Blockchain

How BNB Chain and XRP Ledger Are Outpacing Ethereum and Solana in Real-World Assets

Credit : cryptonews.net

BNB chain and XRP whides (XRPL) have positioned itself as entrance runners within the Actual World Asset (RWA) sector. Each reported substantial will increase within the RWA worth, main progress in August.

Nonetheless, this progress comes within the midst of a broader fall within the sector, with RWAS that’s nonetheless behind different blockchain sectors.

BNB chain and XRPL Leiden RWA -Development within the midst of wider sector decline

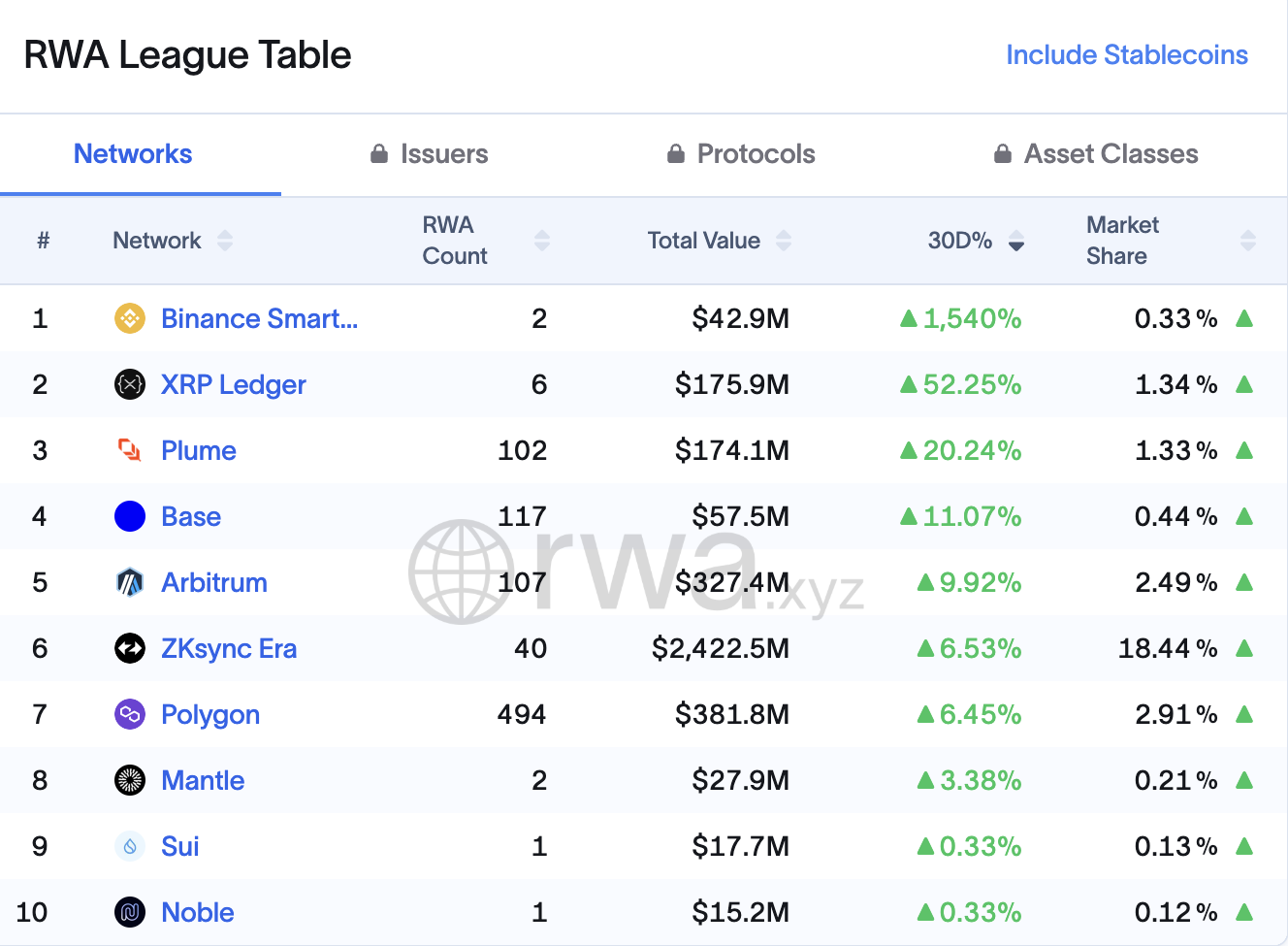

In keeping with knowledge from RWA.XYZ, the worth of RWAS on the BNB chain has risen 1,540percentwithin the final 30 days, making it the best revenue. Following the community was the XRPL, which has seen a rise of 52.2%.

However, the highest protocols have worth, together with Ethereum, Aptos, Solana, Stellar and different, all misplaced worth in the identical time-frame.

Main RWA networks by way of progress. Supply: rwa.xyz

BNB chain now has 0.33% of the market share. Furthermore, the first catalyst for its progress is the Vaneck Treasury Fund (VBILL).

Vbill is the primary tokenized fund from Vaneck. It’s out there on a number of block chains, together with BNB chain, Avalanche, Ethereum and Solana. It presents on-chain entry to short-term notes on the American treasury.

Equally, the RWA progress of Xrpl was led by the openings of Opening.

