Bitcoin

How The IMF Prevents Global Bitcoin Adoption (And Why They Do It)

Credit : bitcoinmagazine.com

The World Sample

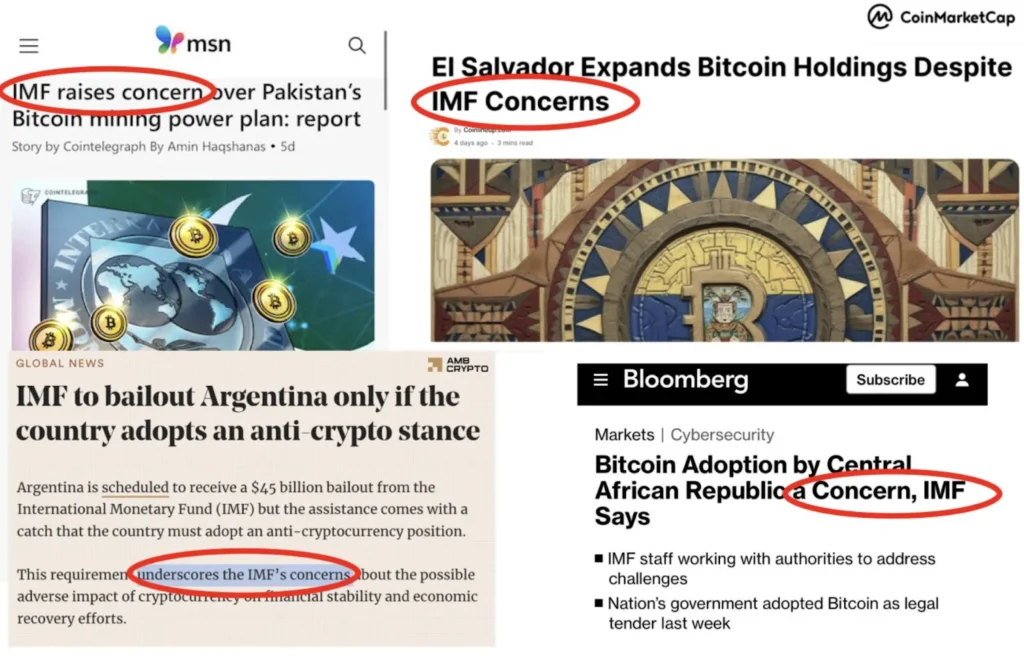

Lately the IMF has:

- Efficiently pressured El Salvador to (de facto) drop Bitcoin as authorized tender, and rollback different Bitcoin insurance policies

- Efficiently pressured CAR’s 2023 Bitcoin repeal via regional banking our bodies

- Been chargeable for the dearth of comply with via from Bitcoin marketing campaign rhetoric to motion from Milei in Argentina.

- Cited “serious concerns” with Pakistan’s Bitcoin plans

- Constantly framed crypto as a “danger” in mortgage negotiations

Right here’s a abstract

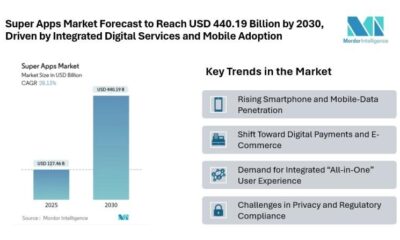

| Nation | GDP ($ Billion) | IMF Mortgage ($ Billion) | IMF Mortgage as % of GDP | IMF response | End result |

| Argentina | 670 | 54.8 | 8.18% | strong | Bitcoin coverage deserted |

| Central African Republic | 2.56 | 0.272 | 2.31% | strong | Bitcoin coverage deserted |

| El Salvador 2.0 (post-2025) | 34.87 | 1.4 | 4.01% | strong | 5 Bitcoin legal guidelines deserted |

| Pakistan | 346.79 | 9.35 | 2.70% | strong | TBD |

| El Salvador 1.0 (2021-2024) | 34.87 | 0 | 0% | strong | Bitcoin maintained |

| Bhutan | 2.9 | 0 | 0% | mild | Bitcoin maintained |

As we are able to see, the one nations that had been in a position to withstand IMF stress had been El Salvador, previous to gaining an IMF mortgage, and Bhutan which doesn’t have an IMF mortgage.

Every nation with an IMF mortgage who has adopted, or tried to undertake Bitcoin at a nation-state stage has been efficiently thwarted, or largely thwarted by the IMF.

How is it that the IMF has been so profitable in stopping international nation state adoption, apart from Bhutan, and why do they aggressively transfer to stop it?

On this detailed report we do a deep-dive into every of the three nations the place the IMF has efficiently pushed again towards Bitcoin adoption, and the indicators that it’s seemingly to achieve success attaining the identical outcome with Pakistan.

Within the final part of this report, we have a look at the IMFs 5 causes to concern Bitcoin, and the way Bitcoin remains to be thriving from a grassroots stage regardless of top-down Bitcoin abandonment, or partial abandonment, by varied nation states.

