Bitcoin

How Trump’s inauguration could trigger a Bitcoin rally OR a crash

Credit : ambcrypto.com

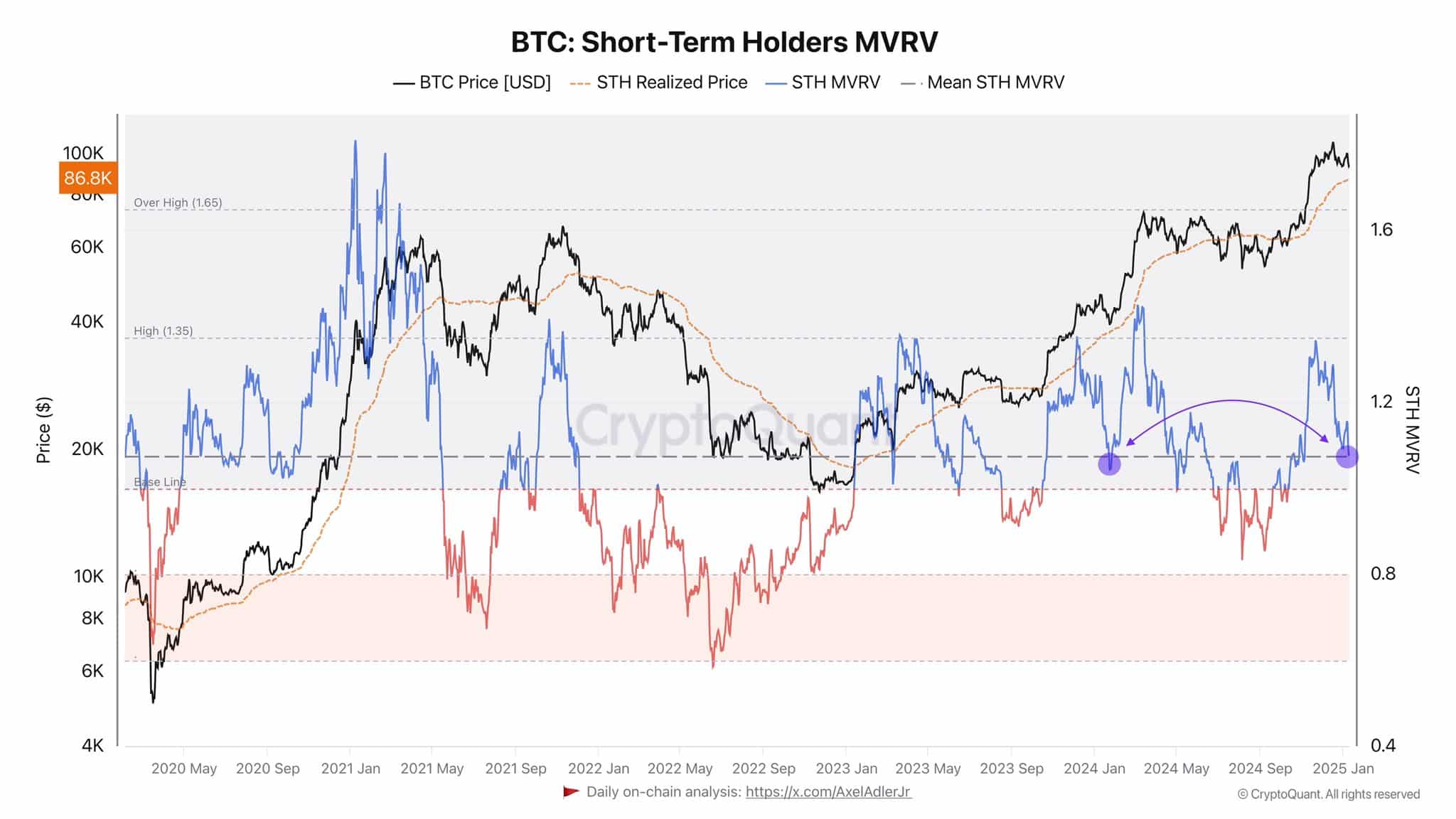

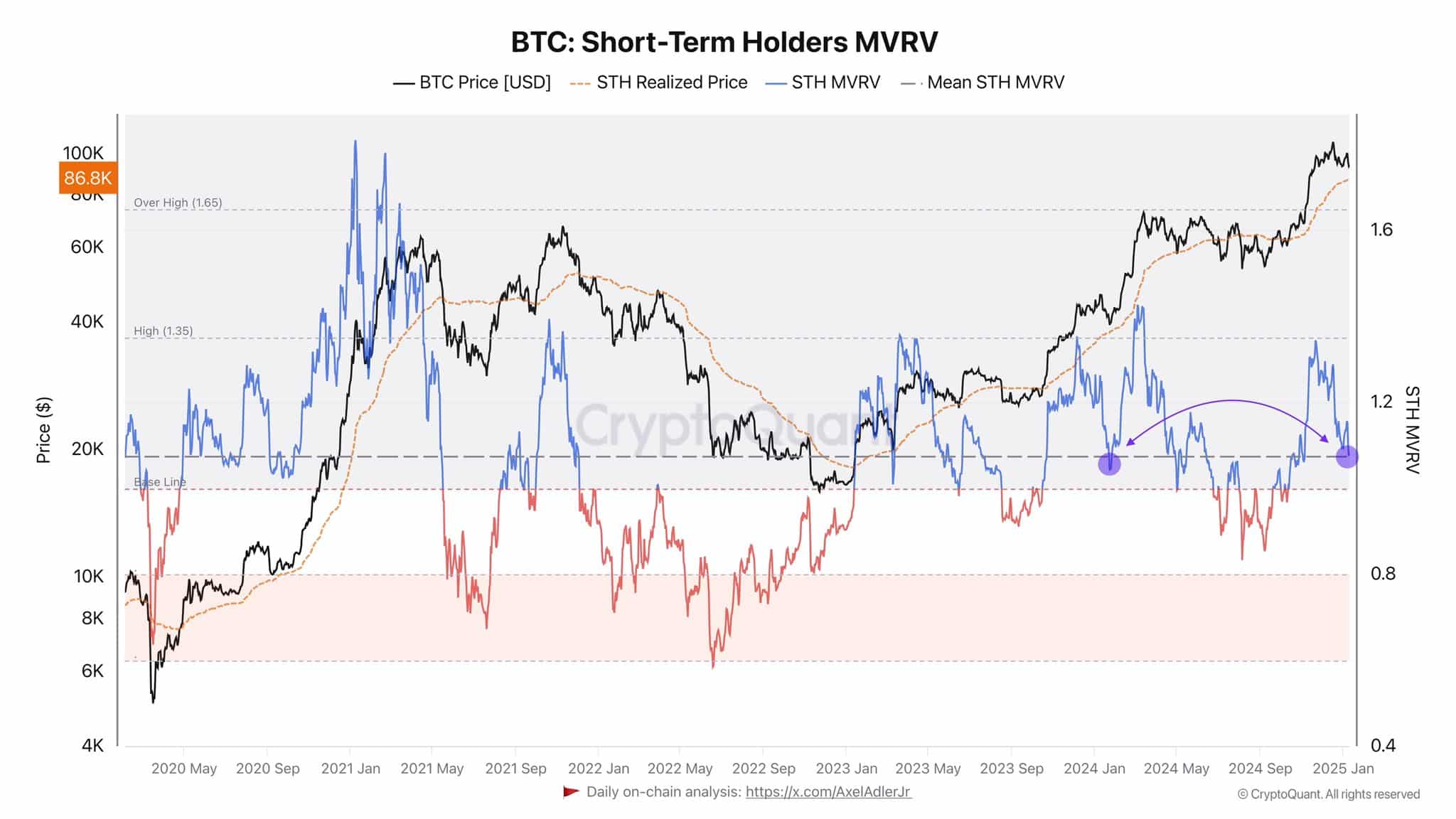

- BTC’s STH MVRV gave the impression to be at an inflection level that might gas or dump BTC

- Choices merchants stepped up their hedging exercise within the run-up to Trump’s inauguration

Bitcoin [BTC] is at a crossroads forward of Donald Trump’s presidential inauguration on January 20. However that is not all: a key valuation indicator, the STH (short-term holders) MVRV, has additionally retreated at a vital level.

Is a brand new ‘Trump pump’ probably?

On the time of writing, the STH’s realized value was valued at $86,000. Taking the STH MVRV stage into consideration, this could possibly be a bullish set off for BTC, in response to CryptoQuant analyst Axel Adler. Adler noted,

“At present, the worth realized by STH is $86.8K. If demand continues till Trump’s inauguration, the STH RP might rise to $90,000. Ought to the president fulfill even a few of the guarantees he made to voters within the early days of his time period, this could possibly be a powerful bullish set off.”

