Bitwise has formally introduced that its spot XRP ETF will go stay in the present day on the New York Inventory Change. The corporate known as it a giant step ahead for XRP, now the world’s third-largest crypto asset by market capitalization. A list web page for the fund has already appeared on Bloomberg, and the ticker will merely be XRP, a rarity and a extremely sought-after image.

Bitwise additionally purchased the area BitXRPetf.comindicating a robust advertising push behind the product. The fund has a 0.34 % administration charge, however Bitwise will waive that charge for the primary month on the primary $500 million in property.

What concerning the value of XRP in the present day?

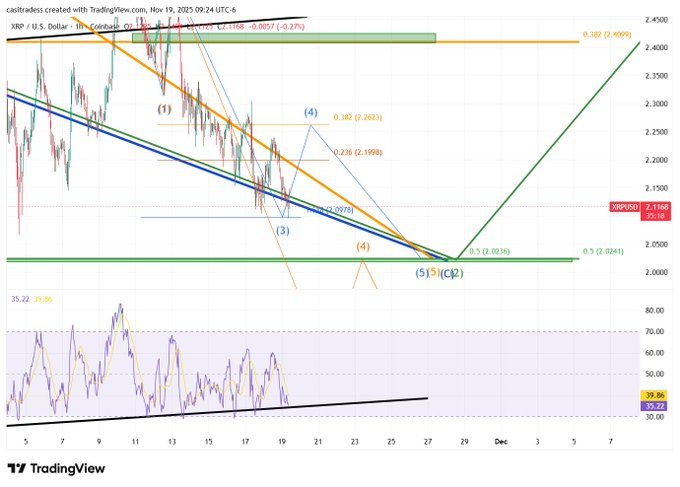

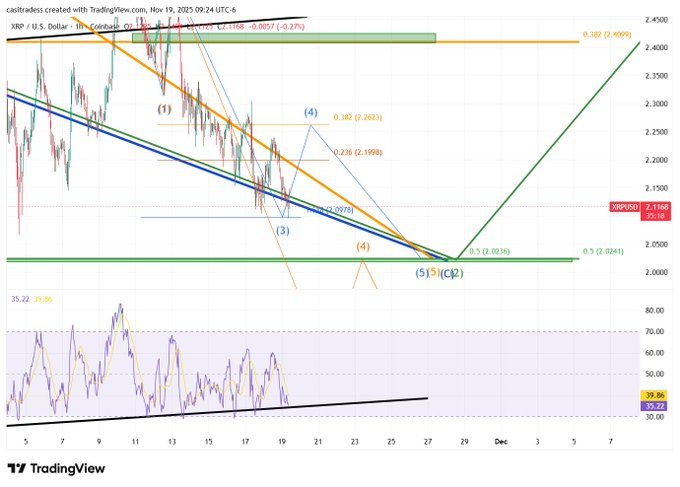

XRP lately fell in the direction of $2.10, however analysts say the transfer appears regular for a Wave 4 correction. XRP additionally hit its RSI assist trendline, indicating a potential rebound.

A pullback to $2.26 continues to be potential within the brief time period, whereas the macro FIB degree of $2.03 stays the principle assist zone of this whole correction part.

Why this ETF is vital for XRP

Analysts say this ETF may trigger a “provide shock” as licensed members would wish to buy XRP to seed and assist the fund.

In addition they count on demand to rise resulting from world macro shifts, together with what analyst Jake Claver calls the “reverse carry commerce” – a scenario through which rising rates of interest in Japan may set off huge monetary flows into different property, together with crypto.

Claver says this domino impact may push XRP into a serious long-term demand cycle, particularly if establishments begin treating it as a real funds infrastructure.

There may be additionally hypothesis that BlackRock may launch its personal XRP ETF in 2025, which might add much more strain to safe XRP provide.

Will the Bitwise ETF Spark a Rally?

The launch may spark new inflows in the present day, however analysts warn that XRP may nonetheless exhibit “jerky” or sideways conduct initially, very similar to Bitcoin and Ethereum did when their ETFs first launched.

Nevertheless, a very powerful query will not be whether or not XRP will make a leap in the present day, however whether or not:

- The inflow will proceed this week

- new ETFs launching on November 20 and 22 will add extra shopping for strain

- establishments accumulate XRP all through the month of December

With ETFs on the rise and curiosity from main monetary gamers rising, in the present day’s debut may very well be the beginning of an extended build-up in demand.

If inflows stay sturdy, XRP may try one other rally as soon as the broader correction passes.