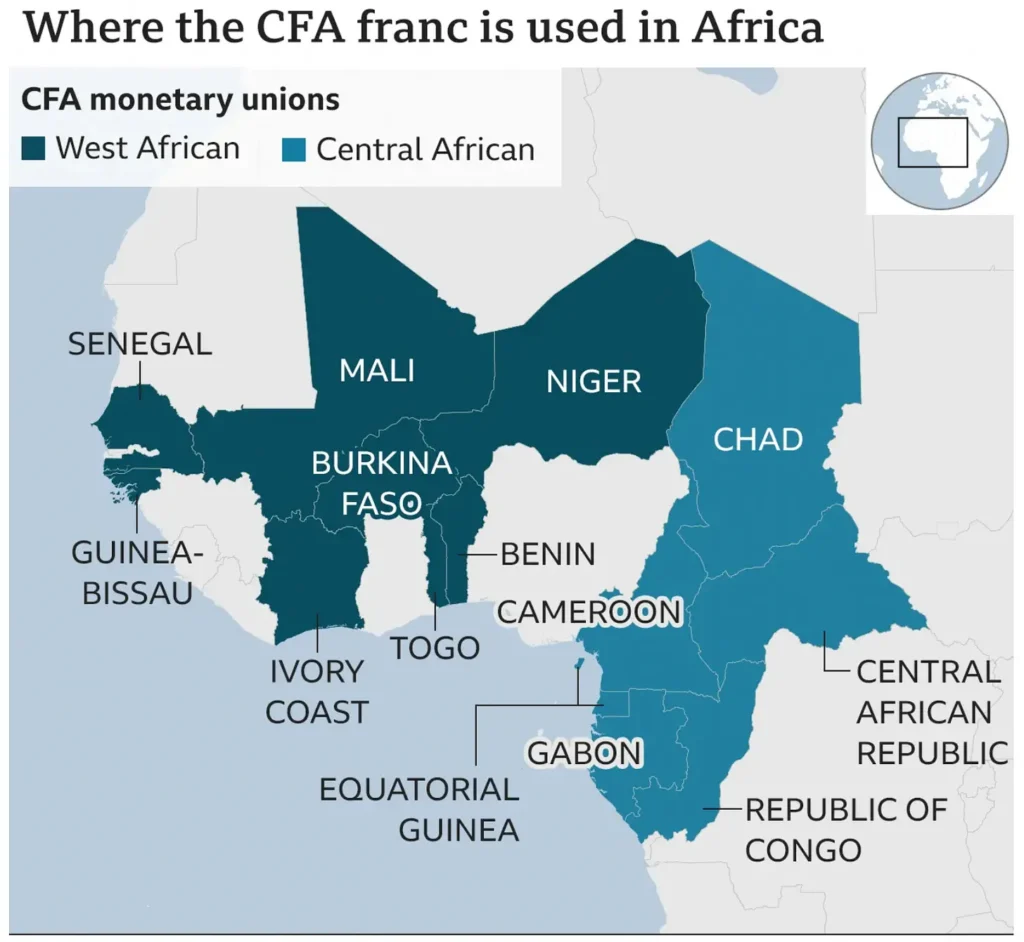

The Central African Republic (CAR) makes use of the CFA franc. The CFA isn’t simply foreign money—it’s a geopolitical chain, backed by France and ruled by the Financial institution of Central African States (BEAC). Of its 14 member nations, the 6 Central African nations (together with CAR) should nonetheless deposit 50% of international reserves in Paris.

This management over reserves fosters economic dependency, whereas establishing export markets for French goods at favorable phrases. In 1994 for instance, the CFA was devalued by half, a coverage that was influenced by Western stress, significantly from the IMF. This triggered the price of imports to leap, resulting in exporters (primarily EU primarily based) with the ability to procure sources from CFA nations at half the associated fee. Regionally the affect was devastating, resulting in wage freezes, layoffs, and widespread social unrest across CFA countries.

When the Central African Republic (CAR) introduced in 2022 it was adopting Bitcoin as authorized tender, BEAC and its regulatory arm COBAC instantly voided the legislation, citing violations of the CEMAC Treaty; The treaty which established the financial and financial neighborhood of Central Africa. This wasn’t forms—it was a warning shot from the financial guardians of la Françafrique.

Why it mattered: To at the present time, CAR’s financial system depends closely on IMF bailouts. With $1.7Billion in exterior debt (61% of GDP), defying BEAC meant risking monetary isolation.

