Bitcoin

How Bitcoin’s move above $80K helped crypto liquidations cross $800 mln

Credit : ambcrypto.com

- Lengthy and brief positions noticed a spike in liquidation quantity over the past buying and selling session.

- Bitcoin contributed greater than $500 million to the liquidation.

The cryptocurrency market has just lately witnessed vital liquidation exercise, with Bitcoin [BTC] on the forefront of those actions.

As merchants navigate risky worth swings, liquidating lengthy and brief positions gives essential insights into the present state of the market. The newest information reveals leverage and threat within the crypto ecosystem.

Longs and shorts reached notable ranges

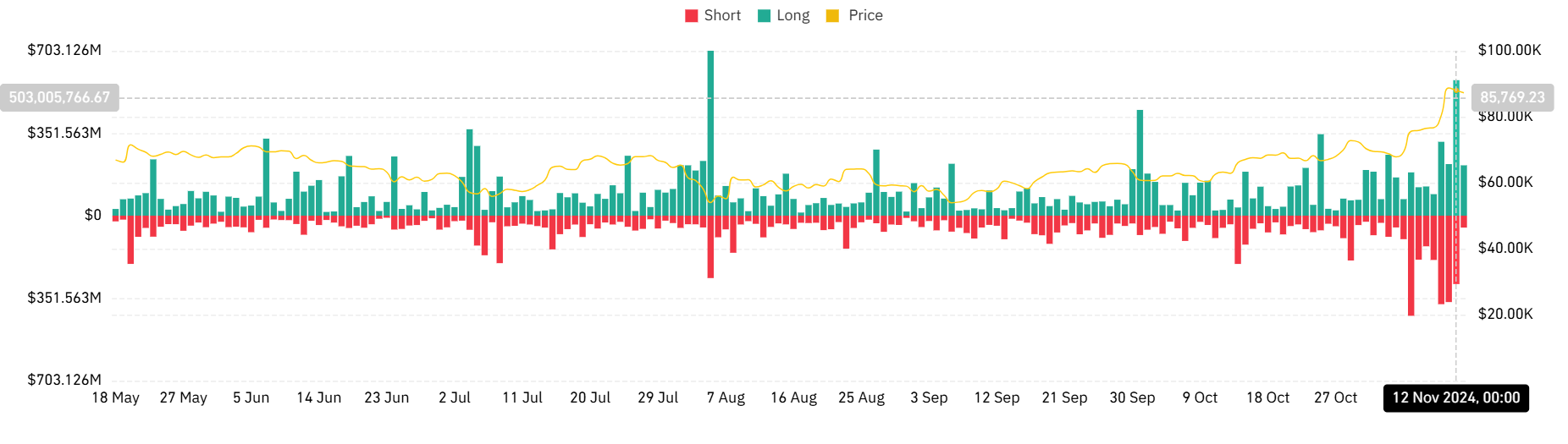

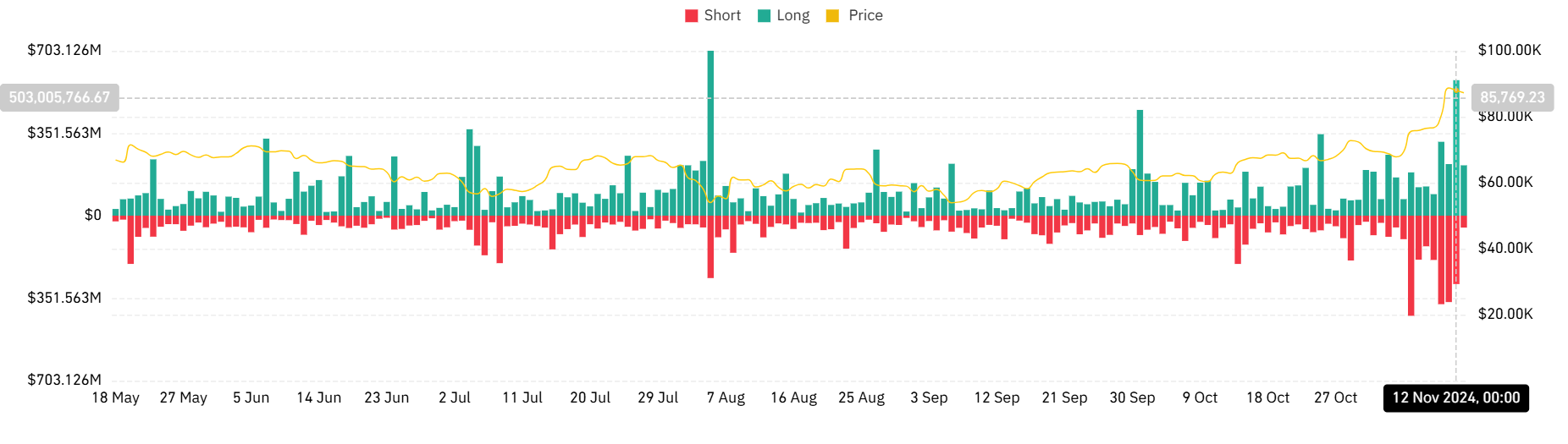

In response to the liquidation schedule on Mint glassGreater than $503 million in liquidations have just lately been recorded, highlighting the influence of Bitcoin’s fast worth actions.

