Altcoin

How Fast Can Polkadot Break $6? A look at DOT’s recent market moves

Credit : ambcrypto.com

- DOT has proven traditional indicators of a wholesome, growth-driven retracement.

- Nonetheless, endurance could also be examined earlier than an outbreak happens.

Polka dot [DOT] displays the broader market’s restoration from a four-month hunch, largely fueled by post-election hype that pushed the inventory near $6. Nonetheless, a three-day pullback noticed the inventory drop to $4.75, with every day lows of virtually 7%.

As is usually the case with crypto, each dip presents a chance for buyers to push the value greater by establishing resistance as new assist. Buying and selling at $5.64 on the time of writing, if DOT has adopted this technique, there’s a good probability that it’s poised to interrupt the $6 ceiling, with the subsequent goal probably reaching $7.

Consolidation required for DOT to interrupt $6

Apparently, DOT’s peak round $6 coincided with an overbought RSI on the every day chart, indicating an overheated situation. This led to panic amongst merchants, who feared an impending correction and exited the cycle earlier than it might happen.

Usually, an exit with out ample shopping for stress results in a pullback. In distinction, consolidation – the place there’s a steadiness between shopping for and promoting – usually units the stage for a breakout.

Taking a look at DOT’s every day chart, a retracement introduced the value right down to virtually $4,775. Nonetheless, two large inexperienced candlesticks within the days that adopted, every notching a better excessive, present that bulls have taken benefit of the dip and bought DOT tokens at a reduced value.

Positive, the bulls have proven confidence in Polkadot’s long-term prospects, however this is probably not sufficient to ensure a transparent breakout. To attain a breakout, bulls must maintain the value above $5, which might probably result in consolidation.

The reasoning is obvious: if we contemplate the general market efficiency of different cash, Polkadot nonetheless lags behind rivalslots of which have posted spectacular double-digit weekly good points. This volatility makes DOT extra delicate to sharp swings.

Subsequently, to keep away from panic promoting, bulls ought to concentrate on sustaining present momentum. Constant accumulation might be essential to stop DOT from altering course and stabilize the value, laying the inspiration for sustainable development sooner or later.

$7 should be too bold

As talked about earlier, DOT is displaying traditional indicators of a wholesome growth-driven retracement, with the value anticipated to fluctuate inside a sure vary within the coming days.

This conduct is the results of a method utilized by spot merchants to permit DOT to consolidate, particularly in a market going through uncertainty.