The IMF’s Silent Marketing campaign

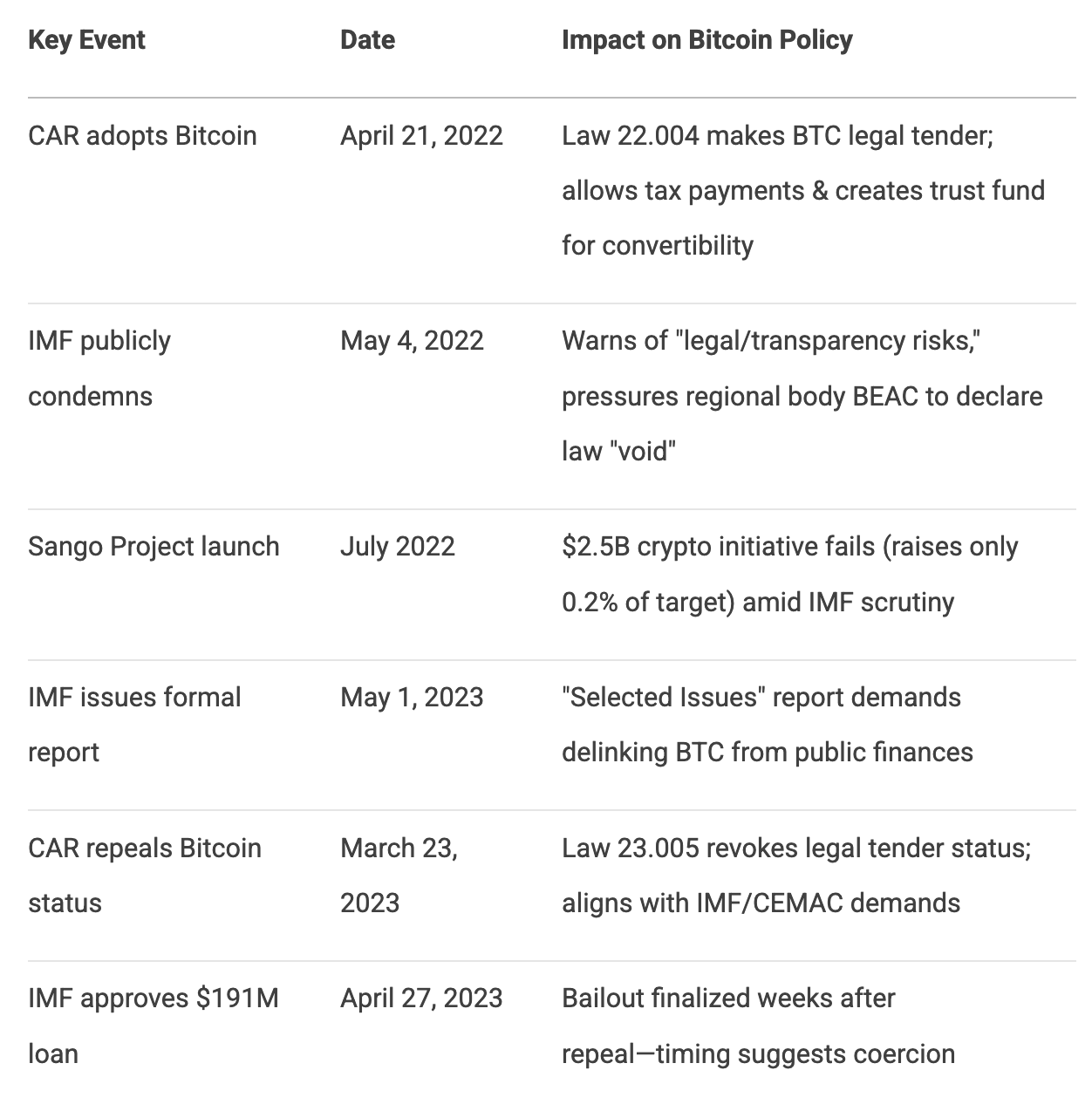

The IMF moved quick. Inside two weeks (Could 4, 2022), it publicly condemned CAR’s “dangerous experiment,” citing authorized contradictions with CEMAC’s crypto ban. The transfer raised “main authorized, transparency, and financial coverage challenges,” the IMF said, that had been just like the issues the IMF raised about El Salvador’s Bitcoin adoption: dangers to monetary stability, shopper safety, and monetary liabilities. (For context, none of these dangers materialized in El Salvador).

However their actual weapon was leverage. As CAR’s largest creditor, the IMF tied its new Prolonged Credit Facility (ECF)—a $191M lifeline—to coverage compliance.

The Timeline That Tells All

This desk traces the IMF’s shadow marketing campaign:

Key to scuttling CAR’s Bitcoin ambitions was making certain that the Sango project — a blockchain-hub initiative from the CAR authorities to promote “e-residency” and citizenship for $60K in Bitcoin — didn’t proceed.

The Sango Mission – coincidence or collusion?

In July 2022, CAR launched the Sango Mission. It aimed to lift $2.5B (100% of GDP).

It failed catastrophically. By January 2023, solely $2M (0.2% of goal) was raised. Whereas IMF studies cite “Technical obstacles with 10% web penetration” as the rationale for the failure, our evaluation reveals a distinct image. Two elements scuttled the challenge.

- Investor flight

- A CAR Supreme Courtroom ruling formally blocked the Sango challenge

Nonetheless, on nearer examination, each of those elements trace at IMF involvement.

Let’s take a more in-depth have a look at the proof.

Investor Flight

The IMF’s position on this investor flight is circumstantial however compelling. On Could 4, 2022, the IMF expressed concerns about CAR’s bitcoin adoption, stating it raised main authorized, transparency, and financial coverage challenges. This assertion, made earlier than the Sango Mission launch, highlighted dangers to monetary stability and regional financial integration, doubtlessly deterring traders. Additional, in July 2022, throughout a employees go to for the Workers-Monitored Program (SMP) overview, the IMF famous “financial downturns on account of rising meals and gasoline costs”, which might have compounded investor caution. Studies additionally point out that the IMF and COBAC warned of inherent risks in CAR’s crypto transfer, including to the skepticism.

The timing of those IMF statements aligns with the noticed investor flight, suggesting that their cautionary stance might have influenced perceptions. Whereas circumstantial, the sequence of occasions suggests IMF affect as a revered monetary establishment within the investor neighborhood seemingly performed a task in investor flight.

Supreme Courtroom Ruling

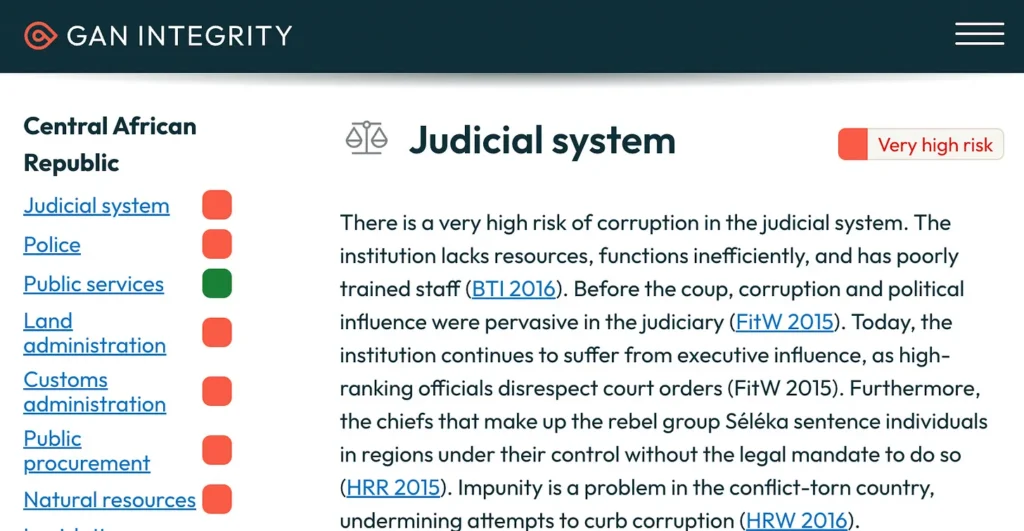

On the floor, the Supreme Courtroom ruling seems to be like an unbiased occasion, till we dig beneath the floor and discover large question-marks over the independence of CAR’s judiciary, a rustic that itself ranks 149/180 on its Corruption Perception Index (extraordinarily low).

