Bitcoin

How to Take Profits at Bitcoin Cycle Peaks

Credit : bitcoinmagazine.com

Discussing when and the right way to promote Bitcoin may be controversial, however if you happen to intend to make this cycle a revenue, it’s important to do that strategically. Though it’s an possibility for indefinite intervals, many traders need to win revenue, cowl the prices of residing or re -invest at decrease costs. Historic tendencies present that Bitcoin usually experiences breakdowns of 70-80percentand provide alternatives to journey with decreased valuations.

View a latest YouTube video right here for a extra in-depth view of this topic: Proven strategy to sell the Bitcoin -Rijpiek

Why not at all times promoting is taboo

Though some, akin to Michael Saylor, by no means promote Bitcoin, this angle doesn’t at all times go well with particular person traders. For individuals who don’t handle billions, taking partial revenue can provide flexibility and peace of thoughts. If Bitcoin peaks at $ 250,000, for instance, and is confronted with a fairly conservative correction of 60%, this could go to $ 100,000 once more, creating an opportunity to succeed in a decrease ranges than we’ve already seen.

The aim is to not promote all the things, however to scale strategic positions, maximize returns and handle dangers. Attaining this requires pragmatic, knowledge -driven choices, no emotional reactions. However once more, if you happen to by no means need to promote, then not! Do what works greatest for you.

Primary timing aids

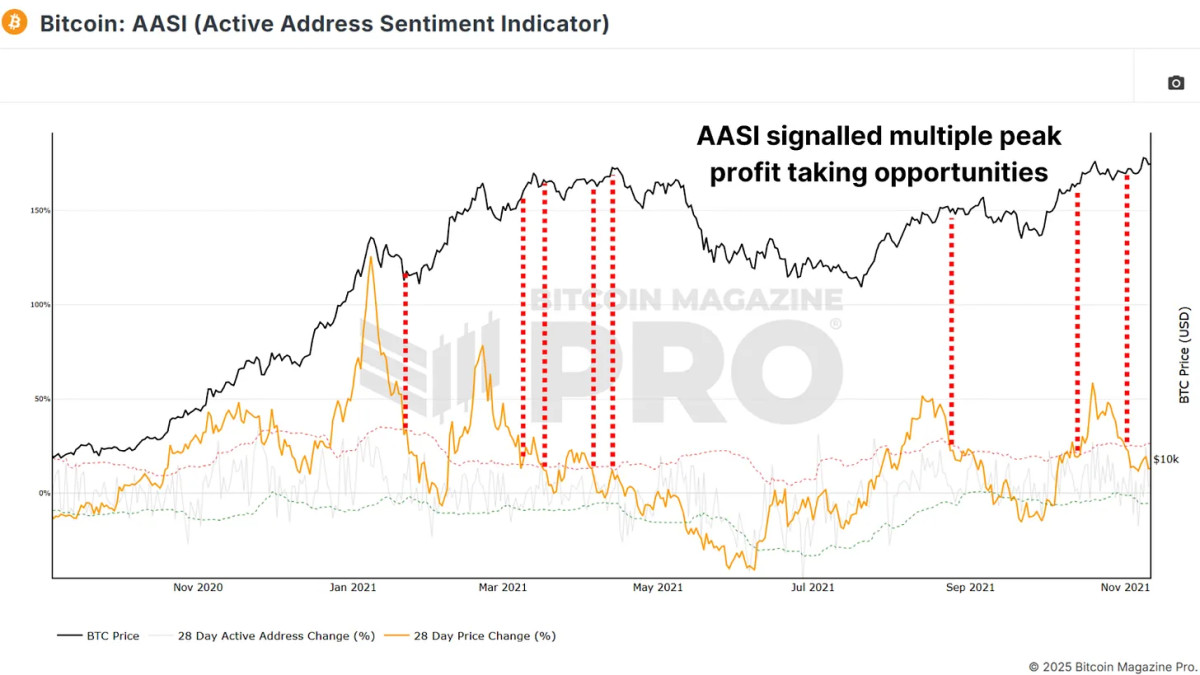

This Active address sentiment indicator (AASI) Compares modifications in community exercise with the worth motion of Bitcoin. It measures deviations between value (orange line) and community exercise, proven by inexperienced and crimson deviation tires.

Throughout the Bull Run of 2021, for instance, indicators emerged when the worth change exceeded the crimson tire. Gross sales indicators appeared on $ 40,000, $ 52,000, $ 58,000 and $ 63,000. Every supplied the chance to scale out whereas the market overheated.

The Anxiety and greed index is an easy however efficient sentiment instrument that quantifies the market or panic. Values above 90 counsel excessive greed, usually prior corrections, akin to in 2021, when Bitcoin got here from $ 3,000 to $ 14,000, the index grew to become 95, which signifies a neighborhood peak.