“@Openeden_x sacrifices a wise contract vault managed by a regulated entity, offering 24/7 Entry to us treasury Payments (T-Payments) By the Openeden Tbill Vault. This on-chain Liquid Liquid BY IN-BILLESS, SHYVABLETS 1: 1 by T-Payments, USD Coin (USDC), and US Greenback reserves, “An Analyst defined.

Within the meantime, Phil Kwok, co-founder of Easya, additionally attributed progress to Rlusd Stablecoin van Ripple. Beincrypto beforehand reported that the Stablecoin was one of many quickest rising belongings in the marketplace.

“Very spectacular progress of the XRP whides. The quickest enhance in the actual world belongings in comparison with some other blockchain,” Kwok posted.

It’s price noting that XRPL just lately made exceptional progress in tokenization. Ripple beforehand labored with CTRL Alt to assist the actual property agentization undertaking of the Dubai Land Division on the XRPL. As well as, Circle’s USDC Stablecoin went stay on the community in June.

Ripple specifically is kind of optimistic concerning the progress of the whole sector. In a report, the corporate predicted that the sector might go to $ 18.9 trillion within the Actual-World belongings by 2033.

Nonetheless, not everybody shares this optimistic imaginative and prescient. Not too long ago, Monetary Gigant JP Morgan acknowledged that the final marketplace for Tokenized belongings stays ‘quite insignificant’.

“This quite disappointing picture about tokenization displays conventional buyers who to date no must see it. There’s to date little proof of banks or clients who go from conventional financial institution deposits to Tokenized financial institution deposits on blockchains,” wrote Nikolaos Panigirtzoglou, written.

Furthermore, the sector is especially dominated by crypto-native corporations, with a complete market capitalization of round $ 25.7 billion. The truth is, its progress has been comparatively gradual.

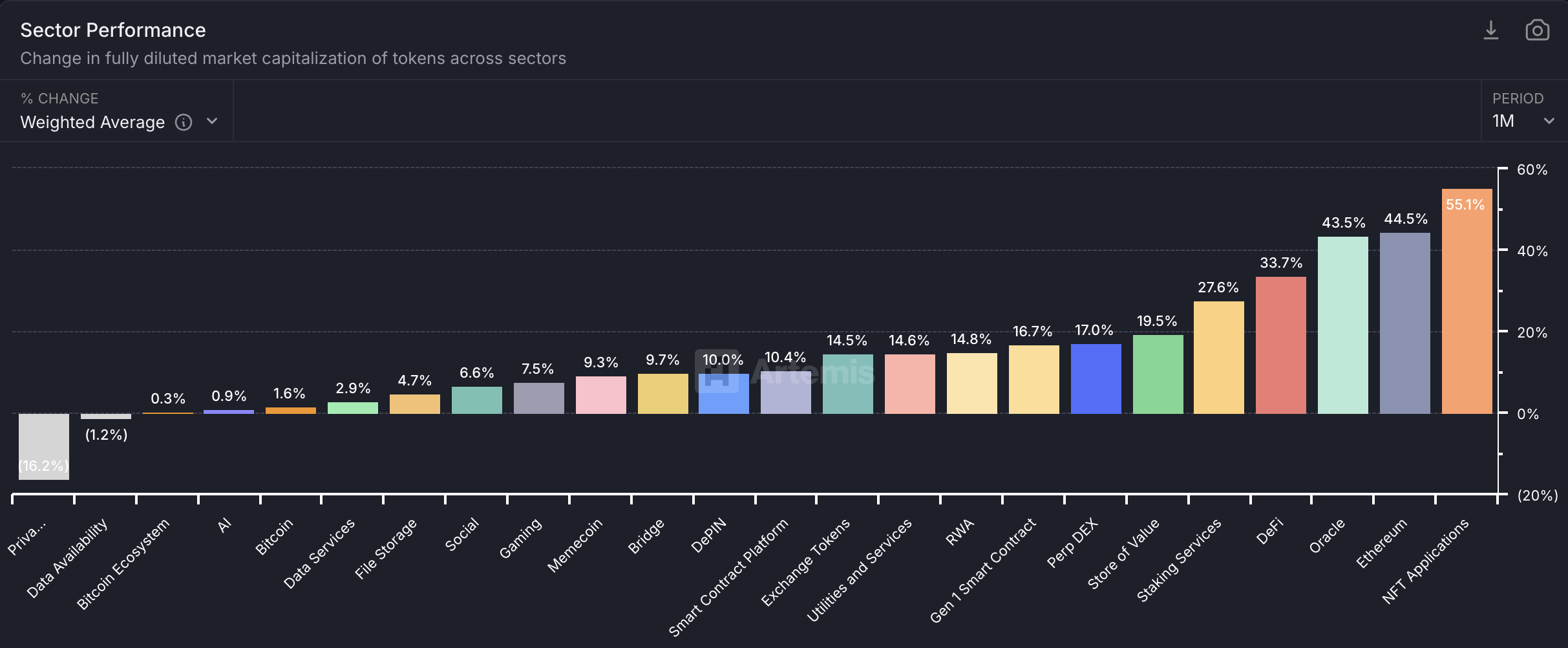

The efficiency of the crypto sector. Supply: Artemis

Information from Artemis confirmed that RWAS grew by solely 14.8% previously month. This determine is pretty underwhelming, particularly compared with the large progress that’s seen in non-fungal tokens (NFTs), Ethereum, Decentralized Finance (Defi) and different sectors.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?