Supply: CryptoQuant

The connected chart reveals that the STH MVRV bounced across the common stage in January 2024. After that, BTC noticed an 88% enhance to $72,000. This additionally coincided with the approval of the US Spot BTC ETFs, suggesting a repeat could possibly be probably if Trump makes bullish bulletins for the sector.

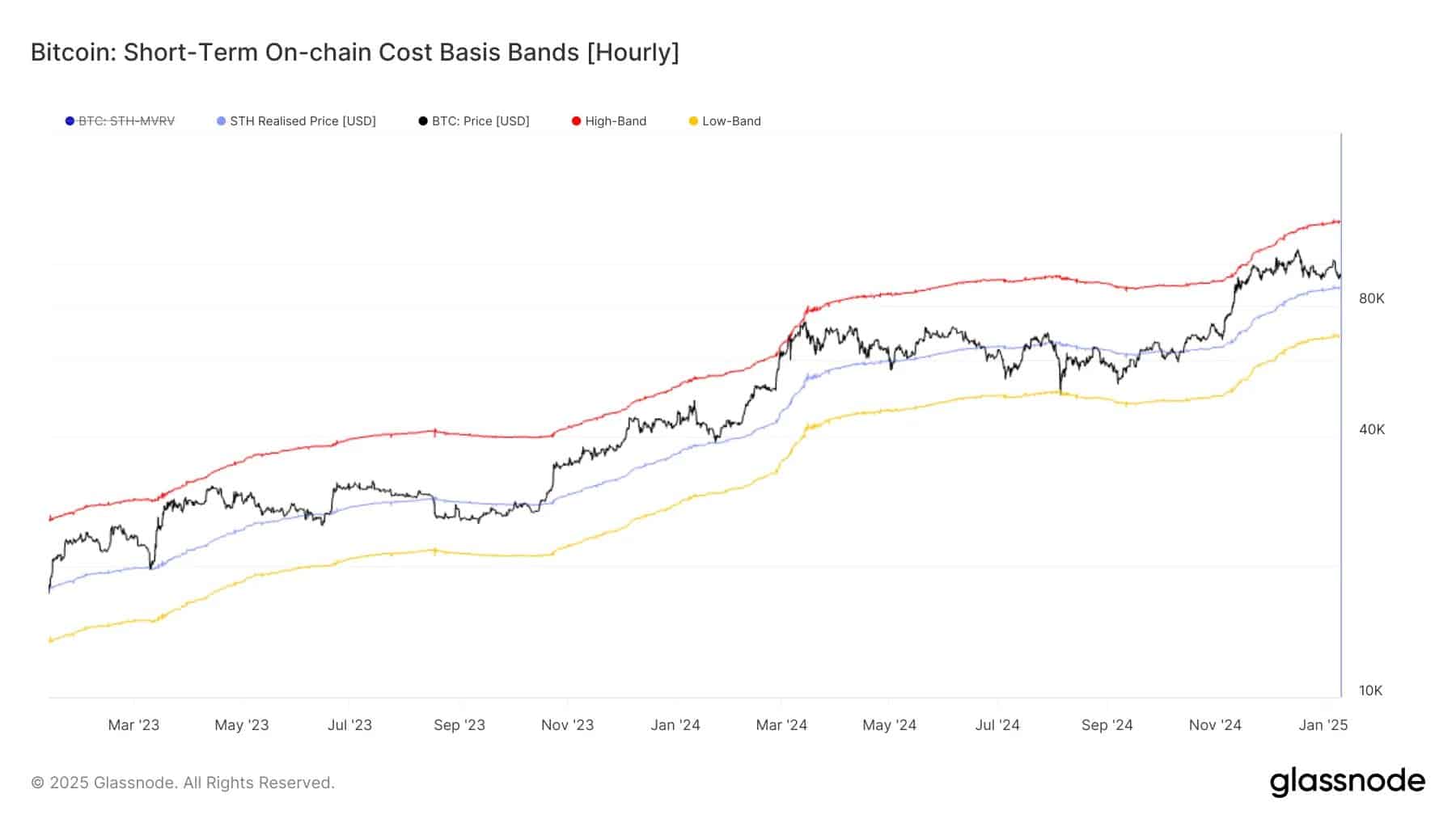

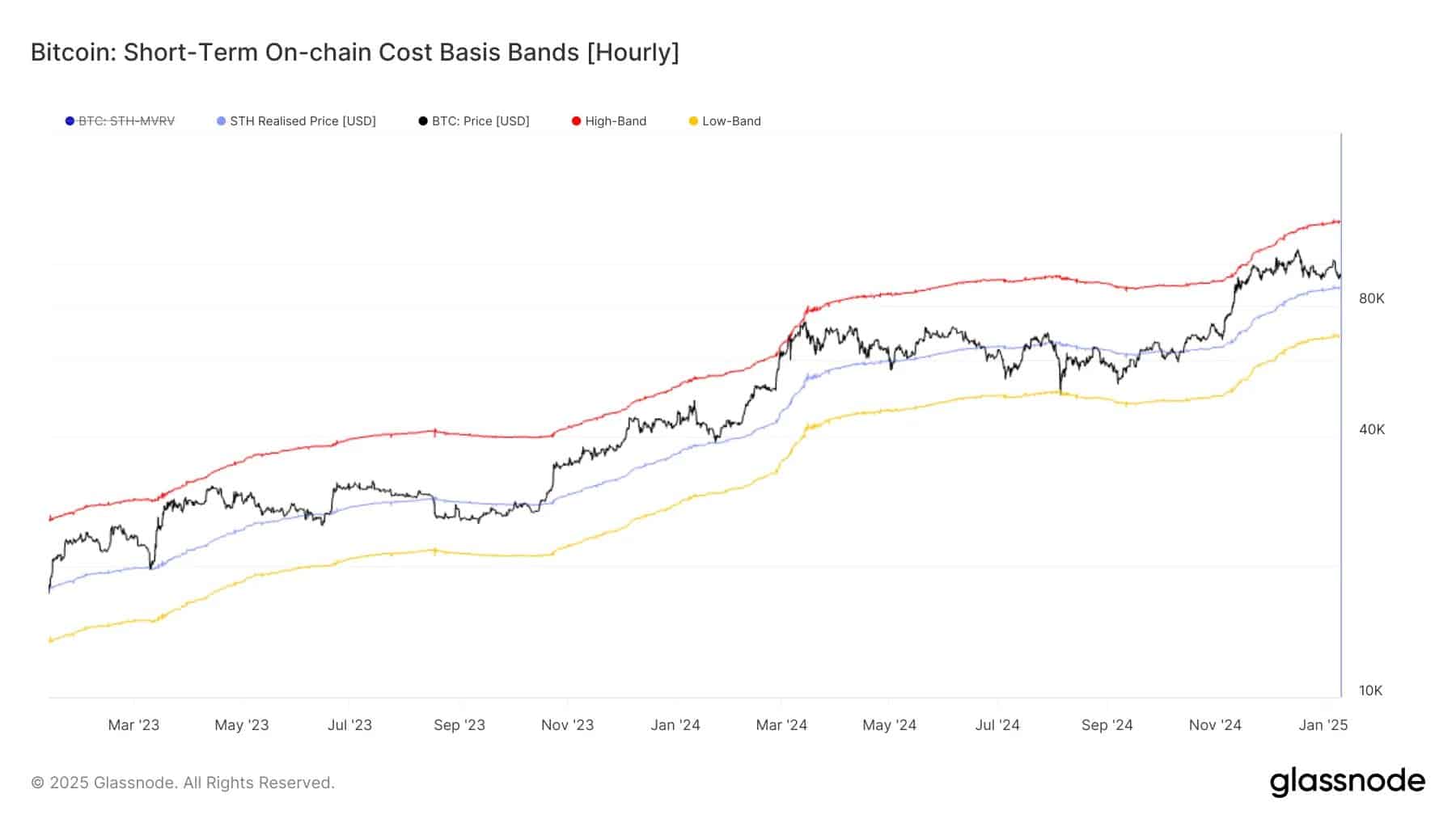

Quite the opposite, a drop beneath the typical stage for STH MVRV traditionally signifies a long-term downtrend or value consolidation for BTC. This might occur if the worth of BTC falls beneath the STH value foundation, which in response to Glassnode was $88,000 on the time of writing.

The analytics firm declared,

“The value of $BTC is now about 7% above the STH value foundation of $88,135. If the worth stabilizes beneath this stage, it could possibly be an indication of waning sentiment amongst new buyers – which is commonly a turning level in market traits.”

Supply: Glassnode

Briefly, if BTC defends $88,000 earlier than or after Trump’s inauguration, a powerful restoration could possibly be imminent. Nonetheless, a drop beneath $88,000 might set off a panic sell-off by the STH cohort, which might drag the cryptocurrency down even additional.