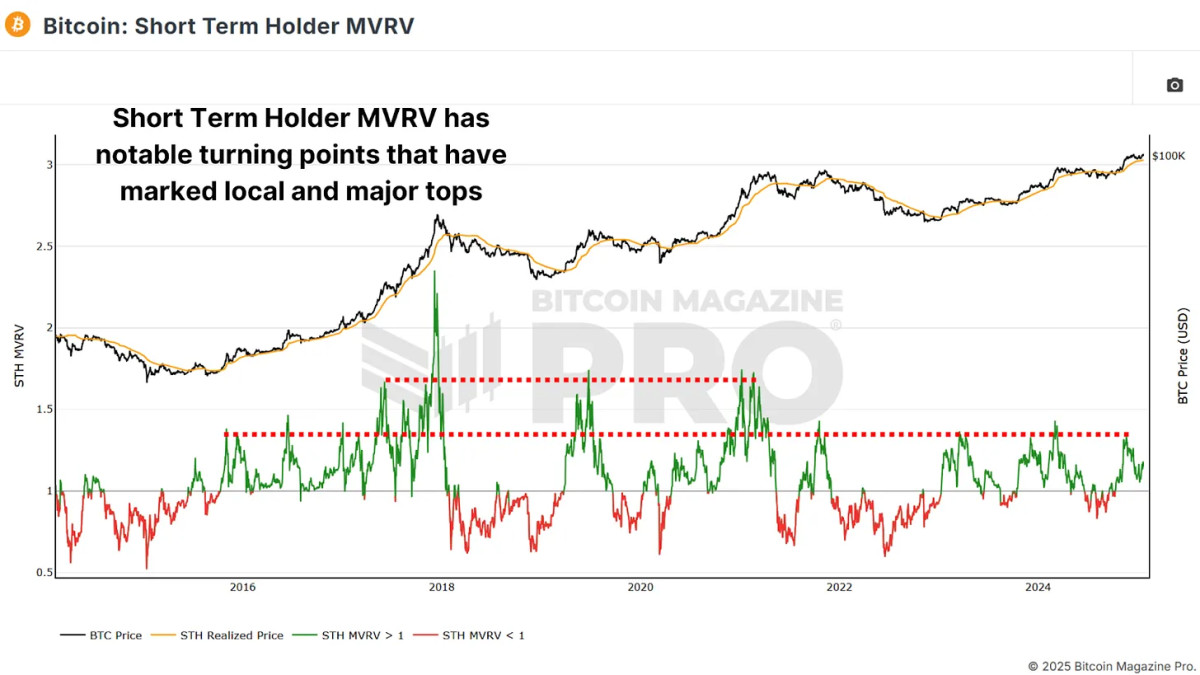

The Short -term holder MVRV Measure the common non -realized revenue or lack of new market contributors by evaluating their price base with present costs. About 33% revenue ranges usually mark reversations and native intracycle peaks, and when not -realized earnings exceed 66%, markets are sometimes overheated and may be near giant cycles peaks.

