s strict cryptocurrency laws are in stark distinction to Hong Kong’s plan. As China focuses on its central financial institution digital foreign money, the digital yuan, Hong Kong’s regulatory framework seeks to supply readability and oversight for personal issuers like Tether and Circle.

Hong Kong is working to advertise a extra numerous digital asset ecosystem, whereas China has banned nearly all of personal cryptocurrency actions.

By implementing these steps, Hong Kong goals to bridge the hole between established monetary programs and the rising digital asset market. Readability in laws can be sure that Web3 innovators and stablecoin issuers search for a steady and safe working surroundings.

Learn extra: Hong Kong could launch stablecoin laws in mid-2024

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024