As talked about, one week after CAR introduced its Bitcoin technique, the IMF reported “issues”, together with dangers to monetary stability, transparency, anti-money laundering efforts, and challenges in managing macroeconomic insurance policies as a result of volatility. (Bloomberg, 4 May, 2022)

On 29 Aug 2022, 117 days later, the Supreme Courtroom of CAR dominated that the Sango challenge was unlawful. For context, the Supreme Courtroom which varieties a part of CAR’s judiciary is described by worldwide transparency our bodies similar to Gan Integrity as some of the corrupt establishments within the nation, with proof pointing to inefficiency, political interference, and sure affect from bribes or political pressure.

The Sango challenge’s collapse grew to become the IMF’s Exhibit A: “Proof Bitcoin can’t work in fragile economies.” However the actuality was, the IMF’s constant expression of “issues” created the setting the place the challenge was structurally undermined prematurely, in order that this conclusion grew to become doable.

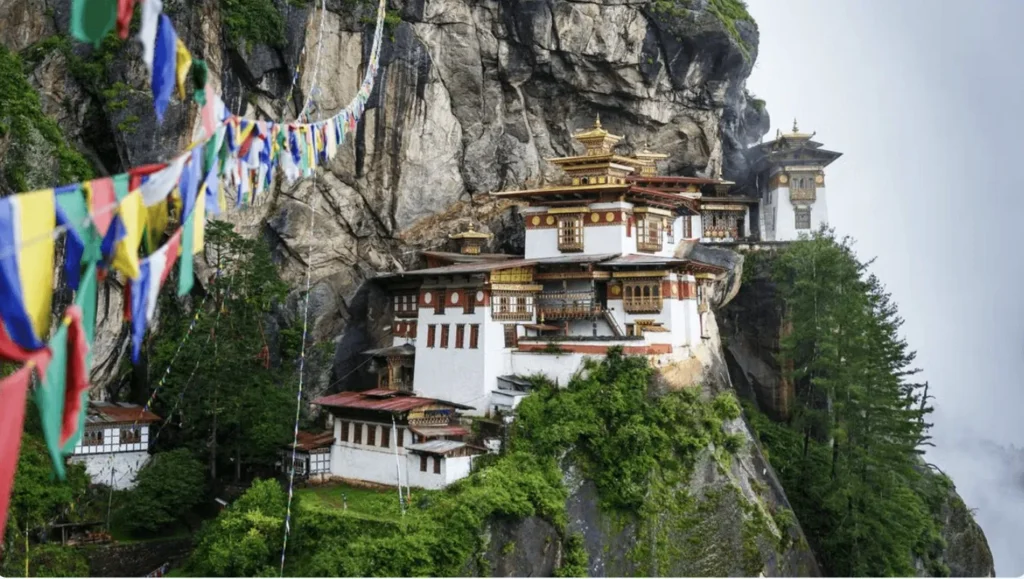

5,200 miles away, within the small nation of Bhutan we see the stark distinction of the profitable Bitcoin rollout that was doable with out IMF’s “involvement”.

The Unstated Conclusion: Bitcoin’s Resilience Past Borders

CAR’s reversal wasn’t about Bitcoin’s viability. It was about uncooked energy. The IMF weaponized regional banking unions (CEMAC), starved CAR of capital, and leveraged a $191M mortgage to extinguish the specter of monetary sovereignty. When the Sango Mission struggled—the entice snapped shut.

But this defeat reveals Bitcoin’s enduring energy. Discover what the IMF didn’t destroy:

The sample is obvious: The place grassroots adoption takes root—Bitcoin survives. However for nations saying top-down Bitcoin manifestos who’ve massive IMF loans, all 4 have met with crushing ranges of resistance: El Salvador, CAR, Argentina and now Pakistan.

CAR’s excellent $115.1 million IMF mortgage steadiness made it weak to heavy IMF stress. In nations with out IMF loans similar to Bhutan, Bitcoin slips via the IMF’s grip. Each peer-to-peer fee, each Lightning transaction, erodes the outdated system’s foundations.

The IMF gained the CAR spherical. However the international battle for monetary sovereignty is simply starting.

If CAR was thwarted in its Bitcoin plans, Argentina by no means made it to the beginning line. Precampaign rhetoric from President Milei advised large issues had been in retailer for Bitcoin. But nothing materialized. Was this only a politician’s rhetoric really fizzling out post-election, or was one thing else at play? This part pulls again the lid on what actually occurred to Argentina’s aborted Bitcoin aspirations.

Understanding how Bitcoin adoption goes, is like assessing whether or not a rocket goes to achieve escape velocity: we should have a look at each the thrust and drag elements.

I’m an optimist: I consider Bitcoin will win: it’s so clearly a greater answer to the damaged cash legacy system we at the moment have. However I’m additionally a realist: I feel most individuals underestimate the energy of entrenched forces which oppose Bitcoin.

After I was working my tech company, we encountered the identical factor. Our expertise was 10x higher, quicker and more economical than the legacy system we finally changed. However they didn’t relinquish their incumbent monopoly simply!