Associated: Bitcoin Deep Dive Information Evaluation & On-Chain Roundup

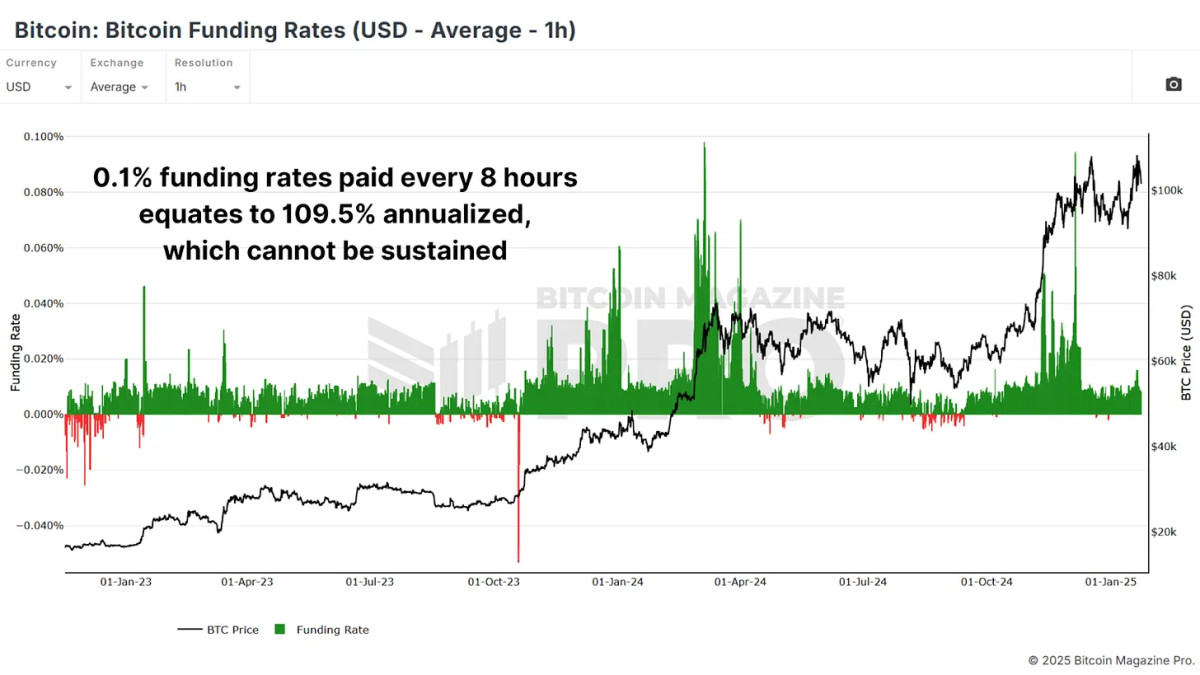

The Bitcoin Financing percentages mirror the premiums that merchants pay to take care of lifting tree positions in Futures markets. Extraordinarily excessive financing percentages counsel extreme bullishness, usually prior corrections. Like most statistics, we will see that discovering a very euphoric majority normally affords a lead.

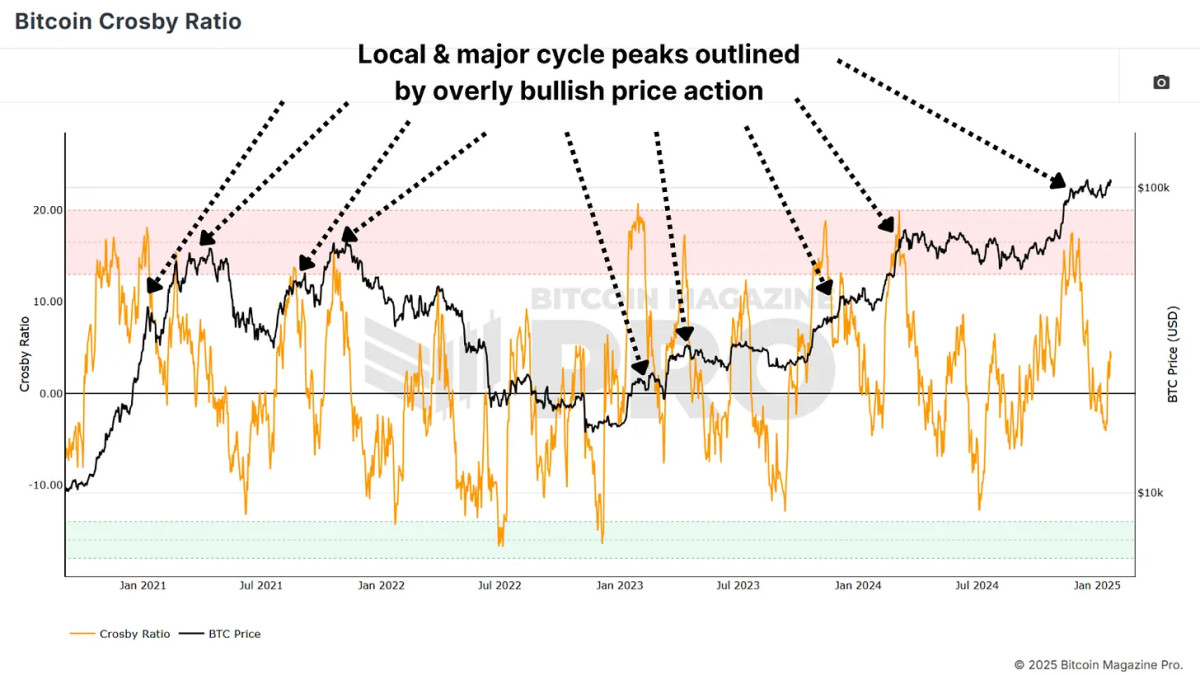

The Crosby ratio is a momentum -based indicator that emphasizes overheated circumstances. When the ratio enters the crimson zone within the day by day graph, and even decrease timetables if you happen to use our tradingview model of the indicator, market revenue factors have normally occurred. When these indicators happen in confluence with different high marking statistics, this reinforces the prospect of a larger prediction.

Conclusion

The timing of the precise high is nearly unimaginable and no metric or technique is watertight. Mix a number of indicators for confluence and keep away from promoting your total place in a single go. Scale as a substitute in steps as essential indicators overheated circumstances and think about setting lagging stops which can be linked to key ranges or a proportion of the worth motion to beat additional earnings if the worth insurance coverage insurance policies are even greater.

Be careful for extra detailed Bitcoin evaluation and for superior capabilities akin to dwell graphics, personalised indicator warnings and in-depth industrial reviews Bitcoin Magazine Pro.

Safeguard: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding choices.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024