Bitcoin

How the Updated MVRV Z-Score Improves Bitcoin Price Predictions

Credit : bitcoinmagazine.com

The Bitcoin MVRV Z-Rating has historically been probably the most efficient instruments for figuring out the tops and bottoms of the Bitcoin market cycle. At present we’re excited to share an enchancment to this metric, making it much more insightful for as we speak’s dynamic market circumstances.

What’s the Bitcoin MVRV Z-Rating?

The MVRV Z score is derived by analyzing the ratio between Bitcoin’s realized cap (the common acquisition price of all Bitcoin in circulation) and its market capitalization (present community valuation). By standardizing this ratio utilizing Bitcoin’s worth volatility (measured as its normal deviation), the Z-Rating highlights durations of overvaluation or undervaluation relative to historic norms.

Peaks within the purple zone point out overvaluation, which signifies optimum revenue alternatives. Bottoms within the inexperienced zone point out undervaluation, which frequently signifies robust accumulation potential. Traditionally, this measure has been remarkably correct in figuring out key market cycle extremes.

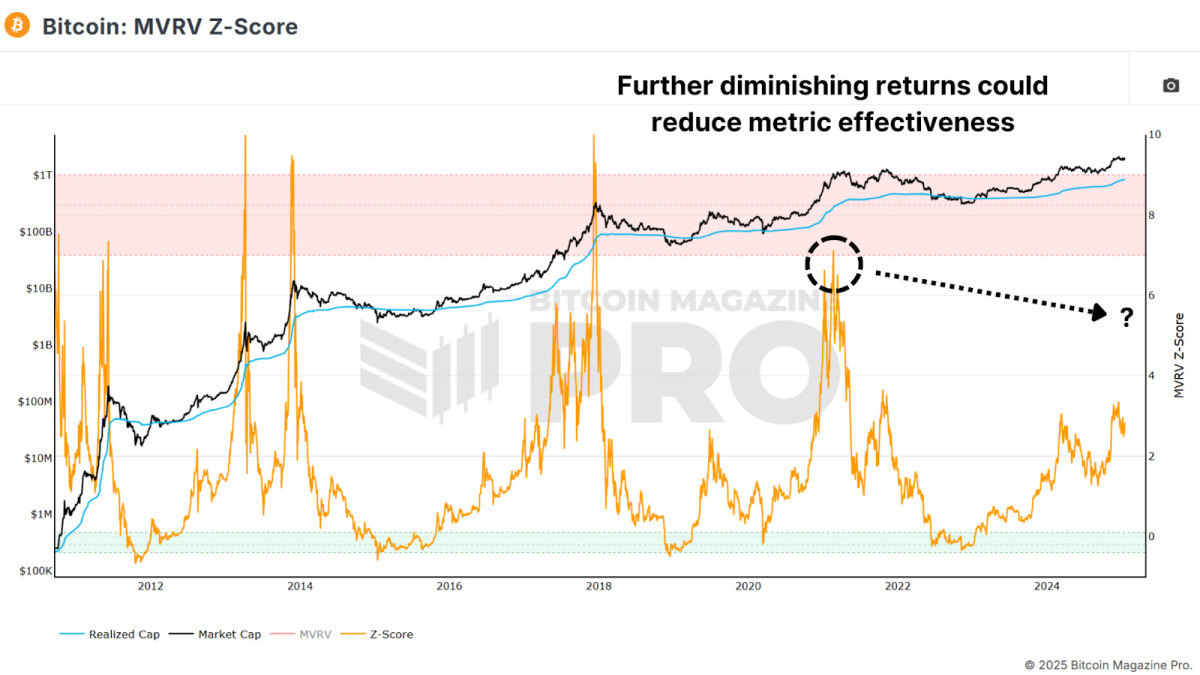

Though highly effective, the normal MVRV Z-Rating has its limitations. In earlier cycles, the Z-Rating reached values of 9–10 throughout market tops. Nevertheless, within the final cycle the rating was solely round 7. This can be as a result of rounded double peak cycle fairly than the sharp blow-off peak we normally expertise. Both means, it’s essential to take note of evolving market dynamics, with rising institutional involvement and altering investor conduct.

The improved MVRV Z-Rating

The MVRV Z-Rating standardizes the uncooked MVRV information utilizing Bitcoin’s total worth historical past, together with the acute volatility of the early years. As Bitcoin matures, these early information factors may skew its relevance to present market circumstances. To satisfy these challenges, we have now the MVRV Z-Score 2YR rolling. As a substitute of utilizing Bitcoin’s total worth historical past, this model calculates volatility based mostly solely on the previous two years of knowledge.

