Analysis

HYPE Price Hits ATH on ETF and Stablecoin Momentum

Credit : coinpedia.org

Hyperliquid value crosses the unknown space with a brand new highest level of $ 57.34. In simply seven days, token has risen by greater than 24%, with a rise of a single day of two.47% that pushes its market capitalization to $ 19.01 billion. Business volumes have risen virtually 40% in 24 hours, indicating elevated curiosity and deep liquidity.

As somebody who follows this rally carefully, I see a mixture of sturdy fundamental ideas and technical triggers that form the worth run of hype. However with momentum indicators who flash warnings, the query is whether or not hype can keep its velocity or whether or not a cooldown is the next. Be part of me whereas I took you thru the elements that led to the Golf and the potential value aims.

Why is the Hype value at present?

Completely different catalysts clarify why the hype value was shot giant this week:

- Paxos USDH proposal: On September 8, Paxos plans for USDH, a conformed stablecoin constructed for hyperliquid. With 95% of the reserve curiosity reserved for Hype -Terugoop.

- Lion Group Holding Conversion: The Nasdaq-listed firm revealed that it might be admitted to Sol and SUI within the hype for $ 600 million, with the infrastructure of hyperliquid being talked about as a bike for long-term progress.

- ETF and ETP developments: Asset supervisor Vaneck strives for a hyperliquid spot strike ETF within the US and on the identical time launches an ETP in Europe.

Onchain & Derivatiats overview

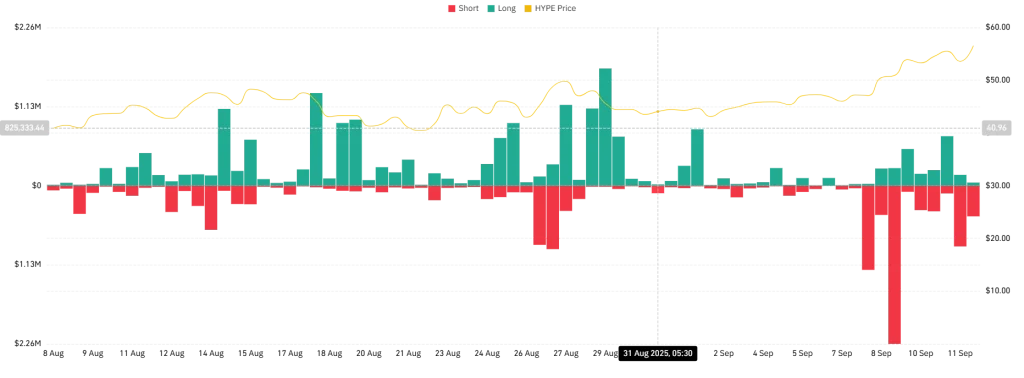

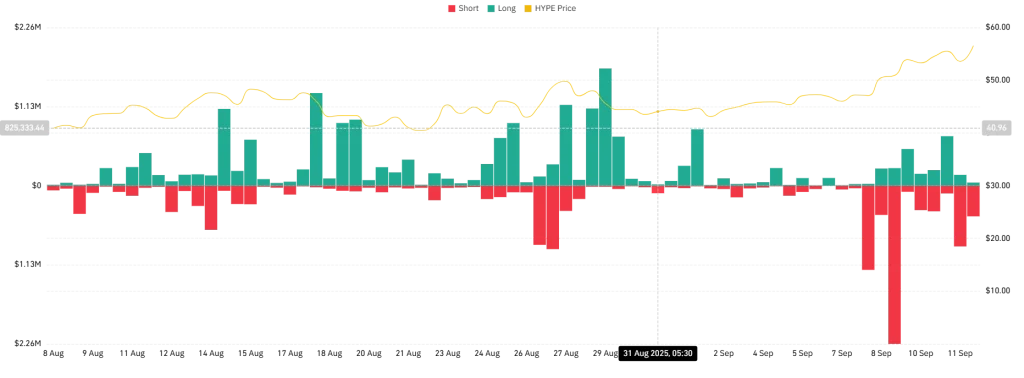

Liquidations have performed a key position within the newest Gulf of Hype. The graph by way of Coinglass Reveals a cluster of brief liquidations on the finish of August, which helped upwards when sellers had been compelled. Extra not too long ago, a wave of lengthy liquidations round 10 September emphasizes the dangers of haunting overbought ranges. With $ 3.08 billion in lungs and $ 3.21 billion in shorts. Successively, even modest value fluctuations may cause sharp liquid cascades, which strengthens volatility within the brief time period.

Hyperliquid value evaluation

On the time of publication, hype is traded at $ 57.18, effectively above its 7-day SMA of $ 51 and 30-day EMA of $ 46.95. The transfer is technically spectacular, which confirms a robust bullish development, however it additionally comes with warning flags. The 7-period RSI is at 83.91 and locations hype firmly in Overbought territory.

Resistance is now falling at $ 61.68, the Fibonacci 127.2% extension. A decisive outbreak there may take away the trail for the hype value within the route of the aim of $ 73.84, in accordance with the 200% Fibonacci stage. Then again, quick help is round $ 49.70, with deeper cushions close to $ 40.33.

What reassure me right here is liquidity. With the turnover at 3.23% and the quantity that rises virtually 40% per day, hyperliquid appears effectively outfitted to soak up the gross sales strain when taking a revenue begins. That stated, haunting the rally at these ranges requires tight threat administration.

FAQs

Sure, the RSI at 83.91 signifies overbough tonditions, which suggests {that a} residence of brief time period or consolidation is probably going.

Hype is confronted with resistance at $ 61.68. A breakout above can concentrate on $ 73.84 within the medium time period.

The Paxos USDH proposal and the ETF plans of Vaneck give hype -legitimacy, whereas the conversion of $ 600 million from Lion Group emphasizes the rising institutional belief.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now