What occurred in Argentina?

When libertarian Javier Milei was elected Argentina’s president in November 2023, many Bitcoin advocates cheered. Right here was a pacesetter who referred to as central bankers “scammers,” vowed to abolish Argentina’s central financial institution (BCRA), and praised Bitcoin as “the pure response towards Central Financial institution scammers.” The case grew to become a litmus take a look at for whether or not Bitcoin might acquire mainstream acceptance via authorities adoption reasonably than grassroots development.

Supply: Coinsprout. 14 Aug 2023

But eighteen months into his presidency, Milei’s Bitcoin imaginative and prescient stays unfulfilled. The rationale? A $45 billion leash held by the Worldwide Financial Fund.

The IMF’s Bitcoin Veto in Argentina

The constraints had already been put in place by the point of Milei’s election. On 3 March, 2022, Argentina’s earlier authorities signed a $45 billion IMF bailout settlement. Within the weeks following, particulars emerged that the settlement had contained an uncommon clause: a requirement to “discourage cryptocurrency use.” This wasn’t a suggestion—it was a loan condition documented within the IMF’s Letter of Intent, citing issues about “monetary disintermediation.”

The instant impact:

- Argentina’s central financial institution banned monetary establishments from crypto transactions (BCRA Communication A 7506, Could 2022)

- The coverage stays enforced underneath Milei, regardless of his pro-Bitcoin rhetoric

Milei’s Pivot

After taking workplace, Milei:

✔ Slashed inflation from 25% month-to-month to underneath 5% (Could 2024)

✔ Lifted foreign money controls (April 2025)

✔ Secured a brand new $20 billion IMF deal (April 2025)

However his manifesto’s flagship proposals—Bitcoin adoption and abolition of BCRA (Argentina’s Central Financial institution) — are conspicuously absent. The mathematics explains why: Argentina owes the IMF greater than another nation, giving the Fund unparalleled leverage.

But there’s irony in Argentina’s case: whereas the IMF blocks official Bitcoin adoption, Argentinians are embracing Bitcoin anyway. Cryptocurrency ownership grew by 116.5% between 2023-2024 in South America.

Throughout the area, Argentina has the best possession charges, at 18.9%, a determine virtually 3 times the global average, and which has surged as residents hedge towards excessive annual inflation of 47.3% (April 2025) — a quiet riot the IMF can’t management.

.

What Comes Subsequent?

All eyes are on the October 2025 mid-term elections. If Milei positive factors legislative assist, he might take a look at the IMF’s pink traces. However for now, the lesson is obvious: when nations borrow from the IMF, their financial sovereignty comes with strings connected.

Key Takeaways

- The IMF’s 2022 mortgage explicitly tied Argentina’s bailout to anti-crypto insurance policies

- Milei has prioritized financial stabilization over Bitcoin advocacy, to keep up IMF assist

- Parallels exist in El Salvador, CAR and now Pakistan revealing a constant IMF playbook

- Argentinians are circumventing restrictions via grassroots Bitcoin adoption

When El Salvador made Bitcoin authorized tender in 2021, it wasn’t simply adopting a cryptocurrency—it was declaring monetary independence. President Nayib Bukele framed it as a riot towards greenback dominance and a lifeline for the unbanked. Three years later, that riot hit a $1.4 billion roadblock: the IMF.

The Value of the Bailout

To safe its 2024 mortgage, El Salvador agreed to dismantle key pillars of its Bitcoin coverage. The situations reveal a scientific unwinding:

- Voluntary Acceptance Solely

Companies are not required to simply accept Bitcoin (2021 mandate repealed). source - Public Sector Ban

Authorities entities prohibited from Bitcoin transactions or debt issuance. This consists of bans on tokenized devices tied to Bitcoin. source - Bitcoin Accumulation Freeze

All authorities purchases halted (6,000+ BTC reserve now frozen)

Full audit of holdings (Chivo pockets, Bitcoin Workplace) by March 2025. source - Belief Fund Liquidation

Fidebitcoin (conversion fund) to be dissolved with audited transparency. source - Chivo Pockets Phaseout

The $30 incentive program winds down after surveys confirmed most customers traded BTC for USD. source - Tax Fee Rollback

USD turns into the only choice for taxes, eliminating Bitcoin’s utility as sovereign fee. source

Bukele’s Calculated Retreat

El Salvador’s compliance makes fiscal sense:

- The mortgage stabilizes debt (84% of GDP) as bond funds loom

- Dollarization stays intact (USD nonetheless major foreign money)

But the backtrack is putting given Bukele’s 2021 rhetoric. The Chivo pockets’s low uptake seemingly made concessions simpler.

What’s Left of the Experiment?

The IMF hasn’t killed Bitcoin in El Salvador—simply official adoption. Grassroots use persists:

- Bitcoin Seaside (native round financial system) nonetheless operates, actually thrives

- Tourism attracts rising numbers of Bitcoin fanatics

However with out state assist, Bitcoin’s position doubtlessly shrinks to a distinct segment device reasonably than a financial revolution, a minimum of within the brief time period.

The Highway Forward

Two eventualities emerge:

- Sluggish Fade: Bitcoin turns into a vacationer curiosity as IMF situations take full impact

- Shadow Revival: Non-public sector retains it alive regardless of authorities retreat

One factor’s clear: when the IMF writes the checks, it additionally writes the principles.

Key Takeaways

- IMF mortgage compelled El Salvador to reverse 6 key Bitcoin insurance policies

- Precedent set for different nations searching for IMF assist

- Grassroots Bitcoin use might outlast authorities involvement

El Salvador made quite a lot of Bitcoin concessions. Whereas arguably this doesn’t harm El Salvador a lot, it sends a robust message to different LATAM nations similar to Ecuador and Guatemala who had been watching El Salvador and considering of copying their playbook (till they checked the scale of the IMF mortgage that they had). So on web steadiness it was a partial IMF win, a partial El Salvador win.