This method higher accounts for Bitcoin’s rising market capitalization and altering dynamics and ensures that the metric adapts to more moderen tendencies, offering higher accuracy for up to date market evaluation. It nonetheless excels at figuring out the tops and bottoms of market cycles, however is adapting to fashionable circumstances. Within the final cycle, this model achieved the next peak worth than the normal Z-Rating, which higher displays the worth motion of 2017. The draw back is that it continues to establish robust accumulation zones with excessive precision.

Crude MVRV ratio

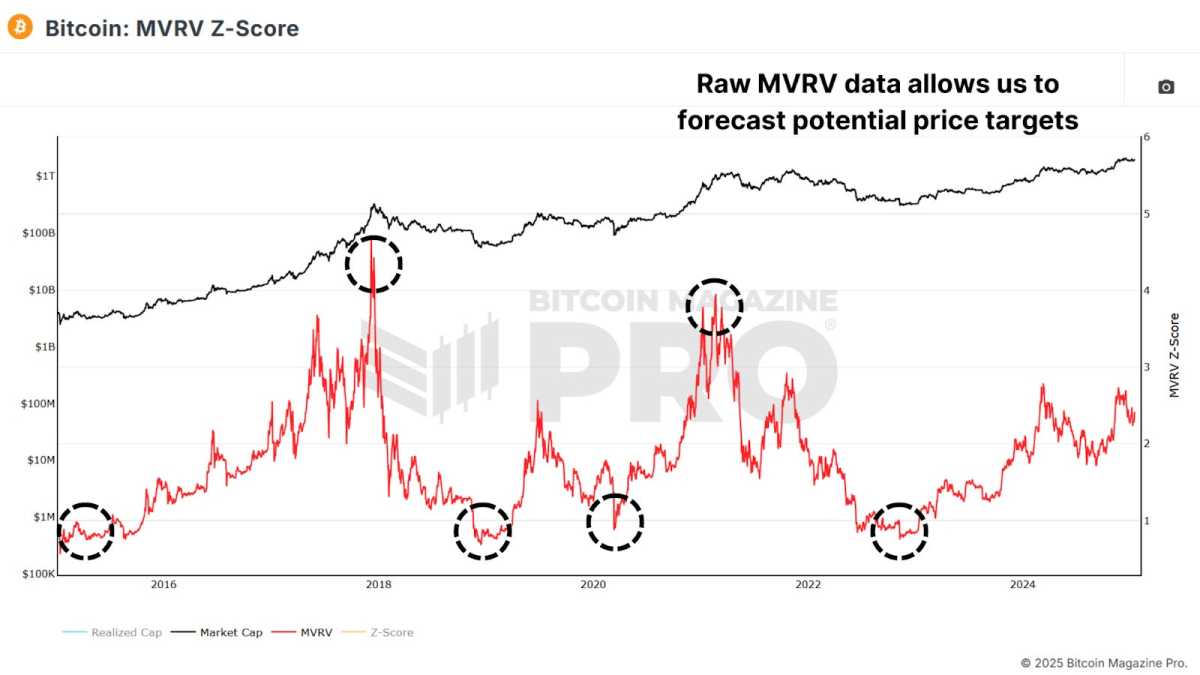

One other complementary method entails analyzing the MVRV ratio with out standardizing for volatility. By doing this we will see that the earlier cycle’s MVRV ratio peaked at 3.96, in comparison with 4.72 the cycle earlier than. These values counsel fewer deviations, doubtlessly offering a extra secure framework for projecting future worth targets.

Assuming a realized worth of $60,000 (considering the present anticipated enhance over the following six months) and an MVRV ratio of three.96, a possible peak worth might be near $240,000. If diminishing returns scale back the ratio to three.0, the height worth may nonetheless attain $180,000.

Conclusion

Whereas the MVRV Z-Rating stays probably the most efficient instruments for timing peaks and troughs available in the market cycle, we ought to be ready that this metric might not attain the identical highs as earlier cycles. By adjusting this information to higher account for Bitcoin’s altering market dynamics, we will account for diminished volatility as BTC grows.

For a extra in-depth take a look at this matter, watch a current YouTube video right here:

Improving the Bitcoin MVRV Z-Score

For extra detailed Bitcoin evaluation and entry to superior options like stay charts, customized indicator alerts and in-depth sector stories, go to Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now