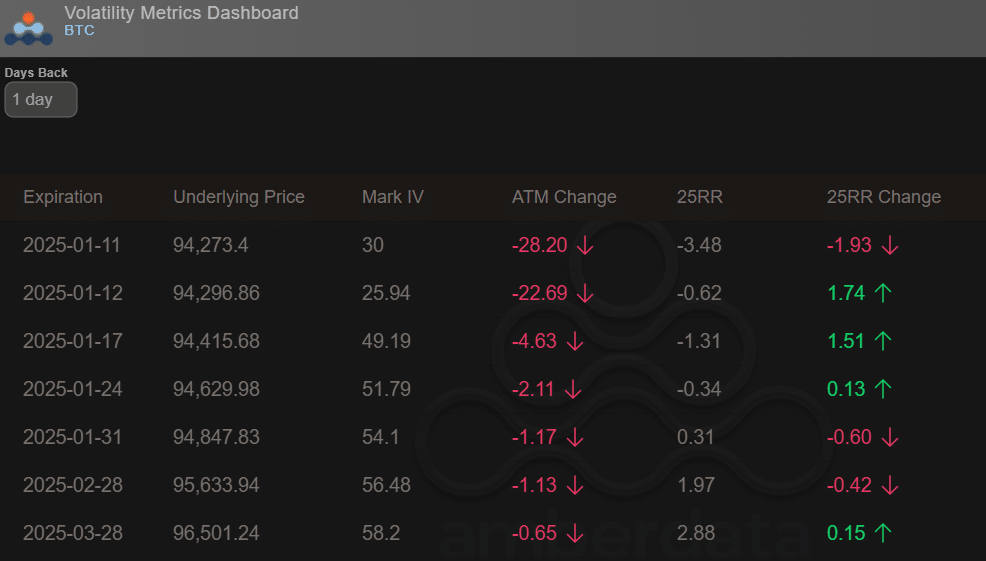

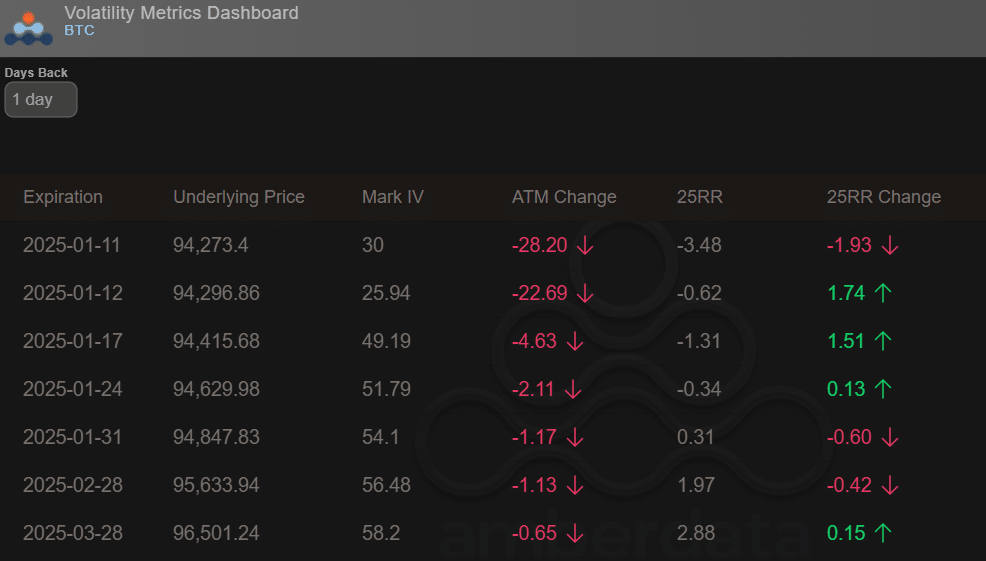

Within the choices market, merchants have priced in damaging to barely bullish prospects earlier than and after the inauguration. This was illustrated by the 24-hour change within the 25RR (25-Delta Danger Reversal).

The indicator was damaging for possibility expirations on January 17 and 24, highlighting rising hedging exercise or a premium for put choices (bearish bets to cowl draw back dangers).

Supply: Amberdata

Earlier than expiration on January 31, the 25RR was barely optimistic at 0.31, indicating a slight premium for calls (bullish bets). Merely put, choices merchants anticipate wild swings and potential declines earlier than the occasion, and a few stabilization afterward.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now