We at the moment are 2 years into Bhutan’s Bitcoin experiment.

Which means we now have some good knowledge on the way it has affected the financial system.

The IMF warned that nations embracing Bitcoin would destabilize their financial system, be much less efficient at attracting international direct funding, and endanger their decarbonizing and environmental initiatives. It particularly voiced issues over Bhutan’s “lack of transparency” with crypto-adoption.

What does the information say?

1. The bitcoin reserves have instantly addressed urgent fiscal wants. “In June 2023, Bhutan allotted $72 million from its holdings to finance a 50% wage improve for civil servants”

2. Bhutan was in a position to “use Bitcoin reserves to avert a disaster as international foreign money reserves dwindled to $689 million”

3. Prime Minister Tshering Tobgay in an interview stated that bitcoin additionally “helps free healthcare and environmental tasks”

4. Tobgay additionally stated their Bitcoin reserves helped in “stabilizing [the nation’s] $3.5 billion financial system”

5. Impartial analysts have now stated that “this mannequin might appeal to international funding, significantly for nations with untapped renewable sources”

Contemplating how the IMF evaluation was not simply improper, however roughly 180° off track, it begs the query, had been the IMF’s predictions ever primarily based on knowledge?

“Get all your mates, libertarians, democrats, republicans, get everybody to purchase Bitcoin – after which it turns into democratized.” inspired John Perkins ~ Bitcoin 2025

What if the IMF’s best concern isn’t inflation… however Bitcoin, and may Bitcoin Break the IMF/World Financial institution Debt Grip?

Throughout my latest dialog with John Perkins (Confessions of an Financial Hit Man), one thing clicked. Alex Gladstein beforehand and brutally uncovered how IMF “structural changes” didn’t get rid of poverty, however actually enriched creditor nations. Perkins layered this along with his personal first-hand accounts.

Perkins laid naked to me how the World South is trapped in a cycle of debt—one designed to maintain wealth flowing West. However right here’s the twist: Bitcoin is already dismantling the playbook in 5 key methods.