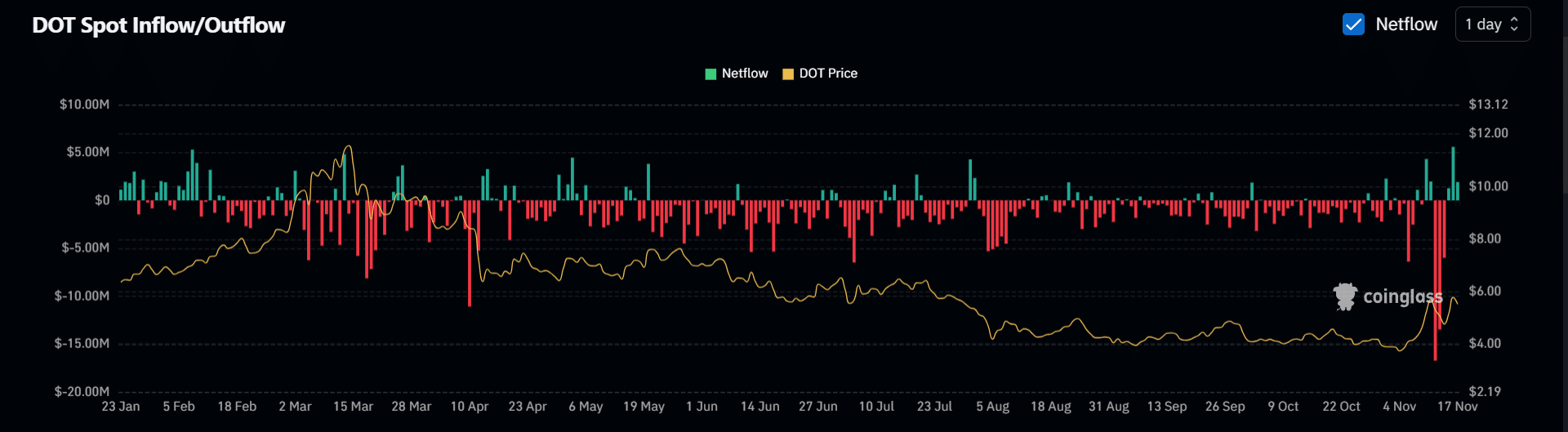

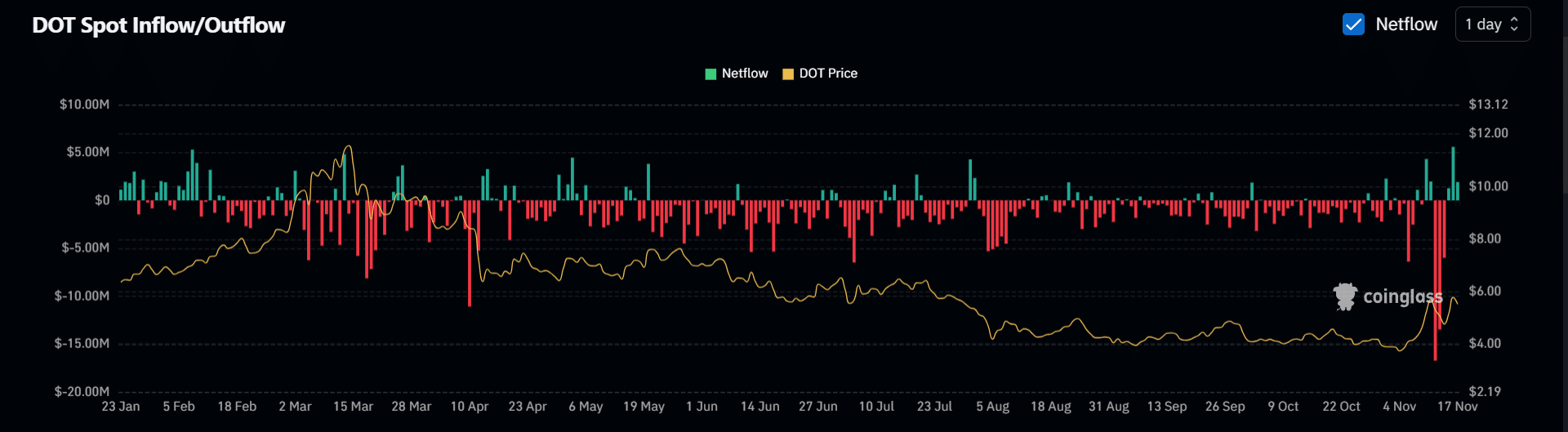

Whereas the subsequent main transfer in the direction of $7 largely depends upon Bitcoin breaking by key psychological ranges, the constant crimson candlesticks shifting south on the chart under point out a bullish outlook, positioning DOT for a potential breakout in the direction of $6.

Supply: Coinglass

Nonetheless, regardless of web outflows reaching an annual excessive of $16.3 million, the impression on DOT’s value was reverse to expectations. Whereas excessive web outflows often point out aggressive accumulation, DOT fell 7%, indicating potential distribution by giant HODLers.

So until this dynamic modifications, it could be troublesome for DOT to focus on $7 as its subsequent value.

Learn Polkadot [DOT] Value forecast 2024-2025

Whereas continued buyouts are anticipated to stabilize Polkadot and make sure $5 as new assist, a extra important accumulation of enormous HODLers will seemingly decide whether or not DOT can method $6.

This might change as soon as BTC crosses $93,000, giving whales the precise incentive to enter.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now