Analysis

How High/Low Can Bitcoin Price Go This Week?

Credit : coinpedia.org

Bitcoin is at a decisive intersection this week, with bulls that regulate an outbreak prior to now. Regardless of a current worth lower, sentiment tries to go everywhere in the derivatives and spot markets. With BTC worth commerce round $ 107,095 and reserving almost 2% every day revenue, the broader crypto market can also be intently watching. Liquidity zones under can act as falling for brief sellers, whereas persistent velocity above $ 107k might ignite an Altcoin rally. Take part on this intention to attain the potential Bitcoin worth targets for this week.

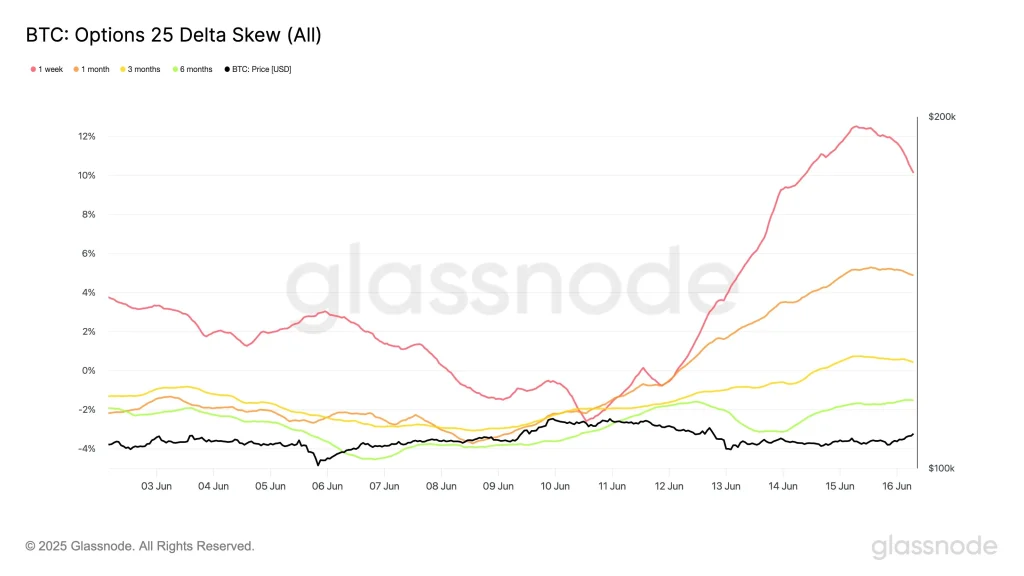

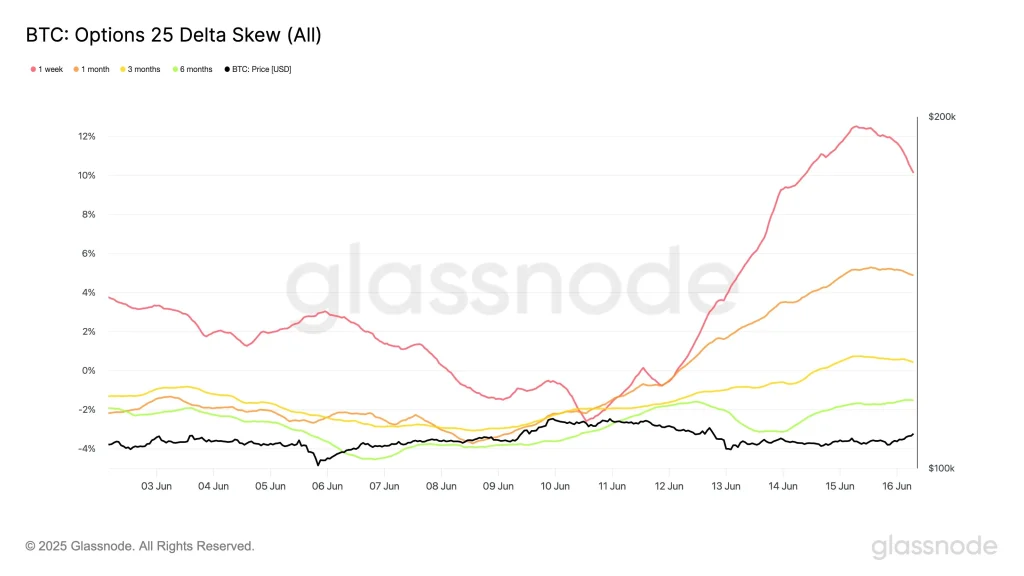

Onchain -Information: Choices Market goes Bullish

Probably the most significant sign this week comes from the choice market. In response to Glass nodeThe 25 Delta Skew, a statistics to measure the demand for calls versus Putten, has develop into heavy bullish:

- 1 -week crooked soar from -2.6% to +10.1%

- 1 month skewed rose from -2.2% to +4.9%

This shift emphasizes merchants who rapidly accumulate quick -term on -call choices, within the expectation of upward volatility. It’s value noting that the divergence between rising crooked and stagnant spot costs means that the market is anticipating an imminent outbreak that isn’t but priced.

Such skew dynamics are usually earlier than sharp directional actions, with the present bias that implies the wrong way up. The rise within the course of the skew, particularly for the forging within the quick time period, emphasizes belief in a bullish catalyst inside the coming days.

Bitcoin -Worth evaluation: calm earlier than the breakout -Storm

In response to a message from analyst Michael van de PoppeThe value construction of Bitcoin signifies {that a} bigger enlargement might unfold if the BTC worth ran above $ 107,000. The graph evaluation shared by him exhibits that the vary from $ 106.6k to $ 107k stays the essential space for momentum irritation.

He additional states that if the liquidity constructing is about $ 105.5k, a sweep to $ 103k might be. The Spotbuy zones are successively on the stage of $ 103k, with additional security nets under $ 100k.

That stated, psychological components corresponding to geopolitical stability, particularly within the Center East, can stimulate the urge for food for the danger and trigger a breakout momentum. If Bulls releases $ 107k, an upward motion to $ 108k may very well be on the horizon, which might presumably open the gates for $ 110.5k.

Additionally learn our Bitcoin (BTC) Worth forecast 2025, 2026-2030 for long-term worth forecasts.

FAQs

Resistance is $ 107k – $ 108.9k, whereas help zones are round $ 105.5k and $ 103k.

It signifies that merchants anticipate volatility and are strongly skewed in direction of the upward within the quick time period.

Provided that the help of $ 105.5k and $ 103k failed, would there most likely be a motion below $ 100k and liquidity -controlled.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024