1. Lowering Remittance Prices to Loosen the Debt Noose

Chris Collins’ Sculpture symbolically captures the debt noose

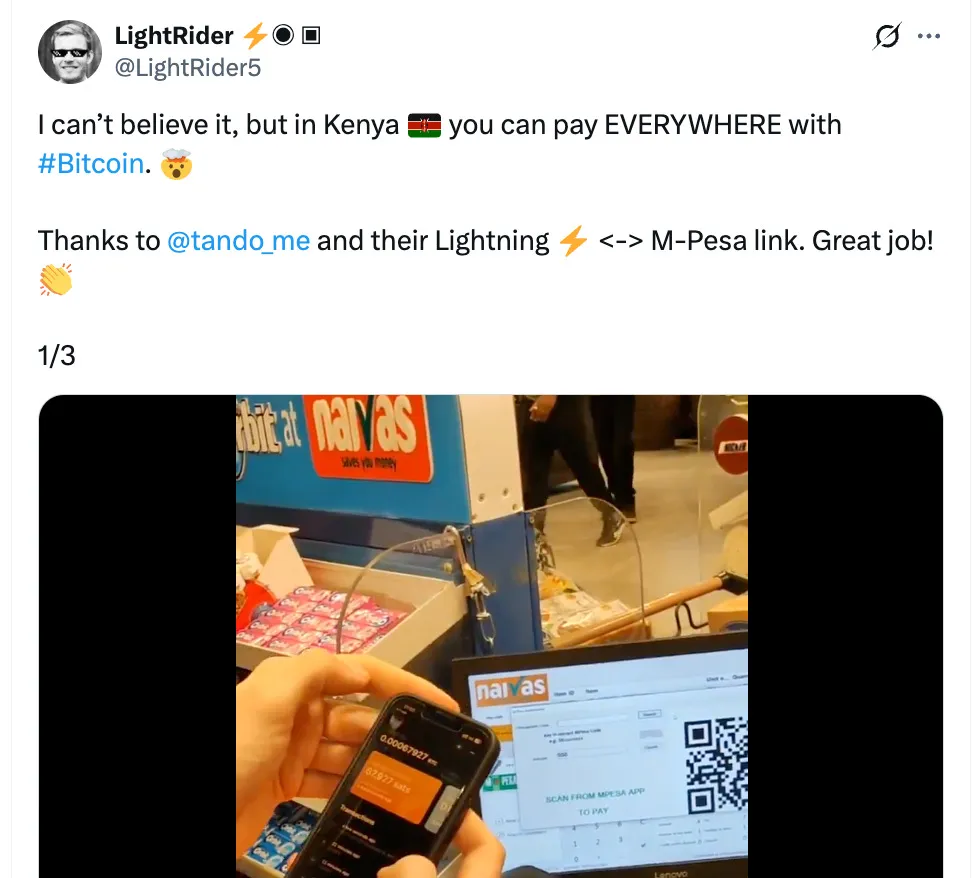

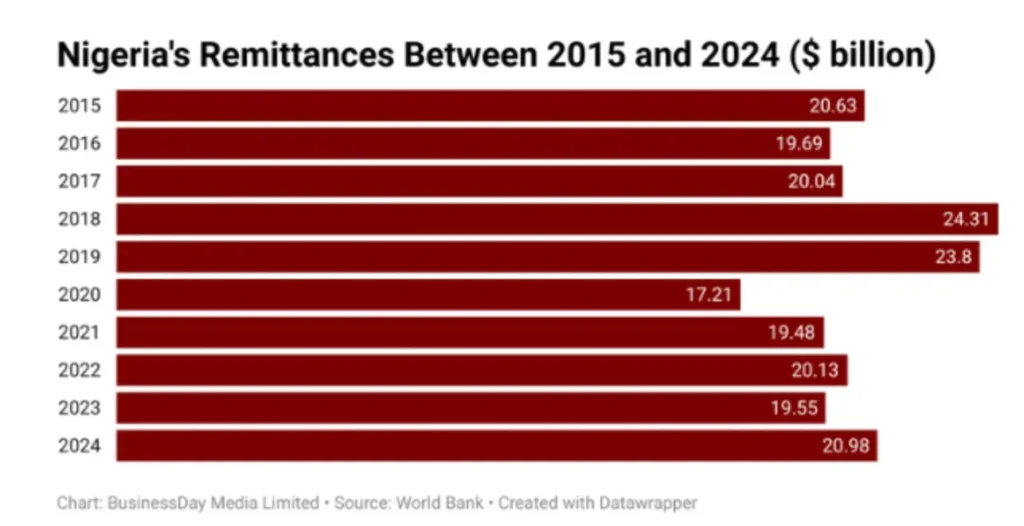

Remittances—cash despatched residence by migrant staff—usually make up a major a part of creating nations’ GDP. Conventional intermediaries similar to Western Union cost charges as excessive as 5–10%. This acts as a hidden tax that drains international reserves. For nations like El Salvador or Nigeria, each remittance greenback that doesn’t circulation into the nation is a greenback their central financial institution should retailer to stabilize their currencies. Typically this retailer of US {dollars} is offered by the IMF.

Bitcoin Adjustments the Recreation

With Lightning, charges drop to virtually zero, and transactions settle in seconds. In 2021, El Salvador’s president Bukele optimistically predicted that bitcoin might save $400 Million in remittance payments. The truth has been there’s little proof remittance funds utilizing bitcoin have reached wherever close to that threshold. Nonetheless the potential is obvious: extra remittances in bitcoin results in greater greenback reserves, which results in much less want for IMF loans.

Little surprise the IMF talked about Bitcoin 221 times of their 2025 mortgage situations for El Salvador. They’d like to stay a related lender.

Bitcoin isn’t simply cheaper for remittances—it bypasses the greenback system fully. In Nigeria, the place the naira struggles, households now maintain BTC as a tougher asset than native foreign money. No want for central banks to burn via greenback reserves. No determined IMF bailouts.

The numbers communicate for themselves:

• Pakistan loses $1.8 billion yearly on remittance fees—Bitcoin might save most of that

• El Salvador already saves $4M+ yearly with simply 1.1% Bitcoin remittance adoption

Adoption isn’t common but—solely 12% of Salvadorans use Bitcoin repeatedly, whereas over 5% of Nigeria’s remittances circulation via crypto. However the development is obvious: each Bitcoin switch weakens the debt dependency cycle.

The IMF sees the menace. The query is: how briskly will this silent revolution unfold?”

Remittances totaled virtually $21 billion in 2024, representing over 4% of Nigeria’s GDP

2. Evading Sanctions and Commerce Limitations

Oil-rich Iran, Venezuela and Russia have had restricted USD entry on account of US sanctions in 1979, 2017 and 2022 respectively, ensuing within the export of vastly fewer barrels per day of oil in every case.

Whether or not we agree with the ideologies of those nations or not, Bitcoin breaks this cycle. Iran already evades sanctions by using Bitcoin as a solution to successfully “export oil”, whereas Venezuela has used Bitcoin to pay for imports, evading sanctions.

Iran can also be in a position to bypass sanctions by monetizing its power exports through mining. This avoids the IMF’s “reform-for-cash” ultimatums whereas maintaining economies working.

The petrodollar’s grip weakens as Russia and Iran pioneer Bitcoin oil offers.

One other nation that has used Bitcoin to keep away from the financial hardship attributable to sanctions is Afghanistan, the place humanitarian support flows via utilizing Bitcoin. NGOs like Code to Inspire bypassed Taliban banking freezes, and Digital Citizen Fund have used Bitcoin to ship support post-Taliban takeover, preventing families from starving.

Afghanistan’s “Code to Encourage” NGO makes use of Bitcoin donations, which can’t be intercepted by the Taliban, to coach girls to write down software program.

Although Bitcoin’s share of sanctioned commerce is small—underneath 2% for Iran and Venezuela’s oil exports—the development is rising.

Sanctions are a important device for geopolitical leverage, usually supported by the IMF and World Financial institution via their alignment with main economies just like the U.S. Sanctioned nations utilizing Bitcoin reduces IMF management over monetary flows whereas concurrently threatening U.S. greenback dominance.

3. Utilizing Bitcoin as a Nation State Inflation Defend

When nations like Argentina face hyperinflation, they borrow USD from the IMF to bolster currency reserves and stabilize their foreign money, solely to face austerity or the enforced sale of strategic property at a low worth when repayments falter. Bitcoin gives a manner out by performing as a worldwide, non-inflatable foreign money that operates independently of presidency oversight, and which appreciates in worth.

El Salvador’s experiment reveals how Bitcoin can reduce dollar dependency. By holding BTC, nations can hedge towards foreign money collapse with out IMF loans. If Argentina had allotted simply 1% of its reserves to Bitcoin in 2018, it might’ve offset the peso’s 90%+ devaluation that 12 months, sidestepping an IMF bailout. Bitcoin’s neutrality additionally means no single entity can impose situations, in contrast to IMF loans that demand privatization or unpopular reforms.