Moreover, AMBCrypto’s evaluation of the whole liquidation confirmed that it rose to nearly $870 million within the final buying and selling session.

Supply: Coinglass

This development illustrated the precarious stability of leverage available in the market, the place merchants betting on continued upward momentum have been caught off guard by sudden worth corrections.

Conversely, the rise in brief liquidations instructed that Bitcoin’s latest rally compelled bears to hedge positions because the asset broke previous key resistance ranges.

Excessive leverage concentrations

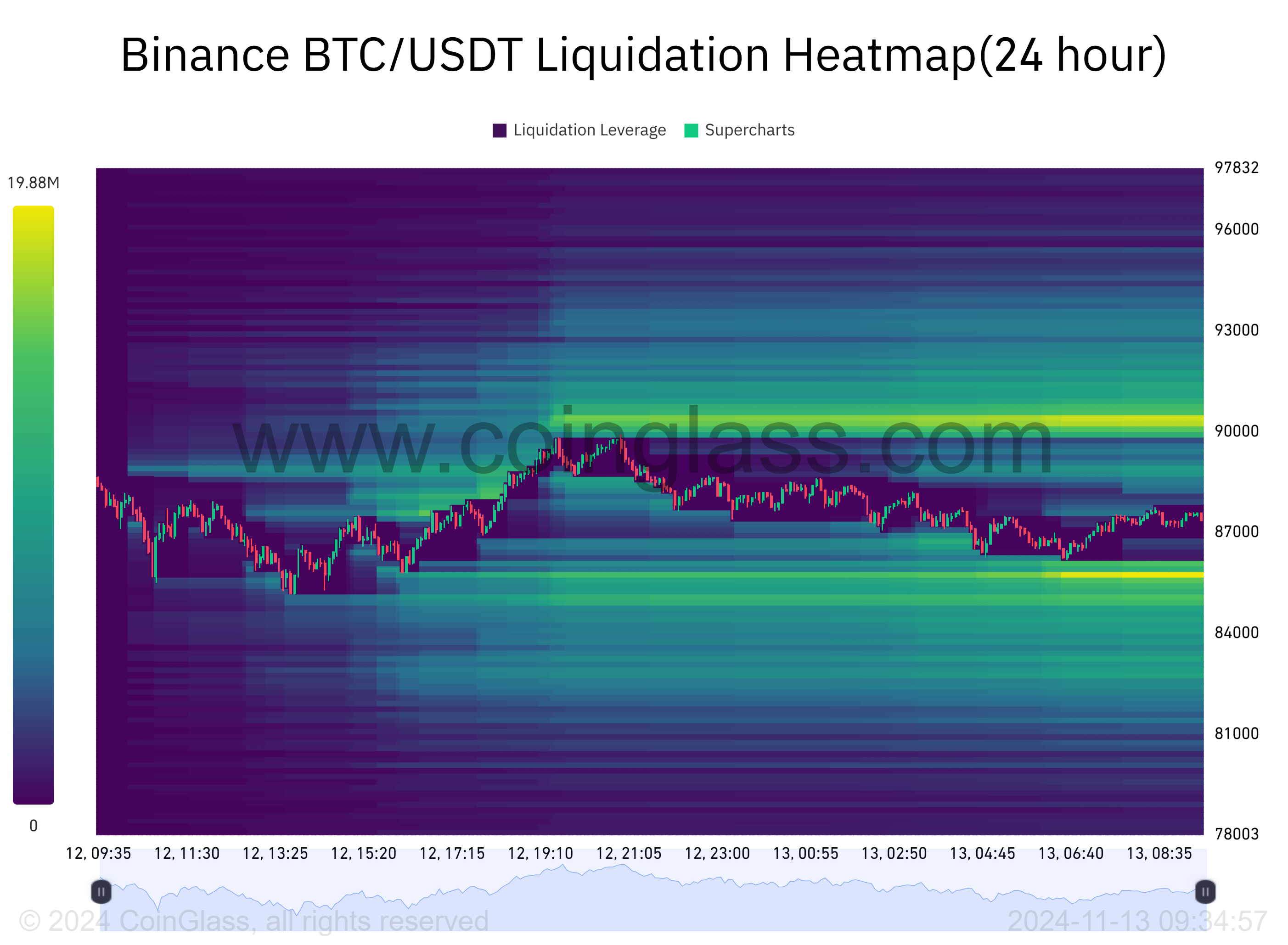

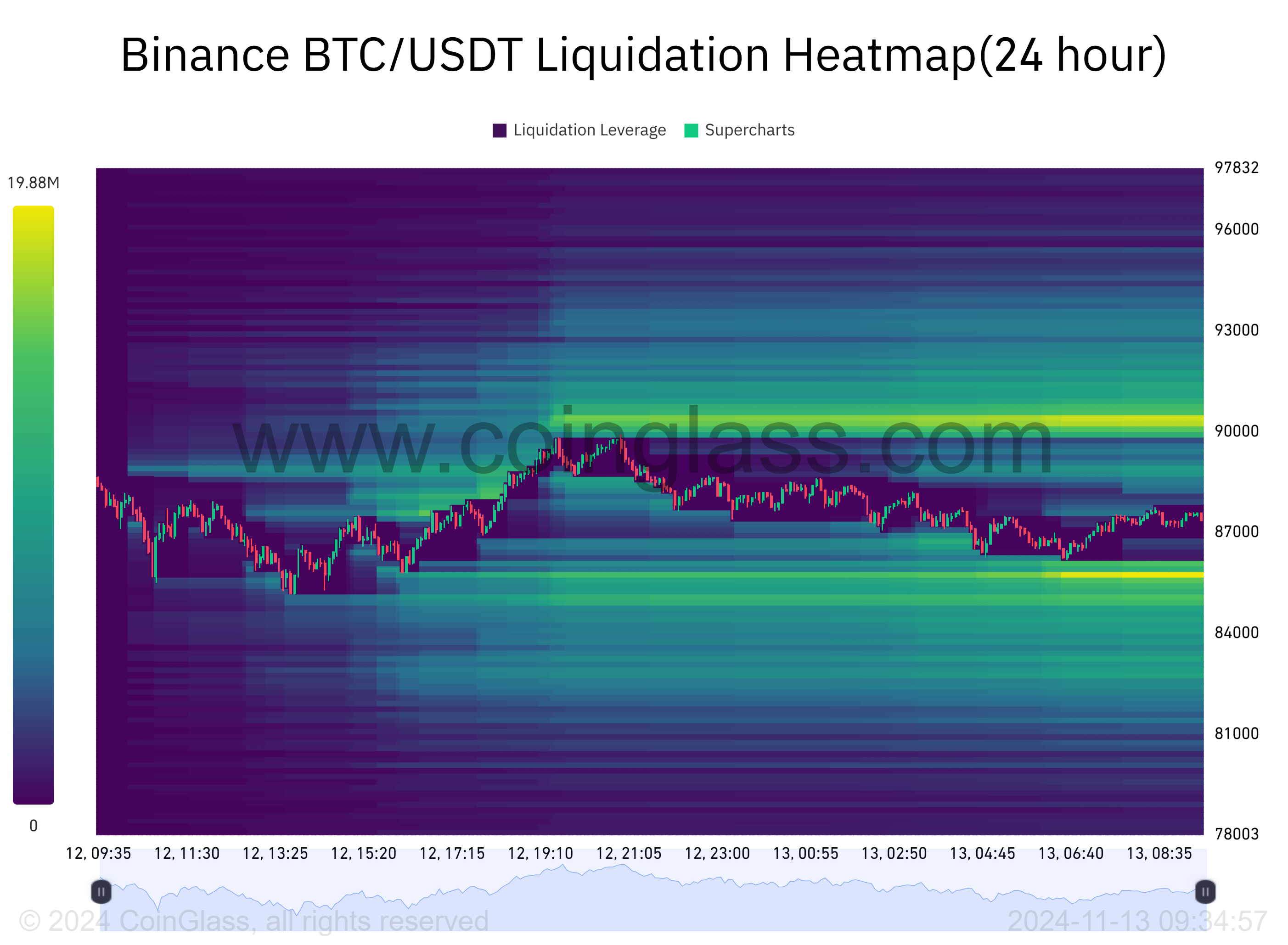

The Binance BTC/USDT Liquidation Heatmap offered further context and confirmed areas of concentrated liquidation exercise.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker areas representing increased debt ranges and extra vital liquidations.

This focus round Bitcoin’s psychological resistance ranges underscored the depth of speculative buying and selling available in the market.

Supply: Coinglass

The yellow line on the chart indicated that Bitcoin’s worth was approaching $85,769, which correlated with the lengthy and brief liquidation wave.

Particularly, the liquidation of lengthy positions dominated the market as Bitcoin’s worth retreated from latest highs, triggering stop-loss orders and margin calls.

Curiously, the liquidation heatmap exhibits that leveraged merchants have positioned vital bets close to present worth ranges, creating each alternatives and dangers.

Whereas these zones can act as liquidity swimming pools to drive worth motion, additionally they sign potential market vulnerability as liquidations proceed to pile up.

Implications for the market

The spike in crypto liquidations, particularly on main exchanges like Binance, mirrored the elevated volatility of the broader market.

With Bitcoin close to all-time highs, liquidation information has highlighted each the keenness and vulnerability of market individuals.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Because the market strikes, merchants will hold an in depth eye on key worth ranges and liquidation information to gauge the following directional transfer.

Whereas liquidations can exacerbate short-term worth fluctuations, additionally they present alternatives for market stabilization and the emergence of recent tendencies.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now