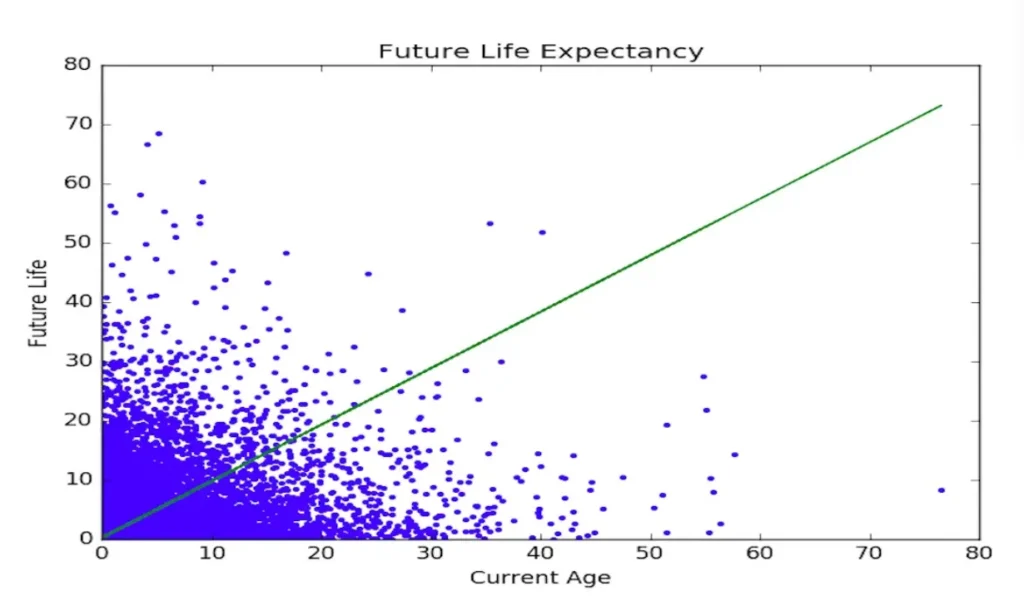

Bitcoin doesn’t have debt-leverage or a protracted historical past of the IMF to attract on when encouraging adoption. Nonetheless, as a result of Lindy Effect (see chart beneath), every passing 12 months Bitcoin turns into a extra viable different.

Lindy Impact: The longer one thing has been profitable, the extra seemingly it’s to proceed being profitable. Bitcoin’s longevity strengthens its potential to disrupt

4. Bitcoin Mining: Turning Power into Debt-Free Wealth

Many creating nations are energy-rich however debt-poor, trapped by IMF loans for infrastructure like dams or energy vegetation. These loans demand low cost power exports or useful resource concessions when defaults hit. Bitcoin mining flips this script by turning stranded power—like flared fuel or overflow hydro—into liquid wealth with out middlemen or transport prices.

Paraguay’s incomes $50 million yearly from hydro-powered mining, overlaying 5% of its commerce deficit. Ethiopia made $55 million in 10 months. Bhutan’s the standout: with 1.1 billion in Bitcoin (36% of its $3.02 billion GDP), its hydro-powered mining might produce $1.25 billion yearly by mid-2025, servicing its $403 million World Financial institution and $527 million ADB money owed with out austerity or privatization. In contrast to IMF loans, mined Bitcoin appreciates in worth and can be utilized as collateral for non-IMF borrowing. This mannequin—monetizing power with out surrendering property—scares the IMF, because it cuts their leverage over the power sector.

Bhutan’s Prime Minister, Tshering Tobgay, calls Bitcoin a “strategic alternative to stop mind drain”

5. Grassroots Bitcoin Economies: Energy from the Floor Up

Bitcoin isn’t just for nations—it’s for communities. In locations like El Salvador’s Bitcoin Beach or South Africa’s Bitcoin Ekasi, locals already use BTC for every day transactions, financial savings, and neighborhood tasks like colleges or clinics. These round economies, usually sparked by philanthropy, purpose for self-sufficiency. In Argentina, the place inflation usually tops 100%, 21% of people used crypto by 2021 to guard wealth. If scaled up, these fashions might scale back reliance on nationwide debt-funded applications, which is in fact the very last thing the IMF need.

Hermann Vivier, founding father of Bitcoin Ekasi, says his neighborhood was impressed by El Salvador’s Bitcoin Seaside to copy their Bitcoin round financial system in S.Africa

Conclusion

By fostering native resilience, Bitcoin undermines the IMF’s “disaster leverage”. Thriving communities don’t want bailouts, so the IMF can’t demand privatization in trade for loans. In Africa, tasks like Gridless Energy’s – which has already introduced 28,000 rural Africans out of power poverty utilizing renewable microgrids tied to Bitcoin mining – minimize the necessity for IMF-backed mega-projects. If hundreds of cities undertake this, greenback shortages would matter much less, and commerce might bypass USD techniques.

Whereas the IMF sometimes engages in spreading misinformation about Bitcoin power consumption and environmental affect as a solution to hinder adoption, its most well-liked and rather more highly effective device is solely to make use of the monetary leverage it has over IMF-indebted nations to “strongly encourage” compliance with its Bitcoinless imaginative and prescient of the long run.

The IMF fought Bitcoin adoption in El Salvador, CAR, and Argentina. Now they’re preventing Pakistan’s intention to mine Bitcoin as a Nation State. Scaling these grassroots efforts is prone to drive the IMF’s hand to crack down increasingly more transparently.

Above: Youngsters from South Africa’s poorest villages be taught to surf through the Bitcoin Ekasi township challenge

Grassroots Bitcoin economies empower communities to thrive with out IMF bailouts. And other people-power is required to search out new progressive methods to beat the IMF’s counterpunch.

It is a visitor submit by Daniel Batten. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024